00018195162135 American WayChambleeGeorgiaFALSE00018195162024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 20, 2024

WHEELS UP EXPERIENCE INC. (Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39541 | 98-1617611 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | |

2135 American Way | |

Chamblee, Georgia | 30341 |

| (Address of principal executive offices) | (Zip Code) |

(212) 257-5252

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | UP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Todd Smith as Chief Financial Officer

(b) On August 20, 2024 (the “Notice Date”), Todd Smith, the Chief Financial Officer of Wheels Up Partners LLC, a Delaware limited liability company (“WUP LLC”) and an indirect subsidiary of Wheels Up Experience Inc. (the “Company”), and principal financial and accounting officer of the Company, notified the Company of his intention to resign from employment with the Company and its subsidiaries, to become effective on September 6, 2024 (the “Departure Date”), in order to pursue a new opportunity. Mr. Smith’s decision to resign was not due to any disagreement with the Company or its subsidiaries on any matter relating to its operations, policies or practices. All outstanding equity incentive awards granted to Mr. Smith that will not vest on or prior to the Departure Date, including any awards made pursuant to the Performance Award Agreement, dated March 3, 2024, by and between the Company and Mr. Smith, will be forfeited. The Company has launched a search to identify a permanent replacement for Mr. Smith.

Appointment of Eric Cabezas as Interim Chief Financial Officer

(c)(e) On the Notice Date, the Company’s Board of Directors (the “Board”) appointed Eric Cabezas, age 39, to serve as Interim Chief Financial Officer and principal financial officer of the Company, to become effective on the Departure Date. Mr. Cabezas has served as the Company’s Senior Vice President of Finance since February 2019, and previously served as the Company’s Interim Chief Financial Officer from May to June 2022. As Senior Vice President of Finance, Mr. Cabezas oversees the strategic finance and financial planning and analysis functions, and continues to play an integral role in the Company’s corporate development and investor relations functions. From 2017 to 2019, Mr. Cabezas served as Director of Finance at Zeta Global, where he oversaw corporate and commercial finance. Mr. Cabezas holds a Bachelor of Science degree from Boston College and an MBA from Columbia Business School.

During the period for which Mr. Cabezas will serve as the Company’s Interim Chief Financial Officer (the “Appointment Period”), he will be paid a base salary of $450,000 per year, be eligible to receive an annual incentive bonus with a target amount equal to 100% of his annual base salary during the Appointment Period (the achievement of which will be based upon the Company’s performance against certain targets identified by the Compensation Committee of the Board and his individual performance toward key performance indicators and other factors), and be entitled to participate at the Executive Vice President level under the Company’s Executive Severance Guidelines.

There are: no family relationships between Mr. Cabezas and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company; except as described above, no arrangements or understandings between Mr. Cabezas and any other person pursuant to which he was appointed as Interim Chief Financial Officer and principal financial officer of the Company; and no transactions between Mr. Cabezas and the Company that would require disclosure under Item 404(a) of Regulation S-K.

Appointment of Alexander Chatkewitz as Principal Accounting Officer

(c) On the Notice Date, the Board appointed Alexander Chatkewitz, age 60, to serve as principal accounting officer of the Company, to become effective on the Departure Date. Mr. Chatkewitz has served as the Company’s Chief Accounting Officer since March 2024. Prior to joining the Company, he served as Senior Vice President, Finance & Controller for Centric Brands LLC (“Centric Brands”) from May 2022 to November 2023, and prior to joining Centric Brands, served as Vice President, Controller & Chief Accounting Officer for JetBlue Airways Corporation (“JetBlue”) from December 2014 to May 2022. He served in various high-level accounting, financial reporting and controllership positions with Marsh McLennan Companies, Altria Group, Inc. and Phillip Morris International Inc. prior to joining JetBlue. Mr. Chatkewitz holds a Bachelor of Science in Business Administration degree in Accounting from Bucknell University, and is a Certified Public Accountant.

There are: no family relationships between Mr. Chatkewitz and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company; no arrangements or

understandings between Mr. Chatkewitz and any other person pursuant to which he was appointed as principal accounting officer of the Company, other than the terms of his offer letter with WUP LLC; and no transactions between Mr. Chatkewitz and the Company that would require disclosure under Item 404(a) of Regulation S-K. Mr. Chatkewitz did not enter into any plan, contract or arrangement or receive any grant or award in connection with his appointment as principal accounting officer of the Company. His at-will employment with the Company will continue to be governed by the terms of his offer letter with WUP LLC.

Departure of Laura Heltebran as Chief Legal Officer and Secretary

(b)(e) On the Notice Date, Laura Heltebran, the Chief Legal Officer and Secretary of the Company and WUP LLC, notified the Company of her intention to resign from employment with the Company and its subsidiaries, to become effective on the Departure Date, in order to pursue other opportunities.

In recognition of Ms. Heltebran’s long-term contributions to the Company, on the Notice Date, WUP LLC and Ms. Heltebran entered into a Separation and Release Agreement (the “Separation Agreement”), which includes a general release of claims by Ms. Heltebran in favor of the Company, subject to a customary consideration period and seven-day revocation period that expires on August 27, 2024 (the “Revocation Period”). Pursuant to the Separation Agreement, Ms. Heltebran will: (i) receive a lump sum of $510,000, less applicable withholdings, representing 12 months of Ms. Heltebran’s base salary and payable on WUP LLC’s first regularly scheduled payroll date that is at least 14 business days after the end of the Revocation Period; (ii) be eligible to receive an annual bonus with a target of 100% of her annual base salary credited for a full year of service during fiscal year 2024, subject to the application of bonus plan performance metrics approved by the Board, to be paid in a lump sum at the same time and in the same manner as regular annual bonuses are distributed to other similarly situated senior executives of WUP LLC; (iii) receive an $8,500 reimbursement as an additional lump sum; (iv) receive 10 hours of flight time on the Company’s King Air 350i aircraft that would have otherwise been awarded to Ms. Heltebran had she remained employed with the Company through the end of 2024; and (v) be eligible for reimbursement for applicable premiums under WUP LLC’s group health insurance plans at the coverage levels in effect on the Departure Date for one year after October 1, 2024, to the extent she elects to participate in continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (COBRA). In addition, any stock options and restricted stock units held by Ms. Heltebran as of the Departure Date that would have otherwise vested in accordance with its terms, absent Ms. Heltebran’s separation of employment, during the 12-month period immediately following the Departure Date will become vested and exercisable as of the Departure Date.

The preceding description of the Separation Agreement is a summary of its material terms, does not purport to be complete, and is qualified in its entirety by reference to the Separation Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

Appointment of Matthew Knopf as Chief Legal Officer and Secretary

On the Notice Date, the Board appointed Matthew Knopf to serve as Chief Legal Officer and Secretary of the Company and WUP LLC, to become effective on September 9, 2024. Mr. Knopf will join the Company from Delta Air Lines, Inc. (“Delta”), where he has served as Senior Vice President and Deputy General Counsel since December 2015. At Delta, he leads the Corporate Transactions, Aircraft Transactions & Finance, SEC & Corporate Governance and Corporate Real Estate legal teams. Prior to joining Delta, he was a corporate partner in the Minneapolis office of Dorsey & Whitney LLP, where he led the firm-wide mergers and acquisitions practice. Mr. Knopf holds a Bachelor of Arts degree from Stony Brook University and a Juris Doctorate from the University of Chicago School of Law.

There are: no family relationships between Mr. Knopf and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company; no arrangements or understandings between Mr. Knopf and any other person pursuant to which he was appointed as Chief Legal Officer and Secretary of the Company, other than the terms of his offer letter with WUP LLC; and no transactions between Mr. Knopf and the Company that would require disclosure under Item 404(a) of Regulation S-K. Descriptions of certain relationships and transactions between the Company and Delta are included in: (i) the Company’s definitive

Press Release

On August 21, 2024, the Company issued a press release regarding the executive transitions described in Items 5.02 and 7.01 of this Current Report, a copy of which is furnished as Exhibit 99.1 and incorporated by reference herein.

The information in Item 7.01 of this Current Report and Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report and Exhibit 99.1 furnished herewith contain certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside of the control of the Company. These forward-looking statements include, but are not limited to, statements regarding the expected impact and timing of certain personnel transitions. The words “anticipate,” “continue,” “could,” “expect,” “plan,” “potential,” “should,” “would,” “pursue” and similar expressions, may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 7, 2024 and the Company’s other filings with the SEC from time to time. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, the Company does not intend to update any of these forward-looking statements after the date of this Current Report. Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1*†+ | | |

| 99.1** | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Filed herewith.

** Furnished herewith.

† Identifies each management contract or compensatory plan or arrangement.

+ Certain portions of this exhibit (indicated by “[***]”) have been omitted pursuant to Item (601)(b)(10) of Regulation S-K. In addition, schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Registrant agrees to furnish supplementally a copy of any omitted schedule or exhibit to the U.S. Securities and Exchange Commission or its staff upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | WHEELS UP EXPERIENCE INC. |

| | | | |

| | | | |

| Date: August 21, 2024 | By: | /s/ George Mattson |

| | | Name: | George Mattson |

| | | Title: | Chief Executive Officer |

Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN REDACTED FROM THIS EXHIBIT, BECAUSE IT IS (1) NOT MATERIAL AND (2) THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. “[***]” INDICATES THAT INFORMATION HAS BEEN REDACTED.

SEPARATION AND RELEASE AGREEMENT

This Separation and Release Agreement (this “Agreement”) is entered into by and between Laura Heltebran (“Employee”) and Wheels Up Partners LLC (the “Company”). In consideration of the material promises contained herein, the parties agree as follows:

1.TERMINATION OF EMPLOYMENT

(a)Employee’s last day of employment with the Company is September 6, 2024 (the “Separation Date”). Employee’s final paycheck, which will include payment for any earned but unpaid wages for time worked through the Separation Date, is being paid to Employee regardless of whether Employee signs this Agreement. Employee’s earned wages will include payment for accrued but unused PTO/vacation through the Separation Date (to the extent not already paid) if applicable under state law and Company policy.

(b)If Employee has existing coverage under the Company’s medical, dental and/or visions plans, such coverage shall continue through the last day of the month in which the Separation Date occurs. Thereafter, regardless of whether Employee enters into this Agreement, Employee shall have the right to elect to continue coverage under such plan at Employee’s own expense, pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”). Employee shall be advised as to Employee’s rights to continue such coverage under COBRA under separate cover.

(c)In the event Employee elects continuation coverage pursuant to COBRA, for Employee and Employee’s eligible dependents within the time period prescribed pursuant to COBRA, the Company will pay the COBRA premiums for such coverage (at the coverage levels in effect immediately prior to Employee’s separation from service) for a period of twelve (12 months commencing October 1, 2024).

2.SEPARATION PAYMENT

(a)If Employee executes this Agreement and does not revoke it as provided in Section 6 below, the Company will provide to Employee a separation payment in the amount of $510,000, less applicable withholdings (the “Payment”). This Payment, which represents 12 months of Employee’s base pay, will be paid in a lump sum on the Company’s next regularly scheduled payroll date that is at least fourteen (14) business days from the Effective Date of this Agreement, as provided in Section 6 below.

(b)Employee shall receive a 2024 annual bonus plan target representing a 100% target of salary and a full year of credited service. The bonus target is subject to the application of the 2024 bonus plan performance metrics as approved by the Company’s board of directors

(the “Board”). The bonus payment is to be paid in a lump sum to the Employee at the same time and in the same manner as regular annual bonuses are distributed to other similarly situated senior executives of the Company.

(c)All outstanding options to purchase Company common stock and any restricted stock, restricted stock units, profits interest units or other equity interest in the Company (each separate award, an “Equity Interest”) held by Employee as of the Separation Date that would have otherwise vested in accordance with its terms, absent termination of employment, during the twelve (12) month period immediately following the Separation Date shall become vested and exercisable as of the Separation Date and each award agreement governing such Equity Interest shall be, and hereby is, amended to provide that any options or restricted stock units, as applicable, that would have otherwise vested in accordance with their terms, absent termination of employment, during the twelve (12) month period immediately following the Separation Date shall become vested and exercisable, as applicable, as of the Separation Date. After giving effect to the accelerated vesting and exercisability, as applicable, set forth in the preceding sentence, any options and/or restricted stock units that remain unvested as of the Separation Date shall be forfeited in their entirety at such time, and Employee shall have no further right, title or interest in or to such unvested equity interests as of the Separation Date.

(d)Employee will receive a reimbursement in the total amount of $8,500 representing a dues refund for Employee’s Wheels Up membership for 2023, which reimbursement shall be tax-free and excluded from Employee’s gross income. Employee will receive two remaining quarterly allocations of five (5) King Air flight hours in 2024. Employee will not be required to obtain a paid Wheels Up membership for 2024 and 2025. Thereafter, employee will be required to purchase a membership beginning January 1, 2026, to retain any unused or outstanding flight hours. If employee does not secure a paid Wheels Up flight membership beginning January 2026, any unused or outstanding flight hour balance will be forfeited.

(e)If the Separation Date is earlier than September 15, 2024, Employee will not be required to repay the Retention Award of $100,000 paid to Employee on March 15, 2024 pursuant to the Retention Award Agreement between Company and Employee dated March 6, 2024.

(f)Employee acknowledges and agrees that the Separation Payments constitutes adequate consideration for all of the terms of this Agreement and does not include any benefit, monetary or otherwise, that was earned or accrued or to which Employee was already entitled without signing this Agreement.

3.EMPLOYEE RELEASE OF CLAIMS AND COVENANT NOT TO SUE

(a)Employee hereby voluntarily, irrevocably, fully, and completely RELEASES, ACQUITS, AND FOREVER DISCHARGES the Company (including any current or former

parent company, subsidiaries, affiliates, predecessors, successors, assigns, agents, employees, plan administrators, representatives, attorneys, insurers, related business entities, and benefit plans, collectively known herein as “Releasees”) from any and all claims, complaints, liabilities, obligations, promises, agreements, controversies, damages, actions, causes of action, suits, rights, demands, costs, losses, debts, and expenses of any nature whatsoever (whether known or unknown), including attorneys’ fees, which Employee ever had, may have, or now has arising from or related to, directly or indirectly, Employee’s employment with the Company, the termination of Employee’s employment or other events occurring through and including the date of Employee’s execution of this Agreement, including, but not limited to:

i.violations of Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Americans with Disabilities Act, the Equal Pay Act, 42 U.S.C. § 1981, the Family and Medical Leave Act, the Employee Retirement Income Security Act (excluding claims for accrued and vested benefits, if any), the Age Discrimination in Employment Act of 1967 (“ADEA”), the Older Workers Benefit Protection Act (“OWBPA”), the Worker Adjustment and Retraining Notification (WARN) Act, the Sarbanes-Oxley Act of 2002, any amendments to the foregoing, and any other federal law, order or regulation applicable to Employee’s employment;

ii.violations of any state or local statutes, orders, laws, ordinances, or regulations applicable to Employee’s employment, and any amendments to the foregoing;

iii.violations of any other federal, state or local statute, rule, regulation or ordinance;

iv.claims for lost or unpaid wages, compensation, or other benefits claims under state law, defamation, intentional infliction of emotional distress, negligent infliction of emotional distress, bad faith action, slander, assault, battery, wrongful or constructive discharge, negligent hiring, retention and/or supervision, fraud, misrepresentation, conversion, tortious interference with property, negligent investigation, breach of contract, or breach of fiduciary duty;

v.any claims to benefits under any bonus, severance, outplacement, or similar plan sponsored by the Company (excluding claims for accrued and vested benefits, if any); and

vi.any other claims for alleged unlawful behavior, the existence of which is specifically denied by the Company.

(b)Employee understands that the release herein includes a release of all known and unknown claims, suspected or unsuspected, past or present, which Employee has or may have

against any of the Releasees under any state or local statute, executive order, regulation, common law and/or public policy relating to unknown claims.

(c)Notwithstanding the foregoing or anything in this Release to the contrary: (i) Employee’s right to be indemnified as an officer and/or director of the Company, Holdings and/or Parent, as applicable, shall remain in full force and effect, in accordance with the governing documents and by-laws of each of the Company, Holdings and Parent, as well as any rights Employee may have under or in respect of any D&O or other insurance policies maintained by the Company, Holdings, Parent or their respective affiliates; (ii) Employee shall not be deemed to have released any rights or claims that Employee may have as an equityholder of Parent, including any agreement pursuant to which he acquired or was granted equity; and (iii) this Release shall not and does not release, alter or affect any rights or claims of Employee arising from or under this Release.

(d)Employee acknowledges that this Agreement constitutes a full SETTLEMENT, ACCORD AND SATISFACTION of all claims covered by the release provisions of this Section. Employee also covenants not to sue or file, or assign to others the right to file, any complaint or claim against the Company or any of the Releasees with any court based on any act or omission arising or occurring prior to the date of Employee’s execution of this Agreement, whether known or unknown at the time of execution. Except as set forth herein, Employee also waives any right to recover individual relief in any civil suit or proceeding brought by Employee or on Employee’s behalf against the Company or any of the Releasees. Notwithstanding the foregoing, nothing in this Agreement shall be construed to prohibit or prevent Employee from communicating with, filing a charge or complaint with, providing documents or information voluntarily or in response to a subpoena or other information request to, or from participating in any investigation or proceeding conducted by the Equal Employment Opportunity Commission, National Labor Relations Board, the Securities and Exchange Commission, the Occupational Safety and Health Administration, law enforcement, or any other federal, state or local agency charged with the enforcement of any employment laws. However, by signing this Agreement, Employee is waiving any right to individual relief (including backpay, front pay, reinstatement or other legal or equitable relief) in any charge, complaint, lawsuit or other proceeding brought by Employee or on Employee’s behalf by any third party, except for any right Employee may have to receive a payment or award from a government agency (and not the Company or any of the Releasees) for information provided to the government agency or where such a waiver of individual relief is otherwise prohibited. In addition, nothing in this Agreement limits or affects Employee from exercising rights, if any, under Section 7 of the NLRA or similar state law to engage in protected, concerted activity with other employees.

(e)Employee and the Company acknowledge that the above release and waiver of claims shall not apply to: (i) claims that either party might make to enforce the terms of this Agreement; (ii) claims for Employee’s vested benefits pursuant to applicable plans, if any; (iii) Employee’s right, if applicable, to continue healthcare insurance under COBRA; (iv) Employee’s

right to receive benefits for unemployment or workers’ compensation benefits; (vi) Employee’s right to pursue any rights or claims that may arise after Employee signs this Agreement; (vii) Employee’s right to challenge the validity or knowing and voluntary nature of this Agreement under the ADEA or OWBPA; and (viii) any other claims that, under controlling law, may not be released by private settlement.

4.COMPANY RELEASE OF CLAIMS AND COVENANT NOT TO SUE

(a)In consideration of this Release, the Company, on behalf of itself, Holdings, Parent, their subsidiaries and affiliates, affiliated persons, partnerships, successors and assigns (collectively, the “Company Releasors”) hereby irrevocably and unconditionally releases, waives and forever discharges Executive, his spouse, family members, heirs, agents, representatives and advisors (collectively, the “Employee Releasees”) individually and collectively, from any and all actions, causes of action, claims, demands, damages, rights, remedies and liabilities of whatsoever kind or character, in law or equity, suspected or unsuspected, known or unknown, past or present, that they have ever had, may now have, or may later assert against the Employee Releasees, whether or not arising out of or related to Employee’s employment by or the performance of any services to or on behalf of the Company or the termination of that employment and those services, from the beginning of time to the Effective Date (hereinafter referred to as “Company’s Claims”), including, without limitation, any and all other Company’s Claims arising out of or related to any contract, any and all federal, state or local constitutions, statutes, rules or regulations, or under the laws of any country or political subdivision, or under any common law right of any kind whatsoever, including, without limitation, any of the Company’s Claims for any kind of tortious conduct, promissory or equitable estoppel, breach of the Company’s policies, rules, regulations, handbooks or manuals, breach of express or implied contract or covenants of good faith, breach of duty of loyalty or fiduciary duty. Notwithstanding the foregoing, the Company’s Claims which are being released herein shall not include any claims or causes of action that the Company Releasors may have against Employee which as of the Separation Date, were unknown to the Company’s Chief Legal Officer (or any predecessor) or the board of directors of Holdings, which may arise from or be related to any acts or omissions undertaken by Employee, or undertaken at his express direction, which constitute fraud, theft or embezzlement against the Company, or any act or omission that constitutes a felony under the laws of the United States or any state. This Release does not limit the Company Group’s ability to comply with or release matters related to Section 10D of the Securities Exchange Act of 1934, as amended, Section 304 of the Sarbanes-Oxley Act, any applicable rules or regulations promulgated by the Securities and Exchange Commission or any national securities exchange or national securities association on which shares of the Parent may be traded, and any Company Group policy of general applicability (which would include general applicability to the Board or Company Group officers) adopted with respect to compensation recoupment, to the extent the application of such rules, regulations and/or policies is permissible under applicable local law. The Company, on behalf of itself and the Company Releasors, represents and warrants that it is not currently aware of any claim against Employee which would fall into any exception to the

claims released above or any matter that would be covered by Section 4(d) hereof. The release shall not affect the Company’s right to enforce the terms of this Release.

(b)To the fullest extent permitted by law, the Company agrees not to lodge or assist anyone else in lodging any formal or informal complaint in court, with any federal, state or local agency or any other forum, in any jurisdiction, against Executive or any of the other Employee Releasees arising out of or related to the Company’s Claims. The Company hereby represents and warrants that it has not brought any complaint, claim, charge, action or proceeding against any of the Employee Releasees in any jurisdiction or forum, nor assisted or encouraged any other person or persons in doing so. The Company further represents and warrants that it has not in the past and will not in the future assign any of the Company’s Claims to any person, corporation or other entity.

(c)Execution of this Release by the Company operates as a complete bar and defense against any and all of the Company’s Claims against Employee or any of the other Employee Releasees. If the Company should hereafter make any of the Company’s Claims in any charge, complaint, action, claim or proceeding against Employee or any of the other Executive Releasees, the Release may be raised as and shall constitute a complete bar to any such charge, complaint, action, claim or proceeding. Further, if any of the individual Company Releasors subsequently institutes legal proceedings against Employee with respect to any of the Company’s Claims, the Company agrees to fully indemnify Employee against and will hold Employee harmless from any and all such claims, costs, damages, demands and expenses (including, without limitation, attorneys’ fees), judgements, losses or other liabilities of any kind or nature whatsoever arising from or directly or indirectly related to the Company’s Claims.

5.CONFIDENTIALITY AND NON-DISPARAGEMENT

(a)Confidentiality of this Agreement. Employee agrees that this Agreement and its terms are confidential and will not be disclosed by Employee at any time, under any circumstances, without the express written consent of the Company. However, nothing in this Section shall prohibit Employee from disclosing the existence and the terms of this Agreement if legally compelled to do so or from disclosing or discussing this Agreement with his or her spouse, attorneys, or tax advisors, or a governmental agency, who (with the exception of a governmental agency) must be informed of and agree to be bound by the confidentiality provisions contained in this Agreement before Employee discloses any information to them about this Agreement.

(b) Confidentiality of the Company’s Trade Secrets and Confidential Information.

(i)Employee understands and agrees that in the course of Employee’s employment with the Company, Employee has acquired confidential information, trade secrets, proprietary data and other non-public information concerning the business,

professional and/or personal affairs, activities and operations of the Company, and the Company’s plans, methods of doing business, practices, procedures, customers and suppliers, as well as confidential information disclosed to the Companies from time to time by third parties, any or all of which (the “Confidential Information”).

(ii)Employee understands and agrees it would be extremely damaging to the Company if Confidential Information were disclosed to a competitor or made available to any other person or corporation. Employee understands and agrees that the Confidential Information has been provided to the Employee in confidence, and Employee further understands and agrees that the Employee has obtained Confidential Information in a fiduciary relationship of trust and confidence and that the Employee will keep the Confidential Information strictly and completely secret and confidential for all time, both now and hereafter, and that Employee will not disclose it in any way, directly or indirectly, or otherwise use for Employee’s benefit or for the benefit of any third party any part or all of the Confidential Information.

(iii)By signing this Agreement, Employee hereby acknowledges that Employee is bound by certain restrictive covenants set forth in Employee’s Confidentiality and Restrictive Covenants Agreement or any other post-termination restrictive covenant agreement Employee entered into at any time with the Company, except that any non-competition restriction included in any restrictive covenant agreement shall be null and void and of no further effect. Employee hereby reaffirms such restrictive covenants and acknowledges and agrees that such covenants are incorporated herein by reference, shall survive the termination of Employee’s employment with the Company and shall remain in full force and effect.

(iv)In addition, Employee agrees to continue to honor all confidentiality commitments of the Company known to Employee and owed to any third parties. Employee further acknowledges that the federal Defend Trade Secrets Act (“DTSA”) provides that an individual shall not be held criminally or civilly liable under federal or state trade secret law for the disclosure of a trade secret (as defined in the federal Economic Espionage Act) that is made in confidence to a government official or to an attorney and solely for the purpose of reporting or investigating a suspected violation of law; or in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition, Employee acknowledges that the DTSA provides that an individual who files a retaliation lawsuit against an employer for reporting a suspected violation of law may disclose a trade secret to his/her attorney and use the trade secret information in court, but only if the individual files any document containing the trade secret under seal; and does not disclose the trade secret, except pursuant to court order.

(c)Non-Disparagement. Employee agrees that Employee will not make, directly or indirectly, to any person or entity, including any member of the public and/or the press, any negative or disparaging oral or written statements by any means, including on social media, about the Company or any of the Releasees or their products or services or employees. Company agrees that it shall advise its officers and members of its Board they should not intentionally make, directly or indirectly, to any person or entity, including any member of the public and/or the press, any negative or disparaging oral or written statements by any means, including on social media, about Employee. However, nothing in this paragraph shall preclude either party from testifying honestly if required by law to testify in a proceeding or complying with any other law.

6.RETURN OF COMPANY PROPERTY

By signing this Agreement, Employee acknowledges that Employee has returned to the Company all of the Company’s property in Employee’s possession, custody and control obtained as a result of employment with the Company, except those items that the Company specifically agrees in writing to permit Employee to retain. Such property includes, but is not limited to, the original and any copy (regardless of the manner in which it is recorded) of all documents provided by the Company to Employee or which Employee developed or collected in the scope of Employee’s employment, as well as all Company-issued equipment, supplies, accessories, keys, access cards, disks, tapes, software, materials, files, or records. If Employee has electronic files or backup copies of Company records, data or information, Employee must return or destroy (at Company’s election) such electronic or backup copies. The Company has agreed to allow Employee to retain her Company-issued cell phones, associated phone numbers, laptop and home office equipment.

7.CONSIDERATION AND REVOCATION PERIODS, OTHER INFORMATION

Employee and the Company acknowledge and agree that Employee has been given at least twenty- one (21) calendar days from the time that Employee receives this Agreement and any attached information to consider the terms of this Agreement before signing it ("Consideration Period"). Employee must return this signed Agreement to the Company’s representative set forth below within the Consideration Period but not prior to the Separation Date. If Employee signs this Agreement before the full 21-day period has expired, Employee acknowledges that Employee is knowingly and voluntarily waiving the remainder of the 21-day consideration period, if any, after carefully considering its terms. Additionally, Employee understands that Employee may revoke this Agreement within seven (7) calendar days following the date Employee signs this Agreement (“Revocation Period”). To be effective, such notice of revocation must be received by the Company by no later than 5:00 PM local time on the seventh (7th) calendar day following the date Employee signs and delivers this Agreement to the Company. Provided that Employee does not revoke this Agreement within the Revocation Period, this Agreement shall be effective and enforceable on the day after the end of the

Revocation Period (the “Effective Date”). Employee should return this signed Agreement and any written revocation notice by e-mail or mail to:

| | | | | |

If by mail: | Wheels Up Attn: Brian Kedzior 601 West 26th Street, Suite 900 New York, NY 10001 |

If by e-mail: | [***] |

8.REMEDIES FOR BREACH

The Company’s obligations under this Agreement are contingent upon Employee’s compliance with all terms and conditions provided for herein. Employee acknowledges that the damages in the event of a breach of any term, condition or covenant in this Agreement would be extremely difficult to calculate. As such, in the event Employee breaches any term, condition or covenant in this Agreement, Employee agrees that the Company will be entitled to recover all payments already made under this Agreement as liquidated damages (and not as a penalty) and cease payment of any as of yet unpaid severance – except that the Company will not seek to recover the first $500 worth of severance pay provided to employee, which Employee may retain and agrees will constitute full and adequate consideration for the release and waiver of claims in this Agreement – in addition to injunctive relief by temporary restraining order, temporary injunction and/or permanent injunction, recovery of attorney’s fees and costs incurred by the Company in obtaining such relief where allowed by law, and any other legal or equitable relief to which the Company may be entitled. Injunctive relief will not exclude other remedies that might apply. Should either party institute an action to enforce the terms of this Agreement, the prevailing party shall be entitled to its reasonable attorneys’ fees and costs. Because of certain language in the OWBPA and associated regulations, this paragraph does not apply to claims Employee might have to challenge the knowing and voluntary nature of this Agreement under the ADEA and OWBPA.

9.MISCELLANEOUS

(a)Scope of Agreement. This Agreement shall accrue to the benefit of and be binding upon the parties hereto, their respective successors, agents and permitted assigns, and as to Employee, his or her spouse, heirs, legatees, administrators, and personal representatives. Employee may not assign his or her rights or obligations under this Agreement without the prior written consent of the Company.

(b)Applicable Law. This Agreement shall be interpreted, enforced, construed, and governed under the laws of the state where Employee last regularly worked for the Company (as

reflected in the Company’s HRIS system of record) without reference to any conflict of laws principles thereof.

(c)Non-Admission. This Agreement is not, and shall not be construed as, an admission by the Company of any wrongdoing or illegal acts or omissions, and the Company expressly denies that it engaged in any wrongdoing or illegal or acts or omissions with respect to Employee’s employment or the separation of Employee’s employment. Employee hereby represents and agrees that Employee shall not, directly or indirectly make any written or oral statements, suggestions or representations that the Company has made or implied any such admission.

(d)D&O Insurance Coverage. The Company shall provide at its own expense directors’ and officers’ liability insurance or directors’ and officers’ liability tail insurance policies covering Employee and shall maintain such insurance or tail policy in place for a minimum of six (6) years following the Separation Date.

(e)Professional Reference. The Company, namely its Chief Executive Officer George Mattson, agrees to provide a positive professional reference to any prospective employer that contacts the Company or Mr. Mattson directly to inquire about Employee’s employment with the Company.

(f)Entire Agreement. This Agreement, and the Restrictive Covenant Agreement entered into between the Company and the Employee on or about the date hereof, contain the entire agreement and understanding concerning the subject matter hereof between the parties hereto, superseding and replacing all prior negotiations, understandings, representations and agreements, written or oral. No modification, amendment, waiver, termination or discharge of this Agreement, or any of the terms or provisions hereof, shall be binding upon either of the parties unless confirmed by a written instrument signed by Employee and an officer of the Company. No waiver by any party of any term or provision of this Agreement or of any default hereunder shall affect such party’s rights thereafter to enforce such term or provision or to exercise any right or remedy in the event of any other default, whether or not similar.

(g)Employee Acknowledgements. Employee acknowledges and affirms that Employee has (i) been paid and/or received all wages, commissions, bonuses, leave (paid or unpaid), separation pay, vacation pay, or any other compensation, benefits, payment or remuneration of any kind or nature with receipt of Employee’s final paycheck except as provided in this Agreement; (ii) reported to the Company any and all work-related injuries or illnesses incurred by Employee during Employee’s employment with the Company; (iii) been properly provided any leave of absence because of any health condition of Employee or any family members, and has not been subjected to any improper treatment, conduct or actions due to a request for or taking such leave; and (iv) not raised a claim, including but not limited to, unlawful discrimination, harassment, sexual harassment, abuse, assault, or other criminal

conduct, or retaliation, in a court or government agency proceeding, in an alternative dispute resolution forum, or through the Company’s internal compliant process, involving the Company or any of the Releasees.

(h)Severability. The provisions of this Agreement are severable, and if any provision of this Agreement (except the release and waiver of claims) shall be held void, voidable, invalid or unenforceable, no other provision of this Agreement shall be affected as a result thereof, and accordingly, the remaining provisions of this Agreement shall remain in full force and effect as though such void, voidable, invalid or inoperative provision had not been contained herein. If the release and waiver of claims is found to be unenforceable, the parties agree to seek a determination by a court of competent jurisdiction as to the rights of the parties, including whether Employee is entitled to retain the benefits paid to Employee under this Agreement.

(i)Counterparts and Electronic Signature. This Agreement may be executed in one or more counterparts, each of which shall be deemed one agreement binding on each of the parties hereto, regardless of whether each party hereto is a signatory to the same counterpart. The parties also agree that this Agreement may be executed by original signature or electronic signature. By using an electronic signature option, Employee and the Company agree and intend to be bound by an electronic signature of the other in the same manner as the use of a signature affixed by hand. Although neither Employee nor the Company are required to electronically sign this Agreement, by using an electronic signature option, the parties are agreeing to conduct this transaction by electronic means. For purposes of this Agreement, facsimile or scanned signatures in lieu of original signatures are also acceptable.

(j)Proper Construction. The language in all parts of this Agreement shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against either of the parties. As utilized in this Agreement, the term “or” shall be deemed to include the term “and/or” and the singular or plural number shall be deemed to include the other, whenever the context so indicates or requires. The section and subsection headings used in this Agreement are intended solely for convenience of reference and shall not in any manner amplify, limit, modify, or otherwise be used in the interpretation of any of the provisions hereof.

10.INFORMATION ABOUT GROUP TERMINATION PROGRAM

If Employee is age 40 or over and Employee’s termination is part of an employment termination program that affects a group of employees, Employee acknowledges that the Company has attached an Appendix A which describes: (a) the class, unit, or group of individuals covered by the employment termination program; the eligibility factors for the program; and applicable time limits; and (b) a list of the job titles and ages of all individuals eligible or selected for the employment termination program as well as those persons who were part of the decisional unit but who are not eligible or selected for the program.

11.ADVICE OF COUNSEL, ACKNOWLEDGMENT OF KNOWING AND VOLUNTARY WAIVER

Employee hereby represents and warrants that:

(a)Employee has CAREFULLY READ THIS AGREEMENT AND FULLY UNDERSTANDS ALL OF THE PROVISIONS OF THIS AGREEMENT;

(b)Employee has been ADVISED IN WRITING BY THE COMPANY and had an OPPORTUNITY TO CONSULT WITH AN ATTORNEY OF EMPLOYEE’S CHOICE AS TO THE TERMS OF THIS AGREEMENT to the full extent that Employee desired before signing this Agreement;

(c)Employee understands, through signing this Agreement, Employee is FOREVER RELEASING the Company and the Releasees from any and all claims arising prior to the date of execution of this Agreement by Employee, including claims under the ADEA and OWBPA;

(d)Employee has had the opportunity to REVIEW AND CONSIDER THIS AGREEMENT FOR TWENTY-ONE (21) DAYS FROM EMPLOYEE’S RECEIPT OF THE AGREEMENT AND ANY ATTACHED INFORMATION, AND HAS SEVEN (7) DAYS AFTER SIGNING THE AGREEMENT TO REVOKE IT;

(e)In signing this Agreement, EMPLOYEE DOES NOT RELY ON NOR HAS HE OR SHE RELIED ON ANY REPRESENTATION OR STATEMENT, WRITTEN OR ORAL, NOT SPECIFICALLY SET FORTH IN THIS AGREEMENT by the Company or by any of the Company’s agents, representatives, or attorneys with regard to the subject matter, basis, or effect of this Agreement or otherwise;

(f)Employee was not coerced, threatened, or otherwise forced to sign this Agreement, and Employee is acting VOLUNTARILY, DELIBERATELY, AND OF EMPLOYEE’S OWN FREE WILL IN SIGNING THIS AGREEMENT, and with ALL INFORMATION NEEDED TO MAKE AN INFORMED DECISION to enter this Agreement; and

(g)The Company has provided Employee with the opportunity to ask any questions regarding this Agreement and provided notice of and an opportunity to retain an attorney, or Employee is already represented by an attorney.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned have signed and executed this Agreement on the date first above written as an expression of their intent to be bound by the foregoing terms of this Agreement.

Wheels Up Partners LLC

By: /s/ Brian Kedzior

Brian Kedzior

Chief People Officer

Date: August 20, 2024

/s/ Laura Heltebran

Laura Heltebran

Address:

[***]

[***]

Date: August 20, 2024

[Separation and Release Agreement]

Wheels Up Announces Executive Leadership Transitions

Chief Financial Officer Todd Smith and Chief Legal Officer Laura Heltebran to depart

Matthew Knopf to join as Chief Legal Officer and Secretary,

with Eric Cabezas acting as interim Chief Financial Officer

Atlanta, GA – August 21, 2024 – Wheels Up Experience Inc. (NYSE: UP) today announced two transitions on its executive leadership team, as Chief Financial Officer Todd Smith will be leaving the company for a new role, and Chief Legal Officer Laura Heltebran will be departing to pursue other opportunities.

Starting September 9, Matthew Knopf will be joining Wheels Up as Chief Legal Officer and Secretary, with Eric Cabezas acting as interim Chief Financial Officer while a search is conducted for Smith’s replacement.

Knopf has served as Senior Vice President and Deputy General Counsel at Delta Air Lines since 2015, leading the Corporate Transactions, Aircraft Transactions & Finance, SEC & Corporate Governance and Corporate Real Estate legal teams.

“Over the last nine years, Matthew has played a pivotal leadership role in the completion of Delta’s many significant transactions and key joint venture restructurings, while serving as Deputy General Counsel,” said Wheels Up Chief Executive Officer George Mattson. “His impressive breadth of experience built during his over 35-year legal career, along with his deep knowledge of the industry and our company, will undoubtedly ensure a seamless transition as Matthew assumes his new role. We’re thrilled to welcome him to the team.”

Cabezas joined Wheels Up in 2019 and previously acted as interim CFO during a period of transition for the company. In his role as SVP of Finance, Cabezas is responsible for providing key financial support to Wheels Up's commercial, operational and functional teams. He was also instrumental in the process of securing the company's 2023 capital investment.

“As we conduct our search for Todd’s replacement, we would like to thank Eric for stepping into the role of interim CFO for the second time in his tenure at Wheels Up,” said Mattson. “I have worked extensively with Eric and have every confidence in his ability to lead our finance team as we continue down the path to becoming a profitable and resilient business.”

Mattson continued, “Todd and Laura were valued members of the executive leadership team who both made critical contributions during their time here. I wish them both the best in their future endeavors.”

About Wheels Up

Wheels Up is a leading provider of on-demand private aviation and one of the largest companies in the industry. Wheels Up offers a complete global aviation solution with a large and diverse fleet and a global network of safety-vetted charter operators, all backed by an uncompromising commitment to safety and service. Customers can access charter and membership programs, as well as unique commercial travel benefits through a one-of-a-kind, strategic partnership with Delta Air Lines. Wheels Up also offers cargo, safety and security solutions and managed services to individuals, industry, government and civil organizations.

Wheels Up is guided by the mission to deliver a premium solution for every customer journey. With the Wheels Up mobile app and website, members and customers have the digital convenience to search, book and fly.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside of the control of Wheels Up Experience Inc. (“Wheels Up”). These forward-looking statements include, but are not limited to, statements regarding the expected impact and timing of certain personnel transitions. The words “anticipate,” “continue,” “could,” “expect,” “plan,” “potential,” “should,” “would,” “pursue” and similar expressions, may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in Wheels Up’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 7, 2024 and Wheels Up’s other filings with the SEC from time to time. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, Wheels Up does not intend to update any of these forward-looking statements after the date of this press release.

For more information, please visit: wheelsup.com

Media Contact

press@wheelsup.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

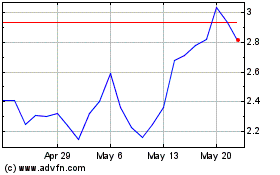

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From Nov 2023 to Nov 2024