false000182507900018250792024-07-082024-07-080001825079us-gaap:WarrantMember2024-07-082024-07-080001825079us-gaap:CommonStockMember2024-07-082024-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 8, 2024

Velo3D, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-39757 |

|

98-1556965 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

2710 Lakeview Court, |

|

|

Fremont, |

California |

|

94538 |

(Address of principal executive offices) |

|

(Zip Code) |

(408) 610-3915

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, par value $0.00001 per share |

|

VLD |

|

New York Stock Exchange |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share |

|

VLD WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 8, 2024, Velo3D, Inc. (the “Company”) received written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company is no longer in compliance with NYSE continued listing standards set forth in Section 802.01B of the NYSE’s Listed Company Manual due to the fact that the Company’s average total market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its stockholders’ equity was less than $50 million. As set forth in the Notice, as of July 5, 2024, the Company’s 30 trading-day average market capitalization was approximately $36.6 million and its last reported stockholders’ deficit, as of March 31, 2024, was approximately ($45.5) million.

In accordance with applicable NYSE procedures, within 45 days from receipt of the Notice, the Company intends to submit a plan to the NYSE advising it of the definitive action(s) the Company has taken, is taking, or plans to take that would bring it into compliance with the continued listing standards within 18 months of receipt of the Notice (the “Cure Period”). The NYSE will review the Company’s plan and, within 45 days, make a determination as to whether the Company has made a reasonable demonstration of its ability to come into conformity with the listing standards within the Cure Period. If the NYSE accepts the Company’s plan, the Company’s common stock will continue to be listed and traded on the NYSE during the Cure Period, subject to the Company’s compliance with the other continued listing standards and continued periodic review by the NYSE of the Company’s progress with respect to its plan.

The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during the Cure Period under the common stock trading symbol “VLD”, subject to the Company’s continued compliance with the plan and other listing requirements of the NYSE. However, the common stock trading symbol will have an added designation of “.BC” to indicate that the status of the common stock is below criteria with the NYSE continued listing standards. The “.BC” indicator will be removed at such time as the Company regains compliance with all applicable continued listing standards.

The Notice does not affect the Company’s reporting obligations with the Securities and Exchange Commission. However, failure to satisfy the conditions of the Cure Period or to maintain compliance with other NYSE listing requirements could lead to delisting.

Item 7.01. Regulation FD Disclosure.

On July 12, 2024, the Company issued a press release announcing the receipt of the Notice. A copy of the press release is furnished herewith as Exhibit 99.1.

The information set forth under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Velo3D, Inc. |

|

|

|

|

|

Date: |

July 12, 2024 |

|

By: |

/s/ Bradley Kreger |

|

|

|

Name: |

Bradley Kreger |

|

|

|

Title: |

Chief Executive Officer |

Velo3D, Inc. Receives Continued Listing Standards Notice from the NYSE

FREMONT, California – July 12, 2024 – Velo3D, Inc. (NYSE: VLD), a leading additive manufacturing technology company for mission-critical metal parts, today announced that on July 8, 2024 it received notice from the New York Stock Exchange (“NYSE”) that it is not in compliance with Section 802.01B of the NYSE Listed Company Manual because its average total market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its stockholders' equity was less than $50 million. As of July 5, 2024, the company’s 30 trading-day average market capitalization was approximately $36.6 million and its last reported stockholders’ deficit, as of March 31, 2024, was approximately ($45.5) million.

In accordance with NYSE procedures, within 45 days from receipt of the notice, the company intends to submit a plan to the NYSE advising it of the definitive action(s) the company has taken, is taking, or plans to take to regain compliance with the continued listing standards. If the NYSE accepts the company’s plan, the company’s common stock will continue to be listed and traded on the NYSE during the 18-month cure period, subject to the company’s compliance with other NYSE continued listing standards and continued periodic review by the NYSE of the company’s progress with respect to its plan.

The notice has no immediate impact on the listing of the company’s common stock and does not affect the company’s reporting obligations with the U.S. Securities and Exchange Commission.

In addition, in a separate letter dated June 28, 2024, the NYSE confirmed that a calculation of the company’s average stock price for the 30 trading days ended June 28, 2024, indicated that the company’s stock price was above the NYSE’s minimum requirement of $1 based on a 30 trading-day average. Accordingly, as of June 28, 2024, the Company was no longer considered below the $1 continued listing criterion.

About Velo3D:

Velo3D is a metal 3D printing technology company. 3D printing—also known as additive manufacturing (AM)—has a unique ability to improve the way high-value metal parts are built. However, legacy metal AM has been greatly limited in its capabilities since its invention almost 30 years ago. This has prevented the technology from being used to create the most valuable and impactful parts, restricting its use to specific niches where the limitations were acceptable.

Velo3D has overcome these limitations so engineers can design and print the parts they want. The company’s solution unlocks a wide breadth of design freedom and enables customers in space exploration, aviation, power generation, energy, and semiconductor to innovate the future in their respective industries. Using Velo3D, these customers can now build mission-critical metal parts that were previously impossible to manufacture. The fully integrated solution includes the Flow print preparation software, the Sapphire family of printers, and the Assure quality control system—all of which are powered by Velo3D’s Intelligent Fusion manufacturing process. The company delivered its first Sapphire system in 2018 and has been a strategic partner to innovators such as SpaceX, Aerojet Rocketdyne, Lockheed Martin, Avio, and General Motors. Velo3D has been named as one of Fast Company’s Most Innovative Companies for 2023. For more information, please visit Velo3D.com, or follow the company on LinkedIn or X (formerly known as Twitter).

VELO, VELO3D, SAPPHIRE and INTELLIGENT FUSION are registered trademarks of Velo3D, Inc.; and WITHOUT COMPROMISE, FLOW and ASSURE are trademarks of Velo3D, Inc. All Rights Reserved © Velo3D, Inc.

Forward-Looking Statements:

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. The company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, statements regarding the company’s ability to regain or maintain compliance with NYSE continued listing standards and the company’s other expectations, beliefs, intentions or strategies for the future. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “FY 2023 10-K”), which was filed by the company with the SEC on April 3, 2024, and the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, which was filed by the company with the SEC on May 15, 2024, and the other documents filed by the company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the company’s control and are difficult to predict. The company cautions not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

|

Investor Relations: |

Velo3D |

Bob Okunski, VP Investor Relations |

investors@velo3d.com |

|

Media Contact: |

Velo3D |

Dan Sorensen, Senior Director of PR |

press@velo3d.com |

v3.24.2

Cover

|

Jul. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 08, 2024

|

| Entity Registrant Name |

Velo3D, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39757

|

| Entity Tax Identification Number |

98-1556965

|

| Entity Address, Address Line One |

2710 Lakeview Court,

|

| Entity Address, City or Town |

Fremont,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94538

|

| City Area Code |

408

|

| Local Phone Number |

610-3915

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001825079

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.00001 per share

|

| Trading Symbol |

VLD

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

VLD WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

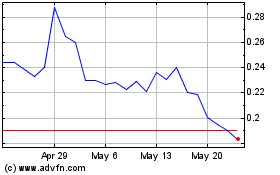

Velo3D (NYSE:VLD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Velo3D (NYSE:VLD)

Historical Stock Chart

From Jan 2024 to Jan 2025