SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13D/A

(Amendment No. 1)

Under the Securities Exchange Act of 1934

Zurn

Elkay Water Solutions Corporation

(Name of Issuer)

Common Stock

(Title of Class of Securities)

98983L108

(CUSIP Number)

Brooke R. Kerendian

DLA Piper LLP (US)

444 West Lake Street,

Suite 900

Chicago, Illinois

60606

Telephone: (312) 368-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 19, 2022

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

Rule 13d-7(b) for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 2

of 20 |

1. Names of Reporting Persons.

Ice Mountain LLC |

2. Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

o

(b)

o

|

3. SEC Use Only

|

4. Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6. Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7. Sole Voting Power

0 |

8. Shared Voting Power

23,454,164 |

9. Sole Dispositive Power

0 |

10. Shared Dispositive Power

23,454,164 |

11. Aggregate Amount Beneficially Owned by Each Reporting Person

23,454,164 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13. Percent of Class Represented by Amount in Row (11)

13.72% |

14. Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 3

of 20 |

1.

Names of Reporting Persons.

Cascade Bay LLC |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

N/A |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

23,454,164 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

23,454,164 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

23,454,164 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

13.

Percent of Class Represented by Amount in Row (11)

13.72% |

14.

Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 4

of 20 |

1.

Names of Reporting Persons.

Katz 2004 DYN Trust |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

N/A |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

Illinois |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

23,454,164 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

23,454,164 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

23,454,164 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

13.

Percent of Class Represented by Amount in Row (11)

13.72% |

14.

Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 5

of 20 |

1.

Names of Reporting Persons.

Katz 2021 Trust for Patti |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨

|

6.

Citizenship or Place of Organization

Florida |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

71,452 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

71,452 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

71,452 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

13.

Percent of Class Represented by Amount in Row (11)

0.04% |

14.

Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 6

of 20 |

1.

Names of Reporting Persons.

Katz New VBA Trust |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

Illinois |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

14,101 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

14,101 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

14,101 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

0.01% |

14.

Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 7

of 20 |

1. Names of Reporting Persons.

Katz Voting Stock Trust |

2. Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3. SEC Use Only

|

4. Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6. Citizenship or Place of Organization

Florida |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7. Sole Voting Power

0 |

8. Shared Voting Power

236,387 |

9. Sole Dispositive Power

0 |

10. Shared Dispositive Power

236,387 |

11. Aggregate Amount Beneficially Owned by Each Reporting Person

236,387 |

12. Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13. Percent of Class Represented by Amount in Row (11)

0.14% |

14. Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 8

of 20 |

1.

Names of Reporting Persons.

Errol R. Halperin Revocable Trust U/A/D 7/8/1996, Phyllis B. Hollander,

Trustee |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

Illinois |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

140,000 |

8.

Shared Voting Power

0 |

9.

Sole Dispositive Power

140,000 |

10.

Shared Dispositive Power

0 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

140,000 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

0.08% |

14.

Type of Reporting Person (See Instructions)

OO |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 9

of 20 |

1.

Names of Reporting Persons.

Aimee Katz |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

N/A |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

6,678 |

8.

Shared Voting Power

23,704,652 |

9.

Sole Dispositive Power

6,678 |

10.

Shared Dispositive Power

23,704,652 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

23,711,330 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

13.

Percent of Class Represented by Amount in Row (11)

13.87% |

14.

Type of Reporting Person (See Instructions)

IN |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 10

of 20 |

1.

Names of Reporting Persons.

April Jalazo |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

N/A |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

23,704,652 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

23,704,652 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

23,704,652 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

13.87% |

14.

Type of Reporting Person (See Instructions)

IN |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 11

of 20 |

1.

Names of Reporting Persons.

Patricia A. Bauer |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

SC |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

232 |

8.

Shared Voting Power

71,452 |

9.

Sole Dispositive Power

232 |

10.

Shared Dispositive Power

71,452 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

71,684 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

0.04% |

14.

Type of Reporting Person (See Instructions)

IN |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 12

of 20 |

1.

Names of Reporting Persons.

The Northern Trust Company |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

OO (1) |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

7,476 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

7,476 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

7,476 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

0.01% |

14.

Type of Reporting Person (See Instructions)

OO |

| | |

| (1) | The securities beneficially owned by The Northern Trust Company

were acquired as a result of the death of Ronald C. Katz on October 19, 2022. The securities

were acquired by the Estate of Ronald C. Katz, deceased, by operation of law upon Ronald

C. Katz’s death. The Northern Trust Company is the personal representative of the Estate

of Ronald C. Katz, deceased. Therefore, this item is not applicable. |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 13

of 20 |

1.

Names of Reporting Persons.

The Estate of Errol R. Halperin, deceased |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

OO (1) |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

0 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

0 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

13.

Percent of Class Represented by Amount in Row (11)

0.00% |

14.

Type of Reporting Person (See Instructions)

OO (2) |

| (1) | The securities beneficially owned by the Estate of Errol R. Halperin,

deceased, were acquired as a result of the death of Errol R. Halperin on September 19,

2022. The securities were acquired by the Estate of Errol R. Halperin, deceased, by operation

of law upon Errol R. Halperin’s death. Therefore, this item is not applicable. As further

disclosed in this Schedule 13D, the securities beneficially owned by the Estate of Errol

R. Halperin, deceased were transferred to the Errol R. Halperin Revocable Trust U/A/D 7/8/1996. |

| (2) | The Reporting Person is an

estate to which the securities reported herein passed upon the death of Errol R. Halperin. |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 14

of 20 |

1.

Names of Reporting Persons.

The Estate of Ronald C. Katz, deceased |

2.

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) o

(b) o

|

3.

SEC Use Only

|

4.

Source of Funds (See Instructions)

OO (1) |

| 5.

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ¨ |

6.

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7.

Sole Voting Power

0 |

8.

Shared Voting Power

7,476 |

9.

Sole Dispositive Power

0 |

10.

Shared Dispositive Power

7,476 |

11.

Aggregate Amount Beneficially Owned by Each Reporting Person

7,476 |

12.

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

13.

Percent of Class Represented by Amount in Row (11)

0.01% |

14.

Type of Reporting Person (See Instructions)

OO (2) |

| (1) | The securities beneficially owned by the Estate of Ronald C. Katz,

deceased, were acquired as a result of the death of Ronald C. Katz on October 19, 2022.

The securities were acquired by the Estate of Ronald C. Katz, deceased, by operation of law

upon Ronald C. Katz’s death. Therefore, this item is not applicable. |

| (2) | The Reporting Person is an

estate to which the securities reported herein passed upon the death of Ronald C.

Katz. |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 15

of 20 |

Explanatory Note

This

Amendment No. 1 (“Amendment No. 1”) to Schedule 13D is being filed jointly by (i) Ice Mountain LLC,

a Delaware limited liability company (“Ice Mountain”); (ii) Cascade Bay LLC, a Delaware limited liability company

(“Cascade Bay”), for itself and as the Manager of Ice Mountain; (iii) Katz 2004 DYN Trust (“DYN”),

the Special Assets Manager of Cascade Bay; (iv) Katz 2021 Trust for Patti (“KTP”); (v) Katz New VBA Trust

(“New VBA”); (vi) Katz Voting Stock Trust, a formerly revocable trust (“KVST”); (vii) the

Estate of Errol R. Halperin, deceased, (viii) Phyllis Hollander, as Successor Trustee under Declaration of Trust dated July 8,

1996, a formerly revocable trust (“Halperin Trust”); (ix) The Northern Trust Company, individually and as the

personal representative of the Estate of Ronald C. Katz, deceased; (x) Aimee Katz, individually and with April Jalazo, the

seat holders of the voting committees with the power to direct DYN, New VBA and KVST (each, a “Voting Committee” and

collectively, the “Voting Committees”), (xi) April Jalazo, individually and with Aimee Katz, the seat holders

of the Voting Committees, (xii) Patricia A. Bauer, individually and as the Special Assets Director with the power to direct KTP,

and (xiii) the Estate of Ronald C. Katz, deceased (each individually, a “Reporting Person”, and collectively,

the “Reporting Persons”), related to the common stock, par value $0.01 per share (the “Common Stock”),

of Zurn Elkay Water Solutions Corporation, a Delaware corporation (the “Issuer”). This Amendment No. 1 amends

and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on July 12, 2022

(the “Original Schedule 13D” and, together with Amendment No. 1, the “Schedule 13D”). Except

as specifically provided herein, this Amendment No. 1 does not modify any of the information previously provided in the Schedule

13D. Capitalized terms used but not defined in this Amendment No. 1 shall have the meanings ascribed to such terms in the Original

Schedule 13D.

This

Amendment No. 1 is being filed to report the following matters: (1) on September 19, 2022, Errol R. Halperin, the

former trustee of DYN and former Trustee of the Halperin Trust, died, (2) on October 19, 2022, Ronald C. Katz, the former

trustee of KVST, died, (3) following the deaths of Errol R. Halperin and Ronald C. Katz, the Voting Proxies terminated,

(4) as described in the Original Schedule 13D, following the Merger, certain additional shares of Common Stock held in escrow

were transferred to certain of the Reporting Persons, as further described in Item 5, (5) as further discussed in Item 5,

during the period April 5, 2024 to July 2, 2024, Ice Mountain sold an aggregate of 1,594,768 shares of Common Stock

of the Issuer, (6) as further discussed in Item 5, during the period January 1, 2024 to January 5, 2024, the

Halperin Trust disposed of 923,804 shares of Common Stock of the Issuer, (7) the Estate of Errol R. Halperin, deceased,

transferred all of its 17,029 shares of Common Stock of the Issuer to the Halperin Trust on January 3, 2024, and

(8) April Katz is now known as April Jalazo.

As a result

of his death, (1) Errol R. Halperin’s former individual interest in the Common Stock of the Issuer, was held by his estate,

which is currently in probate, and all of the Common Stock of the Issuer held by the Estate of Errol R. Halperin, deceased, was subsequently

transferred to the Halperin Trust, (2) Phyllis Hollander was appointed as the Successor Trustee to the Halperin Trust, and (3) Errol

R. Halperin’s former interest in the Common Stock of the Issuer as the trustee of DYN is now controlled by Aimee Katz and April Jalazo,

the seat holders of the DYN Voting Committee. As a result, the Estate of Errol R. Halperin, deceased, and the Halperin Trust each beneficially

owns less than 5% of the Issuer’s outstanding Common Stock.

As a result

of his death, (1) Ronald C. Katz’s former individual interest in the Common Stock of the Issuer is now held by his estate,

which is currently in probate, and The Northern Trust Company was appointed as the personal representative of Ronald C. Katz’s

estate, (2) Ronald C. Katz’s former interest in the Common Stock of the Issuer as a result of his being the trustee of KVST

and the recipient of the Voting Proxies with respect to Ice Mountain and New VBA is now controlled by Aimee Katz and April Jalazo,

the seat holders of the Voting Committees, and (3) Ronald C. Katz’s former interest in the Common Stock of the Issuer as a

result of his being the recipient of the Voting Proxy with respect to KTP is now controlled by Patricia A. Bauer as the Special Assets

Director of KTP. As a result, the Estate of Ronald C. Katz, deceased, beneficially owns less than 5% of the Issuer’s outstanding

Common Stock.

As further

discussed in Item 5, this Amendment No. 1 constitutes an exit filing for KTP, Patricia A. Bauer, the Estate of Errol R. Halperin,

deceased, the Halperin Trust, the Estate of Ronald C. Katz, deceased, and The Northern Trust Company.

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 16

of 20 |

| Item 2. | Identity and Background |

“Item

2. Identity and Background” of the Schedule 13D is hereby amended and restated as follows:

The persons filing this statement

are the Reporting Persons.

The residence

or business address for each of the Reporting Persons is as follows:

| Ice

Mountain: |

c/o

The Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| Cascade

Bay: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| DYN: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| KTP: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| New VBA: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| KVST: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-3, Chicago, IL 60603, Attn: John R. Thickens |

| Estate

of Errol R. Halperin, deceased: |

c/o Phyllis

Hollander, 135 Wellington Road, Northbrook, IL 60062 |

| The Northern

Trust Company: |

The Northern

Trust Company, 50 S. LaSalle St., B-6, Chicago, IL 60603, Attn: Siomara Elizondo |

| Halperin

Trust: |

c/o Phyllis

Hollander, 135 Wellington Road, Northbrook, IL 60062 |

| Aimee

Katz: |

4525 Sterling

Road, Downers Grove, IL 60515-3040 |

| April Jalazo: |

646 Columbus

Drive, Tierra Verde, FL 33715-2030 |

| Patricia

A. Bauer: |

266 Brian Lane, Dawson, IL 62520 |

| Estate

of Ronald C. Katz, deceased: |

c/o The

Northern Trust Company, 50 S. LaSalle St., B-6, Chicago, IL 60603, Attn: Siomara Elizondo |

The principal business or occupation

for each of the Reporting Persons is as follows:

| Ice

Mountain: |

Investing. |

| Cascade

Bay: |

Investing. |

| DYN: |

Not applicable. |

| KTP: |

Not applicable. |

| New VBA: |

Not applicable. |

| KVST: |

Not applicable. |

| Estate

of Errol R. Halperin, deceased: |

Hold certain

assets of the late Errol R. Halperin. |

| The Northern

Trust Company: |

A trust

company. |

| Halperin

Trust: |

Not applicable. |

| Aimee

Katz: |

Retired. |

| April Jalazo: |

Retired. |

| Patricia

A. Bauer: |

Self-employed

real estate broker. |

| Estate

of Ronald C. Katz, deceased: |

Hold certain

assets of the late Ronald C. Katz. |

Each of Ice Mountain and

Cascade Bay are formed under the laws of the State of Delaware. Each of DYN, the Halperin Trust and New VBA are formed under the laws

of the State of Illinois. Each of KTP and KVST are formed under the laws of the State of Florida. The Northern Trust Company is formed

under the laws of the State of Illinois.

Aimee

Katz, April Jalazo, and Patricia A. Bauer are each a citizen of the United States.

Errol R. Halperin and Ronald

C. Katz were each a citizen of the United States.

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 17

of 20 |

No Reporting Person, during

the last five years, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or been party

to any civil proceeding which resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 5. | Interest in Securities of the

Issuer |

“Item 5. Interest

in Securities of the Issuer” of the Schedule 13D is hereby amended and restated as follows:

The information set forth

below in Item 6 is incorporated by reference into this Item 5.

| (a) | Amount beneficially owned and percentage

of class |

Ice

Mountain is the direct record owner of 23,454,164 shares of Common Stock; KVST is the direct record owner of 236,387 shares of Common

Stock; New VBA is the direct record owner of 14,101 shares of Common Stock; KTP is the direct record owner of 71,452 shares of Common

Stock; the Estate of Errol R. Halperin, deceased, is the direct record owner of 0 shares of Common Stock, the Halperin Trust is

the direct record owner of 140,000 shares of Common Stock; Aimee Katz is the direct record owner of 6,678 shares of Common Stock; Patricia

A. Bauer is the direct record owner of 232 shares of Common Stock; and the Estate of Ronald C. Katz, deceased, is the direct record owner

of 7,476 shares of Common Stock.

The aggregate number of

shares of Common Stock beneficially owned by Ice Mountain is 23,454,164, representing 13.72% of the shares of Common Stock outstanding

as of July 26, 2024.

Voting and investment power

with respect to the shares of Common Stock directly owned by Ice Mountain may be deemed to be shared by Cascade Bay, DYN, Aimee Katz

and April Jalazo. Cascade Bay is the manager and sole Class A member of Ice Mountain. DYN is the Special Assets Manager of

Cascade Bay. Aimee Katz and April Jalazo are the seat holders of the DYN Voting Committee. Neither Cascade Bay nor DYN directly

owns any shares of Common Stock. Each of Cascade Bay, DYN, Aimee Katz and April Jalazo may be deemed to be the beneficial owner

of the 23,454,164 shares of Common Stock directly owned by Ice Mountain, representing approximately 13.72% of the shares of Common Stock

outstanding as of July 26, 2024.

The aggregate number of

shares of Common Stock beneficially owned by KVST is 236,387, representing approximately 0.14% of the shares of Common Stock outstanding

as of July 26, 2024.

The aggregate number of

shares of Common Stock beneficially owned by New VBA is 14,101, representing approximately 0.01% of the shares of Common Stock outstanding

as of July 26, 2024.

The aggregate number of

shares of Common Stock beneficially owned by KTP is 71,452, representing approximately 0.04% of the shares of Common Stock outstanding

as of July 26, 2024.

The aggregate number of

shares of Common Stock beneficially owned by the Halperin Trust is 140,000, representing approximately 0.08% of the shares of Common

Stock outstanding as of July 26, 2024.

Voting

and investment power with respect to the shares of Common Stock directly owned by KTP may be deemed to be shared by Patricia A.

Bauer as the Special Assets Director of KTP. Therefore, Patricia A. Bauer may be deemed to beneficially own an aggregate of 71,684 shares

of Common Stock, consisting of the 71,452 shares of Common Stock directly held by KTP and the 232 shares of Common Stock she directly

holds, representing approximately 0.04% of the shares of Common Stock outstanding as of July 26, 2024.

Voting

and investment power with respect to the shares of Common Stock directly owned by the Estate of Ronald C. Katz, deceased, may

be deemed to be shared by The Northern Trust Company as the personal representative of the Estate of Ronald C. Katz, deceased. Therefore,

The Northern Trust Company may be deemed to beneficially own 7,467 shares of Common Stock, representing 0.01% of the shares of Common

Stock outstanding as of July 26, 2024.

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 18

of 20 |

Voting

and investment power with respect to the shares of Common Stock directly and beneficially owned by DYN, New VBA and KVST may be deemed

to be shared by the seat holders comprising the Voting Committees. Therefore, (i) Aimee Katz may be deemed to beneficially own an

aggregate of 23,711,330 shares of Common Stock, consisting of the 23,454,164 shares of Common Stock directly held by Ice Mountain, the

236,387 shares of Common Stock directly held by KVST, the 14,101 shares of Common Stock directly held by New VBA, and the 6,678 shares

of Common Stock directly held by Aimee Katz, representing approximately 13.87% of the shares of Common Stock outstanding as of July 26,

2024; and (ii) April Jalazo may be deemed to beneficially own an aggregate of 23,704,652 shares of Common Stock, consisting

of the 23,454,164 shares of Common Stock directly held by Ice Mountain, the 236,387 shares of Common Stock directly held by KVST, and

the 14,101 shares of Common Stock directly held by New VBA, representing approximately 13.87% of the shares of Common Stock outstanding

as of July 26, 2024.

| (b) | Number of shares of Common Stock to which

such Reporting Person has: |

| (i) | Sole power to vote or direct the vote |

| |

Ice

Mountain: |

0

shares |

| |

Cascade

Bay: |

0 shares |

| |

DYN: |

0 shares |

| |

KTP: |

0 shares |

| |

New VBA: |

0 shares |

| |

KVST: |

0 shares |

| |

Estate

of Errol R. Halperin, deceased: |

0 shares |

| |

The Northern

Trust Company: |

0 shares |

| |

Halperin

Trust: |

140,000

shares |

| |

Aimee

Katz: |

6,678

shares |

| |

April Jalazo: |

0 shares |

| |

Patricia

A. Bauer: |

232 shares |

| |

Estate

of Ronald C. Katz, deceased: |

0 shares |

| (ii) | Shared power to vote or direct the vote: |

| |

Ice

Mountain: |

23,454,164

shares |

| |

Cascade

Bay: |

23,454,164

shares |

| |

DYN: |

23,454,164

shares |

| |

KTP: |

71,452

shares |

| |

New VBA: |

14,101

shares |

| |

KVST: |

236,387

shares |

| |

Estate

of Errol R. Halperin, deceased: |

0 shares |

| |

The Northern

Trust Company: |

7,476

shares |

| |

Halperin

Trust |

0 shares |

| |

Aimee

Katz: |

23,704,652

shares |

| |

April Jalazo: |

23,704,652

shares |

| |

Patricia

A. Bauer: |

71,452

shares |

| |

Estate

of Ronald C. Katz, deceased: |

7,476

shares |

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 19

of 20 |

| (iii) | Sole power to dispose or direct the

disposition of: |

| |

Ice

Mountain: |

0

shares |

| |

Cascade

Bay: |

0

shares |

| |

DYN: |

0

shares |

| |

KTP: |

0

shares |

| |

New

VBA: |

0

shares |

| |

KVST: |

0

shares |

| |

Estate

of Errol R. Halperin, deceased: |

0

shares |

| |

Halperin

Trust: |

140,000

shares |

| |

Aimee

Katz: |

6,678

shares |

| |

April Jalazo: |

0

shares |

| |

Patricia

A. Bauer: |

232

shares |

| |

Estate

of Ronald C. Katz, deceased: |

0

shares |

| (iv) | Shared power to dispose or direct the

disposition of: |

| |

Ice Mountain: |

23,454,164

shares |

| |

Cascade Bay: |

23,454,164 shares |

| |

DYN: |

23,454,164 shares |

| |

KTP: |

71,452 shares |

| |

New VBA: |

14,101 shares |

| |

KVST: |

236,387 shares |

| |

Estate of Errol R. Halperin,

deceased: |

0 shares |

| |

The Northern Trust Company: |

7,476 shares |

| |

Halperin Trust: |

0 shares |

| |

Aimee Katz: |

23,704,652 shares |

| |

April Jalazo: |

23,704,652 shares |

| |

Patricia A. Bauer |

71,452 shares |

| |

Estate of Ronald C. Katz,

deceased: |

7,476 shares |

The percentages of beneficial

ownership reported in this Schedule 13D are based on approximately 170,928,495 shares of

Common Stock of the Issuer outstanding as of July 26, 2024, such number of shares being based on the Issuer’s Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024.

| (c) | Transactions effected in the past sixty

days: |

As described in the Original

Schedule 13D, certain additional shares of Common Stock (the “Escrow Shares”) were held in escrow and could be transferred

to one or more of the Reporting Persons upon the occurrence of certain conditions. On January 2, 2024, the following Reporting Persons

received Escrow Shares directly in their name, as shown below:

| |

Ice Mountain: |

277,092 shares |

| |

New VBA: |

156 shares |

| |

KVST: |

2,615 shares |

| |

Estate of Ronald C. Katz,

deceased: |

83 shares |

During the period

April 5, 2024 to July 2, 2024, Ice Mountain sold an aggregate of 1,594,768 shares of Common Stock of the Issuer in

multiple transactions on the open market, as further described below. Ice Mountain undertakes to provide to Zurn Elkay Water

Solutions Corporation, any security holder of Zurn Elkay Water Solutions Corporation, or the staff of the Securities and Exchange

Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth

column 4 below.

| CUSIP

No. 98983L108 |

SCHEDULE

13D/A |

Page 20

of 20 |

| Date | | |

Amount | | |

Weighted

Average

Price | | |

Price Range

(inclusive) | |

| | 04/05/2024 | | |

| 50,172 | | |

$ | 32.18 | | |

| $32.15

to $32.33 | |

| | 04/08/2024 | | |

| 49,828 | | |

$ | 32.07 | | |

| $32.00

to $32.36 | |

| | 04/11/ 2024 | | |

| 1,223 | | |

$ | 32.20 | | |

| $32.20

to $32.22 | |

| | 04/12/2024 | | |

| 45,009 | | |

$ | 32.24 | | |

| $32.20

to $32.58 | |

| | 04/15/2024 | | |

| 103,768 | | |

$ | 31.96 | | |

| $31.91

to $32.27 | |

| | 04/19/2024 | | |

| 43,690 | | |

$ | 31.93 | | |

| $31.91

to $31.94 | |

| | 04/22/2024 | | |

| 249,582 | | |

$ | 32.04 | | |

| $31.90

to $32.19 | |

| | 04/23/2024 | | |

| 236,728 | | |

$ | 32.44 | | |

| $32.10

to $32.73 | |

| | 05/22/2024 | | |

| 48,388 | | |

$ | 32.97 | | |

| $32.91

to $32.98 | |

| | 05/23/2024 | | |

| 5,232 | | |

$ | 32.08 | | |

| $32.00

to $32.13 | |

| | 05/24/2024 | | |

| 46,380 | | |

$ | 32.00 | | |

| $32.00

to $32.04 | |

| | 06/10/2024 | | |

| 100,000 | | |

$ | 30.10 | | |

| $30.00

to $30.18 | |

| | 06/12/2024 | | |

| 194,081 | | |

$ | 31.55 | | |

| $31.25

to $31.74 | |

| | 06/13/2024 | | |

| 687 | | |

$ | 31.25 | | |

| N/A | |

| | 06/18/2024 | | |

| 154,433 | | |

$ | 30.53 | | |

| $30.40

to $30.85 | |

| | 06/20/2024 | | |

| 36,938 | | |

$ | 30.44 | | |

| $30.40

to $30.51 | |

| | 06/21/2024 | | |

| 8,629 | | |

$ | 30.40 | | |

| $30.40

to $30.42 | |

| | 06/28/2024 | | |

| 100,000 | | |

$ | 29.04 | | |

| $29.00

to $29.21 | |

| | 07/01/2024 | | |

| 8,240 | | |

$ | 29.14 | | |

| $29.00

to $29.27 | |

| | 07/02/2024 | | |

| 111,760 | | |

$ | 29.07 | | |

| $29.00

to $29.13 | |

On January 1, 2024

the Halperin Trust sold 900,000 shares of Common Stock of the Issuer for a weighted average price of $27.05 and on January 5, 2024

the Halperin Trust contributed 23,804 shares of Common Stock of the Issuer for philanthropic purposes. Further, on January 3, 2024,

the Estate of Errol R. Halperin, deceased, transferred all of its 17,029 shares of Common Stock of the Issuer to the Halperin Trust.

As a result of such transfers, the Halperin Trust is the direct record owner of 140,000 shares of Common Stock of the Issuer, and the

Estate of Errol R. Halperin, deceased, is the direct record owner of 0 shares of Common Stock of the Issuer.

Except as otherwise described

above and in Items 3 and 4, there have been no reportable transactions by the Reporting Persons with respect to the Common Stock within

the last 60 days.

| (d) | No other person is known to have the

right to receive, or the power to direct the receipt of dividends from, or the proceeds from

the sale of, the securities covered by this Schedule 13D. |

| (e) | As described herein, as of September 19,

2022 and October 19, 2022, Errol R. Halperin and Ronald C. Katz, respectively, ceased

to be the beneficial owner of more than five percent of the Common Stock of the Issuer. The

filing of this Amendment No. 1 represents an exit filing for KTP, Patricia A. Bauer,

the Estate of Errol R. Halperin, deceased, the Halperin Trust, the Estate of Ronald C. Katz,

deceased, and The Northern Trust Company. |

| Item 6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Schedule

13D is hereby supplemented as follows:

Following the deaths of

Ronald C. Katz and Errol R. Halperin, the Voting Proxies terminated. Following the termination of the Voting Proxies, Aimee Katz and

April Jalazo became the sole seat holders of the Voting Committees with the power to direct DYN, New VBA and KVST.

| Item 7. | Material to be Filed as Exhibits |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true,

complete and correct.

Date: October 2, 2024

| |

ICE MOUNTAIN LLC, a Delaware limited

liability company |

| |

|

| |

By: Cascade Bay LLC, a Delaware limited

liability company, its Manager |

| |

|

| |

|

By: |

The

Northern Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New

Growth Trust dated as of December 1, 2019, and not individually, its General Manager |

| |

|

|

|

Print name: |

John

Thickens |

| |

|

|

|

Its: |

Senior

Vice President |

| |

CASCADE BAY LLC, a Delaware

limited liability company |

| |

|

| |

By: |

The Northern

Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New Growth Trust

dated as of December 1, 2019, and not individually, its General Manager |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ 2004 DYN TRUST |

| |

|

| |

By: |

The Northern

Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New Growth Trust

dated as of December 1, 2019, and not individually, its General Manager |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ 2021 TRUST FOR PATTI |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

Attention.

Intentional misstatements or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

| |

KATZ NEW VBA TRUST |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ VOTING STOCK TRUST |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

PHYLLIS

HOLLANDER, AS SUCCESSOR TRUSTEE UNDER DECLARATION OF TRUST DATED JULY 8, 1996 |

| |

|

| |

By: |

/s/

Phyllis Hollander |

| |

|

Phyllis Hollander, as Trustee, and not individually |

| |

THE NORTHERN TRUST COMPANY |

| |

|

| |

By: |

/s/ Siomara Elizondo |

|

|

Print Name: |

Siomara

Elizondo |

| |

|

Its: |

Authorized

Signatory |

| |

/s/ Aimee Katz |

| |

AIMEE KATZ |

| |

|

| |

/s/ April Jalazo |

| |

APRIL JALAZO |

| |

|

| |

/s/ Patricia A. Bauer |

| |

PATRICIA A. BAUER |

| |

ESTATE OF ERROL R. HALPERIN,

DECEASED |

| |

|

| |

By: |

/s/ Phyllis Hollander |

|

|

Print Name: |

Phyllis

Hollander |

| |

|

Its: |

Independent

Executor |

Attention.

Intentional misstatements or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

| |

ESTATE OF RONALD C. KATZ, DECEASED |

| |

|

| |

By The Northern Trust Company,

Personal Representative |

| |

|

| |

By: |

/s/ Siomara Elizondo |

|

|

Print Name: |

Siomara Elizondo |

| |

|

Its: |

Authorized Signatory |

Attention.

Intentional misstatements or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

Exhibit 99.1

JOINT FILING

AGREEMENT

In

accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the

joint filing on behalf of each of them of a statement on Schedule 13D (including amendments thereto) with respect to the Common Stock

of Zurn Elkay Water Solutions Corporation, and further agree that this Joint Filing Agreement be included as an Exhibit to such

joint filings. In evidence thereof, the undersigned, being duly authorized, have executed this Joint Filing Agreement this 2nd day of

October, 2024.

| |

ICE MOUNTAIN

LLC, a Delaware limited liability company |

| |

|

| |

By: Cascade Bay

LLC, a Delaware limited liability company, its Manager |

| |

|

| |

|

By: |

The

Northern Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New

Growth Trust dated as of December 1, 2019, and not individually, its General Manager |

| |

|

|

|

Print name: |

John

Thickens |

| |

|

|

|

Its: |

Senior

Vice President |

| |

CASCADE BAY LLC, a Delaware

limited liability company |

| |

|

| |

By: |

The Northern

Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New Growth Trust

dated as of December 1, 2019, and not individually, its General Manager |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ 2004 DYN TRUST |

| |

|

| |

By: |

The Northern

Trust Company, as Trustee of each of the Aimee New Growth Trust dated as of December 1, 2019 and the April New Growth Trust

dated as of December 1, 2019, and not individually, its General Manager |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ 2021 TRUST FOR PATTI |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ NEW VBA TRUST |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

KATZ VOTING STOCK TRUST |

| |

|

| |

By: The Northern Trust Company, as Trustee, and

not individually |

| |

|

Print name: |

John

Thickens |

| |

|

Its: |

Senior

Vice President |

| |

PHYLLIS

HOLLANDER, AS SUCCESSOR TRUSTEE UNDER DECLARATION OF TRUST DATED JULY 8, 1996 |

| |

|

| |

By: |

/s/

Phyllis Hollander |

| |

|

Phyllis Hollander, as Trustee, and not individually |

| |

THE NORTHERN TRUST COMPANY |

| |

|

| |

By: |

/s/

Siomara Elizondo |

|

|

Print Name: |

Siomara

Elizondo |

| |

|

Its: |

Authorized

Signatory |

| |

/s/

Aimee Katz |

| |

AIMEE KATZ |

| |

|

| |

/s/ April Jalazo |

| |

APRIL JALAZO |

| |

|

| |

/s/ Patricia A.

Bauer |

| |

PATRICIA A. BAUER |

| |

ESTATE OF ERROL R. HALPERIN,

DECEASED |

| |

|

| |

By: |

/s/

Phyllis Hollander |

|

|

Print Name: |

Phyllis

Hollander |

| |

|

Its: |

Independent

Executor |

| |

ESTATE OF RONALD C. KATZ, DECEASED |

| |

|

| |

By The Northern Trust Company,

Personal Representative |

| |

|

| |

By: |

/s/

Siomara Elizondo |

|

|

Print Name: |

Siomara Elizondo |

| |

|

Its: |

Authorized Signatory |

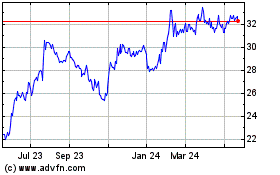

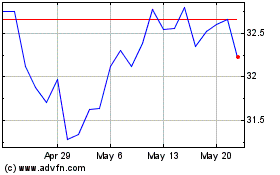

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

From Nov 2023 to Nov 2024