Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 12 2024 - 3:18PM

Edgar (US Regulatory)

Issuer Free Writing

Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement dated

November 12, 2024 and the Prospectus dated May 2, 2022

Registration No. 333-264613

W. P. Carey Inc.

€600,000,000

3.700% Senior Notes due 2034

| Issuer: |

W. P. Carey Inc. |

| |

|

| Offering Format: |

SEC Registered |

| |

|

| Security Type: |

Senior Unsecured Fixed Rate Notes |

| |

|

| Aggregate Principal Amount: |

€600,000,000 |

| |

|

| Stated Maturity Date: |

November 19, 2034 |

| |

|

| Coupon: |

3.700% per year |

| |

|

| Public Offering Price: |

98.880%, plus accrued and unpaid interest, if any, from the Settlement Date |

| |

|

| Mid-Swap Yield: |

2.317% |

| |

|

| Spread to Mid-Swap Yield: |

+152 basis points |

| |

|

| Benchmark Government Security: |

DBR 2.600% due August 15, 2034 |

| |

|

| Benchmark Government Security Price: |

102.190% |

| |

|

| Spread to Benchmark Government

Security: |

+149.2 basis points |

| |

|

| Yield to Maturity (annual): |

3.837% |

| |

|

| Interest Payment Date: |

November 19 of each year, commencing November 19, 2025 |

| |

|

| Day Count Convention: |

Actual/Actual (ICMA) |

| |

|

| Optional Redemption: |

At any time prior to August 19, 2034 (i.e., three months prior to the Stated Maturity Date), make-whole call based on the Comparable Government Bond Rate plus 25 basis points; if redeemed on or after August 19, 2034 (i.e., three months prior to the Stated Maturity Date), at 100% of the aggregate principal amount of the Notes to be redeemed; plus, in each case, accrued and unpaid interest, if any, on the principal amount of the notes to be redeemed to, but not including, such redemption date. |

| |

|

| Listing: |

The Issuer intends to list the notes on the Official List of the Irish Stock Exchange plc, trading as Euronext Dublin and admit the notes to trading on its Global Exchange Market. |

| Joint Book-Running Managers: |

Barclays Bank PLC |

| |

BNP PARIBAS |

| |

J.P. Morgan Securities plc |

| |

Bank of Montreal, London Branch |

| |

|

| Senior Co-Managers: |

BNY Mellon Capital Markets, LLC |

| |

PNC Capital Markets LLC |

| |

RBC Europe Limited |

| |

U.S. Bancorp Investments, Inc. |

| |

|

| Co-Manager: |

Citizens JMP Securities, LLC |

| |

|

| ISIN/Common Code: |

XS2941598786 / 294159878 |

| |

|

| UK MiFIR Product Governance: |

Manufacturer target market (UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels) |

| |

|

| PRIIPs: |

No EU PRIIPs or UK PRIIPs key information document (KID) has been prepared as not available to retail in the EEA or in the UK |

| |

|

| Denominations: |

€100,000 x €1,000 |

| |

|

| Trade Date: |

November 12, 2024 |

| |

|

| Settlement Date; Settlement and Trading: |

November 19, 2024, through the facilities of Euroclear Bank SA/NV, as operator of the Euroclear System, and Clearstream Banking, S.A. |

| |

|

| Expected Ratings: |

Baa1 by Moody’s Investors Service, Inc. and BBB+ by Standard & Poor’s* |

Terms used herein but not defined shall have the

respective meanings as set forth in the Issuer’s preliminary prospectus supplement dated November 12, 2024.

*

A securities rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time.

Each securities rating should be evaluated independently of any other security rating.

We

expect to deliver the Notes against payment for the Notes on or about November 19, 2024. Under the E.U. Central Securities Depositaries

Regulation, trades in the secondary market generally are required to settle in two business days (on which the relevant securities settlement

system is open) unless the parties to a trade expressly agree otherwise. Also under Rule 15c6-1 of the Securities Exchange Act of 1934,

as amended, trades in the secondary market generally are required to settle in one New York business day, unless the parties to a trade

expressly agree otherwise. Accordingly, purchasers who wish to trade Notes before the first business day prior to delivery being required

will be required to specify alternative settlement arrangements to prevent a failed settlement.

UK

MiFIR - professionals/ECPs-only / No PRIIPs or UK PRIIPs KID – Manufacturer target market (UK MiFIR product governance)

is eligible counterparties and professional clients only (all distribution channels). No PRIIPs or UK PRIIPs key information document

(KID) has been prepared as not available to retail in the EEA or UK.

The communication

of this pricing term sheet and any other document or materials relating to the issue of the Notes offered hereby is not being made, and

such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the United Kingdom's

Financial Services and Markets Act 2000, as amended (the “FSMA”). Accordingly, this pricing term sheet and such other documents

and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. This pricing term

sheet and such other documents and/or materials are for distribution only to persons who (i) have professional experience in matters relating

to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), (ii) fall within Article

49(2)(a) to (d) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are other persons to whom it may otherwise

lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”).

This pricing term sheet is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons.

Any investment or investment activity to which this pricing term sheet and any other document or materials relates will be engaged in

only with relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this pricing term

sheet, any such relevant document or materials or any of their contents.

The

Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for

the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and

other documents that the Issuer has filed with the SEC, including the prospectus supplement relating to the notes, for more complete information

about the issuer and this offering. You may get these documents for free by visiting the SEC Web site at www.sec.gov. Alternatively, the

Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement

relating to the notes if you request it by contacting Barclays Bank PLC toll-free at + 1-866-603-5847,

BNP PARIBAS toll-free at +1-800-854-5674 and

J.P. Morgan Securities plc collect at +44 (0) 20 7134 2468.

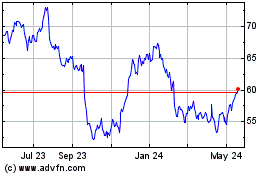

WP Carey (NYSE:WPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

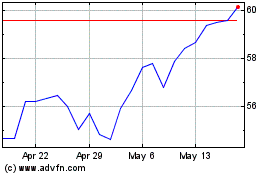

WP Carey (NYSE:WPC)

Historical Stock Chart

From Dec 2023 to Dec 2024