Transcontinental Realty Investors, Inc. (NYSE: TCI), is

reporting its results of operations for the quarter ended June 30,

2020. For the three months ended June 30, 2020, The Company

reported a net loss applicable to common shares of $4.2 million or

$0.48 per diluted share, compared to a net loss applicable to

common shares of $6.3 million or $0.73 per diluted share for the

same period in 2019.

COVID-19

The Company continues to closely monitor the impact of the

COVID-19 pandemic on all aspects of its business. COVID-19 did not

have a significant on the Company’s results of operations or cash

flows during the three months ended June 30, 2020.

- The Company collected approximately 97% of its second quarter

rents, comprised of approximately 95% from multi-family tenants and

approximately 98% from office tenants.

- The Company did not grant any abatements or significant

deferments of rents.

- Occupancy at its non-lease up properties remains stable at 87%

at June 30, 2020 in comparison to 89% at June 30, 2019.

- The Company continued to obtain positive leasing spreads for

new leases and renewals at it properties.

- Ongoing development projects continued during the quarter

unabated without work stoppages. In addition, the Company is

evaluating several new development projects.

The future impact of COVID-19 on the Company’s business and

financial activities will depend on future developments, which at

this stage are unpredictable considering the fluctuations of

COVID-19 outbreaks and the resulting changes in the markets.

Financial Results

Rental and other property revenues were $11.9 million for the

three months ended June 30, 2020 and 2019. For the quarter ended

June 30, 2020, the Company generated revenues of $7.9 million and

$4.0 million from its commercial and residential segments,

respectively.

Property operating expenses decreased to $5.8 million for the

three months ended June 30, 2020 from $7.3 million for the same

period in 2019. The decrease of $1.5 million in property operating

expenses was primarily due to a reduction in property taxes and

maintenance costs.

General and administrative expense decreased to $1.4 million for

the three months ended June 30, 2020 from $2.2 million for the same

period in 2019. The decrease of $0.8 million in general and

administrative expenses was primarily due to a reduction in

professional fees.

Interest income decreased to $4.2 million for the three months

ended June 30, 2020 from $4.9 million for the same period in 2019.

The decrease of $0.7 million in interest income was due to a

decrease in notes receivable from related parties.

Other income increased to $1.5 million for the three months

ended June 30, 2020, compared to $0.7 million for the same period

in 2019. The increase in other income was primarily due to an

increase in tax incentive finance proceeds.

Foreign currency transaction was a loss of $5.6 million for the

three months ended June 30, 2020 as compared to a loss of $2.3

million for the same period in 2019. The increase is foreign

currency loss was due to a decrease in the exchange rate from U.S.

Dollars to the Israel Shekel offset in part by a reduction in the

bonds outstanding.

Loss from unconsolidated investments was $0.7 million for the

three months ended June 30, 2020, compared to a loss of $0.2

million for the same period in 2019. The increase in loss from

unconsolidated investments during the quarter was primarily due to

an increase in depreciation and amortization expense related to the

VAA Joint Venture.

Gain on land sales was $5.3 million for the three months ended

June 30, 2020, compared to $2.1 million for the same period in

2019. In the current period the Company sold approximately 25.9

acres of land for an aggregate sales price of $6.6 million which

resulted in a gain of $5.3 million. For the same period in 2019,

the Company sold approximately 41.6 acres of land for an aggregate

sales price of $7.6 million which resulted in a gain of $2.1

million.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

For the Three Months

Ended

June 30,

For the Six Months Ended

June

30,

2020

2019

2020

2019

(dollars in thousands, except per share amounts)

Revenues: Rental and other property revenues (including $280

and $203 for the three months and $456 and $413 for the six months

ended 2020 and 2019, respectively, from related parties)

$ 11,947

$ 11,840

$ 23,865

$ 23,769

Expenses: Property operating expenses (including $254

and $246 for the three months ended and $496 and $504 for the six

months ended 2020 and 2019, respectively, from related parties)

5,810

7,322

12,119

13,319

Depreciation and amortization

3,418

3,439

6,812

6,548

General and administrative (including $711 and $919 for the three

months ended and $1,766 and $2,420 for the six months ended 2020

and 2019, respectively, from related parties)

1,405

2,211

3,926

4,539

Franchise taxes and other expenses

-

-

1,494

-

Net income fee to related party

112

90

198

190

Advisory fee to related party

2,051

2,158

4,146

3,806

Total operating expenses

12,796

15,220

28,695

28,402

Net operating (loss)

(849)

(3,380)

(4,830)

(4,633)

Other income (expenses): Interest income (including

$4,088 and $4,585 for the three months ended and $7,503 and $8,897

for the six months ended 2020 and 2019, respectively, from related

parties)

4,227

4,878

8,754

9,436

Other income

1,484

688

2,319

4,580

Mortgage and loan interest (including $369 and $513 for the three

months ended and $813 and $1,003 for the six months ended 2020 and

2019, respectively, from related parties)

(7,741)

(7,646)

(15,708)

(15,605)

Foreign currency transaction gain (loss)

(5,599)

(2,325)

2,244

(8,143)

Equity loss from VAA

(735)

(236)

(1,111)

(1,291)

Losses from other unconsolidated investees

7

2

6

(5)

Total other income (expenses)

(8,357)

(4,639)

(3,496)

(11,028)

Income (loss) before gain on land sales, non-controlling interest,

and taxes

(9,206)

(8,019)

(8,326)

(15,661)

Loss on sale of income producing properties

-

(80)

-

(80)

Gain on land sales

5,339

2,133

9,477

4,349

Net income (loss) before taxes

(3,867)

(5,966)

1,151

(11,392)

State income tax expense

(49)

-

(296)

-

Net income (loss)

(3,916)

(5,966)

855

(11,392)

Net (income) attributable to non-controlling interest

(242)

(379)

(400)

(562)

Net income (loss) attributable to Transcontinental Realty

Investors, Inc.

(4,158)

(6,345)

455

(11,954)

Net income (loss) applicable to common shares

$ (4,158)

$ (6,345)

$ 455

$ (11,954)

(Loss) earnings per share - basic Net income (loss)

$ (0.45)

$ (0.68)

$ 0.10

$ (1.31)

Net income (loss) applicable to common shares

$ (0.48)

$ (0.73)

$ 0.05

$ (1.37)

(Loss) earnings per share - diluted Net income (loss)

$ (0.45)

$ (0.68)

$ 0.10

$ (1.31)

Net income (loss) applicable to common shares

$ (0.48)

$ (0.73)

$ 0.05

$ (1.37)

Weighted average common shares used in computing earnings

per share

8,717,767

8,717,767

8,717,767

8,717,767

Weighted average common shares used in computing diluted earnings

per share

8,717,767

8,717,767

8,717,767

8,717,767

Amounts attributable to Transcontinental Realty Investors,

Inc. Net income (loss)

$ (3,916)

$ (5,966)

$ 855

$ (11,392)

Net income (loss) applicable to Transcontinental Realty, Investors,

Inc.

$ (4,158)

$ (6,345)

$ 455

$ (11,954)

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS June 30, 2020 December

31, 2019 (Unaudited) (Audited) (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost

$ 484,639

$ 469,997

Real estate subject to sales contracts at cost

6,307

7,966

Less accumulated depreciation

(96,002)

(90,173)

Total real estate

394,944

387,790

Notes and interest receivable (including $68,170 in 2020 and

$57,817 in 2019 from related parties)

135,664

120,986

Cash and cash equivalents

42,250

51,179

Restricted cash

30,114

32,082

Investment in VAA

52,773

59,148

Investment in other unconsolidated investees

22,638

22,632

Receivable from related parties

128,617

141,541

Other assets

57,167

50,560

Total assets

$ 864,167

$ 865,918

Liabilities and Shareholders’ Equity Liabilities:

Notes and interest payable

$ 255,884

$ 246,546

Bonds and bond interest payable

218,216

229,722

Deferred revenue (including $10,367 in 2020 and $9,468 2019 to

related parties)

10,367

9,468

Accounts payable and other liabilities (including $934 in 2020 and

$935 in 2019 to related parties)

24,778

26,115

Total liabilities

509,245

511,851

Shareholders’ equity: Common stock, $0.01 par value,

authorized 10,000,000 shares; issued 8,717,967 shares in 2020 and

2019; outstanding 8,717,767 shares in 2020 and 2019

87

87

Treasury stock at cost, 200 shares in 2020 and 2019

(2)

(2)

Paid-in capital

257,853

257,853

Retained earnings

75,120

74,665

Total Transcontinental Realty Investors, Inc. shareholders' equity

333,058

332,603

Non-controlling interest

21,864

21,464

Total shareholders' equity

354,922

354,067

Total liabilities and shareholders' equity

$ 864,167

$ 865,918

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200814005378/en/

Transcontinental Realty Investors, Inc. Investor Relations

Daniel Moos (469) 522-4200

investor.relations@transconrealty-invest.com

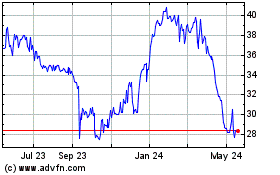

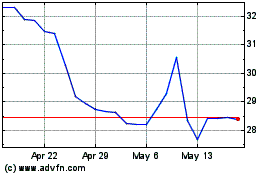

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025