Alta Copper Announces Non-Brokered Financing

October 11 2023 - 5:26PM

Alta Copper Corp. (TSX: ATCU; OTCQX: ATCUF; BVL: ATCU) (“Alta

Copper” or the “Company”) is pleased to announce, subject to the

approval of the Toronto Stock Exchange that it has arranged a

non-brokered private placement (the “Private Placement”) to raise

gross proceeds of Cdn. $766,645. The Company intends to use the

proceeds of the Private Placement for working capital and ongoing

community initiatives in Peru.

The Private Placement will consist of the sale

of approximately 1,533,290 common shares (the “Common Shares”) at a

price of Cdn. $0.50 to raise gross proceeds of approximately Cdn.

$766,645. The Common Shares will be subject to a mandatory hold

period ending four months and one day after issuance, in accordance

with applicable securities law. There will be no

warrants included in this Private Placement.

Giulio T. Bonifacio, Executive Chair, commented:

“ In view of the context of the current capital markets we have

limited the amount raised to minimize dilution to all shareholders

while also arranging our equity offering with no warrant and at a

premium to the market close on October 11, 2023. We are continuing

to advance discussion with several interested parties for purposes

of funding our drilling program planned for 2024 while ensuring we

minimize dilution to all shareholders. Our optimized preliminary

economic assessment which will prove to be a significant project

catalyst is advancing with results now targeted for publication by

Q1-2024 in view of our desire to capture recent positive project

developments both by way of metallurgical test-work and our

geological modelling."

Certain directors and officers of the Company

will subscribe for a portion of the Private Placement, which

subscriptions will constitute related party transactions pursuant

to Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). It is anticipated

that the Company will be exempt from the formal valuation and

minority shareholder approval requirements in connection with the

participation of insiders in reliance on the exemptions contained

in sections 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, as the

fair market value of the insider participation is anticipated to

not exceed 25% of Alta Copper’s market capitalization, as

determined in accordance with MI 61-101.

About Alta CopperAlta Copper is

focused on the development of its 100% owned Cañariaco advanced

staged copper project. Cañariaco comprises 97 square km of highly

prospective land located 150 km northeast of the City of Chiclayo,

Peru, which include the Cañariaco Norte deposit, Cañariaco Sur

deposit and Quebrada Verde prospect, all within a 4 km NE-SW trend

in northern Peru’s prolific mining district. Cañariaco is one of

the largest copper deposits in the Americas not held by a

major.

Cautionary Note Regarding Forward Looking

Statements

This press release contains forward-looking

information within the meaning of Canadian securities laws

(“forward-looking statements”). Forward-looking statements are

typically identified by words such as: believe, expect, anticipate,

intend, estimate, plans, postulate and similar expressions, or are

those, which, by their nature, refer to future events. All

statements that are not statements of historical fact are

forward-looking statements, including, but not limited to,

statements with respect to the of the Private Placement, the use of

proceeds for the Private Placement, the insider participation in

the Private Placement and the business plans of the Company,

including the drill program and the completion and anticipating

timing of the preliminary economic assessment. These

forward-looking statements are made as of the date of this press

release. Although the Company believes the forward-looking

statements in this press release are reasonable, it can give no

assurance that the expectations and assumptions in such statements

will prove to be correct. The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance, and are subject to risks,

uncertainties, assumptions and other factors which could cause

events or outcomes to differ materially from those expressed or

implied by such forward-looking statements. Such factors include,

among others: the state of the equity financing markets in Canada

and other jurisdictions; the receipt of regulatory approvals;

fluctuations in metals prices, the actual results of current

development activities; conclusions of economic evaluations;

changes in project parameters as plans to continue to be refined;

accidents, labour disputes and other risks of the mining industry;

and delays in obtaining approvals or financing. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. We are under no obligation to update or alter any

forward-looking statements except as required under applicable

securities laws.

On behalf of the Board of Alta Copper

Corp.

“Joanne C. Freeze” P.Geo., President, CEO and

Director

For further information please contact:Joanne C.

Freeze, President, CEO and Director jfreeze@altacopper.com +1 604

512 3359

or

Giulio T. Bonifacio, Executive Chair and

Director gtbonifacio@altacopper.com +1 604 318 6760

| |

|

|

| Email: |

|

info@altacopper.com |

| Website: |

|

www.altacopper.com |

| Twitter: |

|

https://twitter.com/Alta_Copper |

| LinkedIn: |

|

https://www.linkedin.com/company/altacopper/ |

| Facebook: |

|

https://www.facebook.com/AltaCopperCorp |

| Instagram: |

|

https://www.instagram.com/altacopper/ |

| YouTube: |

|

https://www.youtube.com/@AltaCopper |

| |

|

|

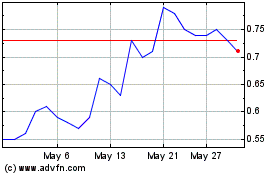

Alta Copper (TSX:ATCU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Alta Copper (TSX:ATCU)

Historical Stock Chart

From Dec 2023 to Dec 2024