Athabasca Oil Corporation Announces Further Hangingstone Cost Reductions

May 10 2021 - 6:00AM

Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to announce that it has executed an amending

Hangingstone Transportation and Storage Services Agreement (“TSSA”)

that resulted in a $44 million prepayment from restricted cash and

a ~$5 million reduction to annual tolls. The amended TSSA reduces

Hangingstone’s dilbit financial assurances by ~$44 million to ~$27

million. The reduction in financial assurances unlocked restricted

cash on the Company’s balance sheet that was concurrently used to

fund the amending prepayment. There is no change to the Company’s

unrestricted cash balance that is expected to grow from $141

million at March 31, 2021 to ~$210 million at year-end (US$60 WTI

& US$11 WCS differentials). The transaction is

effective as of May 7, 2021 and the deal is now closed.

As previously released with the Company’s first

quarter results, Athabasca executed a commercial arrangement with

an industry leading marketing company to construct a truck-in

terminal at no cost to Athabasca. Operations are expected to

commence in July with up to 5,000 bbl/d of third party truck-in

capacity. The additional volumes are expected to generate up to $5

million in annual savings through a processing fee and by

leveraging existing volume commitments under Athabasca’s

transportation agreements.

Inclusive of both transactions, Hangingstone’s

cost structure is expected to be reduced by up to $10 million

annually. Hangingstone now has improved resiliency and

profitability with an estimated US$31.50/bbl WCS operating

break-even. The Company’s corporate operating break-even is

approximately US$43/bbl WTI (US$11 WCS heavy differentials)

including these transactions.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:Matthew TaylorChief

Financial Officer1-403-817-9104mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “forecast”, “continue”, “estimate”, “expect”,

“may”, “will”, “project”, “target”, “should”, “believe”, “predict”,

“pursue”, “potential”, “view” and ”contemplate” and similar

expressions are intended to identify forward-looking information.

The forward-looking information is not historical fact, but rather

is based on the Company’s current plans, objectives, goals,

strategies, estimates, assumptions and projections about the

Company’s industry, business and future operating and financial

results. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that these

expectations will prove to be correct and such forward-looking

information included in this News Release should not be unduly

relied upon. This information speaks only as of the date of this

News Release and, except as required by applicable securities laws,

the Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events. In particular, this News Release contains

forward-looking information pertaining to, but not limited to, the

following: the Company’s 2021 Outlook; forecasted Liquidity;

expected costs savings resulting from the Hangingstone truck-in

terminal; and other matters.

With respect to forward-looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity prices; the regulatory

framework governing royalties, taxes and environmental matters in

the jurisdictions in which the Company conducts and will conduct

business and the effects that such regulatory framework will have

on the Company, including on the Company’s financial condition and

results of operations; the Company’s financial and operational

flexibility; the Company’s financial sustainability; Athabasca's

cash flow break-even commodity price; the Company’s ability to

obtain qualified staff and equipment in a timely and cost-efficient

manner; the applicability of technologies for the recovery and

production of the Company’s reserves and resources; the Company’s

future debt levels; future production levels; the Company’s ability

to obtain financing on acceptable terms; operating costs;

compliance of counterparties with the terms of contractual

arrangements; impact of increasing competition globally; collection

risk of outstanding accounts receivable from third parties.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 3, 2021 and Management’s Discussion and

Analysis dated May 4, 2021, available on SEDAR at www.sedar.com,

including, but not limited to: weakness in the oil and gas

industry; exploration, development and production risks; prices,

markets and marketing; market conditions; continued impact of the

COVID-19 pandemic; climate change and carbon pricing risk;

regulatory environment and changes in applicable law; gathering and

processing facilities, pipeline systems and rail; statutes and

regulations regarding the environment; political uncertainty; state

of capital markets; changing demand for oil and natural gas

products; royalty regimes; foreign exchange rates and interest

rates; hedging; operational dependence; operating costs; project

risks; financial assurances; diluent supply; third party credit

risk; indigenous claims; reliance on key personnel and operators;

income tax; cybersecurity; hydraulic fracturing; liability

management; seasonality and weather conditions; unexpected events;

internal controls; insurance; litigation; competition; chain of

title and expiration of licenses and leases; breaches of

confidentiality; new industry related activities or new

geographical areas; and risks related to our debt and

securities.

Oil and Gas Information

Operating break‐even reflects the estimated WCS

oil price per barrel required to generate an asset level operating

income of Cdn $0. Break‐even is used to assess the impact of

changes in WCS oil prices on operating income of an asset and could

impact future investment decisions. Break-evens economics based on

2021 forecasted production and 0.79FX, -1% C5 diff and C$2.50 AECO

pricing assumptions.

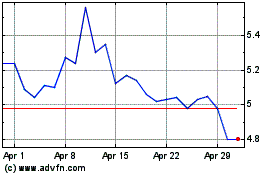

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Jan 2025 to Feb 2025

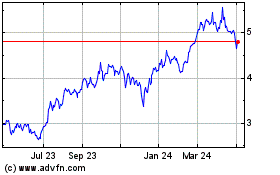

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Feb 2024 to Feb 2025