Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or “the Company”)

demonstrated strong operational results at the end of 2019 and has

approved a 2020 capital budget focused on sustaining annual

production within forecasted funds flow.

Year-end 2019 Operations Update

- Production – Annual average of ~36,200 boe/d,

in line with prior guidance of 36,000 boe/d. Q4 2019 production

averaged ~36,400 boe/d.

- Leismer Update – December production increased

to ~20,100 bbl/d supported by the five-well sustaining pad at L7

that was brought on production in Q4 2019.

- Light Oil Update – At Placid, completions

operations commenced on two Montney multi-well pads that will be

placed on stream in H1 2020. At Greater Kaybob, three drilling rigs

and two frac spreads are currently in operation and are expected to

remain active through H1 2020.

- Capital – Annual expenditures are in line with

prior guidance of $135 million (excl. cap G&A).

2020 Budget Guidance

- Low Sustaining Capital – Expenditures of $125

million focused on resiliency by executing a program aimed at

sustaining production within projected funds flow.

- Resilient Production – Production to average

between 36,000 – 37,500 boe/d (88% liquids).

- Thermal Oil Activity – Expenditures of $65

million focused on Leismer including long-lead initiatives for Pad

L8, a water disposal well which is expected to reduce annual

non-energy operating costs by $3 million and routine pump changes

at both assets. At Hangingstone, the Company will complete its

first facility turnaround during the second quarter. Thermal

production is expected to average between 26,000 – 27,000

bbl/d.

- Light Oil Activity – Expenditures of $60

million with activity weighted towards H1 2020. In the Montney, the

Company will finish the completion and tie-in of 2 multi-well pads

(10 wells). In the Duvernay, activity will include 7 drills, 13

completions and 16 tie-ins. Light Oil production is expected to

average between 10,000 – 10,500 boe/d (55% liquids).

- Funds Flow – Forecasted funds flow of $125

million (US$57.50 WTI and US$17.50 Western Canadian Select “WCS”

heavy differential) with upside at current spot prices.

Athabasca remains focused on increasing free

cash flow by improving break-evens, strengthening its balance sheet

and mitigating external risks. The Company has preserved long term

optionality across a deep inventory of high-quality Thermal Oil

projects and flexible Light Oil development opportunities. This

balanced portfolio provides shareholders with differentiated

exposure to liquids weighted production and significant long

reserve life assets.

|

2020 Guidance |

Full Year |

|

CORPORATE |

|

|

Production (boe/d) |

36,000 – 37,500 |

|

% Liquids |

~88% |

|

Capital Expenditures ($MM) |

$125 |

|

|

|

|

LIGHT OIL |

|

|

Production (boe/d) |

10,000 – 10,500 |

|

Capital Expenditures ($MM) |

$60 |

|

|

|

|

THERMAL OIL |

|

|

Production (bbl/d) |

26,000 – 27,000 |

|

Capital Expenditures ($MM) |

$65 |

|

|

|

|

ADJUSTED FUNDS FLOW SENSITIVITY1 ($MM) |

|

|

US$57.50 WTI / US$17.50 WCS differential |

$125 |

|

US$62.50 WTI / US$17.50 WCS differential |

$180 |

|

|

|

1) Funds flow sensitivity includes current

hedging and flat pricing assumptions (US$5 MSW differential, US$5

C5 differential, C$1.75 AECO, 0.75 C$/US$ FX).

Risk Management and Market Access

Athabasca protects a base level of capital

activity through its risk management program while maintaining cash

flow upside to the current pricing environment. A hedging program

targets up to 50% of corporate production.

For 2020, the Company has hedged 13,500 bbl/d of

WTI through a combination of fixed swaps (~50%) and collars (~50%).

Approximately 50% of forecasted volumes are currently hedged in H1

2020 and 25% hedged in H2 2020. The average floor price is

~US$56.50 WTI with upside exposure to US$60 and US$65 on the WTI

collars. In addition, the Company has hedged ~9,400 bbl/d of WCS

differentials at ~US$19.50 with 8,000 bbl/d protected from

apportionment through direct sales to refineries.

The Company has secured ~7,200 bbl/d of Keystone

pipeline service commencing in 2020 for a term of 20 years. This

capacity diversifies Thermal Oil dilbit sales to the US Gulf Coast

at pipeline economics which will allow the Company to further

enhance its netback.

Longer term, Athabasca has secured egress with

capacity on both the TC Energy Keystone XL pipeline and the Trans

Mountain Expansion Project.

Special Meeting of Shareholders

Athabasca held a Special Meeting of Shareholders

on January 8, 2020 whereby shareholders voted in favor of the

resolution to reduce stated capital (58% shareholder turnout with

99.8% approval).

The Company now has flexibility under the

Business Corporations Act (Alberta) to pursue potential share buy

backs. Athabasca believes that, from time to time, the market price

of its Common Shares may not fully reflect the underlying value of

its business, future prospects and financial position. In such

circumstances, Athabasca may purchase for cancellation outstanding

Common Shares, thereby benefitting all shareholders by increasing

the underlying value of the remaining Common Shares. The Company

may look to execute future share buy backs with sustainable free

cash flow in the future.

Balance Sheet Strength and Capital

Allocation Philosophy

Athabasca continues to be resilient in the

current macro environment and is uniquely positioned to improving

oil fundamentals. Financial liquidity is a priority with $336

million of cash and available credit facilities (Q3 2019). The

Company has demonstrated consistent strong netbacks in Thermal Oil

and industry-leading netbacks in Light Oil, resulting in a ~US$45

WTI funds flow break-even (US$17.50 WCS differential). Athabasca

believes it provides shareholders a compelling value proposition

with future free cash flow and an unhedged funds flow sensitivity

of ~C$70 million for a US$5/bbl move in WTI.

The Company’s capital allocation philosophy is

guided by the following priorities:

- Disciplined Operations • Sustain

production while spending within cash flow • Low

sustaining capital advantage on low decline long life assets

- Strong Balance Sheet • Further

improve resiliency with capital structure optimization

• Significant flexibility with strong current liquidity

of $336 million

- Future Growth Projects • High

quality Thermal leases at Leismer/Corner with regulatory approval

and egress • Flexible high margin Light Oil development

(Montney/Duvernay)

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:

Matthew Taylor

Chief Financial Officer

1-403-817-9104

mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “believe”, “view”, ”contemplate”,

“target”, “potential” and similar expressions are intended to

identify forward-looking information. The forward-looking

information is not historical fact, but rather is based on the

Company’s current plans, objectives, goals, strategies, estimates,

assumptions and projections about the Company’s industry, business

and future operating and financial results. This information

involves known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking information. No assurance

can be given that these expectations will prove to be correct and

such forward-looking information included in this News Release

should not be unduly relied upon. This information speaks only as

of the date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: the Company’s 2019 and 2020 guidance; type well

economic metrics; estimated recovery factors and reserve life

index; and other matters.

Information relating to "reserves" is also

deemed to be forward-looking information, as it involves the

implied assessment, based on certain estimates and assumptions,

that the reserves described exist in the quantities predicted or

estimated and that the reserves can be profitably produced in the

future. With respect to forward-looking information contained in

this News Release, assumptions have been made regarding, among

other things: commodity outlook; the regulatory framework in the

jurisdictions in which the Company conducts business; the Company’s

financial and operational flexibility; the Company’s, capital

expenditure outlook, financial sustainability and ability to access

sources of funding; geological and engineering estimates in respect

of Athabasca’s reserves and resources; and other matters.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 6, 2019 available on SEDAR at

www.sedar.com, including, but not limited to: fluctuations in

commodity prices, foreign exchange and interest rates; political

and general economic, market and business conditions in Alberta,

Canada, the United States and globally; changes to royalty regimes,

environmental risks and hazards; the potential for management

estimates and assumptions to be inaccurate; the dependence on

Murphy as the operator of the Company’s Duvernay assets; the

capital requirements of Athabasca’s projects and the ability to

obtain financing; operational and business interruption risks;

failure by counterparties to make payments or perform their

operational or other obligations to Athabasca in compliance with

the terms of contractual arrangements; aboriginal claims; failure

to obtain regulatory approvals or maintain compliance with

regulatory requirements; uncertainties inherent in estimating

quantities of reserves and resources; litigation risk;

environmental risks and hazards; reliance on third party

infrastructure; hedging risks; insurance risks; claims made in

respect of Athabasca’s operations, properties or assets; risks

related to Athabasca’s amended credit facilities and senior

secured notes; and risks related to Athabasca’s common

shares.

Also included in this press release are

estimates of Athabasca's 2019 and 2020 capital expenditures,

adjusted funds flow, operating netbacks and operating income

levels, free cash flow, which are based on the various assumptions

as to production levels, commodity prices and currency exchange

rates and other assumptions disclosed in this news release. To the

extent any such estimate constitutes a financial outlook, it was

approved by management and the Board of Directors of Athabasca, and

is included to provide readers with an understanding of the

Company’s outlook. Management does not have firm commitments for

all of the costs, expenditures, prices or other financial

assumptions used to prepare the financial outlook or assurance that

such operating results will be achieved and, accordingly, the

complete financial effects of all of those costs, expenditures,

prices and operating results are not objectively determinable. The

actual results of operations of the Company and the resulting

financial results may vary from the amounts set forth herein, and

such variations may be material. The financial outlook contained in

this New Release was made as of the date of this press release and

the Company disclaims any intention or obligations to update or

revise such financial outlook, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

Oil and Gas Information

“BOEs" may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Non-GAAP Financial Measures

The "Adjusted Funds Flow", "Light Oil Operating

Income", "Light Oil Operating Netback", "Light Oil Capital

Expenditures Net of Capital-Carry", "Thermal Oil Operating Income",

"Thermal Oil Operating Netback", "Consolidated Operating Income",

"Consolidated Operating Netback", "Consolidated Capital

Expenditures Net of Capital-Carry", and "Consolidated Free Cash

Flow" financial measures contained in this News Release do not have

standardized meanings which are prescribed by IFRS and they are

considered to be non-GAAP measures. These measures may not be

comparable to similar measures presented by other issuers and

should not be considered in isolation with measures that are

prepared in accordance with IFRS.

Adjusted Funds Flow is not intended to represent

cash flow from operating activities, net earnings or other measures

of financial performance calculated in accordance with IFRS. The

Adjusted Funds Flow measure allows management and others to

evaluate the Company’s ability to fund its capital programs and

meet its ongoing financial obligations using cash flow internally

generated from ongoing operating related activities. Adjusted Funds

Flow per share is calculated as Adjusted Funds Flow divided by the

applicable number of weighted average shares outstanding.

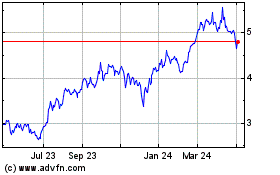

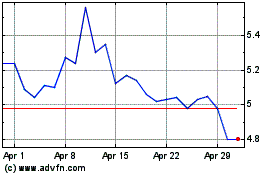

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Feb 2024 to Feb 2025