Condor Gold (AIM: CNR; TSX: COG) is pleased to announce that it has

received the final results of metallurgical tests for a Feasibility

Study (FS) being conducted on the La India Open Pit from Bureau

Veritas Laboratories in Richmond, British Columbia. The most recent

iteration of testing was focused on variability testing and

confirmation of recoveries at the lower grades. The 2022 FS Study

(the “FS” or “Feasibility Study”) will bring the level of

confidence for the Project to the industry-standard of engineering

design, sufficient to support +/- 15% capital and operating cost

estimates.

Highlights of Feasibility Study Metallurgical Test

Results

- The confirmatory

testwork demonstrated that gold recovery is independent of grade

and a fixed gold recovery of 91% assuming a 75 micron grind size

will be used in the project economics of the forthcoming

Feasibility Study.

- Gold extraction

from the 11 variability composites averaged 92.6% at the 75 micron

grind size, which is reduced by 2% to allow for gold being locked

up in the processing plant.

- Gold extraction

from the four low grade composites averaged 93.8% at the 75 micron

target grind, indicating a gold recovery of 91.8% after a 2%

reduction to allow for gold being locked up in the processing

plant.

- At a finer grind

size of 53 microns an average gold extraction of 94.7% was

achieved, indicating a potential upside gold recovery of about

93%.

- The selection of

the composites by both grade and approximate year of production

provides confirmation that the mill recovery will not be materially

affected over the life of the La India Mine.

Mark Child, Chairman and Chief Executive of Condor Gold,

commented:

“I am delighted that a net metallurgical

recovery of 91% will be used in the technical economic models for

the forthcoming Feasibility Study on the La India Open pit. Very

comprehensive metallurgical test-work has been conducted to the

highest standards as a Feasibility Study level is the technical

document to which project finance is provided to the Project. 91%

metallurgical recovery over the life of mine is a terrific result

and represents a significant de-risking of one of the most

important variables in the development of a new mine at La India

Project and provides significant comfort to investors.

The application of both variability testing and

confirmation of low-grade responses is consistent with best

practices in the mining industry, while confirming the ability of

the processing plant to achieve excellent recoveries down into the

lower grade portions of the deposit, in a standard Carbon-in-Pulp

cyanidation plant.

The higher gold recovery at 53 micron-grinds

suggests an opportunity to recover an additional 2% of the

contained gold from the La India material”.

Background

During August of 2021 in preparation for the FS,

Condor assembled eleven further variability composites from La

India Open Pit, testing high grade, medium grade and low-grade

composites as well as composites selected to represent individual

phases and production years. Additional composites were selected to

test responses of the lower grade ores (below 1.5 g/t Au) to ensure

that the recovery parameters previously applied were valid at the

lower grade ranges. This work was conducted by Bureau Veritas

Laboratories (BV) in Richmond, British Columbia.

Discussion – Leaching Studies

The 2022 studies were conducted as a

confirmation and check of earlier leaching test results obtained in

December 2021, and to extend Condor’s understanding of the response

of the mineralized material at smaller grind sizes and lower grade

ranges.

The variability test results are summarized

below in Table 1.

Condor notes that the results of the current BV

results are consistent with the results from the PFS study in 2014,

which indicated a fixed gold recovery of 91%. It is notable that

the current design parameters at a 75 micron grind support a total

retention time of 48 hours versus the 30-hour retention time

nominated in the PFS.

Table 1: Summary of Leach Test Results for 2022 Bureau

Veritas – 11 Variability Composites

|

100 Micron Summary - 11 Variability

Composites |

|

|

|

|

|

|

Sample ID |

Actual P80 Size |

Measured Head* |

Calculated Head |

48h Extraction |

|

μm |

Au (g/t) |

Ag (g/t) |

Au (g/t) |

Ag (g/t) |

Au (%) |

Ag (%) |

|

High Grade Var Comp |

103 |

5.16 |

12.67 |

5.43 |

14.20 |

88.74 |

64.79 |

|

Medium Grade Var Comp |

99 |

1.76 |

9.00 |

2.29 |

9.33 |

87.65 |

57.11 |

|

Low Grade Var Comp |

99 |

0.89 |

4.00 |

1.18 |

3.89 |

91.72 |

48.65 |

|

Starter Pit North Var Comp |

98 |

1.84 |

10.33 |

2.77 |

10.01 |

90.32 |

60.03 |

|

Starter Pit South Var Comp |

101 |

2.95 |

12.67 |

3.92 |

13.63 |

87.30 |

63.32 |

|

Phase 2 - Year 4 Var Comp |

98 |

3.44 |

10.33 |

4.85 |

11.23 |

92.00 |

64.38 |

|

Phase 2 - Year 5 Var Comp |

101 |

4.32 |

7.67 |

4.93 |

8.29 |

91.25 |

63.82 |

|

Phase 2 - Year 6 Var Comp |

105 |

5.25 |

7.00 |

6.10 |

7.13 |

90.58 |

57.95 |

|

Phase 3 - Year 6 Var Comp |

102 |

1.92 |

5.00 |

2.25 |

6.03 |

90.58 |

50.22 |

|

Phase 3 - Year 7 Var Comp |

98 |

1.90 |

4.00 |

2.48 |

4.27 |

91.21 |

53.16 |

|

Phase 3 - Year 8 Var Comp |

99 |

2.65 |

6.00 |

3.58 |

5.49 |

91.73 |

63.59 |

|

|

|

|

|

|

|

|

|

|

Average |

100 |

2.92 |

8.06 |

3.62 |

8.50 |

90.28 |

58.82 |

| |

|

|

|

|

|

|

|

|

75 Micron Summary - 11 Variability Composites |

|

|

|

|

|

|

Sample ID |

Actual P80 Size |

Measured Head* |

Calculated Head |

48h Extraction |

|

μm |

Au (g/t) |

Ag (g/t) |

Au (g/t) |

Ag (g/t) |

Au (%) |

Ag (%) |

|

High Grade Var Comp |

75 |

5.16 |

12.67 |

5.35 |

13.43 |

92.64 |

70.21 |

|

Medium Grade Var Comp |

73 |

1.76 |

9.00 |

2.32 |

12.87 |

90.42 |

45.61 |

|

Low Grade Var Comp |

74 |

0.89 |

4.00 |

1.11 |

3.99 |

93.79 |

49.82 |

|

Starter Pit North Var Comp |

73 |

1.84 |

10.33 |

2.84 |

11.51 |

94.03 |

65.25 |

|

Starter Pit South Var Comp |

73 |

2.95 |

12.67 |

3.83 |

14.07 |

89.93 |

64.47 |

|

Phase 2 - Year 4 Var Comp |

73 |

3.44 |

10.33 |

4.16 |

10.79 |

94.10 |

62.93 |

|

Phase 2 - Year 5 Var Comp |

72 |

4.32 |

7.67 |

4.86 |

8.21 |

92.37 |

63.46 |

|

Phase 2 - Year 6 Var Comp |

72 |

5.25 |

7.00 |

6.13 |

7.55 |

92.46 |

60.26 |

|

Phase 3 - Year 6 Var Comp |

78 |

1.92 |

5.00 |

2.17 |

5.30 |

93.01 |

62.27 |

|

Phase 3 - Year 7 Var Comp |

78 |

1.90 |

4.00 |

2.54 |

4.29 |

93.07 |

53.34 |

|

Phase 3 - Year 8 Var Comp |

77 |

2.65 |

6.00 |

3.70 |

5.76 |

93.54 |

65.29 |

|

|

|

|

|

|

|

|

|

|

Average |

74 |

2.94 |

8.27 |

3.53 |

9.20 |

92.58 |

59.76 |

| |

|

|

|

|

|

|

|

|

53 Micron Summary - 11 Variability Composites |

|

|

|

|

|

|

Sample ID |

Actual P80 Size |

Measured Head* |

Calculated Head |

48h Extraction |

|

μm |

Au (g/t) |

Ag (g/t) |

Au (g/t) |

Ag (g/t) |

Au (%) |

Ag (%) |

|

High Grade Var Comp |

54 |

5.16 |

12.67 |

5.61 |

13.11 |

94.57 |

77.11 |

|

Medium Grade Var Comp |

68 |

1.76 |

9.00 |

2.28 |

7.90 |

91.63 |

74.67 |

|

Low Grade Var Comp |

55 |

0.89 |

4.00 |

1.15 |

4.13 |

95.96 |

51.58 |

|

Starter Pit North Var Comp |

52 |

1.84 |

10.33 |

3.04 |

10.99 |

95.37 |

72.70 |

|

Starter Pit South Var Comp |

52 |

2.95 |

12.67 |

3.87 |

13.82 |

93.55 |

71.07 |

|

Phase 2 - Year 4 Var Comp |

54 |

3.44 |

10.33 |

4.22 |

10.32 |

95.62 |

70.94 |

|

Phase 2 - Year 5 Var Comp |

54 |

4.32 |

7.67 |

4.60 |

7.57 |

95.53 |

73.60 |

|

Phase 2 - Year 6 Var Comp |

52 |

5.25 |

7.00 |

6.02 |

7.61 |

95.12 |

60.56 |

|

Phase 3 - Year 6 Var Comp |

55 |

1.92 |

5.00 |

2.15 |

5.38 |

94.83 |

62.85 |

|

Phase 3 - Year 7 Var Comp |

54 |

1.90 |

4.00 |

2.64 |

4.49 |

95.64 |

55.43 |

|

Phase 3 - Year 8 Var Comp |

56 |

2.65 |

6.00 |

3.59 |

5.84 |

95.19 |

65.77 |

|

|

|

|

|

|

|

|

|

|

Average |

55 |

3.06 |

8.74 |

3.66 |

8.98 |

94.69 |

68.34 |

* Measured Head is determined prior to the leach

testing as determined from a split of the initial sample.

Calculated head is based on the sum of the assays of both the leach

solutions and of the residue. Calculated head is considered the

more reliable measure of the contained gold and recovery.

Condor and its consultants also recognized the

lack of metallurgical testing at the lower grade ranges,

particularly at the break-even and marginal cutoff ranges. While

not a significant contributor to overall project economics, the

stockpiling of low and even sub-grade material offers the

opportunity for capturing additional ounces at the end of mine-

life. This recognition initiated the secondary investigation on the

low-grade material.

The results of the low-grade investigations are

presented in Table 2 below:

Table 2: Low Grade Recovery at 75 micron

|

Low Grade Composites - 75 micron target grind |

|

|

|

|

|

|

Sample ID |

Actual P80 Size |

Measured Head* |

Calculated Head |

48h Extraction |

|

μm |

Au (g/t) |

Ag (g/t) |

Au (g/t) |

Ag (g/t) |

Au (%) |

Ag (%) |

|

Condor 0.5 |

78 |

0.48 |

3.00 |

0.59 |

3.10 |

93.49 |

35.53 |

|

Condor 0.75 |

82 |

0.74 |

3.00 |

0.86 |

3.75 |

94.96 |

46.66 |

|

Condor 1.5 |

78 |

1.23 |

4.67 |

1.55 |

4.97 |

93.08 |

59.79 |

|

Condor 2.0 |

70 |

1.81 |

6.00 |

2.32 |

5.65 |

93.48 |

64.58 |

|

Average response |

77 |

1.06 |

4.17 |

1.33 |

4.37 |

93.75 |

51.64 |

For further information please visit www.condorgold.com or

contact:

|

Condor Gold plc |

Mark Child, Chairman and CEO+44 (0) 20 7493 2784 |

|

|

|

|

Beaumont Cornish Limited |

Roland Cornish and James Biddle+44 (0) 20 7628 3396 |

|

|

|

|

Numis Securities Limited |

John Prior and James Black+44 (0) 20 7260 1000 |

|

|

|

|

BlytheRay |

Tim Blythe, and Megan Ray+44 (0) 20 7138 3204 |

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006

and dual listed on the TSX in January 2018. The Company is a gold

exploration and development company with a focus on Nicaragua.

On 25 October 2021 Condor announced the filing

of a Preliminary Economic Assessment Technical Report (“PEA”) for

its La India Project, Nicaragua on SEDAR https://www.sedar.com. The

highlight of the technical study is a post-tax, post upfront

capital expenditure NPV of US$418 million, with an IRR of 54% and

12 month pay-back period, assuming a US$1,700 per oz gold price,

with average annual production of 150,000 oz gold per annum for the

initial 9 years of gold production. The open pit mine schedules

have been optimised from designed pits, bringing higher grade gold

forward resulting in average annual production of 157,000 oz gold

in the first 2 years from open pit material and underground mining

funded out of cashflow.

In August 2018, the Company announced that the

Ministry of the Environment in Nicaragua had granted the

Environmental Permit (“EP”) for the development, construction and

operation of a processing plant with capacity to process up to

2,800 tonnes per day at its wholly-owned La India gold Project (“La

India Project”). The EP is considered the master permit for mining

operations in Nicaragua. Condor has purchased a new SAG Mill, which

has mainly arrived in Nicaragua. Site clearance and preparation is

at an advanced stage.

Environmental Permits were granted in April and

May 2020 for the Mestiza and America open pits respectively, both

located close to La India. The Mestiza open pit hosts 92 Kt at a

grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated

Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold

(85,000 oz contained gold) in the Inferred Mineral Resource

category. The America open pit hosts 114 Kt at a grade of 8.1 g/t

gold (30,000 oz) in the Indicated Mineral Resource category and 677

Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral

Resource category. Following the permitting of the Mestiza and

America open pits, together with the La India Open Pit Condor has

1.12 M oz gold open pit Mineral Resources permitted for

extraction.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Qualified Persons

The technical review of the SGS metallurgical

results has been conducted by Eric Olin, a principal consultant

with SRK Consulting (U.S. Inc., who is a registered member of SME

and a “qualified person” as defined by NI 43-101. Mr. Olin has over

40 years’ experience in extractive metallurgy including extensive

experience with CIP and CIL gold extraction plants. Eric Olin is a

full time employee of SRK Consulting (U.S.) Inc., an independent

consultancy, and has sufficient experience which is relevant to the

style of mineralization and type of deposit under consideration.

Eric Olin consents to the inclusion in the announcement of the

matters based on their information in the form and context in which

is appears and confirms that this information is accurate and not

false or misleading.

The technical and scientific information in this

press release has been reviewed, verified and approved by Gerald D.

Crawford, P.E. who is a “qualified person” as defined by NI

43-101.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarised or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, October 2021”, dated October

22, 2021 with an effective date of September 9, 2021 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Qualified Persons responsible for the Technical Report are Dr Tim

Lucks of SRK Consulting (UK) Limited, and Mr Fernando Rodrigues, Mr

Stephen Taylor and Mr Ben Parsons of SRK Consulting (U.S.) Inc. Mr

Parsons assumes responsibility for the MRE, Mr Rodrigues the open

pit mining aspects, Mr Taylor the underground mining aspects and Dr

Lucks for the oversight of the remaining technical disciplines and

compilation of the report.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are ‘forward- looking information’

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: the Mineral

Resources, Mineral Reserves and future production rates and plans

at the La India Project. Forward-looking information is often, but

not always, identified by the use of words such as: "seek",

"anticipate", "plan", "continue", “strategies”, “estimate”,

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", “could”, “might”, “will” and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks;

estimation of mineralisation, resources and reserves;

environmental, health and safety regulations of the resource

industry; competitive conditions; operational risks; liquidity and

financing risks; funding risk; exploration costs; uninsurable

risks; conflicts of interest; risks of operating in Nicaragua;

government policy changes; ownership risks; permitting and

licensing risks; artisanal miners and community relations;

difficulty in enforcement of judgments; market conditions; stress

in the global economy; current global financial condition; exchange

rate and currency risks; commodity prices; reliance on key

personnel; dilution risk; payment of dividends; as well as those

factors discussed under the heading “Risk Factors” in the Company’s

annual information form for the fiscal year ended December 31, 2018

dated March 22, 2019, available under the Company’s SEDAR profile

at www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

Technical Glossary

Abrasion IndexThe Bond Abrasion

Test determines the Abrasion Index, which is used to determine

steel media and liner wear in crushers, rod mills, and ball mills.

Bond developed correlations based on the wear rate in pounds of

metal wear/kWh of energy used in the comminution process. Higher

values indicate more abrasive rock.

Calculated HeadCalculated Head

is an assay determined following the metallurgical leach testing

and is based on the sum of the assays of both the leach solutions

and of the residue, and is considered the more reliable measure of

the contained gold and recovery (as compared to the Measured

Head).

Carbon-in-Pulp (CIP) or Carbon in Leach

(CIL)A metallurgical process for extracting gold by

leaching gold from the pulverized host rock with a cyanide

solution. Gold is subsequently adsorbed onto activated charcoal for

later recovery.

Measured HeadMeasured Head is

an assay determined prior to the metallurgical leach testing as

determined from a split of the initial sample to be subjected to a

leach test. It may vary from the calculated head. Calculated head

is based on the sum of the assays of both the leach solutions and

of the residue, and is considered the more reliable measure of the

contained gold and recovery.

Mineral ResourceMineral

Resources are sub-divided, in order of increasing geological

confidence, into Inferred, Indicated and Measured categories. An

Inferred Mineral Resource has a lower level of confidence than that

applied to an Indicated Mineral Resource. An Indicated Mineral

Resource has a higher level of confidence than an Inferred Mineral

Resource but has a lower level of confidence than a Measured

Mineral Resource.

A Mineral Resource is a concentration or

occurrence of solid material of economic interest in or on the

Earth’s crust in such form, grade or quality and quantity that

there are reasonable prospects for eventual economic

extraction.

The location, quantity, grade or quality,

continuity and other geological characteristics of a Mineral

Resource are known, estimated or interpreted from specific

geological evidence and knowledge, including sampling.

Material of economic interest refers to

diamonds, natural solid inorganic material, or natural solid

fossilized organic material including base and precious metals,

coal, and industrial minerals.

The term Mineral Resource covers mineralization

and natural material of intrinsic economic interest which has been

identified and estimated through exploration and sampling and

within which Mineral Reserves may subsequently be defined by the

consideration and application of Modifying Factors. The phrase

‘reasonable prospects for eventual economic extraction’ implies a

judgment by the Qualified Person in respect of the technical and

economic factors likely to influence the prospect of economic

extraction. The Qualified Person should consider and clearly state

the basis for determining that the material has reasonable

prospects for eventual economic extraction. Assumptions should

include estimates of cutoff grade and geological continuity at the

selected cut-off, metallurgical recovery, smelter payments,

commodity price or product value, mining and processing method and

mining, processing and general and administrative costs. The

Qualified Person should state if the assessment is based on any

direct evidence and testing.

Interpretation of the word ‘eventual’ in this

context may vary depending on the commodity or mineral involved.

For example, for some coal, iron, potash deposits and other bulk

minerals or commodities, it may be reasonable to envisage ‘eventual

economic extraction’ as covering time periods in excess of 50

years. However, for many gold deposits, application of the concept

would normally be restricted to perhaps 10 to 15 years, and

frequently to much shorter periods of time.

Inferred Mineral ResourceAn

Inferred Mineral Resource is that part of a Mineral Resource for

which quantity and grade or quality are estimated on the basis of

limited geological evidence and sampling. Geological evidence is

sufficient to imply but not verify geological and grade or quality

continuity.

An Inferred Mineral Resource has a lower level

of confidence than that applying to an Indicated Mineral Resource

and must not be converted to a Mineral Reserve. It is reasonably

expected that the majority of Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued

exploration.

An Inferred Mineral Resource is based on limited

information and sampling gathered through appropriate sampling

techniques from locations such as outcrops, trenches, pits,

workings and drill holes. Inferred Mineral Resources must not be

included in the economic analysis, production schedules, or

estimated mine life in publicly disclosed Pre- Feasibility or

Feasibility Studies, or in the Life of Mine plans and cash flow

models of developed mines. Inferred Mineral Resources can only be

used in economic studies as provided under NI 43-101.

There may be circumstances, where appropriate

sampling, testing, and other measurements are sufficient to

demonstrate data integrity, geological and grade/quality continuity

of a Measured or Indicated Mineral Resource, however, quality

assurance and quality control, or other information may not meet

all industry norms for the disclosure of an Indicated or Measured

Mineral Resource. Under these circumstances, it may be reasonable

for the Qualified Person to report an Inferred Mineral Resource if

the Qualified Person has taken steps to verify the information

meets the requirements of an Inferred Mineral Resource.

Indicated Mineral ResourceAn

Indicated Mineral Resource is that part of a Mineral Resource for

which quantity, grade or quality, densities, shape and physical

characteristics are estimated with sufficient confidence to allow

the application of Modifying Factors in sufficient detail to

support mine planning and evaluation of the economic viability of

the deposit.

Geological evidence is derived from adequately

detailed and reliable exploration, sampling and testing and is

sufficient to assume geological and grade or quality continuity

between points of observation.

An Indicated Mineral Resource has a lower level

of confidence than that applying to a Measured Mineral Resource and

may only be converted to a Probable Mineral Reserve. Mineralization

may be classified as an Indicated Mineral Resource by the Qualified

Person when the nature, quality, quantity and distribution of data

are such as to allow confident interpretation of the geological

framework and to reasonably assume the continuity of

mineralization. The Qualified Person must recognize the importance

of the Indicated Mineral Resource category to the advancement of

the feasibility of the project. An Indicated Mineral Resource

estimate is of sufficient quality to support a Pre-Feasibility

Study which can serve as the basis for major development

decisions.

Mineral ReserveMineral Reserves

are sub-divided in order of increasing confidence into Probable

Mineral Reserves and Proven Mineral Reserves. A Probable Mineral

Reserve has a lower level of confidence than a Proven Mineral

Reserve.

A Mineral Reserve is the economically mineable

part of a Measured and/or Indicated Mineral Resource. It includes

diluting materials and allowances for losses, which may occur when

the material is mined or extracted and is defined by studies at

Pre-Feasibility or Feasibility level as appropriate that include

application of Modifying Factors. Such studies demonstrate that, at

the time of reporting, extraction could reasonably be justified.

The reference point at which Mineral Reserves are defined, usually

the point where the ore is delivered to the processing plant, must

be stated. It is important that, in all situations where the

reference point is different, such as for a saleable product, a

clarifying statement is included to ensure that the reader is fully

informed as to what is being reported.

The public disclosure of a Mineral Reserve must

be demonstrated by a Pre-Feasibility Study or Feasibility

Study.

Mineral Reserves are those parts of Mineral

Resources which, after the application of all mining factors,

result in an estimated tonnage and grade which, in the opinion of

the Qualified Person(s) making the estimates, is the basis of an

economically viable project after taking account of all relevant

Modifying Factors. Mineral Reserves are inclusive of diluting

material that will be mined in conjunction with the Mineral

Reserves and delivered to the treatment plant or equivalent

facility. The term ‘Mineral Reserve’ need not necessarily signify

that extraction facilities are in place or operative or that all

governmental approvals have been received. It does signify that

there are reasonable expectations of such approvals.

‘Reference point’ refers to the mining or

process point at which the Qualified Person prepares a Mineral

Reserve. For example, most metal deposits disclose mineral reserves

with a “mill feed” reference point. In these cases, reserves are

reported as mined ore delivered to the plant and do not include

reductions attributed to anticipated plant losses. In contrast,

coal reserves have traditionally been reported as tonnes of “clean

coal”. In this coal example, reserves are reported as a “saleable

product” reference point and include reductions for plant yield

(recovery). The Qualified Person must clearly state the ‘reference

point’ used in the Mineral Reserve estimate.

Master CompositeA testing

sample comprised of multiple sub-samples taken from multiple

locations within an area of a deposit. This is a common practice

when individual samples are of insufficient size for a minimum

sample requirement for metallurgical tests. Source sub-samples are

selected to represent specific mineralization types or specific

areas within a deposit.

Probable Mineral ReserveA

Probable Mineral Reserve is the economically mineable part of an

Indicated, and in some circumstances, a Measured Mineral Resource.

The confidence in the Modifying Factors applying to a Probable

Mineral Reserve is lower than that applying to a Proven Mineral

Reserve.

The Qualified Person(s) may elect, to convert

Measured Mineral Resources to Probable Mineral Reserves if the

confidence in the Modifying Factors is lower than that applied to a

Proven Mineral Reserve. Probable Mineral Reserve estimates must be

demonstrated to be economic, at the time of reporting, by at least

a Pre-Feasibility Study.

Pre-Feasibility Study (Preliminary

Feasibility Study)The CIM Definition Standards requires

the completion of a Pre-Feasibility Study as the minimum

prerequisite for the conversion of Mineral Resources to Mineral

Reserves.

A Pre-Feasibility Study is a comprehensive study

of a range of options for the technical and economic viability of a

mineral project that has advanced to a stage where a preferred

mining method, in the case of underground mining, or the pit

configuration, in the case of an open pit, is established and an

effective method of mineral processing is determined. It includes a

financial analysis based on reasonable assumptions on the Modifying

Factors and the evaluation of any other relevant factors which are

sufficient for a Qualified Person, acting reasonably, to determine

if all or part of the Mineral Resource may be converted to a

Mineral Reserve at the time of reporting. A Pre-Feasibility Study

is at a lower confidence level than a Feasibility Study.

Relative Density / Specific

Gravity

The weight of a given volume of material

expressed as a ratio of the density of water. A specific gravity of

2.50 would indicate that a cubic meter of the material would weigh

2.5 metric tonnes.

SAG Mill Work Index – Short for Semi-Autogenous

Grinding – (A x b) – The SAG Mill Work Index is a

measure of the resistance of material to grinding in a SAG

mill.

It can be used to determine the grinding power

required for a given throughput of material under SAG mill grinding

conditions.. The index has no units. Higher values indicate better

performance through a SAG mill.

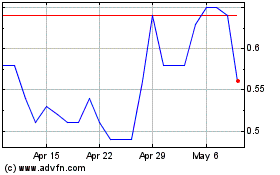

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Condor Gold (TSX:COG)

Historical Stock Chart

From Jan 2024 to Jan 2025