Delta 9 Reports Financials for Q2 2022

August 15 2022 - 5:00PM

DELTA 9 CANNABIS INC. (TSX: DN) (OTCQX: DLTNF) (“Delta 9” or the

“Company”), is pleased to announce financial and operating results

for the three-month and six-month period ending June 30, 2022.

Financial Highlights for the three-month

period ending June 30, 2022

-

Net revenue of $17.5 million for the second quarter of 2022, an

increase of 4%, from $16.75 million for the same quarter last year.

-

Sequential net revenue increased 40% versus $12.5 million for the

three-month period ending March 31, 2022

-

Gross profit of $4.6 million for the second quarter of 2022, a

decrease of 6%, from $4.9 million for the same quarter last

year.

-

Net Loss from operations of $(3.4) million for the second quarter

of 2022 versus a loss from operations of $(0.8) million for the

same quarter last year.

-

Adjusted EBITDA (loss) of $(0.4) million for the second quarter of

2022 versus an adjusted EBITDA of $1.2 million for the same quarter

last year.

Financial Highlights for the six-month

period ending June 30, 2022

-

Net revenue of $30 million for the first six months of 2022, no

change from $30 million for the same period last year.

-

Gross profit of $7.6 million for the first six months of 2022,

versus $8.6 million for the same period last year.

-

Net loss from operations of $(6.4) million for the first six months

of 2022 versus a net loss from income from operations of $(4.0)

million for the same period last year.

-

Adjusted EBITDA (loss) of $(2.1) million for the first six months

of 2022 versus an adjusted EBITDA of $1.2 million for the same

period last year.

"Our team delivered strong second quarter

results with sequential and year over year topline growth and

improved margins driven by a focus on our strategic growth plan,”

said John Arbuthnot, CEO of Delta 9. "During our recent strategic

planning review with the Board of Directors, we have identified

several proactive growth opportunities to maneuver the current

economic conditions by continuing to expand our retail cannabis

store network across Canada and expand certain aspects of our

business into new markets. Our balance sheet remains strong,

enabling the repurchase of $11.8 million in convertible

debt in July, while also providing meaningful working capital to

support organic growth and pursue strategic M&A

acquisitions.”

2nd Quarter

Operational Highlights

- Delta 9 announced

the cash repayment of its unsecured 8.5% convertible debentures

issued in July. The $11.8 million cash repayment

represents a full payout of the Convertible Debentures. The

Convertible Debentures were previously traded on the Toronto Stock

Exchange under the trading symbol “DN.DB”. The Company met the

pre-disbursement conditions required to draw-down $11.8

million under its credit facility with ConnectFirst Credit

Union and concurrently made the cash repayment of the Convertible

Debentures. The Company's $11.8 million draw-down from

its credit facility is subject to a 60-month repayment term at a

fixed rate of 4.55% per annum, amortized over 144 months.

- Delta 9 raised

funds in an overnight marketed equity raise. The Company issued

Units at a price of $0.22 per Unit for aggregate gross proceeds of

approximately $2,000,000. The Offering was led by Research Capital

Corporation as sole agent and sole bookrunner. Each Unit is

comprised of one common share of the Company and one Common Share

purchase warrant of the Company. Each Warrant entitles the holder

to purchase one Common Share at an exercise price of $0.255 per

Common Share for a period of 36 months. Delta 9 also completed a

loan from a shareholder in the amount of $4,990,264.37 that is due

on July 15, 2025. The Loan shall bear interest at 6% per

annum.

- Delta 9 opened its

thirty-fifth Delta 9 Cannabis retail store in Winnipeg and has a

total of 13 cannabis stores in the Province of Manitoba, 21 retail

stores in Alberta and one in Saskatchewan.

- Delta 9 launched

Canada’s first mobile cannabis store, licensed by the Liquor Gaming

and Cannabis Authority of Manitoba (“LGCA”) to sell cannabis

on-site at two major Manitoba music festivals: the 2022 Dauphin

Countryfest and the 2022 Rock the Fields Minnedosa. These festivals

are premier country and rock events in Manitoba, and this

represents a new milestone for cannabis availability in

Canada.

Summary of Quarterly Results:

|

Consolidated Statement of Net Income (Loss) |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

|

Revenue |

$15,192,268 |

$17,120,932 |

$12,479,577 |

$17,495,078 |

|

Cost of Sales |

10,425,214 |

12,247,951 |

9,515,096 |

12,850,777 |

|

Gross Profit Before Unrealized Gain From Changes In Biological

Assets |

4,767,054 |

4,872,981 |

2,964,481 |

4,644,301 |

|

Unrealized gain from changes in fair value of biological assets

(Net) |

1,690,676 |

(1,853,245) |

874,293 |

(542,188) |

|

Gross Profit |

$6,457,730 |

$3,019,736 |

$3,838,774 |

$4,102,113 |

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

General and Administrative |

3,687,945 |

2,972,633 |

3,810,316 |

4,043,257 |

|

Sales and Marketing |

2,649,302 |

3,212,250 |

2,713,630 |

3,381,223 |

|

Share Based Compensation |

175,514 |

371,433 |

246,944 |

107,121 |

|

Total Operating Expenses |

$6,512,761 |

$6,556,316 |

$6,770,890 |

$7,531,601 |

|

|

|

|

|

|

|

Adjusted EBITDA (Loss) 1 |

191,056 |

613,562 |

(1,694,529) |

(391,054) |

|

Income (Loss) from Operations |

$(55,031) |

$(3,536,580) |

$(2,932,116) |

$(3,429,488) |

|

Other Income/ Expenses |

(788,741) |

(1,622,996) |

(1,189,730) |

(1,402,588) |

|

Net Income (Loss) |

$(843,772) |

$(5,159,576) |

$(4,121,846) |

$(4,832,076) |

|

Basic and Diluted Earnings (Loss) Per Share |

$(0.01) |

$(0.05) |

$(0.04) |

$(0.04) |

-

Adjusted EBITDA is a non-IFRS measure, and is calculated as

earnings before interest, tax, depreciation and amortization,

share-based compensation expense, fair value changes and other

non-cash items.

A comprehensive discussion of Delta 9’s financial position and

results of operations is provided in the Company’s Management

Discussion & Analysis for the three-month and six-month period

ending June 30, 2022 filed on SEDAR on August 16, 2022 and can be

found at www.sedar.com.

2022 Second Quarter Results Conference

Call

A conference call to discuss the above results

is scheduled for August 16, 2022. The conference call will be

hosted that day at 1:00 p.m. Eastern Time by John Arbuthnot, Chief

Executive Officer, and Jim Lawson, Chief Financial Officer,

followed by a question-and-answer period.

|

DATE: |

August 16, 2022 |

|

TIME: |

1:00 pm Eastern Time |

|

Dial in # |

1-888-886-7786 |

|

|

|

|

REPLAY: |

1-877-674-6060Available until 12:00 midnight Eastern Time,

September 16, 2022 |

|

Replay passcode: |

599533 # |

For more information contact:

Investor & Media Contact:Ian Chadsey VP Corporate

AffairsMobile: 204-898-7722E-mail: ian.chadsey@delta9.ca

About Delta 9 Cannabis Inc.

Delta 9 Cannabis Inc. is a vertically integrated

cannabis company focused on bringing the highest quality cannabis

products to market. The company sells cannabis products through its

wholesale and retail sales channels and sells its cannabis grow

pods to other businesses. Delta 9's wholly-owned subsidiary, Delta

9 Bio-Tech Inc., is a licensed producer of medical and recreational

cannabis and operates an 80,000 square foot production facility

in Winnipeg, Manitoba, Canada. Delta 9 owns and operates a

chain of retail stores under the Delta 9 Cannabis Store brand.

Delta 9's shares trade on the Toronto Stock Exchange under the

symbol "DN" and on the OTCQX under the symbol "DLTNF". For more

information, please visit www.delta9.ca.

Disclaimer for Forward-Looking Information

Certain statements in this release are

forward-looking statements, which reflect the expectations of

management regarding the Company’s future business plans and other

matters. Forward-looking statements consist of statements that are

not purely historical, including any statements regarding beliefs,

plans, expectations or intentions regarding the future. Forward

looking statements in this news release include statements relating

to: (i) the Company’s plans to establish a chain of cannabis retail

stores across Canada; and (ii) the anticipated production capacity

of the Company’s planned cannabis processing center. Such

statements are subject to risks and uncertainties that may cause

actual results, performance or developments to differ materially

from those contained in the statements, including all risk factors

set forth in the annual information form of Delta 9

dated March 31, 2022 which has been filed on SEDAR. No

assurance can be given that any of the events anticipated by the

forward-looking statements will occur or, if they do occur, what

benefits the Company will obtain from them. Readers are urged to

consider these factors carefully in evaluating the forward-looking

statements contained in this news release and are cautioned not to

place undue reliance on such forward-looking statements, which are

qualified in their entirety by these cautionary statements. These

forward-looking statements are made as of the date hereof and the

Company disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, except as required by

applicable securities laws.

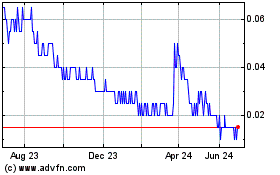

Delta 9 Cannabis (TSX:DN)

Historical Stock Chart

From Dec 2024 to Jan 2025

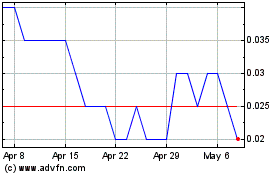

Delta 9 Cannabis (TSX:DN)

Historical Stock Chart

From Jan 2024 to Jan 2025