Imperial Reports 2013 Financial Results

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 31, 2014) -

Imperial Metals Corporation (the "Company") (TSX:III) reports

financial results for its fiscal year ended December 31, 2013(1).

Net income for the year ended December 31, 2013 was $41.0 million

($0.55 per share) compared to net income of $32.6 million ($0.44

per share) in 2012. In addition to variances in revenues and income

from mine operations, variations in net income period over period

are predominately attributable to movements in foreign exchange and

realized and unrealized gains and losses on derivative instruments

and taxes.

In 2013 net income was negatively impacted by foreign exchange

losses of $2.5 million compared to foreign exchange losses of $0.5

million in 2012 primarily on foreign exchange movements on the

increased US Dollar debt being carried by the Company. The average

CDN/US Dollar exchange rate in 2013 was 1.03 compared to an average

of 1.00 in 2012, and at December 31, 2013 the CDN/US Dollar

exchange rate was 1.06.

In 2013 the Company recorded gains on derivative instruments of

$1.6 million compared to losses of $2.8 million in 2012. The

decrease in the copper and gold price compared to the price in the

derivative contracts resulted in a gain in 2013 compared to a loss

in 2012.

Revenues were $187.8 million in 2013 compared to $199.4 million

in 2012. Revenues are impacted by the timing and quantity of

concentrate shipments, metal prices and exchange rate, and period

end revaluations of revenue attributed to concentrate shipments

where copper price will settle at a future date. The decrease in

revenue in 2013 over 2012 is due to lower copper and gold prices

partially offset by a weaker Canadian dollar and a larger volume of

concentrate shipped for the year. There were eight concentrate

shipments in 2013 compared to seven shipments in 2012. The increase

in shipment volumes was more than offset by lower copper and gold

prices in 2013 compared to 2012.

The London Metals Exchange cash settlement copper price per

pound averaged US$3.32 in 2013 compared to US$3.61 in 2012. The

London Metals Exchange cash settlement gold price per troy ounce

averaged US$1,411 in 2013 compared to US$1,667 in 2012. The CDN

Dollar compared to the US Dollar averaged about 3% lower in 2013

than in 2012. In CDN Dollar terms the average copper price in 2013

was CDN$3.42 per pound compared to CDN$3.61 per pound in 2012 and

the average gold price in 2013 was CDN$1,451 per ounce compared to

CDN$1,667 per ounce in 2012.

Revenue in 2013 was decreased by a $7.1 million negative revenue

revaluation compared to a negative revenue revaluation of $2.5

million in 2012. Negative revenue revaluations are the result of

the copper price on the settlement date and/or the current period

balance sheet date being lower than when the revenue was initially

recorded or the copper price at the last balance sheet date. The

copper price started the year at US$3.67 per pound and ended the

year at US$3.35 per pound, compared to the prior year where the

copper price started the year at US$3.48 per pound and ended the

year US$3.59 per pound.

Income from mine operations increased to $64.3 million from

$56.9 million in 2012 as result improved contribution margins from

mine operations.

The Company recorded $8.3 million as its equity share of

Huckleberry's net income during 2013 compared to $5.5 million

equity income in 2012.

Income and mining tax expense increased by $4.3 million from

2012 to 2013 due primarily to higher income before taxes. Cash flow

increased to $78.2 million in 2013 from $66.6 million in 2012. Cash

flow is a measure used by the Company to evaluate its performance,

however, it is not a term recognized under IFRS in Canada. Cash

flow is defined as cash flow from operations before the net change

in non-cash working capital balances, income and mining taxes paid,

and interest paid. The Company believes cash flow is useful to

investors and it is one of the measures used by management to

assess the financial performance of the Company.

Capital expenditures of $397.2 million in 2013, inclusive of

equipment financed by long term debt and capitalized interest, were

up from $147.9 million in 2012. The expenditures in 2013 were

financed by cash flow from the Mount Polley mine, short term and

non-current debt and $38.9 million in equipment financing. At

December 31, 2013 the Company had $3.1 million (December, 2012-$2.8

million) in cash. The short term debt balance at December 31, 2013

was $132.4 million (December 31, 2012-$92.4 million). The increase

in the short term debt is primarily due to funding the development

of the Red Chris project with short term debt which subsequent to

year end was fully repaid from the long term financings.

|

|

|

|

Selected Annual Financial Information |

|

Years Ended December 31 |

|

[expressed in thousands, except share amounts] |

|

2013 |

|

|

2012 |

|

|

2011 |

| Total

Revenues |

|

$ |

187,805 |

|

|

$ |

199,373 |

|

|

$ |

165,590 |

| Net

Income |

|

$ |

40,954 |

|

|

$ |

32,626 |

|

|

$ |

48,708 |

| Net

Income per share |

|

$ |

0.55 |

|

|

$ |

0.44 |

|

|

$ |

0.66 |

|

Diluted Income per share |

|

$ |

0.54 |

|

|

$ |

0.43 |

|

|

$ |

0.65 |

|

Adjusted Net Income(2) |

|

$ |

40,051 |

|

|

$ |

36,807 |

|

|

$ |

31,333 |

|

Adjusted Net Income per share(2) |

|

$ |

0.54 |

|

|

$ |

0.50 |

|

|

$ |

0.42 |

|

Adjusted EBITDA(2) |

|

$ |

86,600 |

|

|

$ |

72,585 |

|

|

$ |

67,465 |

|

Working Capital (deficiency)(3) |

|

$ |

(162,758 |

) |

|

$ |

(74,438 |

) |

|

$ |

8,599 |

| Total

Assets |

|

$ |

975,451 |

|

|

$ |

600,348 |

|

|

$ |

457,755 |

| Total

Long Term Debt (including current portion) |

|

$ |

244,382 |

|

|

$ |

8,341 |

|

|

$ |

1,612 |

| Cash

dividends declared per common share |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

| Cash

Flow(1) |

|

$ |

78,213 |

|

|

$ |

66,646 |

|

|

$ |

53,116 |

| Cash

Flow per share(1) |

|

$ |

1.05 |

|

|

$ |

0.90 |

|

|

$ |

0.72 |

|

| (1) Cash flow and cash flow per

share are measures used by the Company to evaluate its performance

however they are not terms recognized under IFRS. Cash flow is

defined as cash flow from operations before the net change in

non-cash working capital balances, income and mining taxes, and

interest paid and cash flow per share is the same measure divided

by the weighted average number of common shares outstanding during

the period. |

| (2) Refer to table under

heading Non-IFRS Measures for details of the calculation of these

amounts |

| (3) Defined as current assets

less current liabilities. |

Non-IFRS Measures

In March 2014 the Company added two non-IFRS financial measures,

Adjusted EBITDA

(Earnings Before Interest, Taxes, Depreciation and

Amortization)

and cash cost per pound of copper produced, which are described

further below. The Company expects to include these financial

measures in future quarterly and annual financial reports.

Adjusted Net Income

Adjusted net income in 2013 was $40.1 million ($0.54 per share)

compared to $36.8 million ($0.50 per share) in 2012. Adjusted net

income is calculated by removing the gains or losses, net of

related income taxes, resulting from mark to market revaluation of

copper derivative instruments not related to the current period,

net of taxes, as further described in the MD&A(1) under the

heading Non-IFRS Measures Adjusted Net Income.

Adjusted EBITDA

Adjusted EBITDA in 2013 was $86.6 million compared to $72.6

million in 2012.

We define Adjusted EBITDA as net income (loss) before interest

expense, taxes and depletion and depreciation and as adjusted for

the items described below.

Adjusted EBITDA is not necessarily comparable to similarly

titled measures used by other companies. We believe that the

presentation of Adjusted EBITDA is appropriate to provide

additional information to investors about certain non-cash or

unusual items that we do not expect to continue at the same level

in the future, or other items that we do not believe to be

reflective of our ongoing operating performance. We further believe

that our presentation of this non-IFRS financial measure provides

information that is useful to investors because it is an important

indicator of the strength of our operations and the performance of

our core business.

Adjusted EBITDA is not a measurement of operating performance or

liquidity under IFRS and should not be considered as a substitute

for earnings from operations, net income or cash generated by

operating activities computed in accordance with IFRS. Adjusted

EBITDA, further described in the MD&A(1) under the heading

Non-IFRS Measures Adjusted EBITDA, has limitations as an

analytical tool. Because of these limitations Adjusted EBITDA

should not be considered as a measure of discretionary cash

available to us to invest in the growth of our business.

Adjustments to EBIDTA include: interest expense, accretion of

future site reclamation provisions, depletion and depreciation,

income and mining taxes, unrealized losses (gains) on derivative

instruments, foreign exchange losses (gains), share based

compensation, bad debt expense (recovery), revaluation losses

(gains) on marketable securities, losses (gains) on sale of mineral

properties, write down of mineral properties. Refer to the table in

the MD&A(1) under the heading Non-IFRS Measures Adjusted

EBITDA for details of the calculation of Adjusted EBITDA.

|

|

|

|

Cash Cost Per Pound of Copper Produced |

|

Years Ended December 31 |

|

|

|

2013 |

|

2012 |

|

|

|

US$/lb |

|

US$/lb |

| Mount

Polley |

|

$ |

0.88 |

|

$ |

1.20 |

|

Huckleberry |

|

$ |

2.10 |

|

$ |

2.53 |

|

Composite (100% Mount Polley and 50% Huckleberry based on

pounds of copper produced) |

|

$ |

1.31 |

|

$ |

1.65 |

The cash cost per pound of copper produced, derived from the sum

of cash production costs, transportation and offsite costs,

treatment and refining costs, net of by-product and other revenues,

divided by the number of pounds of copper produced during the

period, is a non-IFRS financial measure that does not have a

standardized meaning under IFRS, and as a result may not be

comparable to similar measures presented by other companies.

Management uses this non-IFRS financial measure to monitor

operating costs and profitability. The Company is primarily a

copper producer and therefore calculates this non-IFRS financial

measure individually for its two copper producing mines, Mount

Polley and Huckleberry, and on a composite basis for these two

mines. Refer to the table in the MD&A(1) under the heading

Non-IFRS Measures Estimated Cash Cost per Pound of Copper

Produced for details of the calculation of cash cost per pound

of copper produced for 2013 and 2012.

Derivative Instruments

During 2013 the Company recorded gains of $1.6 million on

derivative instruments compared to losses of $2.8 million in 2012.

These gains and losses result from the mark to market valuation of

the derivative instruments based on changes in the price of copper

and gold. These amounts include realized gains of $0.1 million in

2013 and realized losses of $0.4 million in 2012. The Company does

not use hedge accounting therefore accounting rules require that

derivative instruments be recorded at fair value on each statement

of financial position date, with the adjustment resulting from the

revaluation being charged to the statement of income as a gain or

loss.

The Company utilizes a variety of derivative instruments

including the purchase of puts, forward sales and the use of

min/max zero cost collars. The Company's income or loss from

derivative instruments may be very volatile from period to period

as a result of changes in the copper and gold prices compared to

the copper and gold prices at the time when these contracts were

entered into and the type and length of time to maturity of the

contracts.

Derivative instruments for Mount Polley cover about 71% of the

estimated copper settlements through to December 2014 via min/max

zero cost collars and 61% of the estimated gold settlements via

min/max zero cost collars through December 2015.

At December 31, 2013 the Company has net unrealized gains on its

derivative instruments. This represents an increase in fair value

of the derivative instruments from the dates of purchase to

December 31, 2013.

Fourth Quarter Results

Mineral sales revenues in the fourth quarter of 2013 were $44.0

million, $14.6 million lower than in the same quarter of 2012.

There were a total of two shipments in each of the fourth quarters

of 2013 and 2012 from Mount Polley. Sales revenue is recorded when

title for concentrate is transferred on ship loading. Variations in

quarterly revenue attributed to the timing of concentrate shipments

can be expected in the normal course of business.

The decrease in revenue in the 2013 quarter is largely due to

lower copper and gold prices.

The Company recorded net income of $8.1 million ($0.11 per

share) in the fourth quarter of 2013 compared to net income of

$11.7 million ($0.16 per share) in the prior year quarter.

Expenditures for exploration and ongoing capital projects at

Mount Polley, Red Chris and Sterling totaled $117.4 million during

the three months ended December 31, 2013 compared to $52.2 million

in the 2012 comparative quarter. The increase of $65.2 million in

2013 was primarily due to higher development expenditures at Red

Chris.

Developments During 2013

Mount Polley Mine

At Mount Polley, 2013 production totaled 38.5 million pounds

copper and 45,823 ounces gold, compared to the 33.8 million pounds

copper and 52,236 ounces gold produced in 2012. Copper production

was up on higher grades and recovery, while gold production was

lower with lower gold grades being treated. The annual average mill

throughput was 21,799 tonnes per day down slightly from the record

of 22,191 tonnes per day set in 2012. Mining at Mount Polley

continues to be focused on the lower benches of the phase 3

Springer pit, which has lower levels of oxidation and as a result,

copper and gold recovery were both higher in 2013 than in 2012.

Forecast production for 2014 from Mount Polley is 44.0 million

pounds copper, 47,000 ounces gold and 120,000 ounces silver.

|

|

|

|

|

|

|

|

Annual Production |

|

2013 |

|

2012 |

|

2011 |

| Ore

milled - tonnes |

|

7,956,738 |

|

8,121,878 |

|

7,716,856 |

| Ore

milled per calendar day - tonnes |

|

21,799 |

|

22,191 |

|

21,142 |

| Grade

% - copper |

|

0.295 |

|

0.280 |

|

0.265 |

| Grade

g/t - gold |

|

0.263 |

|

0.304 |

|

0.272 |

|

Recovery % - copper |

|

74.46 |

|

67.40 |

|

58.70 |

|

Recovery % - gold |

|

68.09 |

|

65.70 |

|

62.90 |

|

Copper - lbs |

|

38,501,165 |

|

33,789,600 |

|

26,450,426 |

| Gold

- oz |

|

45,823 |

|

52,236 |

|

42,514 |

|

Silver - oz |

|

123,999 |

|

116,101 |

|

95,786 |

Underground activities at the Boundary zone continued with the

excavation of the ramps, and installation of a ventilation system,

and other facilities required to mine a test stope of approximately

250,000 tonnes. Blast hole drilling is underway with 3,900 metres

completed by end of March 2014. This operation is schedule to

deliver approximately 700 tonnes of ore per day to the mill

starting in April 2014. This higher grade underground ore is a key

reason for the planned increase in copper production in 2014.

At January 1, 2014 remaining reserves for Mount Polley were 86.0

million tonnes grading 0.295% copper and 0.303 g/t gold.

Exploration, development and capital expenditures at Mount

Polley were $74.5 million in 2013 (2012-$29.5 million).

Huckleberry Mine

Increase in copper grade and recovery in 2013 resulted in 41.2

million pounds copper produced, up 17% from 35.1 million pounds in

2012. Huckleberry's 2014 forecast production was to be 42.0 million

pounds copper and 200,000 ounces silver, however with the failure

of the SAG mill bull gear on February 26, 2014 this production

level will likely not be met. Crews have been working diligently to

fully assess and repair the damage caused by this failure. In early

April, Huckleberry plans to resume normal operations with the SAG

mill rotating in the opposite direction. The damaged bull gear will

be replaced later this year.

|

|

|

|

|

|

|

|

Annual Production* |

|

2013 |

|

2012 |

|

2011 |

| Ore

milled - tonnes |

|

5,895,193 |

|

5,876,900 |

|

5,684,300 |

| Ore

milled per calendar day - tonnes |

|

16,151 |

|

16,057 |

|

15,573 |

| Grade

% - Copper |

|

0.346 |

|

0.301 |

|

0.396 |

|

Recovery % - Copper |

|

91.6 |

|

90.0 |

|

91.7 |

|

Copper - lbs |

|

41,212,818 |

|

35,112,000 |

|

45,510,000 |

| Gold

- oz |

|

2,983 |

|

2,578 |

|

3,195 |

|

Silver - oz |

|

238,028 |

|

191,787 |

|

223,557 |

|

|

*production stated 100% - Imperial's allocation is 50% |

Huckleberry's income from mine operations was $31.2 million in

2013 compared to $24.8 million in 2012. Huckleberry's income from

mine operations increased due to a greater number of shipments in

the period (seven in 2013 versus six in 2012).

During 2013 Huckleberry completed 18 drill holes for a total of

5,242 metres of diamond drilling in the mine site area. The

majority of this work was directed towards filling in gaps in

historic drilling and expanding resources directly to the west,

south, southwest and northeast of the planned Main Zone

Optimization (MZO) pit. Several holes were also drilled at the

limits of the MZ Deep target, an extensive zone located between the

Main and East zone pits, to determine the extent of the zone and to

determine its relationship to the other ore zones at Huckleberry.

This drilling, in conjunction with drilling data from 2012, appears

to indicate the presence of a geological continuity of dominantly

low-grade mineralization at depth between Huckleberry's major ore

bodies.

A geochemical soil sampling program on the adjacent Huckleberry

North claims was also completed in 2013. Results from this program

will be used to guide additional work on these claims in 2014.

The new tailings storage facility (TMF-3) construction on the

starter and saddle dams, as well as the piping, pumping, cycloning

and power infrastructure required to operate the TMF3 was completed

in August 2013 and is now being operated. The TMF-3 is being used

for storage of tailings and potentially acid generating (PAG)

waste, generated by the operation.

Huckleberry ore reserves at December 31, 2013 were 42,746,600

tonnes grading 0.330% copper and 0.009% molybdenum. The strip ratio

is approximately 0.7 to 1.0 including the backfilled waste and

tailings that must be removed from the MZO pit.

Exploration, development and capital expenditures at Huckleberry

were $77.7 million in 2013 compared to $88.3 million in 2012.

Imperial holds a 50% interest in Huckleberry Mines Ltd. The

remaining 50% interest is held by a consortium consisting of

Mitsubishi Materials Corporation, Dowa Mining Co. Ltd. and Furukawa

Co.

Note 5 to the audited Consolidated Financial Statements of the

Company for the year ended December 31, 2013 discloses information

on the impact of Huckleberry operations on the financial position

and results of operations of Imperial.

Red Chris Mine Construction Update

To December 31, 2013 the Company had incurred expenditures of

$438.8 million on the construction of Red Chris of which $47.8

million was in accounts payable and accruals at that date. Until

closing of the long term financing arrangements for the Red Chris

project in March 2014, the expenditures on Red Chris were financed

from cash flow from operations, a line of credit facility from the

Company's bankers, equipment loans and a $250.0 million line of

credit facility from Edco Capital Corporation. Concurrent with the

closing of the long term financing arrangements after year end, the

existing bank line of credit and the line of credit facility from

Edco Capital Corporation were repaid in full and cancelled.

The long term financing arrangements for the Company, to be

utilized primarily for the construction of Red Chris, consist of

US$325.0 million 7% five year senior unsecured notes, a senior

secured $200.0 million revolving credit facility, and a five year

$75.0 million junior unsecured credit facility with Edco Capital

Corporation.

The 287kv Northwest Transmission Line (NTL) from Skeena

substation to Bob Quinn is under construction by BC Hydro with a

targeted completion date of May 2014. The 93 kilometre Iskut

extension of the NTL from Bob Quinn to Tatogga is under

construction by the Company with a targeted completion date of June

2014.

Construction of access roads and right of way clearing for the

Iskut extension of the NTL is 100% complete. A 150 person camp and

laydown yards were established along the route to store and

assemble lattice structure components. An experienced power line

constructor has installed to date approximately 57% of the

foundations and assembled 82% of the structures; the remaining

foundations and structures, hardware and conductor will be

installed in the coming months.

Red Chris on-site work began in May 2012. The current status of

site work is:

- A construction camp to house 480 employees and contractors is

fully operational;

- truck shop, warehouse and concentrate shed is complete and

currently being used as dry storage for equipment;

- concrete placement and structural steel erection are complete

for the coarse ore handling facilities, the primary crusher

building, the mechanically stabilized earth wall, the overland

conveyor, the transfer towers and the reclaim tunnel;

- concrete foundations for the 287kv main substation and the

reagent building are complete;

- pre-engineered process plant building is fully enclosed and

internal concrete is approximately 97% complete;

- mechanical installations site wide are approximately 50%

complete;

- North Starter Dam has been built to 1097 metre elevation

providing adequate water storage for mill startup;

- tailings and reclaim system of pipelines and booster pump house

is approximately 25% complete.

Planned activities in 2014 will include the final installation

of the primary crusher, process water tanks, interior steel,

grinding mills, electrical equipment, reagent building and tailings

system. Construction of the 287kv 17 kilometre power line from

Tatogga to the mine site began in January 2014. Mine

pre-development began in January 2014 with the start of stripping

of overburden from the East zone of the Red Chris mine. The Company

is targeting to commence commissioning of the Red Chris mine in

June 2014 and to achieve full operations in the fourth quarter of

2014.

The cost of constructing the Red Chris mine is now forecast to

be $540 million, approximately 8.0% over the December 2012

estimate. The major areas of increase are:

- Certain contractor tenders for 2013 Request for Proposals were

above the cost estimate. These increases were mitigated in part by

Red Chris choosing to self-perform the mechanical and piping

installations;

- Tailings impoundment area earthwork construction costs overran

as additional borrow materials were excavated to uncover suitable

filter zone and till core for placement and compaction. The filter

zone was screened, hauled and placed with small equipment at extra

cost. The additional sand and gravel overburden exposed during

borrow development was placed on the future 2015-2016 dam

construction footprint, which will result in lower tailing dam

construction costs in 2015 than previously forecast. Both these

activities were not budgeted in the original estimate.

|

|

|

|

|

|

Sterling Mine |

|

|

|

|

|

|

Annual Production |

|

2013 |

|

2012 |

| Ore

Stacked - tons |

|

160,789 |

|

77,944 |

| Gold

Grade - oz/ton |

|

0.083 |

|

0.082 |

| Gold

ounces - added to heap |

|

13,348 |

|

6,393 |

| Gold

ounces - in-process & poured |

|

7,142 |

|

3,613 |

|

Gold shipped - ounces |

|

7,431 |

|

2,852 |

Sterling shipped 7,431 ounces gold in 2013. Forecast production

for 2014 from Sterling is 8,000 ounces gold. An engineering design

was submitted and approved by the Nevada Division of Environmental

Protection to increase the permitted height of the leach pad, and

to line the "wedge" area between the old and new heaps. At year's

end the leach pad surface had been leveled to allow for dumping to

the greater height. Installation of the additional liner will

depend upon the need for added capacity. These design changes add

130,000 tons to the leach pad capacity.

Underground production will continue from the stoping until the

known reserves are exhausted mid-year. Any positive results from

the underground drill program have the potential to add to the

mine's expected life.

Permitting and planning for an open pit mine and a new heap

leach pad are underway, for the potential mining of previously

uneconomic mineralization on the property.

Exploration, development and capital expenditures, net of

preproduction revenues including capitalized depreciation totaled a

$1.7 million recovery in 2013, compared to a total expenditure of

$6.2 million in 2012. The Sterling mine recommenced operations on

July 2012 and reached commercial production in March 2013. In

accordance with the Company's accounting policy, all revenue and

related operating costs prior to commercial production were applied

to the carrying value of the Sterling mineral property.

Ruddock Creek Joint Venture Project

The Joint Venture completed a field program in 2013 which

included site infrastructure studies, metallurgical testing

including dense media separation, spiral, flotation, mineralogical,

acid base accounting, and humidity cell testing. The work included

collecting and testing mineralized material from each of the Lower

E, Creek and V zones, and collecting and testing representative

samples of each rock type identified on the property. The

collection of baseline environmental and geotechnical information

included trenching and geotechnical core drilling in order to

provide data for future permitting and engineering studies. Surface

exploration carried out during the quarter included detailed

geological and structural mapping in a number of areas, as well as

the collection of mineralized and non-mineralized rock samples for

age-dating purposes. A higher capacity water control structure for

the underground discharge was constructed. Ongoing consultations

continued with area First Nations.

The Ruddock Creek Joint Venture is owned by Imperial (50%),

Mitsui Mining and Smelting Co. Ltd. (30%) and Itochu Corporation

(20%). The Ruddock Creek zinc/lead property is located 155

kilometres northeast of Kamloops in the Scrip Range of the Monashee

Mountains in southeast British Columbia.

Outlook for 2014

Operations, Earnings and Cash Flow

Base and precious metals production allocable to Imperial in

2014 from the Mount Polley, Huckleberry and Sterling mines is

anticipated to be 65.0 million pounds copper, 56,700 ounces gold

and 220,000 ounces silver. The copper production estimate will be

impacted by the bull gear failure at Huckleberry. Huckleberry

production originally estimated at 42.0 million pounds copper will

likely be lower.

Cash flow protection for the balance of 2014 is supported by

derivative instruments that will see the Company receive certain

minimum prices for copper and gold as disclosed under the heading

Derivative Instruments. However, the quarterly revenues will

fluctuate depending on copper and gold prices, the CDN Dollar/US

Dollar exchange rate, and the timing of concentrate sales which is

dependent on concentrate production and the availability and

scheduling of transportation.

Exploration

Exploration in 2014 will be limited in scope, and will be

conducted at our existing mining operations: Mount Polley,

Huckleberry and Sterling. Mount Polley will continue to focus on

the excavation of a test stope in the Boundary zone. A minor

exploration program will be conducted at Huckleberry, and work will

focus on interpretation of information collected over the last two

years. Underground drilling at Sterling will continue in the

vicinity of the underground workings.

Development

At Mount Polley the majority of ore delivery is from phase 3 of

the Springer pit. Stripping effort at Mount Polley is being

directed at a pushback of the Cariboo pit. Underground ore is

scheduled to be delivered to the mill this year.

At Huckleberry, MZO pit stripping and ore release will continue

throughout 2014. The continuation of the TMF-3 construction (Phase

2) will commence in the 2014 second quarter.

At Red Chris planned activities in 2014 include the final

installation of the primary crusher, process water tanks, interior

steel, grinding mills, electrical equipment, reagent building and

tailings system. Construction of the 287kv 17 kilometre power line

from Tatogga to the mine site began in January 2014. Mine

pre-development began in January 2014 with the start of stripping

of overburden from the East zone of the Red Chris mine. The Company

is targeting to commence commissioning of the Red Chris mine in

June 2014 and to achieve full operations in the fourth quarter of

2014.

Financing

Based on current plans, assumptions, and the debt financings

completed in March 2014, the Company expects to have sufficient

cash resources to support its normal operating and capital

requirements on an ongoing basis.

(1)Information Related to this Press Release

Detailed financial information is provided in the Company's 2013

Annual Report for the year ended December 31, 2013 available on

www.imperialmetals.com and on www.sedar.com.

|

|

|

|

|

|

|

Earnings Announcement Conference Call |

|

|

|

|

Scheduled for April 1, 2014 10:00am PDT / 11:00am MDT / 1:00pm

EDT |

|

|

|

|

|

|

|

|

|

Management will discuss the 2013 Financial Results provided in this

press release. |

|

|

|

|

Following are call-in numbers to participate in the earnings

announcement conference call: |

|

|

|

|

|

|

|

|

|

778.383.7413 local Vancouver |

|

|

|

|

416.764.8609 local Toronto |

|

|

|

|

587.880.2175 local Calgary / Edmonton |

|

|

|

|

888.390.0605 toll free North America |

|

|

|

|

|

|

|

|

|

The

conference call will be available for replay until April 8, 2014 by

dialing |

|

|

|

|

888.390.0541 or 416.764.8677 / replay PIN #642700 |

|

|

|

|

|

|

|

About Imperial

Imperial is an exploration, mine development and operating

company based in Vancouver, British Columbia. The Company operates

the Mount Polley copper/gold mine in British Columbia and the

Sterling gold mine in Nevada. Imperial has 50% interest in the

Huckleberry copper/molybdenum mine and has 50% interest in the

Ruddock Creek lead/zinc property, both in British Columbia. The

Company is in development of its wholly owned Red Chris copper/gold

property in British Columbia.

Cautionary Note Regarding "Forward-Looking Information"

This press release contains "forward-looking information" or

"forward-looking statements" within the meaning of Canadian and

United States securities laws, which we will refer to as

"forward-looking information". Except for statements of historical

fact relating to the Company, certain information contained herein

constitutes forward-looking information. When we discuss mine

plans; costs and timing of current and proposed exploration or

development; development; production and marketing; capital

expenditures; construction of transmission lines; construction of

the Red Chris mine; cash flow; working capital requirements and the

requirement for additional capital; operations; revenue; margins

and earnings; future prices of copper and gold; future foreign

currency exchange rates; future accounting changes; future prices

for marketable securities; future resolution of contingent

liabilities; receipt of permits; or other matters that have not yet

occurred, we are making statements considered to be forward-looking

information or forward-looking statements under Canadian and United

States securities laws. We refer to them in this press release as

forward-looking information. The forward-looking information in

this press release may include words and phrases about the future,

such as: plan, expect, forecast, intend, anticipate, estimate,

budget, scheduled, targeted, believe, may, could, would, might or

will. Forward-looking information includes disclosure relating

to project development plans, costs and timing.

We can give no assurance the forward-looking information will

prove to be accurate. It is based on a number of assumptions

management believes to be reasonable, including but not limited to:

the continued operation of the Company's mining operations, no

material adverse change in the market price of commodities or

exchange rates, that the mining operations will operate and the

mining projects will be completed in accordance with their

estimates and achieve stated production outcomes, volatility in the

Company's share price and such other assumptions and factors as set

out herein.

It is also subject to risks associated with our business,

including but not limited to: the risk that further advances may

not be available under credit facilities; risks associated with

maintaining substantial levels of indebtedness including potential

financial constraints on operations; risks inherent in the mining

and metals business; commodity price fluctuations and hedging;

competition for mining properties; sale of products and future

market access; mineral reserves and recovery estimates; currency

fluctuations; interest rate risks; financing risks; regulatory and

permitting risks; environmental risks; joint venture risks; foreign

activity risks; legal proceedings; and other risks that are set out

in the Company's Management's Discussion & Analysis in

its 2013 Annual Report.

If our assumptions prove to be incorrect or risks materialize,

our actual results and events may vary materially from what we

currently expect as provided in this press release. We recommend

you review the Company's most recent Annual Information

Form and Management's Discussion & Analysis in

its 2013 Annual Report, which includes discussion of material risks

that could cause actual results to differ materially from our

current expectations. Forward-looking information is designed to

help you understand management's current views of our near and

longer term prospects, and it may not be appropriate for other

purposes. We will not necessarily update this information unless we

are required to by securities laws.

Imperial Metals CorporationBrian

KynochPresident604.669.8959Imperial Metals CorporationAndre

DeepwellChief Financial Officer604.488.2666Imperial Metals

CorporationGordon KeevilVice President Corporate

Development604.488.2677Imperial Metals CorporationSabine

GoetzShareholder

Communications604.488.2657investor@imperialmetals.com

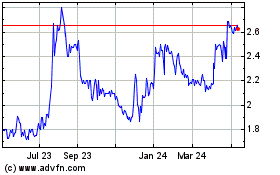

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

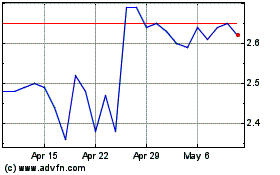

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025