Current Report Filing (8-k)

July 19 2021 - 5:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act

Date of Report (Date of earliest event reported): July 13,

2021

TRANSCONTINENTAL

REALTY INVESTORS, INC.

(Exact Name of Registrant as

Specified in its Charter)

|

Nevada

|

001-09240

|

94-6565852

|

|

(State or other

jurisdiction of incorporation)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

1603 LBJ Freeway, Suite 800

Dallas, Texas

|

75234

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code 469-522-4200

(Former name or former

address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following

provisions:

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange

on which Registered

|

|

Common Stock, par value $0.01

|

TCI

|

New York Stock Exchange

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act.

[ ]

Section 8 - Other Events

Item 8.01. Other Events

On July 13, 2021, Transcontinental

Realty Investors, Inc. (“TCI” or the “Company”) and its subsidiary, Southern Properties Capital

Ltd., a British Virgin Islands company (“SPC”), received an arbitration result involving a dispute between SPC and

the Macquarie Group (“Macquarie”) in connection with the formation of a joint venture between Macquarie and SPC, named

Victory Abode Apartments LLC (“VAA”), concerning the settling of certain accounts under the joint venture agreement.

VAA was formed on November 19,

2018 upon the sale and transfer from SPC to Macquarie of a 50% ownership interest in 52 multifamily properties (collectively, the “VAA

Portfolio”), under which VAA also assumed all liabilities of the VAA Portfolio. SPC and TCI account for the investment in VAA

under the equity method. In connection with the formation of VAA, ten out of the 52 properties are subject to an earn-out provision that

provides for a remeasurement of value after a two-year period following the completion of construction. As of March 31, 2021, SPC recorded

a liability of $10.0 million, which it believed to be the amount that would be required to settle the obligation (“Earn Out

Obligation”).

Macquarie and SPC were unable to reach agreement on the measurement of the Earn Out Obligation

and, therefore, submitted the issue to arbitration in accordance with a provision of the joint venture agreement, Following presentation

by both parties, SPC’s position and claims were declined, and the position of Macquarie was fully accepted. As a result, SPC expects

to be required to pay approximately $39.6 million to Macquarie to satisfy the Earn Out Obligation. SPC and counsel are reviewing the arbitration

result and determining next steps.

The joint venture agreement provides that SPC may settle the Earn Out Obligation by a continual offset

(payment to Macquarie) of future distributions from VAA which generally occur each six months to both members.

As a result, SPC expects to take

approximately a $29.6 million charge for the quarter ended June 30, 2021. SPC has issues of debentures outstanding and listed on the

Tel Aviv Stock Exchange (“TASE”) and is accordingly subject to the rules of the TASE and the Israel Securities Authority.

In satisfaction of those requirements, on July 15, 2021, SPC issued an “immediate report,” a copy of the English version

of which is attached as an exhibit to this report.

Section 9 – Financial Statements and

Exhibits

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The

following exhibit is furnished with this Report:

Exhibit

No. Description

_________________________

* Furnished herewith

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

Dated: July 16, 2021

|

|

|

|

|

|

|

|

|

|

|

|

TRANSCONTINENTAL REALTY INVESTORS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Erik L. Johnson

|

|

|

|

|

Erik L. Johnson

|

|

|

|

|

Executive Vice President and

|

|

|

|

|

Chief Financial Officer

|

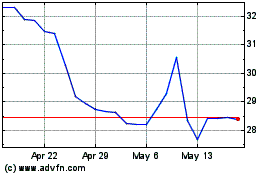

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

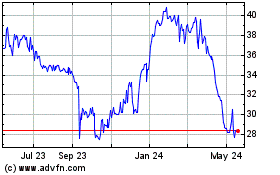

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025