Pillar Income Asset Management, Transcontinental Realty Investors Inc. & Abode Properties Continue Development, Land Sales, &...

April 22 2020 - 9:25AM

Business Wire

Pillar Income Asset Management, as the management company for

Transcontinental Realty Investors Inc. (NYSE: TCI), American Realty

Investors, Inc. (NYSE: ARL), Income Opportunity Realty Investors,

Inc. (NYSE American: IOR) and Abode Properties confirms that

business operations are continuing steadily tied to daily

operations. In addition, the company’s various multifamily

development projects, land sales, and refinancing activities have

continued.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20200422005632/en/

Elevation drawings for Transcontinental

Realty Investors’ multifamily project Parc at Opelika in Opelika,

Alabama. (Graphic: Business Wire)

According to President and CEO, Daniel Moos, “During the

COVID-19 pandemic, our stakeholders retain a sense of optimism and

the expectation for a phased and timely economic recovery. Though

we have been impacted by the 'stay at home' orders in our various

markets, our overall staff, tenants, and vendors have been able to

acclimate and/or maintain operations remotely. Since the state

orders, new leasing activity has continued and we have maintained

consistent occupancy throughout our portfolio.” He continued, “As

we expect there to ultimately be a strong recovery from the

COVID-19 pandemic, especially in the Southwest and Southeast US

where our assets are located, we are also strategically looking at

opportunities to secure parcels of land allowing for future

enhancements to our multifamily asset base.”

Transcontinental Realty Investors currently has 9 multifamily

projects under development in Texas and Louisiana. These assets

total over 1,600 units and over 1.4 million square feet. TCI’s

newest development project, Parc at Opelika, is set to break ground

in the next 90 days in Opelika, Alabama. The company remains

cautiously optimistic that the current challenges facing the

economy will abate over the next several months. These multifamily

development projects are on track to meet their original completion

dates.

The Company’s largest development project, Windmill Farms,

recently achieved 2 significant land sales and 4 more are set to

close, resulting in several lot and large tract sales. With an

expected completed population of 45,000, it is functionally a good

sized privatized city, on the east side of Dallas. The Windmill

Farms lot development program is accelerating as the heavy rainfall

months have passed. 440 lots are nearing completion. Another 414

lots are being paved. Home sales in the 250 delivered lots have

remained solid with homeowners moving in weekly.

Multifamily rent collections have tracked higher than the

national average as of the writing of this press release. We remain

committed to our tenants and employees. As a commercial property

manager we are keeping in constant communication with our tenants

and continue to research and enact new CDC and BOMA guidelines.

“As an employer we are doing everything possible to help our

employees feel supported and connected while we continue to operate

remotely,” added Daniel Moos. “Before the Dallas County stay at

home mandate was in place we provided each employee with a supply

of hand sanitizer and Clorox wipes for their personal use. We also

made sure every employee had the necessary equipment and connection

to go remote at a moment’s notice. We experienced very few issues

when we transitioned. We continue weekly information emails and

managers are being encouraged to conduct weekly video meetings and

plan virtual department activities. Both the property management

and corporate teams continue to be a phenomenal and hard working

group of people.”

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, development, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the ownership and

professional management of income producing apartments and office

buildings that are "undervalued" or "underperforming" at the time

of acquisition. Value is added under Transcontinental ownership,

and the properties are repositioned into higher classifications

through physical improvements and improved management.

Transcontinental has dramatically expanded its development

capabilities associated with luxury apartment homes through its

wholly owned subsidiary Abode Properties, principally on land it

owns or acquires.

About Abode Properties Abode Properties is a subsidiary

of Transcontinental Realty Investors Inc., (NYSE: TCI), a

Dallas-based real estate investment company. Abode’s investment and

strategic focus is to acquire, develop, and operate a portfolio of

desirable multifamily residential properties, while capitalizing on

our ability to obtain long term and static debt structures. The

portfolio stands to benefit from historically established, proven,

and successful operational practices, seasoned on-site management,

and an experienced leadership team with forward thinking

capabilities in order to realize maximum cash flows and consistent

returns, while maintaining unequaled resident and customer service.

We are disciplined and prudent allocators of capital and we will

continue growing our geographically diverse portfolio from the

Southwest to the Southeast. These markets are geographically

located in areas of the country that correspond with both

sustainable and viable economic growth activity. Affiliated

companies include American Realty Investors, Inc. (NYSE: ARL),

Income Opportunity Realty Investors, Inc. (NYSE American: IOR),

Regis Property Management, LLC, and Pillar Income Asset Management,

Inc.

About Pillar Income Asset Management Pillar Income Asset

Management, Inc. is a Dallas-based real estate management company,

which develops and manages in excess of $2.5 billion of real estate

for public and private real estate entities. Affiliated companies

under management or advisement by Pillar include American Realty

Investors, Inc. (NYSE: ARL); Transcontinental Realty Investors,

Inc. (NYSE: TCI); Income Opportunity Realty Investors, Inc. (NYSE

American: IOR); and Abode Properties Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200422005632/en/

Chris Childress On behalf of Transcontinental Realty Investors

Inc. 469.522.4275

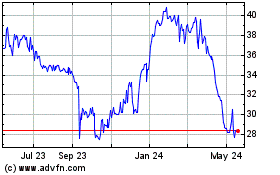

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

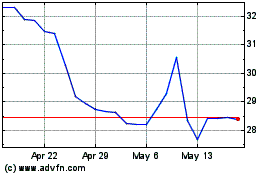

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025