Firan Technology Group Corporation (TSX: FTG) today announced

financial results for the third quarter of 2024.

- Third quarter bookings of $45.9M were up 29% over Q3 2023.

- Third quarter revenues of $43.1M were up 18% over Q3 2023.

- FTG achieved Adjusted EBITDA in Q3 2024 of $7.2M, which was up

45% over Q3 2023.

- FTG achieved Net Earnings in Q3 2024 of $2.8M, which was up

109% over Q3 2023.

Business Highlights

In Q3 2024, FTG once again had strong bookings

because of increasing demand from all segments of the Aerospace and

Defence market. This, combined with strong operating performance

and continued progress in integrating last year’s acquisitions,

resulted in the Corporation achieving its best-ever quarterly

financial results for revenue, Adjusted EBITDA and Adjusted Net

Earnings, and also strong cash flow from operating activities.

During Q3 2024, the Corporation has continued to

invest in technology in existing sites, grow the business

organically, and integrate the two acquisitions completed last

year. FTG is strategically deploying its capital in ways that will

drive increased shareholder returns for the future in both the near

term and long term. Specifically, FTG accomplished the following in

Q3 2024, which continues to improve the Company and position it for

the future:

- Integration activities in Circuits Minnetonka progressed well

in the quarter with continued improvements in throughput and

shipments. Demand remained strong across its customer base and new

customer activity progressed well. The site is fully operational in

the FTG standard ERP system they transitioned to in Q2 of this

year. As the quarter ended, a new General Manager was hired to lead

this site into 2025 and beyond.

- Integration activities in Circuits Haverhill advanced with the

installation of new drills and electrical test equipment. The

expansion of the customer base continued in the quarter. The

implementation of the FTG ERP system also progressed in the

quarter.

- Customer orders received in Q3 2024 totaled $45.9M, resulting

in a book-to-bill ratio of 1.07:1, and over the trailing 12 months

period ended Q3 2024, FTG has achieved a book-to-bill ratio of

1.15:1.

- As of August 30, 2024, FTG had total backlog of $121.4M, which

is a 24% increase over the Q3 2023 backlog of $98.0M.

Table 1 / Key Financial

Metrics

|

|

Three months ended |

Nine months ended |

|

|

August 30, |

|

September 1, |

|

|

August 30, |

|

September 1, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

| Sales |

$43,088 |

|

$36,611 |

|

|

$116,852 |

|

$95,209 |

|

| |

|

|

|

|

|

| Gross

Margin |

|

11,623 |

|

|

8,776 |

|

|

|

31,360 |

|

|

28,546 |

|

| Gross Margin

(%) |

|

27.0 |

% |

|

24.0 |

% |

|

|

26.8 |

% |

|

30.0 |

% |

|

|

|

|

|

|

|

|

Net Earnings to FTG Equity Holders |

$2,764 |

|

$1,320 |

|

|

$6,367 |

|

$7,795 |

|

|

|

|

|

|

|

|

| Adjustments |

|

|

|

|

|

|

Government assistance, net of tax |

|

- |

|

|

- |

|

|

|

- |

|

|

(3,758 |

) |

|

Acquisition and divesture expenses, net of tax |

|

- |

|

|

79 |

|

|

|

- |

|

|

615 |

|

|

Adjusted Net Earnings(1) |

$2,764 |

|

$1,399 |

|

|

$6,367 |

|

$4,652 |

|

|

|

|

|

|

|

|

| Earnings Per

Share |

|

|

|

|

|

|

Basic |

$0.12 |

|

$0.06 |

|

|

$0.27 |

|

$0.33 |

|

|

Diluted |

$0.11 |

|

$0.05 |

|

|

$0.26 |

|

$0.32 |

|

| |

|

|

|

|

|

| Adjusted Earnings Per

Share |

|

|

|

|

|

|

Basic |

$0.12 |

|

$0.06 |

|

|

$0.27 |

|

$0.19 |

|

|

Diluted |

$0.11 |

|

$0.06 |

|

|

$0.26 |

|

$0.19 |

|

(1) Adjusted Net Earnings is not a measure

recognized under International Financial Reporting Standards

(“IFRS”). Management believes that this measure is important to

many of the Corporation’s shareholders, creditors and other

stakeholders. The Corporation’s method of calculating Adjusted Net

Earnings may differ from other corporations and accordingly may not

be comparable to measures used by other corporations.

FTG's sales increased by $6.5M, or 17.7%, from

$36.6M in Q3 2023 to $43.1M in Q3 2024. The revenue increase in Q3

2024 was driven by organic growth, including an increase in

Simulator products sales of $1.2M, and favourable foreign exchange

rates. Year-to-date, sales have increased by $21.6M, or 22.7%,

compared to year-to-date 2023. Year-to-date sales growth was driven

by the acquisitions and organic growth, partially offset by lower

simulator product sales and the strike at Aerospace Toronto in Q1

2024.

The Circuits segment sales in Q3 2024 were up $3.6M, or 13.3%,

compared to last year as a result of strong customer demand and

improved throughput. On a year-to-date basis, the Circuits segment

sales were up $22.3M, or 34.9%, with $16.9M from acquisitions and

$5.4M of organic growth. Circuits sites in Minnetonka and Haverhill

were acquired in April 2023, and year-to-date 2024 includes nine

months of operating results for these sites, as compared to four

months in 2023 year-to-date results.

For the Aerospace segment, sales in Q3 2024 increased by $3.4M,

or 34.2%, compared to last year, due to a $1.2M increase in

Simulator products sales and a $2.2M increase in other organic

sales. On a year-to-date basis, Aerospace segment sales decreased

by $0.3M, or 0.8%. This decrease was primarily due to a $6.3M drop

in year-to-date Simulator product sales and a $3.0M impact from the

Aerospace Toronto strike in Q1 24, which was partially offset by

$9.0M in organic growth.

Gross margin in Q3 2024 was $11.6M, or 27.0%, as compared to

$8.8M, or 24.0%, in Q3 2023. The increase in gross margin dollars

and the gross margin rate primarily stems from higher sales volumes

and operational improvements across FTG’s operations. For the

year-to-date period, the gross margin rate excluding government

assistance is 26.8% for 2024, as compared to 26.7% for 2023.

Factors increasing the gross margin rate include leverage from

higher sales volumes and productivity improvements, while factors

decreasing the gross margin rate include the decrease in sales of

Simulator products, which is cyclical in nature, and the strike at

Aerospace Toronto in Q1 2024.

Net earnings after tax at FTG in Q3 2024 was $2.8M or $0.11 per

diluted share compared to net earnings of $1.3M or $0.05 per

diluted share in Q3 2023. The $1.4M increase in net earnings is the

result of both higher sales volume and operational improvements. On

a year-to-date basis, adjusted net earnings was $6.4M or $0.26 per

diluted share compared to adjusted net earnings of $4.7M or $0.19

per diluted share in the prior year period, with the most

significant adjustment being the exclusion of Government support in

the 2023 results. The increase in adjusted net earnings for the

year-to-date period is inclusive of the negative impacts of the

decrease in Simulator products sales and the strike at Aerospace

Toronto.

The Circuits segment earnings before interest and income taxes

(“EBIT”) was $3.5M in Q3 2024 as compared to $2.2M in Q3 2023. The

increase in Circuits segment EBIT is primarily driven by higher

sales volume and operational improvements. Year-to-date, Circuits

segment EBIT was $8.8M as compared to $7.6M in 2023. Excluding the

$2.8M of government assistance in 2023, Circuits segment EBIT

increased by $4.0M.

The Aerospace segment EBIT was $2.4M in Q3 2024 versus $1.6M in

Q3 2023. The increase in earnings was driven by the increase in

sales. Year-to-date, Aerospace segment EBIT was $5.8M as compared

to $6.7M in 2023 with sales being relatively flat. Excluding $1.0M

of government assistance in 2023, Aerospace segment EBIT was up

$0.1M. Aerospace segment EBIT in 2024 has been negatively impacted

by lower Simulator revenue and the strike in Q1 2024 at Aerospace

Toronto.

Table 2 / EBITDA

|

|

Three months ended |

|

Nine months ended |

|

Trailing 12 Months |

|

|

August 30, |

September 1, |

|

August 30, |

September 1, |

|

|

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

Net earnings to equity holders of FTG |

$2,764 |

$1,320 |

|

$6,367 |

$7,795 |

|

|

$10,193 |

|

Add: |

|

|

|

|

|

|

|

|

Interest and accretion |

|

569 |

|

542 |

|

|

1,681 |

|

771 |

|

|

|

2,193 |

|

Income taxes |

|

1,446 |

|

944 |

|

|

3,257 |

|

2,693 |

|

|

|

2,789 |

|

Depreciation and amortization |

|

2,160 |

|

1,998 |

|

|

6,285 |

|

4,938 |

|

|

|

8,235 |

|

EBITDA(1) |

$6,939 |

$4,804 |

|

$17,590 |

$16,197 |

|

|

$23,410 |

|

Adjustments |

|

|

|

|

|

|

|

|

Stock based compensation |

|

247 |

|

90 |

|

|

633 |

|

315 |

|

|

|

830 |

|

Government assistance |

|

- |

|

- |

|

|

- |

|

(3,758 |

) |

|

|

- |

|

Acquisition and divesture expenses |

|

- |

|

79 |

|

|

- |

|

615 |

|

|

|

- |

|

Adjusted EBITDA(1) |

$7,186 |

$4,973 |

|

$18,223 |

$13,369 |

|

|

$24,240 |

(1) EBITDA and Adjusted EBITDA are not

measures recognized under International Financial Reporting

Standards (“IFRS”). Management believes that these measures are

important to many of the Corporation’s shareholders, creditors and

other stakeholders. The Corporation’s method of calculating EBITDA

and Adjusted EBITDA may differ from other corporations and

accordingly may not be comparable to measures used by other

corporations.

Adjusted EBITDA for Q3 2024 was $7.2M or 16.7%

of sales, as compared to $5.0M or 13.6% of sales in Q3 2023. The

increase in profitability is driven by increased operating leverage

from higher sales and operational improvements across FTG’s

operations. For the trailing twelve months period ended August 30,

2024, adjusted EBITDA was $24.2M or 16.1% of sales as compared to

$19.4M or 14.3% of sales for the full year 2023.

As at August 30, 2024, the Corporation’s net

working capital was $47.8M, compared to $41.0M at year-end in

2023.

Cash flow from operating activities in Q3 2024

was $5.3M as compared to $3.5M in Q3 2023 primarily due to higher

net earnings. Cash used for lease liability payments was $1.0M in

Q3 2024 as compared to $0.9M in Q3 2023. Year-to-date cash flow

from operating activities was $10.0M in 2024 as compared to $7.3M

in the same period in 2023. Excluding $3.8M of Employee Retention

Credit included in the year-to-date period in 2023, year-to-date

cash flow from operating activities increased by $6.5M.

Net debt at the end of Q3 2024 was $2.2M

compared to net debt of $3.6M at the end of 2023. During the

quarter, the Corporation paid the holdback on the IMI acquisition

of $0.4M. In addition, FTG has access to committed credit lines of

approximately $23.8M.

The Corporation will host a live conference call

on Wednesday, October 9, 2024, at 4:00pm (Eastern) to discuss the

results of Q3 2024.

Anyone wishing to participate in the call should dial

1-289-514-5100 or 1-800-717-1738, Conference ID 24844, and identify

that you are calling to participate in the FTG conference call. The

Chair is Mr. Brad Bourne. A replay of the call will be available

until November 15, 2024, and will be available on the FTG website

at www.ftgcorp.com. The number to call for a rebroadcast is

1-289-819-1325 or 1-888-660-6264, Playback Passcode 24844#.

ABOUT FIRAN TECHNOLOGY GROUP CORPORATION

FTG is an aerospace and defence electronics

product and subsystem supplier to customers around the globe. FTG

has two operating units:

FTG Circuits is a manufacturer of high

technology, high reliability printed circuit boards. Our customers

are leaders in the aviation, defence, and high technology

industries. FTG Circuits has operations in Toronto, Ontario,

Chatsworth, California, Fredericksburg, Virginia, Minnetonka,

Minnesota, Haverhill Massachusetts and a joint venture in Tianjin,

China.

FTG Aerospace manufactures and repairs

illuminated cockpit panels, keyboards and electronic assemblies for

original equipment manufacturers of aerospace and defence

equipment. FTG Aerospace has operations in Toronto, Ontario,

Chatsworth, California, and Tianjin, China.

The Corporation's shares are traded on the

Toronto Stock Exchange under the symbol FTG.

FORWARD-LOOKING STATEMENTS

This news release contains certain

forward-looking statements. These forward-looking statements are

related to, but not limited to, FTG’s operations, anticipated

financial performance, business prospects and strategies.

Forward-looking information typically contains words such as

“anticipate”, “believe”, “expect”, “plan” or similar words

suggesting future outcomes. Such statements are based on the

current expectations of management of the Corporation and

inherently involve numerous risks and uncertainties, known and

unknown, including economic factors and the Corporation’s industry,

generally. The preceding list is not exhaustive of all possible

factors. Such forward-looking statements are not guarantees of

future performance and actual events and results could differ

materially from those expressed or implied by forward-looking

statements made by the Corporation. The reader is cautioned to

consider these and other factors carefully when making decisions

with respect to the Corporation and not place undue reliance on

forward-looking statements. Other than as may be required by law,

FTG disclaims any intention or obligation to update or revise any

such forward-looking statements, whether as a result of new

information, future events or otherwise.

For further information please

contact:

Bradley C. Bourne, President and CEOFiran

Technology Group CorporationTel: (416) 299-4000

x314bradbourne@ftgcorp.com

Jamie Crichton, Vice President and CFOFiran

Technology Group CorporationTel: (416) 299-4000

x264jamiecrichton@ftgcorp.com

Additional information can be found at the

Corporation’s website www.ftgcorp.com

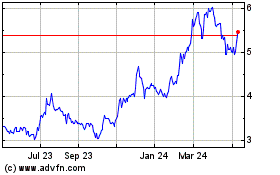

Firan Technology (TSX:FTG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Firan Technology (TSX:FTG)

Historical Stock Chart

From Mar 2024 to Mar 2025