~ Revenues of $493.0 million ~

~ GAAP Diluted Earnings Per Share of $1.26

~

Ubiquiti Inc. (NYSE: UI) ("Ubiquiti" or the "Company") today

announced its financial results for the third quarter ended March

31, 2024.

Third Quarter Fiscal 2024 Financial

Summary

- Revenues of $493.0 million

- GAAP diluted EPS of $1.26

- Non-GAAP diluted EPS of $1.28

Additional Financial

Highlight

- The Company's Board of Directors declared a $0.60 per share

cash dividend payable on May 28, 2024 to shareholders of record at

the close of business on May 20, 2024.

Financial Highlights ($, in millions, except per share

data)

Income statement highlights

F3Q24

F2Q24

F3Q23

Revenues

493.0

465.0

457.8

Enterprise Technology

414.3

391.5

373.6

Service Provider Technology

78.7

73.5

84.2

Gross profit

174.1

177.6

188.5

Gross Profit (%)

35.3%

38.2%

41.2%

Total Operating Expenses

62.9

56.5

55.0

Income from Operations

111.2

121.1

133.5

GAAP Net Income

76.3

82.1

98.6

GAAP EPS (diluted)

1.26

1.36

1.63

Non-GAAP Net Income

77.6

83.3

99.5

Non-GAAP EPS (diluted)

1.28

1.38

1.65

Ubiquiti Inc.

Revenues by Product Type

(In thousands)

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Enterprise Technology

$

414,345

$

373,573

$

1,185,932

$

1,217,279

Service Provider Technology

78,652

84,200

235,097

232,148

Total revenues

$

492,997

$

457,773

$

1,421,029

$

1,449,427

Ubiquiti Inc.

Revenues by Geographical Area

(In thousands)

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

North America

$

242,511

$

230,741

$

693,154

$

683,907

Europe, the Middle East and Africa

200,666

173,262

546,010

568,502

Asia Pacific

26,459

26,880

95,815

116,158

South America

23,361

26,890

86,050

80,860

Total revenues

$

492,997

$

457,773

$

1,421,029

$

1,449,427

Income Statement Items

Revenues

Revenues for the third quarter fiscal 2024 were $493.0 million,

representing an increase from the prior quarter of 6.0% and an

increase from the comparable prior year period of 7.7%.

The increase in revenues compared to the prior quarter was

driven by an increase in revenue from both our Enterprise

Technology platform and Service Provider Technology platform. The

increase in revenues as compared to the comparable prior year

period was driven by an increase in revenue from our Enterprise

Technology platform, offset in part by decrease in revenue from our

Service Provider Technology platform.

Gross Margins

During the third quarter fiscal 2024, GAAP gross profit was

$174.1 million. GAAP gross margin of 35.3% decreased by 2.9% as

compared to the prior quarter GAAP gross margin of 38.2% and

decreased by 5.9% as compared to the comparable prior year period

GAAP gross margin of 41.2%.

The decrease in gross profit margin as compared to the prior

quarter was primarily driven by incremental excess and obsolete

inventory charges and higher warehouse-related operating expenses,

offset in part by lower shipping costs and favorable product mix.

The decrease in gross profit margin as compared to the comparable

prior year period was primarily driven by incremental excess and

obsolete inventory charges, unfavorable product mix and higher

shipping costs, offset in part by lower tariffs.

Research and Development

During the third quarter fiscal 2024, research and development

("R&D") expenses were $42.5 million. This reflects an increase

as compared to the R&D expenses of $36.9 million in the prior

quarter and an increase as compared to the R&D expenses of

$38.2 million in the comparable prior year period.

The increase in R&D expenses as compared to both the prior

quarter and the comparable prior year period were primarily driven

by higher prototype-related expenses and higher employee-related

expenses.

Sales, General and Administrative

The Company’s sales, general and administrative ("SG&A")

expenses for the third quarter fiscal 2024 were $20.4 million. This

reflects an increase as compared to the SG&A expenses of $19.6

million in the prior quarter and an increase compared to the

SG&A expenses of $16.7 million in the comparable prior year

period.

The increase in SG&A costs as compared to the prior quarter

was primarily due to higher travel expenses and higher fees

associated with webstore credit card processing, offset in part by

lower marketing expenses and professional fees. The increase in

SG&A as compared to the comparable prior year period was

primarily due to higher fees associated with webstore credit card

processing, higher travel expenses, professional fees, higher

employee-related expenses, and marketing expenses.

Interest Expense and Other, net

During the third quarter fiscal 2024, Interest expense and

other, net ("I&O") expenses were $18.9 million. This reflects

an increase as compared to the I&O expenses of $18.3 million in

the prior quarter and an increase compared to I&O expenses of

$16.5 million in the comparable prior year period.

The increase in I&O expenses as compared to the prior

quarter was primarily due to increase in foreign exchange losses,

offset in part by lower interest expense driven by a decrease in

borrowings. The increase in I&O expenses as compared to the

comparable prior year period was primarily due to higher interest

expense driven by increased interest rates.

Net Income and Earnings Per Share

During the third quarter fiscal 2024, GAAP net income was $76.3

million and non-GAAP net income was $77.6 million. This reflects a

decrease in GAAP net income and non-GAAP net income from the

comparable prior year period by 22.6% and 22.1%, respectively,

primarily driven by lower gross profit, higher operating expenses

and higher interest expense. Third quarter fiscal 2024 GAAP

earnings per diluted share was $1.26 and non-GAAP earnings per

diluted share was $1.28. This reflects a decrease in GAAP and

non-GAAP earnings per diluted share from the comparable prior year

period of 22.7% and 22.4%, respectively.

About Ubiquiti Inc.

Ubiquiti Inc. is focused on democratizing network technology on

a global scale — creating networking infrastructure in over 200

countries and territories around the world. Our professional

networking products are powered by our UISP and UniFi software

platforms to provide high-capacity distributed Internet access and

unified information technology management, respectively.

Ubiquiti and the U logo are trademarks or registered trademarks

of Ubiquiti and/or its affiliates in the United States and other

countries. For more information, please visit www.ui.com.

Safe Harbor for Forward Looking

Statements

Certain statements in this press release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Statements other than statements of historical

fact including words such as "look", "will", "anticipate",

"believe", "estimate", "expect", "forecast", "consider" and "plan"

and statements in the future tense are forward looking statements.

The statements in this press release that could be deemed

forward-looking statements include the statement regarding our

intention to pay quarterly cash dividends, any statements or

assumptions underlying the foregoing, and any statement regarding

future events and the future financial performance of Ubiquiti Inc.

that involves risks or uncertainties.

Forward-looking statements are subject to certain risks and

uncertainties that could cause our actual future results to differ

materially or cause a material adverse impact on our results.

Potential risks and uncertainties include, but are not limited to,

the impact of public health problems, such as COVID-19, and U.S.

tariffs on results; fluctuations in our operating results; varying

demand for our products due to the financial and operating

condition of our distributors and their customers, and our

distributors’ inventory management practices; political and

economic conditions and volatility affecting the stability of

business environments, economic growth, currency values, commodity

prices and other factors that may influence the ultimate demand for

our products in particular geographies or globally; impact of

counterfeiting and our ability to contain such impact; our reliance

on a limited number of distributors; inability of our contract

manufacturers and suppliers to meet our demand; our dependence on

chipset suppliers for chipsets without a short-term alternative; as

we move into new markets competition from certain of our current or

potential competitors who may be more established in such markets;

our ability to keep pace with technological and market

developments; success and timing of new product introductions by us

and the performance of our products generally; our ability to

effectively manage the significant increase in our transactional

sales volumes; we may become subject to warranty claims, product

liability and product recalls; that a substantial majority of our

sales are into countries outside the United States and we are

subject to numerous U.S. export control and economic sanctions

laws; costs related to responding to government inquiries related

to regulatory compliance; our reliance on certain key members of

our management team, including our founder and chief executive

officer, Robert J. Pera; adverse tax-related matters such as tax

audits, changes in our effective tax rate or new tax legislative

proposals; whether the final determination of our income tax

liability may be materially different from our income tax

provisions; the impact of any intellectual property litigation and

claims for indemnification; litigation related to U.S. securities

laws; and social, economic and political conditions in the United

States and abroad, including the impact of the military conflict

between Russia and Ukraine and the tension between China and

Taiwan. We discuss these risks in greater detail under the heading

"Risk Factors" and elsewhere in our Annual Report on Form 10-K for

the year ended June 30, 2023, and subsequent filings filed with the

U.S. Securities and Exchange Commission (the "SEC"), which are

available at the SEC’s website at www.sec.gov. Copies may also be

obtained by contacting the Ubiquiti Inc. Investor Relations

Department, by email at IR@ui.com or by visiting the Investor

Relations section of the Ubiquiti Inc. website,

https://ir.ui.com/.

Given these uncertainties, you should not place undue reliance

on these forward-looking statements. Also, forward-looking

statements represent our management’s beliefs and assumptions only

as of the date made. Except as required by law, Ubiquiti Inc.

undertakes no obligation to update information contained herein.

You should review our SEC filings carefully and with the

understanding that our actual future results may be materially

different from what we expect.

Ubiquiti Inc.

Condensed Consolidated Statements of

Operations

and Comprehensive Income

(In thousands, except per share data)

(Unaudited)

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Revenues

$

492,997

$

457,773

$

1,421,029

$

1,449,427

Cost of revenues

318,897

269,297

885,407

892,023

Gross profit

174,100

188,476

$

535,622

$

557,404

Operating expenses:

Research and development

42,498

38,210

115,692

104,633

Sales, general and administrative

20,379

16,741

59,302

52,080

Total operating expenses

62,877

54,951

174,994

156,713

Income from operations

111,223

133,525

360,628

400,691

Interest expense and other, net

18,870

16,497

58,356

38,421

Income before income taxes

92,353

117,028

302,272

362,270

Provision for income taxes

16,063

18,451

56,116

58,306

Net income

$

76,290

$

98,577

$

246,156

$

303,964

Net income per share of common stock:

Basic

$

1.26

$

1.63

$

4.07

$

5.03

Diluted

$

1.26

$

1.63

$

4.07

$

5.03

Weighted average shares used in computing

net income per share of common stock:

Basic

60,461

60,441

60,452

60,432

Diluted

60,463

60,455

60,455

60,451

Ubiquiti Inc.

Reconciliation of GAAP Net Income to

Non-GAAP Net Income

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31, 2024

December 31, 2023

March 31,

2023

2024

2023

Net Income

$

76,290

$

82,116

$

98,577

$

246,156

$

303,964

Share-based compensation:

Cost of revenues

44

35

24

113

47

Research and development

1,272

1,161

942

3,567

2,524

Sales, general and administrative

348

310

280

991

823

Tax effect of Non-GAAP adjustments

(399

)

(361

)

(294

)

(1,119

)

(801

)

Non-GAAP net income

$

77,555

$

83,261

$

99,529

$

249,708

$

306,557

Non-GAAP diluted EPS

$

1.28

$

1.38

$

1.65

$

4.13

$

5.07

Shares outstanding (Diluted)

60,463

60,451

60,455

60,455

60,451

Weighted-average shares used in Non-GAAP

diluted EPS

60,463

60,451

60,455

60,455

60,451

Use of Non-GAAP Financial

Information

To supplement our condensed consolidated financial results

prepared under generally accepted accounting principles, or GAAP,

we use non-GAAP measures of net income and earnings per diluted

share that are adjusted to exclude certain costs, expenses and

gains such as share-based compensation expense and the tax effects

of these non-GAAP adjustments.

Reconciliations of the adjustments to GAAP results for the

periods presented are provided above. In addition, an explanation

of the ways in which management uses non-GAAP financial information

to evaluate its business, the substance behind management’s

decision to use this non-GAAP financial information, material

limitations associated with the use of non-GAAP financial

information, the manner in which management compensates for those

limitations, and the substantive reasons management believes that

this non-GAAP financial information provides useful information to

investors is included under the paragraphs below.

Usefulness of Non-GAAP Financial

Information to Investors

We believe that the presentation of non-GAAP net income and

non-GAAP earnings per diluted share provides important supplemental

information regarding non-cash expenses, significant items that we

believe are important to understanding our financial, and business

trends relating to our financial condition and results of

operations. Non-GAAP net income and non-GAAP earnings per diluted

share are among the primary indicators used by management as a

basis for planning and forecasting future periods and by management

and our board of directors to determine whether our operating

performance has met specified targets and thresholds. Management

uses non-GAAP net income and non-GAAP earnings per diluted share

when evaluating operating performance because it believes that the

exclusion of the items described below, for which the amounts or

timing may vary significantly depending upon the Company’s

activities and other factors, facilitates comparability of the

Company’s operating performance from period to period. We have

chosen to provide this information to investors so they can analyze

our operating results in the same way that management does and use

this information in their assessment of our business and the

valuation of our Company.

About our Non-GAAP Net Income and

Non-GAAP Earnings per Diluted Share

We compute non-GAAP net income and non-GAAP earnings per diluted

share by adjusting GAAP net income and GAAP earnings per diluted

share to remove the impact of certain adjustments and the tax

effect of those adjustments. Items excluded from net income

are:

- Share-based compensation expense

- Tax effect of non-GAAP adjustments, applying the principles of

ASC 740

These non-GAAP measures are not in accordance with, or an

alternative to, GAAP and may be materially different from other

non-GAAP measures, including similarly titled non-GAAP measures

used by other companies. The presentation of this additional

information should not be considered in isolation from, as a

substitute for, or superior to, net income or earnings per diluted

share prepared in accordance with GAAP. Non-GAAP financial measures

have limitations in that they do not reflect certain items that may

have a material impact upon our reported financial results.

For more information on the non-GAAP adjustments, please see the

table captioned "Reconciliation of GAAP Net Income to non-GAAP Net

Income" included in this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509848611/en/

Investor Relations Contact

Ubiquiti Inc. Investor Relations ir@ui.com Ph.1-646-780-7958

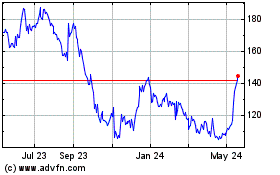

Ubiquiti (NYSE:UI)

Historical Stock Chart

From Dec 2024 to Jan 2025

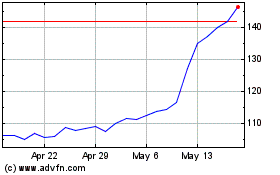

Ubiquiti (NYSE:UI)

Historical Stock Chart

From Jan 2024 to Jan 2025