Brookfield Asset Management Inc. (TSX: BAM)(NYSE: BAM)(AEX: BAMA) -

Investors, analysts and other interested parties can access

Brookfield Asset Management's 2008 Results as well as the

Shareholders' Letter and Supplemental Information on Brookfield's

web site under the Investor Centre/Financial Reports section at

www.brookfield.com.

The 2008 Results conference call can be accessed via webcast on

February 13, 2009 at 11 a.m. Eastern Time at www.brookfield.com or

via teleconference at 1-800-319-4610 toll free in North America.

For overseas calls please dial 1-604-638-5340, at approximately

10:50 a.m. Eastern Time. The teleconference taped rebroadcast can

be accessed at 1-800-319-6413 or 604-638-9010 (Password 2811).

Brookfield Asset Management Inc. today announced its results for

the year ended December 31, 2008.

Cash Flow From Operations

Cash flow from operations on a comparable basis (i.e., excluding

major disposition gains) for the full year was $1.2 billion ($1.98

per share), compared with $1.1 billion ($1.79 per share) reported

in 2007, representing an increase of 11% on a per share basis. Cash

flow from operations for the fourth quarter on the same basis

increased to $241 million ($0.40 per share) from $163 million

($0.25 per share), representing a 48% increase.

Total cash flow from operations, including major disposition

gains, was $1.4 billion ($2.33 per share), compared with $1.9

billion ($3.11 per share) on the same basis in 2007, and for the

fourth quarter totalled $247 million ($0.41 per share) compared

with $575 million ($0.94 per share).

Three months ended Years ended

Cash flow from operations December 31 December 31

-------------------- ------------------

US$ millions (except per share

amounts) 2008 2007 2008 2007

---------------------------------------------------------------------------

Comparable basis (excluding major

disposition gains) $ 241 $ 163 $ 1,214 $ 1,120

- per share 0.40 0.25 1.98 1.79

Total basis (including major

disposition gains) $ 247 $ 575 $ 1,423 $ 1,907

- per share 0.41 0.94 2.33 3.11

---------------------------------------------------------------------------

"Our renewable power and office property businesses both

produced strong operating cash flows during the quarter, which led

to the overall improvement in operating cash flows. The stable

revenue profiles of these businesses should provide us with a

strong earnings base for 2009 and beyond," commented Bruce Flatt,

Senior Managing Partner of Brookfield Asset Management. "In

addition, we continue to bolster our capitalization and liquidity

which, at over $3 billion of core liquidity, remains at

historically high levels."

Net Income

Net income for 2008 was $649 million ($1.02 per share) compared

to $787 million ($1.24 per share) in 2007. Excluding major

disposition gains, net income in 2008 was $525 million ($0.81 per

share) compared with $349 million ($0.51 per share) on the same

basis last year.

Net income in 2007 reflected a large number of disposition

gains. In addition, the 2008 results reflect increases in a higher

level of non-cash charges, including depreciation on assets

purchased in 2007, offset in part by a non-cash tax recovery

arising from an increase in the value of our tax assets.

Three months ended Years ended

December 31 December 31

------------------- ------------------

US$ millions (except per share

amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Net income $ 171 $ 346 $ 649 $ 787

- per share 0.27 0.56 1.02 1.24

----------------------------------------------------------------------------

This news release and accompanying financial statements make

reference to cash flow from operations on a total and per share

basis. Cash flow from operations is defined as net income excluding

depreciation and amortization, interests of non-controlling

shareholders, future income taxes and other items as described as

such in the consolidated statements of income, and including

dividends and disposition gains that are not otherwise included in

net income. Brookfield uses cash flow from operations to assess its

operating results and the value of its business and believes that

many of its shareholders and analysts also find this measure of

value to them. The company provides the components of cash flow

from operations and a full reconciliation between cash flow from

operations and net income with the supplemental information

accompanying this news release. Cash flow from operations is a

non-GAAP measure which does not have any standard meaning

prescribed by GAAP and therefore may not be comparable to similar

measures presented by other companies.

Dividend Declaration

The Board of Directors declared a dividend of US$0.13 per Class

A Common Share, payable on May 31, 2009, to shareholders of record

as at the close of business on May 1, 2009. The Board also declared

all of the regular monthly and quarterly dividends on its preferred

shares.

Information on Brookfield Asset Management's declared share

dividends can be found on the company's web site under Investor

Centre/Stock and Dividend Information.

Additional Information

The Letter to Shareholders and the company's Supplemental

Information for the year ended December 31, 2008 contain further

information on the company's strategy, operations and financial

results. Shareholders are encouraged to read these documents, which

are available on the company's web site.

Brookfield Asset Management Inc., focused on property, power and

infrastructure assets, has approximately $80 billion of assets

under management and is co-listed on the New York and Toronto Stock

Exchanges under the symbol BAM and on NYSE Euronext under the

symbol BAMA. For more information, please visit our web site at

www.brookfield.com.

Please note that Brookfield's audited annual and unaudited

quarterly reports have been filed on Edgar and Sedar and can also

be found in the investor section of our web site at

www.brookfield.com. Hard copies of the annual and quarterly reports

can be obtained free of charge upon request.

For more information, please visit our web site at

www.brookfield.com

Note: This news release contains forward-looking information

within the meaning of Canadian provincial securities laws and

"forward-looking statements" within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the

U.S. Securities Exchange Act of 1934, as amended, "safe harbor"

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. The words "continue", "payable", "expect", "intend",

derivations thereof and other expressions, including conditional

verbs such as "should", are predictions of or indicate future

events, trends or prospects and which do not relate to historical

matters identify forward-looking statements. Forward-looking

statements in this news release include statements in regards to

the strength of our future earnings base and the bolstering of our

capitalization and liquidity levels, procedures and assumptions to

be used in preparing our pro forma opening balance sheet for our

adoption of IFRS and date of our first IFRS reporting period.

Although Brookfield Asset Management believes that its anticipated

future results, performance or achievements expressed or implied of

such assets by the forward-looking statements and information are

based upon reasonable assumptions and expectations, the reader

should not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the company to

differ materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include: economic and financial conditions in the countries in

which we do business; the behaviour of financial markets, including

fluctuations in interest and exchange rates; availability of equity

and debt financing; strategic actions including dispositions; the

ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits;

the company's continued ability to attract institutional partners

to its Specialty Investment Funds; adverse hydrology conditions;

regulatory and political factors within the countries in which the

company operates; acts of God, such as earthquakes and hurricanes;

the possible impact of international conflicts and other

developments including terrorist acts; changes in accounting

policies to be adopted under IFRS and other risks and factors

detailed from time to time in the company's form 40-F filed with

the Securities and Exchange Commission as well as other documents

filed by the company with the securities regulators in Canada and

the United States including the company's most recent Management's

Discussion and Analysis of Financial Results under the heading

"Business Environment and Risks."

We caution that the foregoing factors that may affect future

results is not exhaustive. When relying on our forward-looking

statements to make decisions with respect to Brookfield Asset

Management, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or

information, whether written or oral, as a result of new

information, future events or otherwise.

CONSOLIDATED STATEMENTS OF CASH FLOW FROM OPERATIONS

Three months ended Years ended

(Unaudited) December 31 December 31

US$ millions (except per share ------------------- ------------------

amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Fees earned $ 113 $ 92 $ 449 $ 415

Revenues less direct operating

costs

Commercial properties(1) 388 414 1,862 1,548

Power generation 158 148 886 611

Infrastructure(2) 68 33 196 290

Development and other properties (5) 115 240 418

Specialty funds 49 233 304 370

Investment and other income 212 343 894 1,209

----------------------------------------------------------------------------

983 1,378 4,831 4,861

Expenses

Interest 447 510 1,984 1,786

Other operating costs 160 141 640 464

Current income taxes (47) 28 (7) 68

Non-controlling interests 176 124 791 636

----------------------------------------------------------------------------

Cash flow from operations $ 247 $ 575 $ 1,423 $ 1,907

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash flow from operations per

common share

Diluted $ 0.41 $ 0.94 $ 2.33 $ 3.11

Diluted - excluding major

disposition gains $ 0.40 $ 0.25 $ 1.98 $ 1.79

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Commercial properties includes $31 million (2007 - $nil) of dividend

income recognized in the first three months of 2008 from Canary Wharf

Group which is included in "Investment and Other Income" in the

company's consolidated financial statements, which are prepared in

accordance with Canadian GAAP

(2) Infrastructure includes the results of the company's Chilean

transmission operations, which are recorded on a consolidated basis for

the first six months of 2007 and on an equity accounted basis in 2008

Notes

Cash flow from operations is reconciled to net income before

other items on page 6 of this news release as follows:

Three months ended Years ended

(Unaudited) December 31 December 31

-------------------- ---------------

US$ millions 2008 2007 2008 2007

--------------------------------------------------------------------------

Net income excluding other items

(see page 6) $ 242 $ 569 $ 1,401 $ 1,555

Dividends from equity accounted

investments(1) 5 6 22 21

Gain on sale of exchangeable

debentures(1) - - - 331

--------------------------------------------------------------------------

Cash flow from operations (per

above) $ 247 $ 575 $ 1,423 $ 1,907

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(1) Included in "Investment and Other Income" in the Statements of Cash

Flow from Operations

The consolidated statements of cash flow from operations above

are prepared on a basis that is consistent with Management's

Discussion and Analysis of Financial Results and differ from the

company's consolidated financial statements presented in its annual

report, which are prepared in accordance with Canadian generally

accepted accounting principles ("GAAP"). Management uses cash flow

from operations as a key measure to evaluate performance and to

determine the underlying value of its businesses. Readers are

encouraged to consider both measures in assessing Brookfield Asset

Management's results. Cash flow from operations is equal to net

income excluding "other items" as presented in the following

consolidated statements of income and including dividends from

investments and the gain on the sale of an exchangeable debenture

investment. The exchangeable debenture gain would have been

included in income prior to the implementation of a change in

accounting requirements but, as a result of a transitional

provision, has been recorded in shareholders' equity.

UNDERLYING VALUE AND NET INVESTED CAPITAL

Underlying Net Invested Capital

Value ------------------------------

As at December 31 (Unaudited) (Unaudited) (Unaudited)

US$ millions 2008 2008 2007

----------------------------------------------------------------------------

Assets

Operating platforms

Commercial properties $ 7,798 $ 4,575 $ 4,598

Power generation 6,639 1,215 1,425

Infrastructure 1,004 761 1,645

Development and other

properties 3,313 3,334 3,464

Specialty funds 903 870 1,112

Investments 701 702 1,336

Cash and financial

assets 1,073 1,073 892

Other assets 2,650 2,568 3,013

----------------------------------------------------------------------------

$ 24,081 $ 15,098 $ 17,485

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities

Corporate borrowings $ 2,284 $ 2,284 $ 2,048

Subsidiary borrowings 733 733 711

Capital securities 1,425 1,425 1,570

Other liabilities 3,267 2,654 3,482

----------------------------------------------------------------------------

7,709 7,096 7,811

Capitalization

Co-investor interests

in consolidated

operations 3,541 2,214 2,160

Preferred equity 870 870 870

Common equity 11,961 4,918 6,644

----------------------------------------------------------------------------

16,372 8,002 9,674

----------------------------------------------------------------------------

$ 24,081 $ 15,098 $ 17,485

----------------------------------------------------------------------------

----------------------------------------------------------------------------

UNDERLYING VALUE OF COMMON EQUITY

As at December 31,

2008 (unaudited)

US$ millions (except

per share amounts) Total Per Share

---------------------------------------------------------

Common equity -

including future

tax liability $ 11,961 $ 20.67

Add back: future tax

liability 2,220 3.70

---------------------------------------------------------

Common equity -

excluding future

tax liability $ 14,181 $ 24.37

---------------------------------------------------------

---------------------------------------------------------

This news release contains a preliminary analysis of the

underlying value of the company and its common equity, based on the

procedures and assumptions that we expect to follow in preparing

our pro forma opening balance sheet for our adoption of

International Financial Reporting Standards ("IFRS"). Accordingly,

certain assets, such as appraisal surplus relating to inventories

and intangible assets, such as the value of the company's asset

management business, have not been reflected. Please refer to our

Supplemental Information under "Introduction - Basis of

Presentation," which is available on the company's website for

further information.

This information has been prepared using the standards and

interpretations currently issued and expected to be effective at

the end of our first annual IFRS reporting period, which we intend

to be December 31, 2010. Consequently, in preparing this

information, assumptions have been made about the accounting

policies expected to be adopted. Certain accounting policies

expected to be adopted under IFRS may not be adopted and the

application of such policies to certain transactions or

circumstances may be modified and as a result underlying values are

subject to change. Furthermore, the underlying values have not been

audited or subject to a review by the Corporation's auditor.

CONSOLIDATED STATEMENTS OF INCOME

Three months ended Years ended

(Unaudited) December 31 December 31

US$ millions (except per share ---------------------- --------------------

amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Total revenues $ 3,006 $ 3,158 $ 12,868 $ 9,343

Fees earned $ 113 $ 92 $ 449 $ 415

Revenues less direct operating

costs

Commercial properties(1) 388 414 1,862 1,548

Power generation 158 148 886 611

Infrastructure(2) 68 33 196 290

Development and other

properties (5) 115 240 418

Specialty funds 49 233 304 370

Investment and other income 207 337 872 857

----------------------------------------------------------------------------

978 1,372 4,809 4,509

Expenses

Interest 447 510 1,984 1,786

Other operating costs 160 141 640 464

Current income taxes (47) 28 (7) 68

Non-controlling interests 176 124 791 636

----------------------------------------------------------------------------

242 569 1,401 1,555

Other items

Depreciation and amortization (355) (294) (1,330) (1,034)

Equity accounted losses from

investments (12) (4) (46) (72)

Revaluation and other items (262) (95) (267) (112)

Future income taxes 545 35 461 (88)

Non-controlling interests in

the foregoing items 13 135 430 538

----------------------------------------------------------------------------

Net income $ 171 $ 346 $ 649 $ 787

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per common share

Diluted $ 0.27 $ 0.56 $ 1.02 $ 1.24

Basic $ 0.28 $ 0.57 $ 1.04 $ 1.27

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Commercial properties includes $31 million (2007 - $nil) of dividend

income recognized in the first three months of 2008 from Canary Wharf

Group which is included in "Investment and Other Income" in the

company's consolidated financial statements, which are prepared in

accordance with Canadian GAAP

(2) Infrastructure includes the results of the company's Chilean

transmission operations, which are recorded on a consolidated basis for

the first six months of 2007 and on an equity accounted basis in 2008

Note

The consolidated statements of income are prepared on a basis

consistent with the company's financial statements presented in its

annual report, which are prepared in accordance with Canadian

GAAP.

MAJOR DISPOSITION GAINS

Cash Flow from

Years ended December 31 Operations Net Income

---------------- ----------------

US$ millions (Unaudited) Quarter 2008 2007 2008 2007

----------------------------------------------------------------------------

Core office properties -

disposition 3 $ 80 $ - $ 48 $ -

Longview sale 4 24 - 15 -

Brazil Residential dilution loss 4 (18) - (18) -

Private equity - other

operations 1 58 - 58 -

Core office properties - debt

breakage costs 3 - (14) - (8)

Banco Brascan joint venture gain 2 - 17 - 17

Brazil exchange seats sale 4 - 168 - 168

Norbord exchangeable debenture 2 65 - 21 -

Core office properties -

dispositions 1/2/4 - 54 - 32

Sale of Stelco 4 - 231 - 229

Disposition gains included in

opening retained earnings(1) 1/2/3 - 331 - -

----------------------------------------------------------------------------

$ 209 $ 787 $ 124 $ 438

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) As opposed to net income, due to a prescribed change in accounting

guidelines

Contacts: Brookfield Asset Management Denis Couture, SVP,

Investor Relations and Corporate and International Affairs (416)

956-5189 (416) 363-2856 (FAX) Email: dcouture@brookfield.com

Website: www.brookfield.com

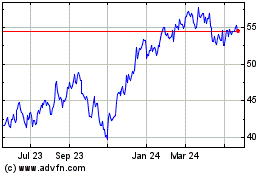

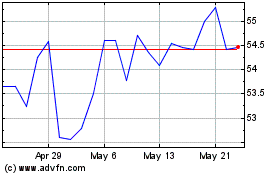

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Apr 2024 to May 2024

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From May 2023 to May 2024