Firm Capital Property Trust Reports Solid Q4/2023 Results and Improving AFFO Payout Ratio

March 12 2024 - 4:01PM

Firm Capital Property Trust (“

FCPT” or the

“

Trust”), (TSX: FCD.UN) is pleased to report its

financial results for the three and twelve months ended December

31, 2023.

PROPERTY PORTFOLIO HIGHLIGHTS

The portfolio consists of 65 commercial properties with a total

gross leasable area (“GLA”) of 2,553,184 square

feet, five multi-residential complexes comprised of 599 units and

four Manufactured Home Communities comprised of 537 units. The

portfolio is well diversified and defensive in terms of geographies

and property asset types, with 49% of NOI (42% of asset value)

comprised of grocery anchored retail followed by industrial at 28%

of NOI (32% of asset value). In addition, the portfolio is well

diversified in terms of geographies with 38% of NOI (41% of asset

value) comprised of assets located in Ontario, followed by Quebec

at 37% of NOI (33% of asset value).

TENANT DIVERSIFICATION The

portfolio is well diversified by tenant profile with no tenant

currently accounting for more than 11.2% of total net rent.

Further, the top 10 tenants are comprised of large national tenants

and account for 31.8% of total net rent.

TAX EFFICIENT DISTRIBUTIONS

94% of 2023 Distributions were Return of Capital (“ROC”) or

Non-Taxable. For the year ended December 31, 2023 the

Trust is pleased to report that 88% of distributions were ROC while

6% represented the non-taxable portion of capital gains.

Q4/2023 HIGHLIGHTS

Key highlights for the three months ended

December 31, 2023 are as follows:

- Net income was approximately $6.8 million, compared to $8.7

million net income recorded for the same period in 2022;

- $7.48 Net Asset Value (“NAV”) per Unit;

- Net Operating Income (“NOI”) was approximately

$9.5 million, a 3% increase from the same period in 2022;

- Same Property NOI increased 5% over Q4/2023 and YTD;

- Adjusted Funds From Operations (“AFFO”) was

approximately $4.7 million,10% higher than the same period in

2022;

- AFFO per Unit for Q4/2023 increased by 10% to $0.128 over

Q4/2022.

- Payout ratio decreased to 101% for Q4/2023 from 112% over the

same period in 2022;

- Commercial occupancy was 96.5%, Multi-Residential occupancy was

96.9% while Manufactured Homes Communities was 100.0%;

- The Trust closed on the sale of a retail property from the

Center Ice Retail Portfolio, for gross proceeds of approximately

$2.0 million. The Trust’s pro-rata share of the gross proceeds was

$1.4 million.

- Conservative leverage profile with Debt / Gross Book Value

(“GBV”) at 52.6%; and

- The Trust declared and approved monthly distributions in the

amount of $0.0433 per Trust Unit for Unitholders of record on April

30, 2024, May 31, 2024 and June 28, 2024, payable on or about May

15, 2024, June 17, 2024 and July 15, 2024, respectively.

See chart below for additional information:

| |

Three Months |

|

Twelve Months Ended |

|

|

Dec 31, 2023 |

Dec 31, 2022 |

Change |

|

Dec 31, 2023 |

Dec 31, 2022 |

Change |

|

Rental Revenue |

$14,544,449 |

|

$14,245,157 |

|

2 |

% |

|

$57,508,091 |

|

$54,018,887 |

|

6 |

% |

|

NOI - IFRS Basis |

|

9,451,214 |

|

|

9,165,483 |

|

3 |

% |

|

|

36,727,491 |

|

|

35,457,372 |

|

4 |

% |

| NOI

- Cash Basis |

|

9,459,501 |

|

|

9,163,698 |

|

3 |

% |

|

|

36,597,428 |

|

|

35,074,668 |

|

4 |

% |

|

Same-Property NOI |

|

11,548,507 |

|

|

10,973,479 |

|

5 |

% |

|

|

33,503,483 |

|

|

31,858,318 |

|

5 |

% |

| Net

Income (loss) |

|

6,809,718 |

|

|

8,663,638 |

|

(21 |

%) |

|

|

15,367,821 |

|

|

(1,184,280 |

) |

NM1 |

|

FFO |

|

5,253,312 |

|

|

4,586,850 |

|

15 |

% |

|

|

18,627,450 |

|

|

19,524,208 |

|

(5 |

%) |

|

AFFO |

|

4,739,112 |

|

|

4,327,687 |

|

10 |

% |

|

|

16,700,144 |

|

|

16,445,149 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

|

|

|

$637,378,171 |

|

$633,898,464 |

|

1 |

% |

|

Total Mortgages |

|

|

|

|

|

303,792,112 |

|

|

306,781,314 |

|

(1 |

%) |

|

Credit Facility |

|

|

|

|

|

31,300,000 |

|

|

18,726,067 |

|

67 |

% |

|

|

|

|

|

|

|

|

|

|

Unitholders' Equity |

|

|

|

|

|

291,692,787 |

|

|

296,513,896 |

|

(2 |

%) |

|

Units Outstanding (000s) |

|

|

|

|

|

36,926 |

|

|

37,100 |

|

(0 |

%) |

|

|

|

|

|

|

|

|

|

| FFO

Per Unit |

$0.142 |

|

$0.123 |

|

15 |

% |

|

$0.504 |

|

$0.541 |

|

(7 |

%) |

| AFFO

Per Unit |

$0.128 |

|

$0.116 |

|

10 |

% |

|

$0.452 |

|

$0.456 |

|

(1 |

%) |

|

Distributions Per Unit |

$0.130 |

|

$0.130 |

|

0 |

% |

|

$0.520 |

|

$0.520 |

|

(0 |

%) |

|

|

|

|

|

|

|

|

|

| FFO

Payout Ratio |

|

91 |

% |

|

106 |

% |

(1400 bps) |

|

|

103 |

% |

|

96 |

% |

700 bps |

| AFFO

Payout Ratio |

|

101 |

% |

|

112 |

% |

(1100 bps) |

|

|

115 |

% |

|

114 |

% |

100 bps |

| Wtd.

Avg. Int. Rate - Mort. Debt |

|

|

|

|

|

3.7 |

% |

|

3.8 |

% |

(10) bps |

| Debt

to GBV |

|

|

|

|

|

53 |

% |

|

51 |

% |

137 bps |

|

|

|

|

|

|

|

|

|

| GLA

- Commercial, SF |

|

|

|

|

|

2,553,184 |

|

|

2,552,214 |

|

0 |

% |

|

Units - Multi-Res |

|

|

|

|

|

599 |

|

|

599 |

|

0 |

% |

|

Units - MHCs |

|

|

|

|

|

537 |

|

|

422 |

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

Occupancy - Commercial |

|

|

|

|

|

96.5 |

% |

|

95.9 |

% |

60 bps |

|

Occupancy - Multi-Res |

|

|

|

|

|

96.9 |

% |

|

90.3 |

% |

660 bps |

|

Occupancy MHCs |

|

|

|

|

|

100.0 |

% |

|

99.8 |

% |

20 bps |

|

|

|

|

|

|

|

|

|

| Rent

PSF - Retail |

|

|

|

|

$18.81 |

|

$18.43 |

|

2 |

% |

| Rent

PSF - Industrial |

|

|

|

|

$8.16 |

|

$7.60 |

|

7 |

% |

| Rent

per month - Multi-Res |

|

|

|

|

$1,405 |

|

$1,198 |

|

17 |

% |

|

Rent per month - MHCs |

|

|

|

|

$612 |

|

$603 |

|

1 |

% |

1 NM = Percentage change is not meaningful

For the complete financial statements,

Management’s Discussion & Analysis and supplementary

information, please visit www.sedar.com or the Trust’s website at

www.firmcapital.com.

DISTRIBUTION REINVESTMENT PLAN &

UNIT PURCHASE PLAN The Trust has in place a Distribution

Reinvestment Plan (“DRIP”) and Unit Purchase Plan

(the “UPP”). Under the terms of the DRIP, FCPT’s

Unitholders may elect to automatically reinvest all or a portion of

their regular monthly distributions in additional Units, without

incurring brokerage fees or commissions. Under the terms of the

UPP, FCPT’s Unitholders may purchase a minimum of $1,000 of Units

per month and maximum purchases of up to $12,000 per annum.

Management and trustees have not participated in the DRIP or UPP to

date and own or control approximately 10% of the issued and

outstanding trust units of the Trust.

ABOUT FIRM CAPITAL PROPERTY TRUST (TSX :

FCD.UN) Firm Capital Property Trust is focused on creating

long-term value for Unitholders, through capital preservation and

disciplined investing to achieve stable distributable income. In

partnership with management and industry leaders. The Trust’s plan

is to own as well as to co-own a diversified property portfolio of

multi-residential, flex industrial, and net lease convenience

retail. In addition to stand alone accretive acquisitions, the

Trust will make joint acquisitions with strong financial partners

and acquisitions of partial interests from existing ownership

groups, in a manner that provides liquidity to those selling owners

and professional management for those remaining as partners. Firm

Capital Realty Partners Inc., through a structure focused on an

alignment of interests with the Trust sources, syndicates and

property and asset manages investments on behalf of the Trust.

FORWARD LOOKING INFORMATION

This press release may contain forward-looking

statements. In some cases, forward-looking statements can be

identified by the use of words such as "may", "will", "should",

"expect", "plan", "anticipate", "believe", "estimate", "predict",

"potential", "continue", and by discussions of strategies that

involve risks and uncertainties. The forward-looking statements are

based on certain key expectations and assumptions made by the

Trust. By their nature, forward-looking statements involve numerous

assumptions, inherent risks and uncertainties, both general and

specific, that contribute to the possibility that the predictions,

forecasts, projections and various future events will not occur.

Although management of the Trust believes that the expectations

reflected in the forward-looking statements are reasonable, there

can be no assurance that future results, levels of activity,

performance or achievements will occur as anticipated. Neither the

Trust nor any other person assumes responsibility for the accuracy

and completeness of any forward-looking statements, and no one has

any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or such other

factors which affect this information, except as required by

law.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, which may be made

only by means of a prospectus, nor shall there be any sale of the

Units in any state, province or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under securities laws of any such state, province

or other jurisdiction. The Units of the Firm Capital Property Trust

have not been, and will not be registered under the U.S. Securities

Act of 1933, as amended, and may not be offered, sold or delivered

in the United States absent registration or an application for

exemption from the registration requirements of U.S. securities

laws.

Certain financial information presented in this

press release reflect certain non- International Financial

Reporting Standards (“IFRS”) financial measures,

which include NOI, Same Store NOI, FFO and AFFO. These measures are

commonly used by real estate investment entities as useful metrics

for measuring performance and cash flows, however, they do not have

standardized meaning prescribed by IFRS and are not necessarily

comparable to similar measures presented by other real estate

investment entities. These terms are defined in the Trust’s

Management Discussion and Analysis (“MD&A”)

for the year ended December 31, 2023 as filed on www.sedar.com.

For further information, please contact:

|

Robert

McKee

President & Chief Executive Officer(416)

635-0221 |

|

Sandy PoklarChief Financial Officer(416) 635-0221 |

For Investor Relations information, please

contact:

| Victoria Moayedi Director, Investor Relations (416)

635-0221 |

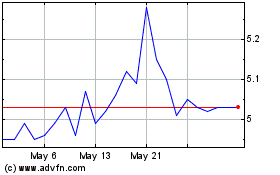

Firm Capital Property (TSX:FCD.UN)

Historical Stock Chart

From Feb 2025 to Mar 2025

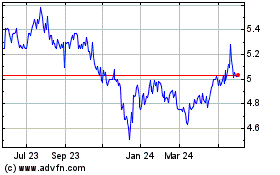

Firm Capital Property (TSX:FCD.UN)

Historical Stock Chart

From Mar 2024 to Mar 2025