WEX Announces Intention to Launch Modified Dutch Auction Tender Offer

February 25 2025 - 8:03AM

Business Wire

Intends to launch a “modified Dutch auction”

tender offer to repurchase up to $750 million worth of common stock

at a purchase price of not less than $148 per share nor greater

than $170 per share

WEX Inc. (NYSE: WEX), the global commerce

platform that simplifies the business of running a business, today

announced its current intention to launch a “modified Dutch

auction” tender offer to purchase up to $750 million worth of

common stock, par value $0.01 per share (“Common Stock”) at a cash

purchase price of not less than $148 per share nor greater than

$170 per share (the “Purchase Price”). WEX currently expects to

consummate one or more debt financings, resulting in aggregate

gross proceeds of at least $750 million, to be used principally to

fund the anticipated tender offer. The tender offer is currently

expected to commence tomorrow, February 26, 2025, and to expire at

one minute after 11:59 p.m., New York City Time, on Tuesday, March

25, 2025, unless the offer is extended or earlier terminated. The

tender offer is expected to be subject to certain conditions,

including a financing condition, each of which must be satisfied

prior to the expiration time of the tender offer in order to

ultimately consummate the tender offer.

Melissa Smith, WEX’s Chair, Chief Executive Officer, and

President said, “The anticipated tender offer reflects the shared

confidence that management and the Board of Directors have in the

future outlook of our business, the strength of our commercial and

product portfolio, and our belief in the long-term value of WEX. We

remain committed to the investments we’ve previously communicated

to drive organic growth and will focus this year on delivering on

these initiatives.”

A “modified Dutch auction” tender offer allows shareholders to

indicate how many shares of Common Stock and at what price (within

the range set forth in the tender offer) they wish to tender their

shares. Based on the number of shares of Common Stock tendered and

the prices specified by the tendering shareholders, if the tender

offer is consummated, WEX will determine the lowest price per share

within the range that will enable it to purchase $750 million of

shares of Common Stock, or such lesser number of shares of Common

Stock that are properly tendered and not properly withdrawn prior

to the expiration date of the tender offer. All shares purchased in

any tender offer would be purchased at the same price, even if the

shareholder tendered at a lower price. Shares of WEX tendered at a

price above the price at which WEX is able to purchase $750 million

of shares will not be purchased in the tender offer.

If and when WEX initiates any tender offer, neither WEX nor its

Board of Directors will make any recommendation to any shareholder

as to whether to tender or refrain from tendering any shares of

Common Stock or as to the price or prices at which shareholders may

choose to tender their shares. WEX has not authorized any person to

make any such recommendation. If WEX does launch such a tender

offer, shareholders must decide whether to tender their shares of

Common Stock and, if so, how many shares to tender and at what

price or prices to tender. In doing so, shareholders should

carefully evaluate all of the information in the tender offer

documents, when available, before making any decision with respect

to the tender offer, and should consult their own broker or other

financial and tax advisors.

Additional Information Regarding the Potential Tender

Offer

The potential tender offer described in this press release has

not yet commenced, and there can be no assurance that WEX will

commence the equity tender offer on the terms described in this

release or at all. This press release is for informational purposes

only. This press release is not a recommendation to buy or sell

shares of Common Stock or any other securities, and it is neither

an offer to purchase nor a solicitation of an offer to sell shares

of Common Stock or any other securities. On the commencement date

of the tender offer, if any, a tender offer statement on Schedule

TO/I, including an offer to purchase, a letter of transmittal, and

related materials, will be filed with the United States Securities

and Exchange Commission (the “SEC”) by WEX. The tender offer, if

made, will only be made pursuant to the offer to purchase, the

letter of transmittal, and related materials filed as a part of the

Schedule TO/I. When available, shareholders should read carefully

the offer to purchase, letter of transmittal, and related materials

because they will contain important information, including the

various terms of, and conditions to, the tender offer. Once the

tender offer is commenced, shareholders will be able to obtain a

free copy of the tender offer statement on Schedule TO/I, the offer

to purchase, letter of transmittal, and other documents that WEX

will be filing with the SEC at the SEC’s website at www.sec.gov,

the investor relations section of WEX’s website at www.wexinc.com,

or from the information agent for the tender offer.

About WEX

WEX (NYSE: WEX) is the global commerce platform that simplifies

the business of running a business. WEX has created a powerful

ecosystem that offers seamlessly embedded, personalized solutions

for its customers around the world. Through its rich data and

specialized expertise in simplifying benefits, reimagining mobility

and paying and getting paid, WEX aims to make it easy for companies

to overcome complexity and reach their full potential. For more

information, please visit www.wexinc.com.

Forward Looking Statements

This press release contains forward-looking statements

including, but not limited to, statements regarding its intention

to launch a modified Dutch auction tender offer. Any statements in

this press release that are not statements of historical facts are

forward-looking statements. When used in this press release, the

words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “project,” “will,” “positions,”

“confidence,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such words. Forward-looking statements relate to

our future plans, objectives, expectations, and intentions and are

not historical facts and accordingly involve known and unknown

risks and uncertainties and other factors that may cause the actual

results or performance to be materially different from future

results or performance expressed or implied by these

forward-looking statements, including the ability of the Company to

execute the modified Dutch tender offer as intended; as well as

other risks and uncertainties identified in Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2024, filed

with the Securities and Exchange Commission on February 20, 2025

and subsequent filings with the Securities and Exchange Commission.

The forward-looking statements speak only as of the date of this

press release and undue reliance should not be placed on these

statements. The Company disclaims any obligation to update any

forward-looking statements as a result of new information, future

events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224986071/en/

News media: WEX Megan Zaroda, 610-379-6211

Megan.Zaroda@wexinc.com Investor: WEX Steve Elder, 207-523-7769

Steve.Elder@wexinc.com

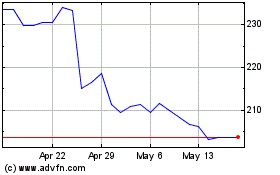

WEX (NYSE:WEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

WEX (NYSE:WEX)

Historical Stock Chart

From Feb 2024 to Feb 2025