0001389170false00013891702024-08-012024-08-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 1, 2024

TARGA RESOURCES CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware (State or other jurisdiction of incorporation or organization) |

|

001-34991 (Commission File Number) |

|

20-3701075 (IRS Employer Identification No.) |

811 Louisiana, Suite 2100

Houston, TX 77002

(Address of principal executive office and Zip Code)

(713) 584-1000

(Registrants’ telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of exchange on which registered |

Common Stock |

TRGP |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Targa Resources Corp. (the “Company”) issued a press release regarding its financial results for the three months ended June 30, 2024. A conference call to discuss these results is scheduled for 11:00 a.m. Eastern time (10:00 a.m. Central time) on Thursday, August 1, 2024. The conference call will be webcast live and a replay of the webcast will be available through the Investors section of the Company’s web site (http://www.targaresources.com). A copy of the earnings press release is furnished as Exhibit 99.1 to this report, which is hereby incorporated by reference into this Item 2.02.

The press release and accompanying schedules and/or the conference call discussions include the non-generally accepted accounting principles (“non-GAAP”) financial measures of adjusted EBITDA, adjusted cash flow from operations, adjusted free cash flow and adjusted operating margin (segment). The press release provides reconciliations of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Our non-GAAP financial measures should not be considered as alternatives to GAAP measures and have important limitations as analytical tools.

Item 7.01 Regulation FD Disclosure.

The Company uses any of the following to comply with its disclosure obligations under Regulation FD: press releases, SEC filings, public conference calls, or the Company’s website. The Company routinely posts important information on its website (http://www.targaresources.com), including information that may be deemed to be material. The Company encourages investors and others interested in the Company to monitor these distribution channels for material disclosures.

Item 8.01 Other Events.

On July 30, 2024, the Board of Directors of Targa Resources Corp. (the “Company”) approved a new share repurchase program (the “2024 Share Repurchase Program”) for the repurchase of up to $1.0 billion of the Company’s outstanding common stock. The 2024 Share Repurchase Program is effective immediately. The amount authorized under the 2024 Share Repurchase Program is in addition to the amount remaining as of June 30, 2024, under the Company’s existing share repurchase program adopted in May 2023. The 2024 Share Repurchase Program does not obligate the Company to repurchase any specific dollar amount or number of shares and share repurchases thereunder will be made in accordance with applicable securities laws and may be discontinued by the Company, in its sole discretion and without notice.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Targa Resources Corp.

|

|

|

Date: August 1, 2024 |

By: |

/s/ Jennifer R. Kneale |

|

|

Jennifer R. Kneale |

|

|

President – Finance and Administration (Principal Financial Officer) |

|

|

|

|

|

Exhibit 99.1 |

|

|

811 Louisiana, Suite 2100 Houston, TX 77002 713.584.1000 |

Targa Resources Corp. Reports Record Second Quarter 2024 Results and Increases Full Year 2024 Outlook

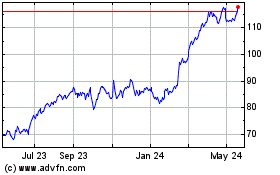

HOUSTON – August 1, 2024 - Targa Resources Corp. (NYSE: TRGP) (“TRGP,” the “Company” or “Targa”) today reported second quarter 2024 results.

Second quarter 2024 net income attributable to Targa Resources Corp. was $298.5 million compared to $329.3 million for the second quarter of 2023. The Company reported adjusted earnings before interest, income taxes, depreciation and amortization, and other non-cash items (“adjusted EBITDA”)(1) of $984.3 million for the second quarter of 2024 compared to $789.1 million for the second quarter of 2023.

Highlights

•Record adjusted EBITDA for the second quarter of $984.3 million

•Record Permian, NGL transportation, and fractionation volumes during the second quarter

•Repurchased a quarterly record $355.1 million of common stock during the second quarter

•Announced a new $1.0 billion common share repurchase program

•Estimate 2024 adjusted EBITDA to be $3.95 billion to $4.05 billion, a 5% increase over its previous estimate

•Announced two new 275 million cubic feet per day (“MMcf/d”) gas plants in the Permian Basin

•Estimate 2024 net growth capital expenditures of approximately $2.7 billion due to the acceleration of spend attributable to higher anticipated volume growth on Targa’s Permian systems

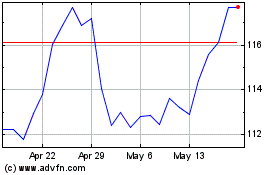

On July 11, 2024, the Company declared a quarterly cash dividend of $0.75 per common share, or $3.00 per common share on an annualized basis, for the second quarter of 2024. Total cash dividends of approximately $164 million will be paid on August 15, 2024 on all outstanding shares of common stock to holders of record as of the close of business on July 31, 2024.

Targa repurchased 2,985,816 shares of its common stock during the second quarter of 2024 at a weighted average per share price of $118.91 for a total net cost of $355.1 million. There was $291.3 million remaining under the Company’s $1.0 billion common share repurchase program as of June 30, 2024. In July 2024, the Company’s Board of Directors approved a new share repurchase program for the repurchase of up to $1.0 billion of the Company’s outstanding common stock. The amount authorized under the new share repurchase program is in addition to the amount remaining under the existing share repurchase program.

Second Quarter 2024 - Sequential Quarter over Quarter Commentary

Targa reported record second quarter adjusted EBITDA of $984.3 million, representing a 2 percent increase compared to the first quarter of 2024. The sequential increase in adjusted EBITDA was attributable to higher volumes across Targa’s Gathering and Processing (“G&P”) and Logistics and Transportation (“L&T”) systems. In the G&P segment, higher sequential adjusted operating margin was attributable to record Permian natural gas inlet volumes, higher recoveries, and higher fees. In the L&T segment, record NGL pipeline transportation and fractionation volumes drove the sequential increase in segment adjusted operating margin. Increasing NGL pipeline transportation and fractionation volumes were attributable to higher supply volumes from Targa’s Permian G&P systems. Higher segment operating expenses were attributable to higher system volumes and expansions and higher general and administrative expenses were attributable to higher compensation and benefits.

Capitalization and Liquidity

The Company’s total consolidated debt as of June 30, 2024 was $13,567.0 million, net of $84.6 million of debt issuance costs and $29.5 million of unamortized discount, with $11,534.4 million of outstanding senior notes, $1,303.0 million outstanding under the Commercial Paper Program, $550.0 million outstanding under the Securitization Facility, and $293.7 million of finance lease liabilities.

Total consolidated liquidity as of June 30, 2024 was approximately $1.6 billion, including $1.4 billion available under the TRGP Revolver, $166.4 million of cash and $50.0 million available under the Securitization Facility.

Financing Update

On May 21, 2024, Targa repaid all $500.0 million outstanding under the $1.5 billion unsecured term loan facility due July 2025 (the “Term Loan Facility”). As a result of the repayment, the Company recorded a loss due to debt extinguishment of $0.8 million.

Growth Projects Update

During the second quarter, Targa commenced operations at its new 230 MMcf/d Roadrunner II plant in Permian Delaware and its new 120 MBbl/d Train 9 fractionator in Mont Belvieu, TX, on-time and on-budget. Targa expects to begin starting up operations on the reactivation of Gulf Coast Fractionators (“GCF”) in Mont Belvieu during the third quarter of 2024. In its G&P segment, construction continues on Targa’s 275 MMcf/d Greenwood II and Pembrook II plants in Permian Midland and its 275 MMcf/d Bull Moose plant in Permian Delaware. In its L&T segment, construction continues on Targa’s Daytona NGL Pipeline and its 120 MBbl/d Train 10 and 150 MBbl/d Train 11 fractionators in Mont Belvieu. Targa remains on-track to complete these expansions as previously disclosed.

In August 2024, in response to increasing production and to meet the infrastructure needs of its customers, Targa announced the construction of a new 275 MMcf/d cryogenic natural gas processing plant in Permian Delaware (the “Bull Moose II plant”) and a new 275 MMcf/d cryogenic natural gas processing plant in Permian Midland (the “East Pembrook plant”). The Bull Moose II plant is expected to begin operations in the first quarter of 2026 and the East Pembrook plant is expected to begin operations in the third quarter of 2026.

On July 31, 2024, WhiteWater announced that WhiteWater, MPLX LP (NYSE: MPLX), and Enbridge Inc. (NYSE: ENB), through the WPC Joint Venture (“WPC”), the joint venture that owns the Whistler Pipeline, have partnered with Targa to reach final investment decision to move forward with the construction of the Blackcomb Pipeline (“Blackcomb”) after having secured sufficient firm transportation agreements with predominantly investment grade shippers. Blackcomb is designed to transport up to 2.5 billion cubic feet per day (“Bcf/d”) of natural gas through approximately 365 miles of 42-inch pipeline from the Permian Basin in West Texas to the Agua Dulce area in South Texas. Blackcomb is expected to be in service in the second half of 2026, pending the receipt of customary regulatory and other approvals. Blackcomb is a joint venture owned 70.0 percent by WPC, 17.5 percent by Targa, and 12.5 percent by MPLX.

2024 Outlook

Given the strength of volume growth across Targa’s integrated assets, the Company now expects to generate full year 2024 adjusted EBITDA of $3.95 billion to $4.05 billion, a 5 percent increase over its previous estimate. With today’s announcement related to moving ahead with the construction of its Bull Moose II and East Pembrook plants, incremental spending on related infrastructure attributable to higher volume growth on Targa’s systems in the Permian Basin, and spending on the acceleration of downstream connections and residue gas takeaway, Targa now estimates total net growth capital expenditures for 2024 to be approximately $2.7 billion. The increase from Targa’s previous estimate is attributable to the acceleration of volume growth across Targa’s Permian footprint necessitating additional G&P plant and field infrastructure that is expected to be highly utilized when it comes online bringing increasing volumes through the rest of Targa’s integrated system. Targa continues to estimate net maintenance capital expenditures for 2024 to be approximately $225 million.

Positioning in 2025

For 2025, higher volume growth across Targa’s Permian systems is expected to drive a meaningful year-over-year increase in adjusted EBITDA and higher adjusted EBITDA than previously forecasted, and a similar Free Cash Flow inflection as previously forecasted, which means the Company is well positioned to continue to provide a meaningful increase in capital returned to shareholders through increasing common dividends per share and continued common share repurchases.

Targa continues to estimate a meaningful step down in net growth capital expenditures in 2025 versus 2024 as the Company’s large downstream Daytona NGL Pipeline and Train 10 fractionator remain on-track to be completed as previously disclosed. Due to higher anticipated volume growth on Targa’s Permian systems in 2025, necessitating the acceleration of G&P plant and field capital spend in the Permian, and its newly announced equity investment in Blackcomb (which is expected to be project financed), Targa currently estimates approximately $1.7 billion of net growth capital expenditures for 2025. Spending in 2025 is largely Permian G&P focused on additional infrastructure that will be highly utilized at start-up and will bring increasing volumes through Targa’s integrated system.

For a more detailed bridge of estimated 2024 and 2025 net growth capital expenditures, please refer to slide 5 in the earnings supplement presentation available under Events and Presentations in the Investors section of the Company’s website at www.targaresources.com/investors/events. An updated investor presentation is also available under Events and Presentations in the Investors section of the Company’s website at www.targaresources.com/investors/events.

Conference Call

The Company will host a conference call for the investment community at 11:00 a.m. Eastern time (10:00 a.m. Central time) on August 1, 2024 to discuss its second quarter results. The conference call can be accessed via webcast under Events and Presentations in the Investors section of the Company’s website at www.targaresources.com/investors/events, or by going directly to https://edge.media-server.com/mmc/p/9n9qxwtw. A webcast replay will be available at the link above approximately two hours after the conclusion of the event.

(1)Adjusted EBITDA is a non-GAAP financial measure and is discussed under “Non-GAAP Financial Measures.”

Targa Resources Corp. – Consolidated Financial Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

(In millions) |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of commodities |

$ |

2,991.1 |

|

|

$ |

2,914.6 |

|

|

$ |

76.5 |

|

|

|

3 |

% |

|

$ |

6,944.4 |

|

|

$ |

6,939.7 |

|

|

$ |

4.7 |

|

|

— |

|

Fees from midstream services |

|

570.9 |

|

|

|

489.1 |

|

|

|

81.8 |

|

|

|

17 |

% |

|

|

1,180.0 |

|

|

|

984.5 |

|

|

|

195.5 |

|

|

20 |

% |

Total revenues |

|

3,562.0 |

|

|

|

3,403.7 |

|

|

|

158.3 |

|

|

|

5 |

% |

|

|

8,124.4 |

|

|

|

7,924.2 |

|

|

|

200.2 |

|

|

3 |

% |

Product purchases and fuel |

|

2,197.4 |

|

|

|

2,068.9 |

|

|

|

128.5 |

|

|

|

6 |

% |

|

|

5,415.4 |

|

|

|

5,088.0 |

|

|

|

327.4 |

|

|

6 |

% |

Operating expenses |

|

290.7 |

|

|

|

272.6 |

|

|

|

18.1 |

|

|

|

7 |

% |

|

|

568.7 |

|

|

|

530.7 |

|

|

|

38.0 |

|

|

7 |

% |

Depreciation and amortization expense |

|

348.6 |

|

|

|

332.1 |

|

|

|

16.5 |

|

|

|

5 |

% |

|

|

689.1 |

|

|

|

656.9 |

|

|

|

32.2 |

|

|

5 |

% |

General and administrative expense |

|

98.3 |

|

|

|

81.0 |

|

|

|

17.3 |

|

|

|

21 |

% |

|

|

184.8 |

|

|

|

163.4 |

|

|

|

21.4 |

|

|

13 |

% |

Other operating (income) expense |

|

(0.2 |

) |

|

|

— |

|

|

|

(0.2 |

) |

|

|

(100 |

%) |

|

|

(0.3 |

) |

|

|

(0.6 |

) |

|

|

0.3 |

|

|

50 |

% |

Income (loss) from operations |

|

627.2 |

|

|

|

649.1 |

|

|

|

(21.9 |

) |

|

|

(3 |

%) |

|

|

1,266.7 |

|

|

|

1,485.8 |

|

|

|

(219.1 |

) |

|

(15 |

%) |

Interest expense, net |

|

(176.0 |

) |

|

|

(166.6 |

) |

|

|

(9.4 |

) |

|

|

6 |

% |

|

|

(404.6 |

) |

|

|

(334.7 |

) |

|

|

(69.9 |

) |

|

21 |

% |

Equity earnings (loss) |

|

2.9 |

|

|

|

3.4 |

|

|

|

(0.5 |

) |

|

|

(15 |

%) |

|

|

5.6 |

|

|

|

3.2 |

|

|

|

2.4 |

|

|

75 |

% |

Gain (loss) from financing activities |

|

(0.8 |

) |

|

|

— |

|

|

|

(0.8 |

) |

|

|

100 |

% |

|

|

(0.8 |

) |

|

|

— |

|

|

|

(0.8 |

) |

|

100 |

% |

Other, net |

|

(0.1 |

) |

|

|

(2.0 |

) |

|

|

1.9 |

|

|

|

95 |

% |

|

|

1.8 |

|

|

|

(4.9 |

) |

|

|

6.7 |

|

|

137 |

% |

Income tax (expense) benefit |

|

(94.3 |

) |

|

|

(96.4 |

) |

|

|

2.1 |

|

|

|

2 |

% |

|

|

(177.1 |

) |

|

|

(206.7 |

) |

|

|

29.6 |

|

|

14 |

% |

Net income (loss) |

|

358.9 |

|

|

|

387.5 |

|

|

|

(28.6 |

) |

|

|

(7 |

%) |

|

|

691.6 |

|

|

|

942.7 |

|

|

|

(251.1 |

) |

|

(27 |

%) |

Less: Net income (loss) attributable to noncontrolling interests |

|

60.4 |

|

|

|

58.2 |

|

|

|

2.2 |

|

|

|

4 |

% |

|

|

117.9 |

|

|

|

116.4 |

|

|

|

1.5 |

|

|

1 |

% |

Net income (loss) attributable to Targa Resources Corp. |

|

298.5 |

|

|

|

329.3 |

|

|

|

(30.8 |

) |

|

|

(9 |

%) |

|

|

573.7 |

|

|

|

826.3 |

|

|

|

(252.6 |

) |

|

(31 |

%) |

Premium on repurchase of noncontrolling interests, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

490.7 |

|

|

|

(490.7 |

) |

|

(100 |

%) |

Net income (loss) attributable to common shareholders |

$ |

298.5 |

|

|

$ |

329.3 |

|

|

$ |

(30.8 |

) |

|

|

(9 |

%) |

|

$ |

573.7 |

|

|

$ |

335.6 |

|

|

$ |

238.1 |

|

|

71 |

% |

Financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (1) |

$ |

984.3 |

|

|

$ |

789.1 |

|

|

$ |

195.2 |

|

|

|

25 |

% |

|

$ |

1,950.8 |

|

|

$ |

1,729.7 |

|

|

$ |

221.1 |

|

|

13 |

% |

Adjusted cash flow from operations (1) |

|

808.5 |

|

|

|

622.0 |

|

|

|

186.5 |

|

|

|

30 |

% |

|

|

1,547.2 |

|

|

|

1,393.2 |

|

|

|

154.0 |

|

|

11 |

% |

Adjusted free cash flow (1) |

|

(43.0 |

) |

|

|

(3.7 |

) |

|

|

(39.3 |

) |

|

NM |

|

|

|

(40.0 |

) |

|

|

310.3 |

|

|

|

(350.3 |

) |

|

(113 |

%) |

(1)Adjusted EBITDA, adjusted cash flow from operations and adjusted free cash flow are non-GAAP financial measures and are discussed under “Non-GAAP Financial Measures.”

NM Due to a low denominator, the noted percentage change is disproportionately high and as a result, considered not meaningful.

Three Months Ended June 30, 2024 Compared to Three Months Ended June 30, 2023

The increase in commodity sales reflects higher NGL prices ($357.7 million) and higher NGL, natural gas and condensate volumes ($272.7 million), partially offset by lower natural gas and condensate prices ($302.5 million) and the unfavorable impact of hedges ($251.6 million).

The increase in fees from midstream services is primarily due to higher gas gathering and processing fees, and higher export volumes, partially offset by lower transportation and fractionation fees.

The increase in product purchases and fuel reflects higher NGL prices and higher NGL, natural gas and condensate volumes, partially offset by lower natural gas and condensate prices.

The increase in operating expenses is primarily due to higher labor and rental costs as a result of increased activity and system expansions.

See “—Review of Segment Performance” for additional information on a segment basis.

The increase in depreciation and amortization expense is primarily due to the impact of system expansions on the Company’s asset base, partially offset by the shortening of depreciable lives of certain assets that were idled in the second quarter of 2023 and subsequently shut down in the third quarter of 2023.

The increase in general and administrative expense is primarily due to higher compensation and benefits.

The increase in interest expense, net, is due to higher borrowings, partially offset by an increase in capitalized interest.

Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

The increase in commodity sales reflects higher NGL, natural gas and condensate volumes ($985.8 million) and higher NGL prices ($158.0 million), partially offset by lower natural gas prices ($632.3 million) and the unfavorable impact of hedges ($510.0 million).

The increase in fees from midstream services is primarily due to higher gas gathering and processing fees, and higher export volumes.

The increase in product purchases and fuel reflects higher NGL, natural gas and condensate volumes and higher NGL prices, partially offset by lower natural gas prices.

The increase in operating expenses is primarily due to higher labor and rental costs as a result of increased activity and system expansions.

See “—Review of Segment Performance” for additional information on a segment basis.

The increase in depreciation and amortization expense is primarily due to the impact of system expansions on the Company’s asset base, partially offset by the shortening of depreciable lives of certain assets that were idled in the second quarter of 2023 and subsequently shut down in the third quarter of 2023.

The increase in general and administrative expense is primarily due to higher compensation and benefits.

The increase in interest expense, net, is due to recognition of cumulative interest on a 2024 legal ruling associated with the Splitter Agreement and higher borrowings, partially offset by an increase in capitalized interest.

The decrease in income tax expense is primarily due to a decrease in pre-tax book income, partially offset by the release of valuation allowance in 2023.

The premium on repurchase of noncontrolling interests, net of tax is due to the acquisition of Blackstone Energy Partners’ 25% interest in the Grand Prix Joint Venture in 2023.

Review of Segment Performance

The following discussion of segment performance includes inter-segment activities. The Company views segment operating margin and adjusted operating margin as important performance measures of the core profitability of its operations. These measures are key components of internal financial reporting and are reviewed for consistency and trend analysis. For a discussion of adjusted operating margin, see “Non-GAAP Financial Measures ― Adjusted Operating Margin.” Segment operating financial results and operating statistics include the effects of intersegment transactions. These intersegment transactions have been eliminated from the consolidated presentation.

The Company operates in two primary segments: (i) Gathering and Processing; and (ii) Logistics and Transportation.

Gathering and Processing Segment

The Gathering and Processing segment includes assets used in the gathering and/or purchase and sale of natural gas produced from oil and gas wells, removing impurities and processing this raw natural gas into merchantable natural gas by extracting NGLs; and assets used for the gathering and terminaling and/or purchase and sale of crude oil. The Gathering and Processing segment’s assets are located in the Permian Basin of West Texas and Southeast New Mexico (including the Midland, Central and Delaware Basins); the Eagle Ford Shale in South Texas; the Barnett Shale in North Texas; the Anadarko, Ardmore, and Arkoma Basins in Oklahoma (including the SCOOP and STACK) and South Central Kansas; the Williston Basin in North Dakota (including the Bakken and Three Forks plays); and the onshore and near offshore regions of the Louisiana Gulf Coast.

The following table provides summary data regarding results of operations of this segment for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

|

(In millions, except operating statistics and price amounts) |

|

Operating margin |

$ |

|

572.6 |

|

|

$ |

|

502.5 |

|

|

$ |

|

70.1 |

|

|

|

14 |

% |

|

$ |

|

1,128.9 |

|

|

$ |

|

1,040.9 |

|

|

$ |

|

88.0 |

|

|

|

8 |

% |

Operating expenses |

|

|

205.7 |

|

|

|

|

189.8 |

|

|

|

|

15.9 |

|

|

|

8 |

% |

|

|

|

393.7 |

|

|

|

|

371.2 |

|

|

|

|

22.5 |

|

|

|

6 |

% |

Adjusted operating margin |

$ |

|

778.3 |

|

|

$ |

|

692.3 |

|

|

$ |

|

86.0 |

|

|

|

12 |

% |

|

$ |

|

1,522.6 |

|

|

$ |

|

1,412.1 |

|

|

$ |

|

110.5 |

|

|

|

8 |

% |

Operating statistics (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plant natural gas inlet, MMcf/d (2) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permian Midland (4) |

|

|

2,866.4 |

|

|

|

|

2,504.3 |

|

|

|

|

362.1 |

|

|

|

14 |

% |

|

|

|

2,806.3 |

|

|

|

|

2,426.9 |

|

|

|

|

379.4 |

|

|

|

16 |

% |

Permian Delaware |

|

|

2,805.1 |

|

|

|

|

2,560.8 |

|

|

|

|

244.3 |

|

|

|

10 |

% |

|

|

|

2,727.0 |

|

|

|

|

2,528.1 |

|

|

|

|

198.9 |

|

|

|

8 |

% |

Total Permian |

|

|

5,671.5 |

|

|

|

|

5,065.1 |

|

|

|

|

606.4 |

|

|

|

12 |

% |

|

|

|

5,533.3 |

|

|

|

|

4,955.0 |

|

|

|

|

578.3 |

|

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SouthTX (5) |

|

|

339.4 |

|

|

|

|

371.0 |

|

|

|

|

(31.6 |

) |

|

|

(9 |

%) |

|

|

|

322.2 |

|

|

|

|

363.5 |

|

|

|

|

(41.3 |

) |

|

|

(11 |

%) |

North Texas |

|

|

191.8 |

|

|

|

|

208.0 |

|

|

|

|

(16.2 |

) |

|

|

(8 |

%) |

|

|

|

188.1 |

|

|

|

|

201.8 |

|

|

|

|

(13.7 |

) |

|

|

(7 |

%) |

SouthOK (5) |

|

|

361.5 |

|

|

|

|

395.0 |

|

|

|

|

(33.5 |

) |

|

|

(8 |

%) |

|

|

|

359.3 |

|

|

|

|

389.5 |

|

|

|

|

(30.2 |

) |

|

|

(8 |

%) |

WestOK |

|

|

215.1 |

|

|

|

|

211.0 |

|

|

|

|

4.1 |

|

|

|

2 |

% |

|

|

|

212.6 |

|

|

|

|

207.6 |

|

|

|

|

5.0 |

|

|

|

2 |

% |

Total Central |

|

|

1,107.8 |

|

|

|

|

1,185.0 |

|

|

|

|

(77.2 |

) |

|

|

(7 |

%) |

|

|

|

1,082.2 |

|

|

|

|

1,162.4 |

|

|

|

|

(80.2 |

) |

|

|

(7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Badlands (5) (6) |

|

|

143.9 |

|

|

|

|

128.9 |

|

|

|

|

15.0 |

|

|

|

12 |

% |

|

|

|

135.5 |

|

|

|

|

130.3 |

|

|

|

|

5.2 |

|

|

|

4 |

% |

Total Field |

|

|

6,923.2 |

|

|

|

|

6,379.0 |

|

|

|

|

544.2 |

|

|

|

9 |

% |

|

|

|

6,751.0 |

|

|

|

|

6,247.7 |

|

|

|

|

503.3 |

|

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coastal |

|

|

467.0 |

|

|

|

|

552.1 |

|

|

|

|

(85.1 |

) |

|

|

(15 |

%) |

|

|

|

495.8 |

|

|

|

|

530.7 |

|

|

|

|

(34.9 |

) |

|

|

(7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

7,390.2 |

|

|

|

|

6,931.1 |

|

|

|

|

459.1 |

|

|

|

7 |

% |

|

|

|

7,246.8 |

|

|

|

|

6,778.4 |

|

|

|

|

468.4 |

|

|

|

7 |

% |

NGL production, MBbl/d (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permian Midland (4) |

|

|

424.1 |

|

|

|

|

363.6 |

|

|

|

|

60.5 |

|

|

|

17 |

% |

|

|

|

408.4 |

|

|

|

|

349.4 |

|

|

|

|

59.0 |

|

|

|

17 |

% |

Permian Delaware |

|

|

364.5 |

|

|

|

|

332.5 |

|

|

|

|

32.0 |

|

|

|

10 |

% |

|

|

|

335.7 |

|

|

|

|

326.7 |

|

|

|

|

9.0 |

|

|

|

3 |

% |

Total Permian |

|

|

788.6 |

|

|

|

|

696.1 |

|

|

|

|

92.5 |

|

|

|

13 |

% |

|

|

|

744.1 |

|

|

|

|

676.1 |

|

|

|

|

68.0 |

|

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SouthTX (5) |

|

|

42.2 |

|

|

|

|

45.6 |

|

|

|

|

(3.4 |

) |

|

|

(7 |

%) |

|

|

|

35.6 |

|

|

|

|

42.0 |

|

|

|

|

(6.4 |

) |

|

|

(15 |

%) |

North Texas |

|

|

23.5 |

|

|

|

|

24.3 |

|

|

|

|

(0.8 |

) |

|

|

(3 |

%) |

|

|

|

22.7 |

|

|

|

|

23.7 |

|

|

|

|

(1.0 |

) |

|

|

(4 |

%) |

SouthOK (5) |

|

|

43.5 |

|

|

|

|

47.3 |

|

|

|

|

(3.8 |

) |

|

|

(8 |

%) |

|

|

|

35.8 |

|

|

|

|

43.1 |

|

|

|

|

(7.3 |

) |

|

|

(17 |

%) |

WestOK |

|

|

15.5 |

|

|

|

|

12.5 |

|

|

|

|

3.0 |

|

|

|

24 |

% |

|

|

|

13.6 |

|

|

|

|

12.8 |

|

|

|

|

0.8 |

|

|

|

6 |

% |

Total Central |

|

|

124.7 |

|

|

|

|

129.7 |

|

|

|

|

(5.0 |

) |

|

|

(4 |

%) |

|

|

|

107.7 |

|

|

|

|

121.6 |

|

|

|

|

(13.9 |

) |

|

|

(11 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Badlands (5) |

|

|

18.0 |

|

|

|

|

15.6 |

|

|

|

|

2.4 |

|

|

|

15 |

% |

|

|

|

16.3 |

|

|

|

|

15.5 |

|

|

|

|

0.8 |

|

|

|

5 |

% |

Total Field |

|

|

931.3 |

|

|

|

|

841.4 |

|

|

|

|

89.9 |

|

|

|

11 |

% |

|

|

|

868.1 |

|

|

|

|

813.2 |

|

|

|

|

54.9 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coastal |

|

|

34.4 |

|

|

|

|

36.8 |

|

|

|

|

(2.4 |

) |

|

|

(7 |

%) |

|

|

|

36.7 |

|

|

|

|

36.5 |

|

|

|

|

0.2 |

|

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

965.7 |

|

|

|

|

878.2 |

|

|

|

|

87.5 |

|

|

|

10 |

% |

|

|

|

904.8 |

|

|

|

|

849.7 |

|

|

|

|

55.1 |

|

|

|

6 |

% |

Crude oil, Badlands, MBbl/d |

|

|

99.1 |

|

|

|

|

104.7 |

|

|

|

|

(5.6 |

) |

|

|

(5 |

%) |

|

|

|

96.8 |

|

|

|

|

107.7 |

|

|

|

|

(10.9 |

) |

|

|

(10 |

%) |

Crude oil, Permian, MBbl/d |

|

|

27.9 |

|

|

|

|

29.4 |

|

|

|

|

(1.5 |

) |

|

|

(5 |

%) |

|

|

|

27.7 |

|

|

|

|

27.5 |

|

|

|

|

0.2 |

|

|

|

1 |

% |

Natural gas sales, BBtu/d (3) |

|

|

2,876.8 |

|

|

|

|

2,672.6 |

|

|

|

|

204.2 |

|

|

|

8 |

% |

|

|

|

2,763.7 |

|

|

|

|

2,622.8 |

|

|

|

|

140.9 |

|

|

|

5 |

% |

NGL sales, MBbl/d (3) |

|

|

569.7 |

|

|

|

|

493.8 |

|

|

|

|

75.9 |

|

|

|

15 |

% |

|

|

|

534.3 |

|

|

|

|

476.6 |

|

|

|

|

57.7 |

|

|

|

12 |

% |

Condensate sales, MBbl/d |

|

|

21.2 |

|

|

|

|

19.4 |

|

|

|

|

1.8 |

|

|

|

9 |

% |

|

|

|

20.1 |

|

|

|

|

19.6 |

|

|

|

|

0.5 |

|

|

|

3 |

% |

Average realized prices (7): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas, $/MMBtu |

|

|

0.10 |

|

|

|

|

1.29 |

|

|

|

|

(1.19 |

) |

|

|

(92 |

%) |

|

|

|

0.77 |

|

|

|

|

1.94 |

|

|

|

|

(1.17 |

) |

|

|

(60 |

%) |

NGL, $/gal |

|

|

0.44 |

|

|

|

|

0.41 |

|

|

|

|

0.03 |

|

|

|

7 |

% |

|

|

|

0.46 |

|

|

|

|

0.47 |

|

|

|

|

(0.01 |

) |

|

|

(2 |

%) |

Condensate, $/Bbl |

|

|

72.83 |

|

|

|

|

85.79 |

|

|

|

|

(12.96 |

) |

|

|

(15 |

%) |

|

|

|

74.91 |

|

|

|

|

76.02 |

|

|

|

|

(1.11 |

) |

|

|

(1 |

%) |

(1)Segment operating statistics include the effect of intersegment amounts, which have been eliminated from the consolidated presentation. For all volume statistics presented, the numerator is the total volume sold during the period and the denominator is the number of calendar days during the period.

(2)Plant natural gas inlet represents the Company’s undivided interest in the volume of natural gas passing through the meter located at the inlet of a natural gas processing plant, other than Badlands.

(3)Plant natural gas inlet volumes and gross NGL production volumes include producer take-in-kind volumes, while natural gas sales and NGL sales exclude producer take-in-kind volumes.

(4)Permian Midland includes operations in WestTX, of which the Company owns a 72.8% undivided interest, and other plants that are owned 100% by the Company. Operating results for the WestTX undivided interest assets are presented on a pro-rata net basis in the Company’s reported financials.

(5)Operations include facilities that are not wholly owned by the Company.

(6)Badlands natural gas inlet represents the total wellhead volume and includes the Targa volumes processed at the Little Missouri 4 plant.

(7)Average realized prices, net of fees, include the effect of realized commodity hedge gain/loss attributable to the Company’s equity volumes. The price is calculated using total commodity sales plus the hedge gain/loss as the numerator and total sales volume as the denominator, net of fees.

The following table presents the realized commodity hedge gain (loss) attributable to the Company’s equity volumes that are included in the adjusted operating margin of the Gathering and Processing segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

|

Three Months Ended June 30, 2023 |

|

|

|

(In millions, except volumetric data and price amounts) |

|

|

|

Volume

Settled |

|

|

Price

Spread (1) |

|

|

Gain

(Loss) |

|

|

Volume

Settled |

|

|

Price

Spread (1) |

|

|

Gain

(Loss) |

|

Natural gas (BBtu) |

|

|

10.5 |

|

|

$ |

2.58 |

|

|

$ |

27.1 |

|

|

|

15.3 |

|

|

$ |

1.73 |

|

|

$ |

26.4 |

|

NGL (MMgal) |

|

|

112.0 |

|

|

|

0.05 |

|

|

|

5.1 |

|

|

|

164.9 |

|

|

|

0.11 |

|

|

|

17.7 |

|

Crude oil (MBbl) |

|

|

0.4 |

|

|

|

(11.25 |

) |

|

|

(4.5 |

) |

|

|

0.6 |

|

|

|

(3.67 |

) |

|

|

(2.2 |

) |

|

|

|

|

|

|

|

|

$ |

27.7 |

|

|

|

|

|

|

|

|

$ |

41.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2024 |

|

|

Six Months Ended June 30, 2023 |

|

|

|

(In millions, except volumetric data and price amounts) |

|

|

|

Volume

Settled |

|

|

Price

Spread (1) |

|

|

Gain

(Loss) |

|

|

Volume

Settled |

|

|

Price

Spread (1) |

|

|

Gain

(Loss) |

|

Natural gas (BBtu) |

|

|

26.2 |

|

|

$ |

1.73 |

|

|

$ |

45.4 |

|

|

|

35.0 |

|

|

$ |

1.51 |

|

|

$ |

52.9 |

|

NGL (MMgal) |

|

|

246.1 |

|

|

|

0.03 |

|

|

|

6.8 |

|

|

|

349.0 |

|

|

|

0.08 |

|

|

|

27.2 |

|

Crude oil (MBbl) |

|

|

0.9 |

|

|

|

(8.22 |

) |

|

|

(7.4 |

) |

|

|

1.2 |

|

|

|

(4.17 |

) |

|

|

(5.0 |

) |

|

|

|

|

|

|

|

|

$ |

44.8 |

|

|

|

|

|

|

|

|

$ |

75.1 |

|

(1)The price spread is the differential between the contracted derivative instrument pricing and the price of the corresponding settled commodity transaction.

Three Months Ended June 30, 2024 Compared to Three Months Ended June 30, 2023

The increase in adjusted operating margin was due to higher natural gas inlet volumes and higher fees in the Permian, partially offset by lower natural gas and condensate prices. The increase in natural gas inlet volumes in the Permian was attributable to the addition of the Midway plant during the second quarter of 2023, the Greenwood and Wildcat II plants during the fourth quarter of 2023, the Roadrunner II plant during the second quarter of 2024, and continued strong producer activity.

The increase in operating expenses was primarily due to higher volumes in the Permian and the addition of the Midway, Greenwood, Wildcat II and Roadrunner II plants.

Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

The increase in adjusted operating margin was due to higher natural gas inlet volumes and higher fees in the Permian, partially offset by lower commodity prices. The increase in natural gas inlet volumes in the Permian was attributable to the addition of the Legacy II plant during the first quarter of 2023, the Midway plant during the second quarter of 2023, the Greenwood and Wildcat II plants during the fourth quarter of 2023, the Roadrunner II plant during the second quarter of 2024, and continued strong producer activity.

The increase in operating expenses was primarily due to higher volumes in the Permian and the addition of the Legacy II, Midway, Greenwood, Wildcat II and Roadrunner II plants.

Logistics and Transportation Segment

The Logistics and Transportation segment includes the activities and assets necessary to convert mixed NGLs into NGL products and also includes other assets and value-added services such as transporting, storing, fractionating, terminaling, and marketing of NGLs and NGL products, including services to LPG exporters and certain natural gas supply and marketing activities in support of the Company’s other businesses. The Logistics and Transportation segment also includes Grand Prix NGL Pipeline, which connects the Company’s gathering and processing positions in the Permian Basin, Southern Oklahoma and North Texas with the Company’s Downstream facilities in Mont Belvieu, Texas. The associated assets are generally connected to and supplied in part by the Company’s Gathering and Processing segment and, except for the pipelines and smaller terminals, are located predominantly in Mont Belvieu and Galena Park, Texas, and in Lake Charles, Louisiana.

The following table provides summary data regarding results of operations of this segment for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

(In millions, except operating statistics) |

Operating margin |

$ |

|

547.7 |

|

|

$ |

|

408.0 |

|

|

$ |

|

139.7 |

|

|

34% |

|

$ |

|

1,079.8 |

|

|

$ |

|

937.1 |

|

|

$ |

|

142.7 |

|

|

15% |

Operating expenses |

|

|

85.4 |

|

|

|

|

82.5 |

|

|

|

|

2.9 |

|

|

4% |

|

|

|

175.4 |

|

|

|

|

159.0 |

|

|

|

|

16.4 |

|

|

10% |

Adjusted operating margin |

$ |

|

633.1 |

|

|

$ |

|

490.5 |

|

|

$ |

|

142.6 |

|

|

29% |

|

$ |

|

1,255.2 |

|

|

$ |

|

1,096.1 |

|

|

$ |

|

159.1 |

|

|

15% |

Operating statistics MBbl/d (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NGL pipeline transportation volumes (2) |

|

|

783.5 |

|

|

|

|

620.7 |

|

|

|

|

162.8 |

|

|

26% |

|

|

|

750.6 |

|

|

|

|

579.0 |

|

|

|

|

171.6 |

|

|

30% |

Fractionation volumes |

|

|

902.2 |

|

|

|

|

794.4 |

|

|

|

|

107.8 |

|

|

14% |

|

|

|

849.7 |

|

|

|

|

776.7 |

|

|

|

|

73.0 |

|

|

9% |

Export volumes (3) |

|

|

394.1 |

|

|

|

|

303.2 |

|

|

|

|

90.9 |

|

|

30% |

|

|

|

416.6 |

|

|

|

|

338.1 |

|

|

|

|

78.5 |

|

|

23% |

NGL sales |

|

|

1,018.4 |

|

|

|

|

947.0 |

|

|

|

|

71.4 |

|

|

8% |

|

|

|

1,123.0 |

|

|

|

|

977.1 |

|

|

|

|

145.9 |

|

|

15% |

(1)Segment operating statistics include intersegment amounts, which have been eliminated from the consolidated presentation. For all volume statistics presented, the numerator is the total volume sold during the period and the denominator is the number of calendar days during the period.

(2)Represents the total quantity of mixed NGLs that earn a transportation margin.

(3)Export volumes represent the quantity of NGL products delivered to third-party customers at the Company’s Galena Park Marine Terminal that are destined for international markets.

Three Months Ended June 30, 2024 Compared to Three Months Ended June 30, 2023

The increase in adjusted operating margin was due to higher pipeline transportation and fractionation margin, higher marketing margin, and higher LPG export margin. Pipeline transportation and fractionation volumes benefited from higher supply volumes primarily from the Company’s Permian Gathering and Processing systems and the addition of Train 9 during the second quarter of 2024. Marketing margin increased due to greater optimization opportunities. LPG export margin increased due to higher volumes as the Company benefited from the completion of its export expansion during the third quarter of 2023 and the Houston Ship Channel allowing night-time vessel transits, partially offset by maintenance and required inspections.

The increase in operating expenses was due to higher system volumes, higher compensation and benefits, and the addition of Train 9, partially offset by lower repairs and maintenance.

Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

The increase in adjusted operating margin was due to higher pipeline transportation and fractionation margin and higher LPG export margin, partially offset by lower marketing margin. Pipeline transportation and fractionation volumes benefited from higher supply volumes primarily from the Company’s Permian Gathering and Processing systems and the addition of Train 9 during the second quarter of 2024. LPG export margin increased due to higher volumes as the Company benefited from the completion of its export expansion during the third quarter of 2023 and the Houston Ship Channel allowing night-time vessel transits, partially offset by maintenance and required inspections. Greater seasonal optimization opportunities drove marketing margin higher during the first quarter of 2023.

The increase in operating expenses was due to higher system volumes, higher compensation and benefits, higher repairs and maintenance, and the addition of Train 9.

Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

|

(In millions) |

|

Operating margin |

|

$ |

(46.6 |

) |

|

$ |

151.9 |

|

|

$ |

(198.5 |

) |

|

$ |

(68.7 |

) |

|

$ |

327.7 |

|

|

$ |

(396.4 |

) |

Adjusted operating margin |

|

$ |

(46.6 |

) |

|

$ |

151.9 |

|

|

$ |

(198.5 |

) |

|

$ |

(68.7 |

) |

|

$ |

327.7 |

|

|

$ |

(396.4 |

) |

Other contains the results of commodity derivative activity mark-to-market gains/losses related to derivative contracts that were not designated as cash flow hedges. The Company has entered into derivative instruments to hedge the commodity price associated with a portion of the Company’s future commodity purchases and sales and natural gas transportation basis risk within the Company’s Logistics and Transportation segment.

About Targa Resources Corp.

Targa Resources Corp. is a leading provider of midstream services and is one of the largest independent midstream infrastructure companies in North America. The Company owns, operates, acquires and develops a diversified portfolio of complementary domestic midstream infrastructure assets and its operations are critical to the efficient, safe and reliable delivery of energy across the United States and increasingly to the world. The Company’s assets connect natural gas and NGLs to domestic and international markets with growing demand for cleaner fuels and feedstocks. The Company is primarily engaged in the business of: gathering, compressing, treating, processing, transporting, and purchasing and selling natural gas; transporting, storing, fractionating, treating, and purchasing and selling NGLs and NGL products, including services to LPG exporters; and gathering, storing, terminaling, and purchasing and selling crude oil.

Targa is a FORTUNE 500 company and is included in the S&P 500.

For more information, please visit the Company’s website at www.targaresources.com.

Non-GAAP Financial Measures

This press release includes the Company’s non-GAAP financial measures: adjusted EBITDA, adjusted cash flow from operations, adjusted free cash flow and adjusted operating margin (segment). The following tables provide reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures.

The Company utilizes non-GAAP measures to analyze the Company’s performance. Adjusted EBITDA, adjusted cash flow from operations, adjusted free cash flow and adjusted operating margin (segment) are non-GAAP measures. The GAAP measures most directly comparable to these non-GAAP measures are income (loss) from operations, Net income (loss) attributable to Targa Resources Corp. and segment operating margin. These non-GAAP measures should not be considered as an alternative to GAAP measures and have important limitations as analytical tools. Investors should not consider these measures in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Additionally, because the Company’s non-GAAP measures exclude some, but not all, items that affect income and segment operating margin, and are defined differently by different companies within the Company’s industry, the Company’s definitions may not be comparable with similarly titled measures of other companies, thereby diminishing their utility. Management compensates for the limitations of the Company’s non-GAAP measures as analytical tools by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating these insights into the Company’s decision-making processes.

Adjusted Operating Margin

The Company defines adjusted operating margin for the Company’s segments as revenues less product purchases and fuel. It is impacted by volumes and commodity prices as well as by the Company’s contract mix and commodity hedging program.

Gathering and Processing adjusted operating margin consists primarily of:

•service fees related to natural gas and crude oil gathering, treating and processing; and

•revenues from the sale of natural gas, condensate, crude oil and NGLs less producer settlements, fuel and transport and the Company’s equity volume hedge settlements.

Logistics and Transportation adjusted operating margin consists primarily of:

•service fees (including the pass-through of energy costs included in certain fee rates);

•system product gains and losses; and

•NGL and natural gas sales, less NGL and natural gas purchases, fuel, third-party transportation costs and the net inventory change.

The adjusted operating margin impacts of mark-to-market hedge unrealized changes in fair value are reported in Other.

Adjusted operating margin for the Company’s segments provides useful information to investors because it is used as a supplemental financial measure by management and by external users of the Company’s financial statements, including investors and commercial banks, to assess:

•the financial performance of the Company’s assets without regard to financing methods, capital structure or historical cost basis;

•the Company’s operating performance and return on capital as compared to other companies in the midstream energy sector, without regard to financing or capital structure; and

•the viability of capital expenditure projects and acquisitions and the overall rates of return on alternative investment opportunities.

Management reviews adjusted operating margin and operating margin for the Company’s segments monthly as a core internal management process. The Company believes that investors benefit from having access to the same financial measures that management uses in evaluating the Company’s operating results. The reconciliation of the Company’s adjusted operating margin to the most directly comparable GAAP measure is presented under “Review of Segment Performance.”

Adjusted EBITDA

The Company defines adjusted EBITDA as Net income (loss) attributable to Targa Resources Corp. before interest, income taxes, depreciation and amortization, and other items that the Company believes should be adjusted consistent with the Company’s core operating performance. The adjusting items are detailed in the adjusted EBITDA reconciliation table and its footnotes. Adjusted EBITDA is used as a supplemental financial measure by the Company and by external users of the Company’s financial statements such as investors, commercial banks and others to measure the ability of the Company’s assets to generate cash sufficient to pay interest costs, support the Company’s indebtedness and pay dividends to the Company’s investors.

Adjusted Cash Flow from Operations and Adjusted Free Cash Flow

The Company defines adjusted cash flow from operations as adjusted EBITDA less cash interest expense on debt obligations and cash tax (expense) benefit. The Company defines adjusted free cash flow as adjusted cash flow from operations less maintenance capital expenditures (net of any reimbursements of project costs) and growth capital expenditures, net of contributions from noncontrolling interest and contributions to investments in unconsolidated affiliates. Adjusted cash flow from operations and adjusted free cash flow are performance measures used by the Company and by external users of the Company’s financial statements, such as investors, commercial banks and research analysts, to assess the Company’s ability to generate cash earnings (after servicing the Company’s debt and funding capital expenditures) to be used for corporate purposes, such as payment of dividends, retirement of debt or redemption of other financing arrangements.

The following table presents a reconciliation of Net income (loss) attributable to Targa Resources Corp. to adjusted EBITDA, adjusted cash flow from operations and adjusted free cash flow for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

(In millions) |

|

Reconciliation of Net income (loss) attributable to Targa Resources Corp. to Adjusted EBITDA, Adjusted Cash Flow from Operations and Adjusted Free Cash Flow |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Targa Resources Corp. |

$ |

298.5 |

|

|

$ |

329.3 |

|

|

$ |

573.7 |

|

|

$ |

826.3 |

|

Interest (income) expense, net |

|

176.0 |

|

|

|

166.6 |

|

|

|

404.6 |

|

|

|

334.7 |

|

Income tax expense (benefit) |

|

94.3 |

|

|

|

96.4 |

|

|

|

177.1 |

|

|

|

206.7 |

|

Depreciation and amortization expense |

|

348.6 |

|

|

|

332.1 |

|

|

|

689.1 |

|

|

|

656.9 |

|

(Gain) loss on sale or disposition of assets |

|

(0.6 |

) |

|

|

(1.7 |

) |

|

|

(1.6 |

) |

|

|

(3.2 |

) |

Write-down of assets |

|

0.3 |

|

|

|

1.7 |

|

|

|

1.2 |

|

|

|

2.6 |

|

(Gain) loss from financing activities |

|

0.8 |

|

|

|

— |

|

|

|

0.8 |

|

|

|

— |

|

Equity (earnings) loss |

|

(2.9 |

) |

|

|

(3.4 |

) |

|

|

(5.6 |

) |

|

|

(3.2 |

) |

Distributions from unconsolidated affiliates |

|

5.9 |

|

|

|

6.2 |

|

|

|

12.2 |

|

|

|

8.8 |

|

Compensation on equity grants |

|

15.1 |

|

|

|

15.0 |

|

|

|

29.7 |

|

|

|

30.0 |

|

Risk management activities |

|

46.6 |

|

|

|

(151.9 |

) |

|

|

68.8 |

|

|

|

(327.7 |

) |

Noncontrolling interests adjustments (1) |

|

1.7 |

|

|

|

(1.2 |

) |

|

|

0.8 |

|

|

|

(2.2 |

) |

Adjusted EBITDA |

$ |

984.3 |

|

|

$ |

789.1 |

|

|

$ |

1,950.8 |

|

|

$ |

1,729.7 |

|

Interest expense on debt obligations (2) |

|

(172.4 |

) |

|

|

(163.6 |

) |

|

|

(397.3 |

) |

|

|

(328.8 |

) |

Cash taxes |

|

(3.4 |

) |

|

|

(3.5 |

) |

|

|

(6.3 |

) |

|

|

(7.7 |

) |

Adjusted Cash Flow from Operations |

$ |

808.5 |

|

|

$ |

622.0 |

|

|

$ |

1,547.2 |

|

|

$ |

1,393.2 |

|

Maintenance capital expenditures, net (3) |

|

(52.8 |

) |

|

|

(46.2 |

) |

|

|

(102.7 |

) |

|

|

(88.0 |

) |

Growth capital expenditures, net (3) |

|

(798.7 |

) |

|

|

(579.5 |

) |

|

|

(1,484.5 |

) |

|

|

(994.9 |

) |

Adjusted Free Cash Flow |

$ |

(43.0 |

) |

|

$ |

(3.7 |

) |

|

$ |

(40.0 |

) |

|

$ |

310.3 |

|

(1)Noncontrolling interest portion of depreciation and amortization expense.

(2)Excludes amortization of interest expense. The three and six months ended June 30, 2024 includes $0.9 million and $55.8 million, respectively, of interest expense associated with the Splitter Agreement ruling.

(3)Represents capital expenditures, net of contributions from noncontrolling interests and includes contributions to investments in unconsolidated affiliates.

The following table presents a reconciliation of estimated net income of the Company to estimated adjusted EBITDA for 2024:

|

|

|

|

|

2024E |

|

|

(In millions) |

|

Reconciliation of Estimated Net Income Attributable to Targa Resources Corp. to |

|

|

Estimated Adjusted EBITDA |

|

|

Net income attributable to Targa Resources Corp. |

$ |

1,355.0 |

|

Interest expense, net (1) |

|

790.0 |

|

Income tax expense |

|

360.0 |

|

Depreciation and amortization expense |

|

1,355.0 |

|

Equity earnings |

|

(15.0 |

) |

Distributions from unconsolidated affiliates |

|

25.0 |

|

Compensation on equity grants |

|

65.0 |

|

Risk management and other |

|

70.0 |

|

Noncontrolling interests adjustments (2) |

|

(5.0 |

) |

Estimated Adjusted EBITDA |

$ |

4,000.0 |

|

(1)Includes $55.8 million of interest expense associated with the Splitter Agreement ruling.

(2)Noncontrolling interest portion of depreciation and amortization expense.

Regulation FD Disclosures

The Company uses any of the following to comply with its disclosure obligations under Regulation FD: press releases, SEC filings, public conference calls, or our website. The Company routinely posts important information on its website at www.targaresources.com, including information that may be deemed to be material. The Company encourages investors and others interested in the company to monitor these distribution channels for material disclosures.

Forward-Looking Statements