initiated by

ETNA FRENCH BIDCO

presented by

BNP PARIBAS - LAZARD - Morgan

Stanley - SOCIETE GENERALE

Guaranteeing and presenting bank -

Presenting banks

Regulatory News:

Exclusive Networks (Paris:EXN):

THIS PRESS RELEASE DOES NOT CONSTITUTE A TENDER OFFER. THE

OFFER AND THE DRAFT OFFER DOCUMENT REMAIN SUBJECT TO REVIEW BY THE

AMF

This document is an unofficial English-language translation

of the French-language press release which was published by the

offeror on 18 December 2024. In the event of any differences

between this unofficial English-language translation and the

official French-language press release, the official

French-language press release shall prevail.

PRICE OF THE OFFER:

EUR 18.96 per Exclusive Networks

share

DURATION OF THE

OFFER:

12 trading days

The timetable of the simplified

tender offer referred to herein will be set out by the French

financial market authority (Autorité des marchés financiers) (the

“AMF”) in accordance with the provisions of its general

regulation (the “AMF General Regulation”).

AMF | AUTORITÉ DES MARCHÉS

FINANCIERS

This press release (the “Press

Release”) was prepared by Etna French Bidco and published

pursuant to Article 231-16 of the General Regulation of the

AMF.

The offer and the

draft offer document remain subject to review by the

AMF.

IMPORTANT NOTICE

In accordance with the provisions of

Article L. 433-4 II of the French Monetary and Financial Code and

Articles 237-1 et seq. of the AMF General Regulation, in the event

that, at the closing of the offer, the number of shares of

Exclusive Networks not tendered to the offer by the minority

shareholders of Exclusive Networks (excluding treasury shares held

by Exclusive Networks, shares covered by a liquidity mechanism

and/or assimilated to shares held by the Offeror, alone or in

concert) does not represent more than 10% of the share capital and

voting rights of Exclusive Networks, Etna French Bidco intends to

require the AMF, at the latest within three (3) months following

the closing of the offer, to implement a squeeze-out procedure for

the shares of Exclusive Networks not tendered to the offer

(excluding treasury shares held by Exclusive Networks, shares

covered by a liquidity mechanism and/or assimilated to shares held

by the Offeror, alone or in concert) to be transferred to Etna

French Bidco in exchange for compensation per share equal to the

offer price, i.e., €18.96 per Exclusive Network share, net of all

costs.

The Press Release must be read together

with all other documents published in connection with the offer. In

particular, in accordance with Article 231-28 of the General

Regulation of the AMF, a description of the legal, financial and

accounting characteristics of Etna French Bidco will be filed with

the AMF and made available to the public no later than the day

preceding the opening of the offer. A press release will be issued

to inform the public of the manner in which this information will

be made available.

The offer is not and will not be proposed

in any jurisdiction where it would not be permitted under

applicable law. Acceptance of such offer by persons residing in

countries other than France and the United States of America may be

subject to specific obligations or restrictions imposed by legal or

regulatory provisions. The recipients of the offer are solely

responsible for compliance with such laws and it is therefore their

responsibility, before accepting the offer, to determine whether

such laws exist and are applicable, based on the advice they obtain

from their own advisers.

For more information, see Section 2.12

(Offer restrictions outside of France) below.

The draft offer document prepared by Etna French Bidco (the

“Draft Offer Document”) is available on the websites of

Exclusive Networks (www.exclusive-networks.com) and of the AMF

(www.amf-france.org) and may be obtained free of charge from:

Etna French Bidco

37, avenue Pierre 1er de

Serbie

75008 Paris

BNP Paribas

(Département M&A EMEA)

5, boulevard Haussmann

75009 Paris

Lazard Frères Banque

175, Boulevard Haussmann

75008 Paris

Morgan Stanley

61, Rue de Monceau

75008 Paris

Société Générale

GLBA/IBD/ECM/SEG 75886

Paris Cedex 18

1. OVERVIEW OF THE OFFER

Pursuant to Title III of Book II and more specifically Articles

233-1 and 234-2 et seq. of the AMF General Regulation, Etna French

Bidco, a simplified joint stock company (société par actions

simplifiée) with a share capital of EUR 108,272,026.16, having its

registered office at 37, avenue Pierre 1er de Serbie, 75008 Paris,

registered with the Paris Trade and Companies Registry under number

930 705 991 (“BidCo” or the “Offeror”) irrevocably

offers to all the shareholders of Exclusive Networks, a public

limited company (société anonyme) with a share capital of EUR

7,333,622.88, having its registered office at 20, Quai du Point du

Jour, 92100 Boulogne-Billancourt, registered with the Nanterre

Trade and Companies Registry under number 839 082 450 (

“Exclusive Networks” or the “Company”, and together

with its directly - or indirectly - controlled subsidiaries, the

“Group”), to purchase in cash all of their shares in the

Company admitted to trading on compartment A of the Euronext Paris

regulated market (“Euronext Paris”) under ISIN code

FR0014005DA7 with mnemonic “EXN” (the “Shares”) other than

the Shares held by the Offeror (subject to the exceptions set out

below) in the context of a simplified mandatory tender offer, the

terms of which are described below (the “Offer”).

The Offer price is eighteen euros and ninety-six cents (EUR

18.96) per Share (the “Offer Price”)1. The Offer Price is

the same as the price paid in cash by the Offeror in connection

with the Acquisitions (as defined below).

As a result of the crossing of the thresholds of 30% of the

Company’s share capital and voting right following the completion

of the Acquisitions and Contributions (as defined below), the Offer

is mandatory pursuant to the provisions of Article L. 433-3, I of

the French Monetary and Financial Code and Article 234-2 of the AMF

General Regulation.

The Offer follows the completion of the Acquisitions and

Contributions, pursuant to which the Offeror has acquired and now

holds 66.66% of the share capital and theoretical voting rights of

the Company2.

As of the date of the Draft Offer Document, BidCo holds directly

61,109,300 Shares and 61,109,300 voting rights representing 66.66%

of the share capital and the theoretical voting rights of the

Company3.

In accordance with Article 231-6 of the AMF General Regulation,

the Offer targets all Shares, whether outstanding or to be issued

before the closing of the Offer, that are not held, directly or

indirectly, by the Offeror, i.e., to the knowledge of the Offeror

and as at the date of the Draft Offer Document, a maximum of

29,547,754 Shares, except for the Shares held in treasury by the

Company, i.e., to the knowledge of the Offeror and as of the date

of the Draft Offer Document, 1,013,232 Shares, which the board of

directors of the Company decided not to tender to the Offer.

To the knowledge of the Offeror, as of the date of the Draft

Offer Document, except for the existing Shares and the Free Shares

(as defined below) granted by the Company, there are no other

equity securities or other financial instruments issued by the

Company or rights conferred by the Company that may give access,

immediately or in the future, to the share capital or voting rights

of the Company.

The Offer will be conducted under the simplified procedure in

accordance with the provisions of Articles 233-1 et seq. of the AMF

General Regulation.

The Offer will be, if the required conditions are met, followed

by a squeeze-out procedure pursuant to Articles L. 433-4 II of the

French Monetary and Financial Code and 237-1 et seq. of the AMF

General Regulation.

The duration of the Offer will be 12 trading days.

In accordance with the provisions of Article 231-13 of the AMF

General Regulation, BNP Paribas, Lazard Frères Banque, Morgan

Stanley, and Société Générale, acting as the presenting banks of

the Offer (the “Presenting Banks”), have filed the draft

Offer and the Draft Offer Document with the AMF on behalf of the

Offeror.

It is specified that only BNP Paribas is guaranteeing, in

accordance with the provisions of Article 231-13 of the AMF General

Regulation, the content and irrevocable nature of the commitments

made by the Offeror in the context of the Offer.

1.1. Background of the

Offer

1.1.1 Reasons for the Offer

Exclusive Networks is a global trusted cybersecurity specialist

helping to drive the transition to a totally trusted digital world

for all people and organizations. Exclusive Networks has grown to

become one of the pre-eminent cybersecurity solutions businesses,

building a platform to service both leading cybersecurity vendors

and thousands of global partners and end-users.

The Consortium (as defined below) is willing to support the

Company so that it can better execute on its value creation plan

and grow its business to establish itself as a true global champion

thanks in part to the combined expertise of the members of the

Consortium (as defined below) including CD&R’s long track

record in the technology sector, including IT services and

solutions, Permira’s 35+ years of investing in technology and the

support of the Founder (as defined below).

On 22 July 2024, CD&R LLP, a limited liability partnership

established and existing under the laws of the United Kingdom,

having its registered office located at Cleveland House, 33 King

Street, SW1Y 6RJ, London United Kingdom, and registered under

number OC343911, acting in its capacity as advisor to Clayton,

Dubilier and Rice, LLC, the manager of the Clayton, Dubilier and

Rice private equity funds, a Delaware limited liability company

whose registered office is at 375 Park Avenue, 18th Floor New York,

NY 10152 and registered under number 4742790 (“CD&R”)

delivered a binding offer to the board of directors of Exclusive

Networks, which was accepted by Exclusive Networks after

completion, on 23 July 2024, of the Company’s works council’s

consultation process, in the context of which the works council’s

issued a favorable opinion provided that the transaction does not

have a negative social impact for the employees.

In this context, on 23 July 2024, CD&R, Everest UK Holdco

Limited, a private limited company incorporated under the laws of

England and Wales, having its registered office located 80 Pall

Mall, London, United Kingdom, SW1Y 5ES, registered under number

11382959 (“Everest”), HTIVB, a société anonyme incorporated

under the laws of Belgium, having its registered office located

Grand Route 217, B-1428 Braine-l’Alleud, Belgium, registered with

the trade and companies registry under number BE 0867 024 206

(“HTIVB”), Mr. Olivier Breittmayer, a French citizen,

residing at 63, avenue de Lequime, 1640 Rhodes Saint Genese,

Belgium, born in Neuilly-sur-Seine, on 9 March 1964 (“OB”

and together with HTIVB the “Founder”), Etna UK Topco

Limited, a private limited company incorporated under the laws of

England and Wales, having its registered office located C/O Alter

Domus (Uk) Limited 10th Floor, 30 St Mary Axe, London, United

Kingdom, EC3A 8BF, registered under number 15838779 (“UK

TopCo”), Etna UK Midco Limited, a private limited company

incorporated under the laws of England and Wales, having its

registered office located C/O Alter Domus (Uk) Limited 10th Floor,

30 St Mary Axe, London, United Kingdom, EC3A 8BF, registered under

number 15839201(“UK MidCo”), Etna French Topco, a société

par actions simplifiée, organized under the laws of France, whose

registered office is at 37, avenue Pierre 1er de Serbie, 75008

Paris, and registered with the trade and company registry of Paris,

under number 930 723 143 (“French TopCo”), Etna French

Midco, a société par actions simplifiée, organized under the laws

of France, whose registered office is at 37, avenue Pierre 1er de

Serbie, 75008 Paris, and registered with the trade and company

registry of Paris, under number 930 694 492 (“French MidCo”)

and BidCo entered into an agreement entitled “Consortium and

Investment Agreement” to govern inter alia the terms of their

consortium in the context of the Offer (as amended from time to

time, the “Consortium and Investment Agreement”). CD&R,

Everest and the Founder are hereafter referred to as the

“Consortium”.

On the same day, BidCo entered into share purchase agreements

with the Founder and Everest, respectively, and the Founder and

Everest entered into contribution agreements with UK MidCo and UK

TopCo, respectively, in relation to the Acquisitions and

Contributions as further described in Section 1.3.2 of this Press

Release.

On 24 July 2024, following the execution of the Consortium and

Investment Agreement, the Consortium announced its intention to

file a simplified tender offer for the Shares at the Offer Price

following the implementation of an exceptional distribution of five

euros and twenty-nine cents (EUR 5.29) per Share to be approved by

the general meeting of the shareholders of the Company (the

“Exceptional Distribution”) and the completion of the

Acquisitions and Contributions (as further described in Section

1.3.2 of this Press Release).

On 24 July 2024 the Company announced that the board of

directors of the Company had formed an ad hoc committee composed of

three independent members (the “Ad Hoc Committee”). The

board of directors of the Company, upon the recommendation of the

Ad Hoc Committee, appointed Finexsi, represented by Mr. Christophe

Lambert, as an independent expert in order to deliver a fairness

opinion on the financial terms of the Offer, including in the

perspective of a potential squeeze-out, and a solvency opinion on

the Exceptional Distribution.

It was also announced in the same press release that, upon the

recommendation of the Ad Hoc Committee, the board of directors of

the Company with the unanimous vote of the board members present or

represented:

- welcomed favourably the proposed Offer; and

- agreed to take certain undertakings including (i) a cooperation

undertaking in relation to (x) the implementation of the

Exceptional Distribution, (y) the negotiations and entering into

the long form financing agreements and (z) the obtention of the

regulatory approvals, (ii) an undertaking not to tender Exclusive

Network’s treasury shares to the Offer, (iii) an undertaking not to

proceed to the issuance of new securities by the Group companies

(except for shares issued as a result of the vesting of Free Shares

(actions gratuites)) and (iv) a customary non-solicit

undertaking.

On 31 October 2024, the shareholders’ general meeting of the

Company approved the Exceptional Distribution which was paid on 16

December 2024.

On 17 December 2024, the Acquisitions and Contributions were

completed in accordance with the Consortium and Investment

Agreement.

The Offer has been filed following the implementation of the

Exceptional Distribution, the completion of the Acquisitions and

Contributions and the subsequent crossing of the 30% threshold by

the Offeror reported in a threshold crossing declarations filed

with the AMF, as described in Section 1.1.4 (Declarations of

crossing of thresholds and of intentions) of this Press

Release.

1.1.2 Presentation of the Offeror

The Offeror is a simplified joint stock company (société par

actions simplifiée) incorporated under French law for the purposes

of the Offer, which is jointly controlled by CD&R Stratos

Limited (“CD&R Stratos”, an entity indirectly ultimately

controlled by funds controlled by CD&R) and Everest (an entity

indirectly ultimately controlled by funds advised by Permira

Advisers LLP, together “Permira”) pursuant to the

Shareholders’ Agreement (further described in Section 1.3.3 of this

Press Release).

As of the date of the Draft Offer Document, the Offeror is

wholly owned by French MidCo, who itself is wholly owned by French

TopCo, who itself is wholly owned by UK MidCo, who itself is 7.74%

owned by HTIVB and 92.26% owned by UK TopCo, and UK TopCo is itself

48.76% owned by CD&R Stratos and 51.24% by Everest.

Following closing of the Offer, the shareholding structure of UK

TopCo will be adjusted to reflect the share capital that will be

subscribed by CD&R Stratos by way of set-off of shareholder

loans provided in the context of the financing of the Transaction,

as described in Section 2.10. Assuming implementation of the

squeeze-out, UK TopCo would be c. 60% owned by CD&R Stratos,

and c. 40% owned by Everest and would continue to be jointly

controlled by CD&R Stratos and Everest.

Founded in 1978 and 1985 respectively, CD&R and Permira are

leading global investment firms specializing, among other sectors,

in technology. For his part, Mr. Olivier Breittmayer, has more than

35 years’ experience of working with fast-growth technology

companies across sales, marketing, product development and

management roles and served as Chief Executive Officer of Exclusive

Networks from 2005 to 2020.

1.1.3 Shareholding structure of the Company’s share capital

and voting rights

To the knowledge of the Offeror, as at the date of the Draft

Offer Document, the Company has a share capital of EUR 7,333,622.88

divided into 91,670,286 Shares of a nominal value of €0.08

each.

(a) Shareholding structure of the

Company’s share capital and voting rights before the Acquisitions

and the Contributions

To the Offeror’s knowledge, ownership of the Company’s share

capital and theoretical voting rights broke down as follows before

the Acquisitions and the Contributions:

Shareholder

Number of Shares

% of capital

Number of voting

rights

% of voting rights

Everest

52,509,374

57.28%

52,509,374

57.28%

Founder4

8,599,926

9.38%

8,599,926

9.38%

Bpifrance Investissement5

7,935,873

8.66%

7,935,873

8.66%

Treasury Shares

1,013,232

1.10%

1,013,232

1.1%

Free float

21,611,881

23.58%

21,611,881

23.58%

Total

91,670,286

100.00%

91,670,2866

100.00%

(b) Shareholding structure of the

Company’s share capital and voting rights after the Acquisitions

and Contributions

To the Offeror’s knowledge, ownership of the Company’s share

capital and theoretical voting rights is currently as follows,

after completion of the Acquisitions and Contributions:

Shareholder

Number of Shares

% of capital

Number of voting

rights

% of voting rights

BidCo

61,109,300

66.66%

61,109,300

66.66%

Bpifrance Investissement7

7,935,873

8.66%

7,935,873

8.66%

Treasury Shares

1,013,232

1.1%

1,013,232

1.1%

Free float

21,611,881

23.58%

21,611,881

23.58%

Total

91,670,286

100.00%

91,670,286

100.00%

The situation of the holders of Free Shares and details of free

share plans awarded by the Company to certain managers and

employees are described in Section 2.4 (Situation of the

beneficiaries of Free Shares) of this Press Release.

1.1.4 Declarations of threshold crossing and of

intentions

In accordance with Articles L. 233-7 et seq. of the French

Commercial Code:

- by declaration dated 17 December 2024,

BidCo informed the AMF that, following the completion of the

Acquisitions and Contributions, BidCo has crossed upwards the

thresholds of 5%, 10%, 15%, 20%, 25%, 30%, 1/3 and 50% of the

Company’s share capital and voting rights, and filed a statement of

intents;

- on the same day, BidCo also informed the

Company of the upwards crossing of the statutory threshold of 1% of

the Company’s share capital and voting rights, and multiple of this

percentage up to 66.66%, in accordance with Article 11 of the

Company’s articles of association;

- by declaration dated 17 December 2024,

Everest informed the AMF, that, following the Everest Acquisition

and Everest Contribution, that Everest has crossed downwards the

thresholds of 50%, 1/3, 30%, 25%, 20%, 15%, 10% and 5% of the

Company’s share capital and voting rights;

- on the same day, Everest informed the

Company of the downwards crossing of the statutory threshold of 1%

of the Company’s share capital and voting rights, and multiple of

this percentage, in accordance with Article 11 of the Company’s

articles of association;

- by declaration of dated 17 December 2024,

the Founder informed the AMF that, following the Founder

Acquisition and Founder Contribution, the Founder has crossed

downwards the threshold of 5% of the Company’s share capital and

voting rights; and

- on the same day, the Founder informed the

Company of the downwards crossing of the statutory threshold of 1%

of the Company’s share capital and voting rights, and multiple of

this percentage, in accordance with Article 11 of the Company’s

articles of association.

1.1.5 Acquisition of Shares by the Offeror during the last 12

months

Neither the Offeror nor the persons acting in concert with the

Offeror have acquired any Shares in the twelve (12) months

preceding the filing of the Draft Offer Document at a price higher

than the Offer Price.

1.1.6 Regulatory administrative and antitrust

approvals

The Offer is not subject to any regulatory approval, as the

antitrust, foreign direct investment and foreign subsidy regulation

approvals (or the confirmation that no regulatory approval was

required), required for the closing of the Acquisitions and

Contributions and/or the opening of the Offer (as applicable), have

already been obtained from the relevant authorities.

1.2. Intentions of the Offeror for the

next twelve months

1.2.1. Industrial, commercial and financial strategy

The Offeror intends to maintain the Group’s integrity, and, with

the support of the current management team, to continue the main

strategic orientations implemented by the Company and does not

intend to materially modify the operational model of the Company,

outside the normal evolution of the business.

1.2.2. Intentions regarding employment

The Offer is consistent with the continuation of the Company’s

business activities and development. As a result, the Offer should

not in itself result in any particular impact on the Company’s

workforce, compensation policy or human resource management

policy.

The Offeror intends to set up a long-term incentive plan the

beneficiaries and terms of which have not yet been determined.

Should such a long-term incentive plan be implemented, the

mechanisms envisaged would be customary and in line with market

practice for this type of transactions so as not to include clauses

that could be construed as an earn-out or a guaranteed sale price

clause for those beneficiaries who would also be shareholders of

the Company.

1.2.3. Composition of the Company’s governing bodies and

management

The board of directors of the Company currently comprises eight

(8) directors (including the CEO), three (3) of which represent the

Consortium.

Promptly following the closing of the Offer, the Offeror intends

to modify the current composition of the Company’s board of

directors to reflect the fact that it controls the Company, so

that, regardless of the outcome the Offer, at least the majority of

the members of the board of directors of the Company be appointed

upon the proposal of the Offeror. In this context, the Company’s

board of directors’ composition may not comply with the AFEP-MEDEF

corporate governance code.

In the event of the implementation of a Squeeze-Out, the Offeror

may vote further changes to the Company’s corporate governance.

1.2.4. Interest of the Offer for the Offeror, the Company and

its shareholders

The Offeror is offering the Company’s shareholders who tender

their Shares to the Offer the opportunity to obtain immediate

liquidity at an attractive price.

The Offer Price of eighteen euros and ninety-six cents (EUR

18.96) per Share represents a premium of 48.7% on the undisturbed

stock price of EUR 12.75 (ex-post) as of March 13, 2024 (being the

date prior to initial market rumors8), and a premium of 49.6%,

42.0%, 48.7%, and 40.9%, respectively, on the volume-weighted

1-month, 3-month, 6-month and 12-month average share prices

(ex-post VWAP), before initial market rumors, as well as a premium

of 20.7% compared to the all-time high share price (ex-post) before

initial market rumors, reached on May 17, 2023.

The summary of the assessment of the Offer Price, including the

premiums offered as part of the Offer, are set out in Section 3

(Summary of the assessment of the Offer Price) of this Press

Release.

1.2.5. Synergies – Economic gains

The Offeror is a company incorporated in France on 5 July 2024,

whose corporate purpose is to acquire, animate and hold stakes in

the share capital and voting rights of French and foreign

companies. The Offeror, which does not have any stake in other

companies, does not anticipate the realization of cost or revenue

synergies with the Company following the completion of the

Offer.

1.2.6. Intentions regarding a potential merger or legal

reorganization

The Offeror does not intend to merge with the Company.

However, in the event of the implementation of a Squeeze-Out,

the Offeror reserves the right to proceed with any subsequent

changes in the organization of the Group, the Company, or of other

entities of the Group.

1.2.7. Intentions regarding the implementation of a

squeeze-out and a delisting of the Company following the

Offer

In accordance with the provisions of Article L. 433-4, II, of

the French Monetary and Financial Code and Articles 237-1 et seq.

of the AMF General Regulation, the Offeror intends to ask the AMF,

within three (3) months from the closing of the Offer, to implement

a squeeze-out procedure for the Shares not tendered to the Offer by

the minority shareholders of the Company (other than (x) the Shares

held by the Company or its subsidiaries and (y) the Shares

assimilated to shares held by the Offeror) to be transferred to the

Offeror, if they do not represent more than 10% of the share

capital and voting rights of the Company, following the Offer (the

“Squeeze-Out”).

In such case, the Squeeze-Out would be implemented for an

indemnification in a per Share amount equal to the Offer price,

i.e., eighteen euros and ninety-six cents (EUR 18.96) per Share,

net of all costs. The implementation of this procedure will result

in the delisting of the Shares from Euronext Paris.

The amount of the indemnification will be paid, net of all

costs, at the end of the Squeeze-Out, into a blocked account opened

for this purpose with Uptevia, appointed as centralising agent for

the cash indemnification transactions for the Squeeze-Out. After

the closure of the affiliates’ accounts, Uptevia, upon presentation

of the balance certificates issued by Euroclear France, will credit

the account-holding custodian institutions with the amount of the

indemnification, who will be responsible for crediting the accounts

of the holders of the Shares with the indemnification due to

them.

In accordance with Article 237-8 of the AMF General Regulation,

the unallocated funds corresponding to the indemnification for

Shares whose beneficiaries remain unknown will be held by Uptevia

or by the relevant account-holding custodian, as the case may be,

for a period of ten (10) years from the date of the Squeeze-Out and

paid to the French Caisse des dépôts et consignations at the end of

this period. These funds will be made available to the

beneficiaries subject to the thirty-year prescription period in

favour of the French State.

1.2.8. Company’s dividend distribution policy

Following the settlement-delivery of the Offer, the Company’s

dividend policy and any change thereto will continue to be

determined by its corporate bodies in accordance with applicable

laws and regulations and the Company’s articles of association (as

may be amended from time to time), and based on the Company’s

distributive capacity, financial situation and financial needs.

The Offeror reserves the right to change the Company’s dividend

policy following the settlement-delivery of the Offer in compliance

with any applicable regulatory requirements.

1.3. Agreements that may have a

significant impact on the assessment or outcome of the

Offer

1.3.1. Consortium and Investment Agreement

As set out in Section 1.1.1 (Reasons for the Offer), the

Consortium and Investment Agreement was entered into between

CD&R, Everest, the Founder, UK TopCo, UK MidCo, French TopCo,

French MidCo and the Offeror, on 23 July 2024 (as further amended

on 2 August 2024, 20 November 2024, and 17 December 2024), to and

sets the terms and conditions of the Acquisitions, Contributions

and the Offer (the “Transaction”) as well as the respective

obligations of the parties in connection thereto.

Financing of the Offer

The Consortium and Investment Agreement provides that the

acquisition of the Shares in the context of the Acquisitions and

the Offer, as well as the transactions costs, will be funded by

debt financing and equity financing, in cash or in kind, by the

members of the Consortium.

Acquisitions and Contributions

The Consortium and Investment Agreement provides notably for an

undertaking by BidCo, UK TopCo, UK MidCo, Everest and the Founder

to enter into the agreements regarding the Acquisitions and

Contributions further described in Section 1.3.2 below.

Launch of the Offer

The Consortium and Investment Agreement provides notably

for:

- the main terms of the Offer, to be filed by

the Offeror with the AMF promptly following completion of the

Acquisitions and Contributions; and

- an acknowledgement of the fact that BidCo

intends to seek to enter into put and call options with the holders

of the Unvested Free Shares (as defined and described in Section

2.4) allowing for the transfer of the underlying Shares to BidCo or

any affiliate thereof or any third-party that BidCo may

substitute.

Regulatory clearances

The Consortium and Investment Agreement provides for an

undertaking by the parties to take all necessary steps to obtain

approvals from the competent antitrust, foreign direct investment

and foreign subsidy authorities, in the context of the

Transaction.

Commitments concerning the

Group

The Consortium and Investment Agreement provides that the

Founder and Everest shall exercise all their powers to enable the

Company and its subsidiaries to operate their business in the

ordinary course consistent with past practice (including, not to

issue or authorize any issuance of any security of the Company,

except if such issuance results from the vesting of free shares

(actions gratuites, within the meaning of Articles L. 225-197-1 et

seq. of the French Commercial Code)).

Other commitments

Lastly, the Consortium and Investment Agreement provides

for:

- an undertaking by the parties to

co-operate, collaborate and otherwise work together in good faith

in order to facilitate, proceed with, negotiate and agree and

complete the Transaction as soon as reasonably practicable;

- an undertaking by the parties not to

knowingly take any action or knowingly omit to take any action that

is inconsistent with, or which could frustrate, or which could be

reasonably expected to delay, disrupt, prejudice or otherwise

negatively impact the implementation or likely success of the

Transaction;

- an undertaking from Everest (i) not to take

certain actions in relation to the holding companies incorporated

for the purposes of the Transaction (BidCo, French MidCo, French

TopCo, UK MidCo and UK TopCo) which are wholly owned by Everest

until obtaining the regulatory approvals and (ii) to sell 40% of

the share capital of UK TopCo to CD&R following the obtention

of the last regulatory approval;

- an undertaking from Everest and the

Founder, to the extent of their powers and subject to applicable

laws, to exercise their powers to have a representative of CD&R

at the board of directors of the Company;

- an acknowledgement that certain managers

and employees to be identified by the members of the Consortium may

be offered the opportunity to roll-over a portion of their Shares

representing a portion (to be determined) of the net proceeds which

would have resulted for them from the disposal of their Shares in

the context of the Offer, providing that they enter into specific

arrangements to be agreed with them; and

- a customary standstill undertaking from the

members of the Consortium.

1.3.2. Acquisitions and Contributions Agreements

On 23 July 2024, BidCo entered into (i) a share purchase

agreement9 with Everest, pursuant to which BidCo agreed to acquire,

and Everest agreed to sell (in accordance with the terms of the

amendment agreement dated 17 December 2024) 25,501,852 Shares held

by Everest at the Offer Price (the “Everest Acquisition”)

and (ii) a share purchase agreement with the Founder, pursuant to

which BidCo agreed to acquire, and the Founder agreed to sell (in

accordance with the terms of the amendment agreement dated 17

December 2024) 4,176,664 Shares held by the Founder at the Offer

Price (the “Founder Acquisition”) and together with the

Everest Acquisition, the “Acquisitions”).

On 23 July 2024, UK TopCo and Everest also entered into a

subscription and contribution agreement, pursuant to which Everest

agreed to contribute (in accordance with the terms of the amendment

agreement dated 17 December 2024) 27,007,522 Shares to UK TopCo at

the Offer Price paid in ordinary shares to be issued by UK TopCo

for the same value (the “Everest Contribution”) and UK MidCo

and the Founder entered into a subscription and contribution

agreement, pursuant to which the Founder agreed to contribute (in

accordance with the terms of the amendment agreement dated 17

December 2024) 4,423,262 Shares to UK MidCo paid in ordinary shares

to be issued by UK MidCo for the same value (the “Founder

Contribution”, and together with the Everest Contribution, the

“Contributions”).

The Acquisitions and the Contributions were subject to the

satisfaction of the following conditions precedent: (i) the payment

of the Exceptional Distribution and (ii) obtaining the regulatory

clearances.

These conditions precedent having been satisfied, the

Contributions were completed on 17 December 2024.

1.3.3. Shareholders’ Agreement

Pursuant to the Consortium and Investment Agreement, the members

of the Consortium have undertaken to enter into a shareholders’

agreement consistent with the terms and conditions included in a

term sheet attached to the Consortium and Investment Agreement and

described below:

(a) Governance

UK MidCo is a a private limited company incorporated under the

laws of England and Wales under the control of a board of directors

(the “Board”). The Board will initially be comprised of

seven (7) directors appointed as follows:

- three (3) directors appointed by CD&R

Stratos;

- three (3) directors appointed by Everest;

and

- OB.

(b) Transfer of the securities

The following provisions are notably contemplated regarding the

transfer of the securities of UK TopCo and UK MidCo:

- lock-up period: all shareholders of UK

TopCo and UK MidCo are prohibited from transferring their shares

for a period of three years, except with regards to customary

transfers to affiliates or family members, or transfers in the

context of a sale of all or substantially all of the securities to

a third party or an IPO;

- drag-along right: all shareholders of UK

TopCo and UK MidCo will be subject to a customary drag-along

obligation in the event of a sale approved by CD&R Stratos and

Everest, or as the case may be, CD&R Stratos or Everest,

depending on the timing of the sale and/or whether certain

financial conditions are met, as the case may be;

- tag-along right: all shareholders of UK

TopCo and UK MidCo will benefit from a customary proportional tag

along right in the event of a transfer of securities of the UK

TopCo by CD&R Stratos or Everest, except with regards to

certain transfers to affiliates or transfers required pursuant to

the drag-along provisions; and

(c) Exit

The following provisions are applicable to an exit:

- initiation of an exit: CD&R Stratos and

Everest can jointly initiate an exit process at any time and each

of CD&R and Everest can individually initiate an exit process

following (i) the fifth anniversary of completion in the case of an

IPO or (ii) the sixth anniversary of completion in the case of a

sale (it being specified that, depending on the timing of the sale,

the initiation of such process by Everest requires that certain

financial conditions are met).

- exit assistance: shareholders of UK TopCo

and UK MidCo agree to provide their reasonable assistance in case

of implementation of an exit process.

1.3.4. Liquidity Agreements

The Offeror will propose to the beneficiaries of the Unvested

Free Shares (as this term is defined in Section 2.4) and

Unavailable Free Shares (as this term is defined in Section 2.4)

(together, the “Covered Shares”) to enter into put and call

options for their Covered Shares in order to enable them to benefit

from cash liquidity for the Covered Shares that could not be

tendered in the Offer (the “Liquidity Agreement”).

Pursuant to the Liquidity Agreement, if an event of squeeze out,

delisting, insufficient liquidity on the market (if the Company

remains listed) or a change of control (together, a “Call

Event”) has occurred, the Offeror will have against each

beneficiary of Covered Shares a call option (the “Call

Option”), whereby the beneficiary irrevocably and

unconditionally undertakes to sell to the Offeror, its Covered

Shares at the Offeror’s request at any time during the applicable

Call Exercise Period (as defined below).

In the event of delisting or squeeze-out of the Company and

absent any exercise of the Call Option by the Offeror during the

Call Exercise Period, as well as in the event of a change of

control, the beneficiaries will benefit from a put option granted

by the Offeror (the “Put Option”, together with the Call

Option the “Options”), whereby the Offeror irrevocably

undertakes to acquire from the beneficiary, its relevant Covered

Shares, upon request by the beneficiary request at any time during

the Put Exercise Period (as defined below).

The exercise price shall correspond to the price per Covered

Share resulting from the fair market valuation carried out by an

expert on the basis of the last consolidated accounts of the

Company relating to the financial year closed on December 31 of the

year preceding the end of the relevant Applicable Restricted Period

(the “Consideration”). By exception, in respect of the Call

Option, the Covered Shares whose vesting period will expire in 2025

may be acquired by the Offeror at an exercise price equal to the

Offer Price.

By way of exception, if the Call Event or Put Event triggering

the exercise of the Options is a change of control, the

Consideration per Covered Share shall be calculated consistently

with the price of the securities transferred as part of the change

of control.

The Unavailable Free Shares for which a Liquidity Agreement will

have been entered into, within the framework of the liquidity

mechanism described above, will be assimilated to the Shares held

by the Offeror in accordance with article L. 233-9 I, 4° of the

French Commercial Code, and will not be covered by the said

squeeze-out.

It is specified that the Options do not contain any contractual

mechanism likely to (i) be analyzed as a price supplement or (ii)

call into question the relevance of the Offer Price per share or

the equal treatment of minority shareholders.

“Applicable Restricted Period” shall mean the period

during which the beneficiary may not dispose of the Covered Shares

without triggering unfavorable tax or social security consequences,

corresponding to the applicable lock-up period pursuant to the

relevant Free Shares Plans; it being specified for the sake of

clarity that the Applicable Restricted Period of certain Covered

Shares may expire after the expiration date of the Applicable

Restricted Period of other Covered Shares of the same Free Shares

Plan, as the case may be.

“Call Exercise Period” shall mean (i) in case of a Call

Event that is a Change of Control, a four-month period starting on

the date of consummation of the Change of Control, and (ii) in case

of any other Call Event, a four-month period starting on the first

business day following the later of (x) the last day of the

Applicable Restricted Period for the Covered Shares and (y) the

date on which the Consideration Notice is issued during the fiscal

year during which the Applicable Restricted Period expires.

“Consideration Notice” shall mean the notice sent by the

Offeror to the beneficiary of the Consideration as determined by an

expert within five (5) business days after receipt by the Offeror

of the expert conclusions.

“Put Exercise Period” shall mean a period starting on the

first business day following the expiry of the Call Exercise Period

applicable to any given Covered Shares and expiring on the 10th of

December of the year during which the Call Exercise Period expired

with respect to such Covered Shares.

1.3.5. Managers and employees undertakings

Certain managers and employees have been proposed to execute

unilateral undertaking vis-à-vis the Offeror to execute an

agreement to contribute their Shares to UK MidCo at the Offer Price

and paid in ordinary shares issued by UK MidCo valued by

transparency with the Offer Price.

Pursuant to such unilateral undertaking, the rolling managers

and employees will enter into a long-form shareholders agreement on

or before the date on which their contribution is implemented and

reflecting customary terms regarding lock-up, drag-along, tag-along

and leaver provisions.

1.3.6. Other agreements of which the Offeror is aware

With the exception of the agreements described in this Section

1.3 (Agreements that may have a significant impact on the

assessment or outcome of the Offer) of this Press Release, the

Offeror is not aware of any other agreement which could have an

impact on the assessment or outcome of the Offer.

2. CHARACTERISTICS OF THE OFFER

2.1. Terms of the Offer

In accordance with Articles 231-13 and 231-18 of the AMF General

Regulation, the Presenting Banks, acting as presenting institutions

on behalf of the Offeror, filed the draft Offer with the AMF on 19

December 2024, in the form of a simplified tender offer for all the

Shares outstanding or to be issued other than the Shares held by

the Offeror (subject to the exceptions set out in Section 2.3

(Number and nature of the Shares targeted by the Offer) of this

Press Release), i.e., a maximum of 29,547,754 Shares. A notice of

filing will be published by the AMF on its website

(www.amf-france.org).

In the context of the Offer, which will be carried out in

accordance with the simplified procedure in accordance with the

provisions of Articles 233-1 et seq. of the AMF General Regulation,

the Offeror irrevocably undertakes to the Company’s shareholders to

acquire all the Shares that will be tendered to the Offer, during

the Offer period, at the Offer Price, i.e., eighteen euros and

ninety-six cents (EUR 18.96) per Share.

The attention of the Company’s shareholders is drawn to the fact

that, as the Offer will be conducted following the simplified

procedure, it will not be reopened following the publication of the

result of the Offer by the AMF.

BNP Paribas, as guaranteeing bank, guarantees the content and

the irrevocable nature of the commitments made by the Offeror as

part of the Offer, in accordance with the provisions of Article

231-13 of the AMF General Regulation.

2.2. Adjustment of the terms of the

Offer

Any distribution of a dividend, interim dividend, reserve, share

premium or any other distribution (in cash or in kind) decided by

the Company where the ex-date or any share capital reduction would

occur before the closing of the Offer, shall give rise to the

adjustment, on a euro-for-euro basis, of the price per Share

proposed in the context of the Offer.

2.3. Number and nature of the Shares

targeted by the Offer

As of the date of the Draft Offer Document, BidCo holds

61,109,300 Shares and 61,109,300 voting rights representing 66.66%

of the share capital and the theoretical voting rights of the

Company10.

The Offer targets all the Shares, whether outstanding or to be

issued, that are not held, directly or indirectly, by the Offeror,

i.e., to the knowledge of the Offeror and as at the date of the

Draft Offer Document, a maximum of 29,547,754 Shares, except for

the Shares held in treasury by the Company, i.e., to the knowledge

of the Offeror and as of the date of the Draft Offer Document,

1,013,232 Shares, which the board of directors of the Company

decided not to tender to the Offer.

To the knowledge of Offeror, as of date of the Draft Offer

Document, except for the Unvested Free Shares granted by the

Company (as described in the Section 2.4), there are no other

equity securities or other financial instruments issued by the

Company or rights conferred by the Company that may give access,

immediately or in the future, to the share capital or voting rights

of the Company.

2.4. Situation of the beneficiaries of Free Shares

To the knowledge of the Offeror, as of the date of the Draft

Offer Document, the Company has set up several plans (the “Free

Shares Plans”) for the allocation of free shares for certain

employees and/or corporate officers of the Company and its Group

(the “Free Shares”).

The main characteristics of the Free Shares Plans as at 18

December 2024 are described in Section 2.4 of the Draft Offer

Document.

Following the adjustment of the Free Shares Plans mentioned

above, and to the Offeror’s knowledge, a maximum of 1,588,023 Free

Shares (in case of outperformance) or 942,159 Free Shares (in case

of the performance conditions are met) are currently under a

vesting period and shall remain so until the estimated closing date

of the Offer (the “Unvested Free Shares”). The Unvested Free

Shares are not included in the Offer (subject to the cases of

lifting of unavailability period provided for by the applicable

legal or regulatory provisions).

As of the date of the Draft Offer Document and to the Offeror’s

knowledge, on 14 May 2024, 63,914 shares have been issued to the

CEO of the Company pursuant to a free shares plan dated 2022. As

per applicable laws, the CEO is required to retain a number of free

shares until termination of his functions (the “Unavailable Free

Shares”).

The Offeror will propose to the beneficiaries of the Unvested

Free Shares and Unavailable Free Shares to enter into put and call

options for their Unvested Free Shares, and as the case may be

Unavailable Free Shares, in order to enable them to benefit from

cash liquidity for such Unvested Free Shares and Unavailable Free

Shares under terms and conditions mentioned in Section 1.3.4 of

this Press Release.

2.5. Terms and conditions of the

Offer

In accordance with Article 231-13 of the AMF General Regulation,

the Presenting Banks, acting on behalf of the Offeror, filed the

Offer and the Draft Offer Document with the AMF on 19 December

2024. A notice of filing of the Offer will be published by the AMF

on its website (www.amf-france.org) on the same day.

In accordance with Article 231-16 of the AMF General Regulation,

the Draft Offer Document, as filed with the AMF, is made available

to the public free of charge at the registered office of the

Offeror and at the Presenting Banks and will be published on the

websites of the Company (www.exclusive-networks.com) and of the AMF

(www.amf-france.org).

The Offer and the Draft Offer Document remain subject to review

by the AMF.

The AMF will publish on its website a clearance decision of the

Offer after having verified its conformity with the legal and

regulatory applicable provisions. Pursuant to the provisions of

Article 231-23 of the AMF General Regulation, this clearance

decision will serve as the approval (“visa”) of the Offer document

of the Offeror.

The Offer document having thus received the AMF’s approval

(“visa”) will, in accordance with the provisions of Article 231-27

of the AMF General Regulation, be made available to the public free

of charge, no later than the day before the opening of the Offer,

at the Offeror’s registered office and at the Presenting Banks.

This document will also be published on the websites of the AMF

(www.amf-france.org) and of the Company

(www.exclusive-networks.com).

In accordance with Article 231-28 of the AMF General Regulation,

the document containing “Other Information” relating to the legal,

financial, accounting and other characteristics of the Offeror will

be made available to the public free of charge, no later than the

day before the opening of the Offer, at the Offeror’s registered

office and at the Presenting Banks. This document will also be

published on the websites of the AMF (www.amf-france.org) and of

the Company (www.exclusive-networks.com).

In accordance with Articles 231-27 and 231-28 of the AMF General

Regulation, press releases specifying the details for obtaining or

consulting these documents made available to the public will be

published, no later than the day before the opening of the Offer,

on the website of the Company (www.exclusive-networks.com).

Prior to the opening of the Offer, the AMF will publish a notice

of opening and the timetable with respect to the Offer, and

Euronext Paris will publish a notice setting out the content of the

Offer and specifying the timetable and terms of its

realization.

2.6. Procedure for tendering Shares to

the Offer

The Shares tendered to the Offer must be freely negotiable and

free from any lien, pledge, collateral or other security interest

or restriction of any kind on the free transfer of their ownership.

The Offeror reserves the right to reject any Shares tendered to the

Offer that do not comply with this condition.

The Offer and all related agreements are subject to French law.

Any dispute or litigation, regardless of the subject matter or

basis, relating to this Offer shall be brought before the court

having jurisdictions.

The Offer will be opened for a period of 12 trading days. The

attention of the Company’s shareholders is drawn to the fact that,

as the Offer will be conducted following the simplified procedure,

in accordance with the provisions of Articles 233-1 et seq. of the

AMF General Regulation, the Offer will not be reopened following

the publication of the result of the Offer by the AMF.

The Shares held in pure registered form (“nominatif pur”) in the

Company’s register will have to be converted and held in

administered registered form (“nominatif administré”) or in bearer

form (“au porteur”) in order to be tendered to the Offer.

Accordingly, holders of Shares held in registered form in an

account managed by a financial intermediary and who would like to

tender their Shares to the Offer should request, as soon as

possible, the conversion of their Shares into administered

registered form or bearer form in order to tender them to the

Offer. Notwithstanding the foregoing, shareholders whose Shares are

held in pure registered form will also be able to tender their

shares to the semi-centralized Offer on Euronext Paris without

first converting them to bearer or administered registered shares

by going through Uptevia, acting as registrar of the Shares.

The Offeror draws the attention of the shareholders to the fact

that those who would expressly request the conversion into bearer

form would lose the advantages of holding the Shares in registered

form.

The shareholders of the Company whose Shares are registered with

a financial intermediary and who would like to tender their Shares

to the Offer must submit to their financial intermediary holding

their Shares a tender or sale order at the Offer Price, i.e.,

eighteen euros and ninety-six cents (EUR 18.96) per Share, by using

the form made available to them by such financial intermediary in

time for their order to be executed and at the latest on the

closing date of the Offer, specifying whether they opt either for

the sale of their Shares directly on the market or for the tender

of their Shares in the semi-centralised Offer by Euronext Paris in

order to benefit from the Offeror reimbursing the brokerage fees by

the Offeror under the conditions described in Section 2.11

(Reimbursement of brokerage fees) below.

Procedure for tendering Shares to the

Offer directly through the market

The shareholders of Exclusive Networks wishing to tender their

Shares to the Offer through the market sale procedure must submit

their sale orders no later than the last day of the Offer and the

settlement-delivery of the Shares sold will occur on the second

trading day following the day of execution of the orders, it being

noted that the trading costs (including the corresponding brokerage

fees and related value-added tax (“VAT”)) relating to such

transactions will remain entirely at the expense of the shareholder

selling directly on the market.

Exane, investment services provider duly authorised as a member

of the stock market, will acquire, on behalf of the Offeror, the

Shares that will be sold on the market in accordance with

applicable regulations.

It should also be noted that the Offeror may acquire Shares in

the context of the Offer by way of off-market purchases in

accordance with applicable laws and regulations and as described in

Section 2.7.

Procedure for tendering Shares in the

semi-centralised Offer by Euronext Paris

Exclusive Networks’ shareholders wishing to tender their Shares

in the semi-centralised Offer by Euronext Paris must submit their

tender order to the financial intermediary with which their Shares

are deposited no later than the last day of the Offer (subject to

specific time limits for certain financial intermediaries). The

settlement-delivery will then occur after completion of the

semi-centralisation transactions.

In this context, the Offeror will bear the shareholders’

brokerage fees under the conditions described in Section 2.11

(Reimbursement of brokerage fees) below.

Euronext Paris will pay directly to the financial intermediaries

the amounts due for the reimbursement of the fees mentioned below,

as from the settlement-delivery date of the

semi-centralisation.

The shareholders of the Company are invited to contact their

financial intermediaries regarding the terms and conditions for

tendering their Shares in the semi-centralised Offer and for

revoking their orders.

2.7. Offeror’s right to purchase Shares

on and off the market during the Offer period

As from the publication by the AMF, pursuant to Article 231-14

of the AMF General Regulation, of the main terms of the proposed

Offer, and until the opening of the Offer, the Offeror intends to

acquire, on the market through BNP Paribas and/or off-market,

Shares in accordance with the provisions of Articles 231-38 and

231-39 of the AMF General Regulation, within the limits set out in

Article 231-38, IV of the AMF General Regulation, corresponding to

a maximum of 30% of the existing Shares targeted by the Offer,

i.e., a maximum of 8,864,326 Shares as at the date of the Draft

Offer Document, by a market order at the Offer Price or by

off-market purchases at the Offer Price.

Such acquisitions will be declared each day to the AMF and

published on the AMF’s website in accordance with the regulations

in force.

2.8. Indicative timetable of the

Offer

Prior to the opening of the Offer, the AMF will publish a notice

of opening and timetable, and Euronext Paris will publish a notice

announcing the terms and timetable of the Offer.

An indicative timetable of the Offer is proposed below for

information purposes only:

Date

Main steps of the

Offer

19 December 2024

- Filing of the Offer and the Offeror’s

Draft Offer Document with the AMF

- Offeror’s Draft Offer Document made

available to the public at the registered office of the Offeror and

at the Presenting Banks and published on the websites of the

Company (www.exclusive-networks.com)

and of the AMF (www.amf-france.org)

- Publication by the Offeror of this Press

Release announcing the filing of the Offer and availability of the

Draft Offer Document

16 January 2025

- Filing of the Company’s draft response

document (projet de note en réponse), including the reasoned

opinion of the Company’s board of directors and the independent

expert’s report

- Company’s draft response document made

available to the public at the Company’s registered office and

published on the websites of the Company (www.exclusive-networks.com) and of the AMF

(www.amf-france.org)

- Publication by the Company of a press

release announcing the filing and the availability of its draft

response document

11 February 2025

- Publication by the AMF of its clearance

decision on the Offer, which serves as the clearance (“visa”) of

the Offeror’s Offer document and of the Company’s response

document.

- Offeror’s final Offer document having

received the AMF’s clearance (“visa”) made available to the public

at the registered office of the Offeror and at the Presenting Banks

and published on the websites of the Company (www.exclusive-networks.com) and of the AMF

(www.amf-france.org)

- Company’s response document having

received the AMF’s approval (“visa”) made available to the public

at the Company’s registered office and published on the websites of

the Company (www.exclusive-networks.com) and of the AMF

(www.amf-france.org)

11 February 2025

- Filing by the Offeror of the “Other

Information” document relating to the legal, financial, accounting

and other characteristics of the Offeror with the AMF

11 February 2025

- Filing by the Company of the “Other

Information” document relating to the legal, financial, accounting

and other characteristics of the Company with the AMF

12 February 2025

- Offeror’s offer document and information

relating to its legal, financial, accounting and other

characteristics are made available to the public and posted to the

websites of the AMF (www.amf-france.org) and the Company

(www.exclusive-networks.com)

- Publication by the Offeror of a press

release announcing the availability to the public of its Offer

document having received the AMF’s clearance (“visa”) and of the

document containing “Other Information” relating to the legal,

financial, accounting and other characteristics

- Company’s response document and

information relating to its legal, financial, accounting and other

characteristics made available to the public and posted to the

websites of the AMF (www.amf-france.org) and the Company

(www.exclusive-networks.com)

- Publication by the Company of a press

release announcing the availability to the public of its response

document having received the AMF’s clearance (“visa”) and of the

document containing “Other Information” relating to its legal,

financial, accounting and other characteristics

12 February 2025

- Publication by the AMF of the notice of

opening of the Offer

- Publication by Euronext Paris of the

notice relating to the Offer and its terms.

13 February 2025

- Opening of the Offer

28 February 2025

- Closing of the Offer

3 March 2025

- Publication by the AMF of the notice of

the result of the Offer

12 March 2025

- Settlement-delivery of the

semi-centralized Offer by Euronext Paris

Week of the 17 March 2025

- Implementation of the squeeze-out

procedure, if applicable

2.9. Costs of the Offer

The overall amount of external fees, costs and expenses incurred

by the Offeror as well as expenses incurred in connection with the

Acquisitions and the Contributions including, in particular, fees

and other expenses relating to its various legal, financial and

accounting advisors, and any other experts and consultants, and the

advertising and communication costs, is estimated to be

approximately EUR 56.5 million (including taxes).

2.10. Financing of the

Offer

As set out in the Section 1.3.1 (Consortium and Investment

Agreement) of this Press Release, the Offer will be funded:

- partially in equity, through a cash

investment from CD&R, of an amount of up to EUR 360,842,129.33

which will be provided through shareholder loans to UK TopCo that

will be cascaded down to the Offeror and then, following the

closing of the Offer, capitalized in consideration for the issuance

of new ordinary shares to be issued by UK TopCo, UK MidCo, French

TopCo, French MidCo, and the Offeror – it being specified that the

number of shares to be issued by such entities pursuant to the

capitalization of the shareholder loans will depend on the number

of Shares acquired by the Offeror in the context of the Offer;

and

- partially in debt, by means of a term loan

made available to the Offeror, under an English law senior

facilities agreement (the “Senior Facilities Agreement”), in

an aggregate maximum principal amount equal to EUR 300,000,000 and

USD 133,000,000 with a maturity of seven years, an opening margin

of 4.5% and whose purpose is, among others, to finance the

Acquisitions and the purchase of the shares during the tender offer

(including the Squeeze-Out) (the “B2 Facility”).

It is also specified that the Senior Facilities Agreement is

structured with four facilities for a maximum principal amount of

up to EUR 1,377,000,000 and USD 400,000,000:

- a B1 facility being a term loan made

available to Everest SubBidco (direct subsidiary of the Company)

and Etna US Finco 1 LLC (for its USD portion) (direct subsidiary of

Everest SubBidco) in an aggregate principal amount equal to EUR

607,000,000 and USD 267,000,000 with a maturity of seven years, an

opening margin of 4.5% and whose purpose is, among others, to

finance the Exceptional Distribution and the refinancing of any

existing indebtedness of the Company and its subsidiaries;

- the B2 Facility (as defined above) which

will also be available to Etna US Finco 2 LLC for its USD portion

(direct subsidiary of the Offeror);

- two delayed draw term loan facility being

two term loans made available to Everest SubBidco in an aggregate

principal amount equal to EUR 235,000,000 with a maturity of seven

years, an opening margin of 4.5% and whose purpose is, among

others, to finance M&A activities, the general corporate and/or

working capital purposes of the Group; and

- a revolving facility made available to each

of the Offeror, the Company and Everest SubBidco in an aggregate

principal amount equal to EUR 235,000,000 with a maturity of six

and a half years, an opening margin of 3.50% and whose purpose is,

among others, to finance the general corporate and/or working

capital purposes of the Group.

The bank financing described above will be secured by, among

others, the granting by the Offeror as pledgor to the benefit of

the lending banks of a pledge of securities account over the shares

it will hold in the Company.

2.11. Reimbursement of brokerage

fees

Except as set out below, no costs or fees paid by the Offeror to

any intermediary or person soliciting the tendering of Shares to

the Offer, or holder who tendered Shares to the Offer will be

reimbursed.

The Offeror will bear the brokerage fees and related VAT paid by

the holders of Shares having tendered their Shares in the

semi-centralized Offer, up to a maximum of 0.3 % (excluding taxes)

of the amount of the Shares tendered to the Offer with a maximum of

one hundred and fifty euros (EUR 150) per file (including VAT).

Holders eligible for the reimbursement of the brokerage fees as

described above (and the related VAT) will only be the holders of

Shares that are registered in an account on the day preceding the

opening of the Offer and who tender their Shares in the

semi-centralized Offer. Holders who sell their Shares directly on

the market will not be entitled to the aforementioned reimbursement

of brokerage fees (and related VAT).

2.12. Offer restrictions

outside of France

The Offer has not been subject to any application for

registration or approval by any financial market regulatory

authority other than the AMF and no measures will be taken in this

respect.

The Offer is therefore made to shareholders of the Company

located in France and outside France, provided that the local laws

to which they are subject allow them to take part in the Offer

without requiring that the Offeror complete additional

formalities.

The publication of the Draft Offer Document, the Offer, the

acceptance of the Offer and the delivery of the Shares may, in

certain jurisdictions, be subject to specific regulations or

restrictions. Accordingly, the Offer is not directed at persons

subject to such restrictions, either directly or indirectly, and

must not be accepted from any jurisdiction where the Offer is

subject to restrictions.

Neither the Draft Offer Document nor any other document relating

to the Offer constitutes an offer to sell or acquire financial

instruments or a solicitation of such an offer in any jurisdiction

in which such an offer or solicitation would be unlawful, could not

validly be made, or would require the publication of a prospectus

or the completion of any other formality under local financial law.

The holders of Shares located outside of France may only

participate in the Offer to the extent that such participation is

permitted under the local laws to which they are subject.

Accordingly, the persons in possession of the Draft Offer

Document are required to obtain information regarding any

applicable local restrictions and to comply with such restrictions.

Failure to comply with such restrictions may constitute a violation

of applicable securities laws.

The Offeror shall not be liable for any breach by any person of

any applicable legal or regulatory restrictions.

United States of America

The Offer is made for the securities of Exclusive Networks, a

company organized under French law, and is subject to French

disclosure and procedural requirements, which are different from

those of the United States. Shareholders in the United States are

advised that the securities of Exclusive Networks are not listed on

a U.S. securities exchange and that Exclusive Networks is not

subject to the periodic reporting requirements of the U.S.

Securities Exchange Act of 1934, as amended (the “U.S. Exchange

Act”), and is not required to, and does not, file any reports

with the U.S. Securities and Exchange Commission (the “SEC”)

thereunder.

The Offer is made in the United States pursuant to Section 14(e)

and Regulation 14E of the U.S. Exchange Act, subject to exemptions

provided by Rule 14d-1(c) under the U.S. Exchange Act for a Tier I

tender offer (the “Tier I Exemption”), and otherwise in

accordance with the disclosure and procedural requirements of

French law, including with respect to withdrawal rights, the offer

timetable, settlement procedures, waiver of conditions and timing

of payments, which are different from those applicable under U.S.

domestic tender offer procedures and law. Holders of securities of

Exclusive Networks domiciled in the United States (the “U.S.

Holders”) are encouraged to consult with their own advisors

regarding the Offer.

The Offer is made to the U.S. Holders on the same terms and

conditions as those made to all other shareholders of Exclusive

Networks to whom an offer is made. Any information documents,

including the Draft Offer Document, are being disseminated to U.S.

Holders on a basis comparable to the method pursuant to which such

documents are provided to Exclusive Networks’ other

shareholders.

As permitted under the Tier I Exemption, the settlement of the

Offer is based on the applicable French law provisions, which

differ from the settlement procedures customary in the United

States, particularly as regards to the time when payment of the

consideration is rendered. The Offer, which is subject to French

law, is being made to the U.S. Holders in accordance with the

applicable U.S. securities laws, and applicable exemptions

thereunder, in particular the Tier I Exemption. To the extent the

Offer is subject to U.S. securities laws, those laws only apply to

U.S. Holders and thus will not give rise to claims on the part of

any other person.

It may be difficult for Exclusive Networks’ shareholders to

enforce their rights and any claims they may have arising under the

U.S. federal or state securities laws in connection with the Offer,

since Exclusive Networks is located outside the United States, and

some or all of its officers and directors may be residents of

countries other than the United States. Exclusive Networks’

shareholders may not be able to sue Exclusive Networks or its

officers or directors in a non-U.S. court for violations of U.S.

securities laws. Further, it may be difficult to compel Exclusive

Networks and/or its respective affiliates to subject themselves to

the jurisdiction or judgment of a U.S. court.

To the extent permissible under applicable law or regulations,

the Offeror may from time to time and during the pendency of the

Offer, and other than pursuant to the Offer, directly or indirectly

purchase or arrange to purchase Shares outside the United States.

These purchases may occur either in the open market at prevailing

prices or in private transactions at negotiated prices. In

addition, to the extent permissible under applicable laws or

regulations, the financial advisors to the Offeror may also engage

in ordinary course trading activities in securities of Exclusive

Networks, which may include purchases or arrangements to purchase

such securities as long as such purchases or arrangements are in

compliance with the applicable law. Information regarding such

purchases or agreements will be published by the AMF on its website

(www.amf-france.org).

The receipt of cash pursuant to the Offer by a U.S. Holder may

be a taxable transaction for U.S. federal income tax purposes and

under applicable U.S. state and local, as well as foreign and

other, tax laws. Each shareholder is urged to consult an

independent professional adviser regarding the tax consequences of

accepting the Offer. Neither the Offeror nor its directors,

officers, employees or agents or any other person acting on their

behalf in connection with the Offer shall be responsible for any

tax effects or liabilities resulting from acceptance of this

Offer.

Neither the SEC nor any U.S. State securities commission has

approved or disapproved the Offer, or passed any comment upon the

adequacy or completeness of the Draft Offer Document. Any

representation to the contrary is a criminal offense in the in the

United States.

2.13. Tax treatment of the

Offer

The tax regime of the Offer is described in Section 2.13 (Tax

regime of the Offer) of the Draft Offer Document.

3. SUMMARY OF ASSESSMENT OF THE OFFER PRICE

The table below displays the summary of the valuation derived

from the valuation methodologies retained and outlines the premium

/ (discount) of implied price per share compared to the ex-post

Offer Price per Share of €18.96 (equivalent to €24.25 ex-ante).

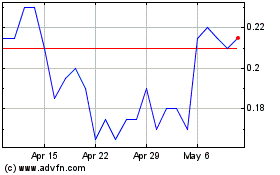

Ex-post Exceptional

Distribution

Analysis of the historical

stock market price

Price per share (€)

Premium (%)

On March 13, 2024

12.75

48.7%

1-month VWAP

12.67

49.6%

3-month VWAP

13.35

42.0%

6-month VWAP

12.75

48.7%

12-month VWAP

13.46

40.9%

12-month highest price

15.71

20.7%

12-month lowest price

9.73

94.9%

Highest price since IPO

15.71

20.7%

Reference to precedent

transaction on Exclusive Networks’ capital

Price paid for the acquisition of

a 3.7% stake from HTIVB (Olivier Breittmayer)

13.71

38.3%

Reference to the price paid

for the acquisition of a block from Permira and Olivier

Breittmayer