ERES REIT Outlines Minimal Impact To Business As A Result Of Recent Dutch Government Announcements

September 22 2022 - 12:11PM

European Residential Real Estate Investment Trust (TSX:ERE.UN,

“

ERES” or the “

REIT”) announced

today that on September 20, 2022, the Dutch government published

its 2023 budget, as well as a number of announced changes to tax

legislation. Key proposed changes which are relevant for the REIT

include the following, all effective January 1, 2023:

- The landlord

levy tax, which impacts certain of the REIT’s regulated suites,

will be abolished. The abolition, which was previously announced as

part of the government’s coalition agreement, will positively

result in an improvement in ERES’s long-term net operating income

margin.

- The real estate

transfer tax (“RETT”) rate will be increased from

8% to 10.4%. Although this will result in an incremental cost on

future acquisitions, it will otherwise have no direct impact on the

REIT’s business or operations.

- The lower rate

applicable to the first bracket of profits subject to corporate

income tax (“CIT”) will be increased from 15% to

19%. Furthermore, this lower CIT rate will apply to the first

€200,000 in annual profits per taxpayer in 2023, which was

decreased from the threshold of €395,000 applicable in 2022.

Although this does negatively impact ERES, its estimated effect

will be immaterial to the REIT’s operations and financial

results.

Notably, the Dutch government also announced

that effective January 1, 2024, real estate investment trusts in

the Netherlands (fiscale beleggingsinstellingen) will no longer be

allowed to invest directly in real estate and remain exempt from

corporate income tax (instead subject only to dividend withholding

tax on mandatory annual distributions, as per the current tax

regime rules). As a consequence, profits earned by real estate

investment trusts from real estate investments in the Netherlands

will become subject to Dutch corporate income tax. Importantly,

this will not have an impact on ERES as the REIT’s structure is

such that it does not hold any direct interest in real estate, and

instead holds all of its investments indirectly through taxable

vehicles. In effect, it does not apply to ERES as a real estate

investment trust formed in Canada, and impacts only those which are

formed in the Netherlands.

Notwithstanding the above, the Dutch government

has not released any further announcement on rent control or other

potential regulatory developments and legislative proposals

affecting the housing market. The Minister of Housing reiterated

that it will update the Parliament in the fall of 2022.

About ERES

ERES is an unincorporated, open-ended real

estate investment trust. ERES’s Units are listed on the TSX under

the symbol ERE.UN. ERES is Canada’s only European-focused,

multi-residential REIT, with a current initial focus on investing

in high-quality, multi-residential real estate properties in the

Netherlands. ERES owns a portfolio of 158 multi-residential

properties, comprised of 6,900 suites and ancillary retail space

located in the Netherlands, and owns one office property in Germany

and one office property in Belgium.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information, please visit our website

at www.eresreit.com.

Cautionary Statements Regarding

Forward-Looking Statements

All statements in this press release that do not

relate to historical facts constitute forward-looking statements.

These statements represent ERES’s intentions, plans, expectations

and beliefs and are subject to certain risks and uncertainties that

could result in actual results differing materially from these

forward-looking statements. These risks and uncertainties are more

fully described in regulatory filings that can be obtained on SEDAR

at www.sedar.com.

For further information

| ERES |

ERES |

| Mr. Phillip Burns |

Ms. Jenny Chou |

| Chief Executive Officer |

Chief Financial Officer |

| 416.354.0167 |

416.354.0188 |

| p.burns@eresreit.com |

j.chou@eresreit.com |

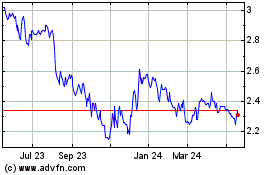

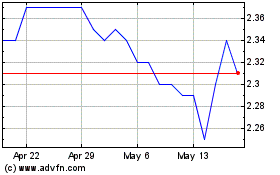

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025