Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for its fiscal year ended

December 31, 2019.

| Select Annual

Financial Information |

|

Years Ended December 31 |

|

|

expressed in thousands, except share and per share amounts |

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

Continuing Operations: |

|

|

|

|

|

Total revenues |

|

$ |

71,823 |

|

$ |

104,437 |

|

$ |

164,021 |

|

|

Net income (loss) |

|

$ |

(40,266 |

) |

$ |

(109,464 |

) |

$ |

42,891 |

|

|

Net income (loss) per share |

|

$ |

(0.32 |

) |

$ |

(0.92 |

) |

$ |

0.45 |

|

|

Diluted income (loss) per share |

|

$ |

(0.32 |

) |

$ |

(0.92 |

) |

$ |

0.45 |

|

|

Adjusted net loss (1) |

|

$ |

(49,269 |

) |

$ |

(68,622 |

) |

$ |

(96,213 |

) |

|

Adjusted net loss per share (1) |

|

$ |

(0.39 |

) |

$ |

(0.58 |

) |

$ |

(1.02 |

) |

|

Adjusted EBITDA(1) |

|

$ |

(4,490 |

) |

$ |

(3,334 |

) |

$ |

(2,944 |

) |

|

Cash flow (1)(2) |

|

$ |

(3,611 |

) |

$ |

106,468 |

|

$ |

707 |

|

|

Cash flow per share (1)(2) |

|

$ |

(0.03 |

) |

$ |

0.90 |

|

$ |

0.01 |

|

|

Discontinued Operations: |

|

|

|

|

|

Total revenues |

|

$ |

164,993 |

|

$ |

255,736 |

|

$ |

289,092 |

|

|

Net income (loss) |

|

$ |

362,002 |

|

$ |

(16,131 |

) |

$ |

34,222 |

|

|

Net income (loss) per share |

|

$ |

2.85 |

|

$ |

(0.14 |

) |

$ |

0.36 |

|

|

Diluted income (loss) per share |

|

$ |

2.85 |

|

$ |

(0.14 |

) |

$ |

0.36 |

|

|

Adjusted net income (loss) (1) |

|

$ |

40,284 |

|

$ |

(16,141 |

) |

$ |

33,588 |

|

|

Adjusted net income (loss) per share (1) |

|

$ |

0.32 |

|

$ |

(0.13 |

) |

$ |

0.66 |

|

|

Adjusted EBITDA(1) |

|

$ |

142,858 |

|

$ |

36,602 |

|

$ |

91,401 |

|

|

Cash flow (1)(2) |

|

$ |

23,822 |

|

$ |

36,981 |

|

$ |

87,674 |

|

|

Cash flow per share (1)(2) |

|

$ |

0.19 |

|

$ |

0.31 |

|

$ |

0.93 |

|

|

Working capital (deficiency) |

|

$ |

55,252 |

|

$ |

(789,470 |

) |

$ |

(238,269 |

) |

|

Total assets |

|

$ |

1,058,502 |

|

$ |

1,573,903 |

|

$ |

1,723,768 |

|

|

Total debt (including current portion) |

|

$ |

3,816 |

|

$ |

871,268 |

|

$ |

852,378 |

|

|

(1) Refer to table under heading Non-IFRS Financial Measures

for further details. |

|

(2) Cash flow is defined as the cash flow from operations before

the net change in non-cash working capital balances, income and

mining taxes, and interest paid. Cash flow per share is defined as

Cash flow divided by the weighted average number of common shares

outstanding during the year. |

Select Items Affecting Net Income

(Loss) (presented on an after-tax basis)

| |

|

Years Ended December 31 |

|

|

expressed in thousands |

|

|

2019 |

|

|

2018 |

|

| Net loss before undernoted

items from continuing operations |

|

$ |

(14,284 |

) |

$ |

(16,593 |

) |

|

Interest expense |

|

|

(46,273 |

) |

|

(52,183 |

) |

|

Recovery of BC Mineral taxes including interest |

|

|

11,288 |

|

|

- |

|

|

Gain on sale of Sterling |

|

|

- |

|

|

296 |

|

|

Impairment of mineral properties |

|

|

- |

|

|

(79,719 |

) |

|

Foreign exchange gain (loss) on debt |

|

|

10,292 |

|

|

(36,214 |

) |

|

Loss on early repayment of debt |

|

|

(1,289 |

) |

|

- |

|

|

Settlement and insurance recoveries |

|

|

- |

|

|

74,949 |

|

|

Net Loss from continuing operations |

|

$ |

(40,266 |

) |

$ |

(109,464 |

) |

On March 10, 2019, the Company entered into an

agreement to sell a 70% interest in the Red Chris mine to Newcrest.

The Company completed the sale to Newcrest on August 15, 2019 for a

final purchase price of US$804.4 million subject to debt and

working capital adjustments. In accordance with IFRS, the Company

has classified Red Chris mine as a discontinued operation effective

January 1, 2019 up to closing of the transaction with Newcrest on

August 14, 2019, and the prior year comparative annual consolidated

statement of income (loss) has been restated accordingly. Effective

August 15, 2019 onwards, the results from the Red Chris Mine are

presented on a proportional basis relative to Imperial’s 30%

beneficial interest in the joint venture. Unless otherwise stated

this MD&A will report the total of continuing and discontinued

operations as one total (e.g. net income) for ease of comparison

with the prior comparative period.

Revenues decreased to $236.8 million in 2019

compared to $360.2 million in 2018, a decrease of $123.4 million or

34%.

Revenue from the Red Chris mine in 2019 was

$200.9 million compared to $255.7 million in 2018. This decrease

was attributable to the Company’s ownership decreasing to 30% from

100% on August 15, 2019 compared to its 100% share in 2018. There

were 13.2 concentrate shipments in 2019 from the Red Chris mine

(2018-12.0 concentrate shipments).

Revenue from the Mount Polley mine in 2019 was

$34.9 million compared to $104.4 million in 2018. The decrease was

attributable to the mine being on care and maintenance from May

2019 onwards. Mount Polley mine had only 1.0 concentrate shipment

in 2019 (2018-3.0 concentrate shipments).

Variations in revenue are impacted by the timing

and quantity of concentrate shipments, metal prices and exchange

rates, and period end revaluations of revenue attributed to

concentrate shipments where metal prices will settle at a future

date.

The London Metals Exchange cash settlement

copper price per pound averaged US$2.72 in 2019 compared to US$2.96

in 2018. The London Metals Exchange cash settlement gold price per

troy ounce averaged US$1,392 in 2019 compared to US$1,269 in 2018.

The average US$ strengthened by 2.0% compared to the CDN$ in 2019

over 2018. In 2019 the average copper price was CDN$3.61 per pound

and the average gold price was CDN$1,847 per ounce compared to 2018

when the average copper price was CDN$3.84 per pound and the

average gold price was CDN$1,645 per ounce.

Revenue in 2019 decreased by a $3.3 million

negative revenue revaluation compared to a negative revenue

revaluation of $19.0 million in 2018. Revenue revaluations are the

result of the metal prices on the settlement date and/or the

current period balance sheet date being higher or lower than when

the revenue was initially recorded or the metal prices at the last

balance sheet date and finalization of contained metals as a result

of final assays.

Net loss from continuing operations in 2019 was

$40.3 million ($0.32 per share) compared to net loss of $109.5

million ($0.92 per share) in 2018. The majority of decrease in net

loss of $69.2 million was primarily due to the following

factors:

- Loss from mine operations decreased

from a loss of $21.1 million in 2018 to a loss of $6.6 million in

2019, a decrease in net loss of $14.5 million.

- Interest expense decreased from

$73.4 million in 2018 to $46.3 million in 2019, a decrease to net

loss of $27.1 million.

- Foreign exchange gains/losses went

from a loss of $37.4 million in 2018 to a gain of $10.1 million in

2019, a decrease in net loss of $47.5 million.

- Impairment on mineral properties

decreased from $109.2 million in 2018 to $nil in 2019, a decrease

in net loss of $109.2 million.

- Rehabilitation costs of $nil in

2019 compared to $0.2 million in 2018, a decrease in net loss of

$0.2 million.

- Other income totalled $0.3 million

in 2019 compared to income of $108.1 million in 2018, largely due

to the settlement of $106.2 million net of costs, pertaining to the

August 4, 2014 tailings dam breach at the Mount Polley Mine (“Mount

Polley Breach”), an increase in net loss of $107.8 million.

- An income and mining tax recovery

of $28.0 million in 2019 compared to a recovery of $35.8 million in

2018, an increase in net loss of $7.8 million.

The average US$/CDN$ exchange rate in the 2019

was 1.327 compared to an average of 1.296 in 2018.

Cash flow from continuing operations was

negative $3.6 million in 2019 compared to positive cash flow of

$106.5 million in 2018. Cash flow is a measure used by the Company

to evaluate its performance, however, it is not a term recognized

under IFRS. The Company believes Cash flow is useful to investors

and it is one of the measures used by management to assess the

financial performance of the Company.

Capital expenditures attributed to continuing

operations were $20.0 million in 2019, up from $14.5 million in

2018. The increase was due to the inclusion of Red Chris

expenditures from August 15, 2019 onwards representing Imperial’s

30% proportionate share compared to the prior year where these

expenditures were classified as discontinued operations.

At December 31, 2019 the Company had $90.0

million in cash compared to $18.6 million at December 31, 2018.

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net income, adjusted EBITDA, cash flow and cash

cost per pound of copper produced which are described in detail

below. The Company believes these measures are useful to investors

because they are included in the measures that are used by

management in assessing the financial performance of the

Company.

Adjusted net income, adjusted EBITDA, and cash

flow are not generally accepted earnings measures and should not be

considered as an alternative to net income (loss) and cash flows as

determined in accordance with IFRS. As there is no standardized

method of calculating these measures, these measures may not be

directly comparable to similarly titled measures used by other

companies.

Adjusted Net Loss and Adjusted Net Loss

per Share

Adjusted net loss from continuing operations in

2019 was $49.3 million ($0.39 per share) compared to an adjusted

net loss of $68.6 million ($0.58 per share) in 2018. Adjusted net

income or loss shows the financial results excluding the effect of

items not settling in the current period and non-recurring items.

Adjusted net income or loss is calculated by removing the gains or

loss, resulting from acquisition and disposal of property, mark to

market revaluation of derivative instruments not related to the

current period, net of tax, unrealized foreign exchange gains or

losses on non-current debt, net of tax.

Adjusted EBITDA

Adjusted EBITDA from continuing operations in

2019 was a loss of $4.5 million compared to a loss of $3.3 million

in 2018. We define Adjusted EBITDA as net income (loss) before

interest expense, taxes, depletion and depreciation, and as

adjusted for certain other items.

Cash Flow and Cash Flow Per

Share

Cash flow from continuing operations in 2019 was

negative $3.6 million compared to positive $106.5 million in 2018.

Cash flow per share was $0.00 in 2019 compared to $0.90 in

2018.

Cash flow and cash flow per share are measures

used by the Company to evaluate its performance however they are

not terms recognized under IFRS. Cash flow is defined as cash flow

from operations before the net change in non-cash working capital

balances, income and mining taxes, and interest paid and cash flow

per share is the same measure divided by the weighted average

number of common shares outstanding during the year.

Cash Cost Per Pound of Copper

Produced

The Company is primarily a copper producer and

therefore calculates this non-IFRS financial measure individually

for its three copper mines, Red Chris (30% share effective August

15, 2019), Mount Polley and Huckleberry, and on a composite basis

for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced.

Idle mine costs during the periods when the

Huckleberry and Mount Polley mines were not in operation have been

excluded from the cash cost per pound of copper produced.

|

Calculation of Cash Cost Per Pound of Copper Produced expressed in

thousands, except cash cost per pound of copper produced |

| |

|

Year Ended December 31, 2019 |

|

|

|

|

|

*Red |

|

|

**Mount |

|

Financial |

|

|

|

|

Chris |

|

|

Polley |

|

Statements |

|

|

Cash cost of copper produced in US$ |

|

$ |

123,368 |

|

$ |

12,907 |

|

$ |

136,275 |

|

|

Copper produced – pounds |

|

|

50,334 |

|

|

3,825 |

|

|

54,159 |

|

|

Cash cost per lb copper produced in US$ |

|

$ |

2.45 |

|

$ |

3.37 |

|

$ |

2.52 |

|

|

|

|

|

|

|

|

Year Ended December 31, 2018 |

|

|

|

|

*Red |

|

|

**Mount |

|

Financial |

|

|

|

|

Chris |

|

|

Polley |

|

Statements |

|

| Cash cost of copper produced

in US$ |

|

$ |

141,223 |

|

$ |

29,032 |

|

$ |

170,255 |

|

| Copper produced – pounds |

|

|

60,349 |

|

|

14,974 |

|

|

75,323 |

|

| Cash

cost per lb copper produced in US$ |

|

$ |

2.34 |

|

$ |

1.94 |

|

$ |

2.26 |

|

* The Red Chris Mine was classified as a

discontinued operation effective January 1, 2019 to August 14, 2019

and prior periods have been restated. Effective August 15, 2019

onwards, the results from Red Chris are presented in continuing

operations on a proportional basis relative to Imperial’s 30%

beneficial interest in the joint venture.** The Mount Polley Mine

is a continuing operation. The mine was placed on care and

maintenance on May 26, 2019.

DEVELOPMENTS DURING 2019

Red Chris Mine

On August 15, 2019, Imperial completed the sale

of a 70% interest in the Red Chris copper and gold mine to

Newcrest. The Company and Newcrest formed a joint venture for the

operation of Red Chris with Newcrest acting as operator. The

Company retains a 30% joint venture interest in the Red Chris

mine.

During 2019, a production plan was developed

following an in-depth review of historic data, with key assumptions

being identified and validated against past performance. The plan

reflects a lower mining rate as compared to 2018 (105,000 tonnes

per day vs. 130,000 tonnes per day). The metal production for 2019

was estimated by a similar application of historic data for

incorporation of mill availability, throughput (tonnes per

operating hour) and recovery.

Mine teams followed the plan with the intent of

targeting higher grades using an internal Geo Met process which

focused on daily reviews by the onsite teams relating to geological

and metallurgical performance. The maintenance teams focused on

both scheduled and unscheduled downtimes in the plant which

included formal measures as part of the business KPI system. These

initiatives were successful, with the mill achieving 90%

availability.

In the mill, ‘donut’ launders were installed on

the first two rougher cells during December 2019, and four more are

expected to be installed during the 2020 first quarter. The new

launders are expected to increase the mass pull in the rougher

circuit and lead to increased recovery of copper and gold.

Red Chris mine 2019 metals production was 71.9

million pounds copper, 36,471 ounces gold, and 133,879 ounces

silver, of which Imperial’s portion of the production, representing

100% for the period January 1 through August 14, 2019 and 30% of

production for the period August 15 through December 31, 2019 was

50.3 million pounds copper, 25,177 ounces gold, and 90,577 ounces

silver.

Red Chris metals production guidance (100%),

provided by Newcrest in August 2019 for the period August 15, 2019

to June 30, 2020 (to conform to their annual year end of June 30,

2020), is in the range of 63-79 million pounds copper and

36,000-50,000 ounces gold.

|

Annual Production for the Year Ended December 31 |

|

2019(1) |

|

2018(1) |

|

| Ore

milled – tonnes |

|

10,430,762 |

|

10,668,313 |

|

| Ore milled per calendar

day – tonnes |

|

28,577 |

|

29,228 |

|

| Grade % – copper |

|

0.412 |

|

0.339 |

|

| Grade g/t – gold |

|

0.244 |

|

0.259 |

|

| Recovery % – copper |

|

76.0 |

|

75.6 |

|

| Recovery % – gold |

|

44.5 |

|

47.1 |

|

| Copper – 000’s pounds |

|

71,880 |

|

60,349 |

|

| Gold – ounces |

|

36,471 |

|

41,935 |

|

| Silver

– ounces |

|

133,879 |

|

103,634 |

|

(1) production stated at 100%

Exploration in 2019 included over 17,500 metres

of drilling completed in the Gully/Far West area, in search for

additional zones of higher grade mineralization within the Red

Chris porphyry corridor, and in the East zone, designed to obtain

geological, geotechnical and metallurgical data to support future

studies for underground block cave mining. Initial results were

released on January 29, 2020. Drilling in the Gully zone discovered

additional mineralization, including 304 metres grading 0.2% copper

and 0.44 g/t gold in hole RC-19-603.

Exploration, development and capital

expenditures were $42.5 million in 2019 compared to $62.9 million

in 2018 (100% to August 15, 2019, and 30% thereafter).

Mount Polley Mine

Mount Polley mine ceased operations May 26,

2019, and remains on care and maintenance. Metal production for the

period January 1 to May 26, 2019 was 3.8 million pounds copper,

10,619 ounces gold, and 11,119 ounces silver.

|

Annual Production for the Year Ended December 31 |

|

2019(1) |

|

2018 |

|

| Ore

milled – tonnes |

|

2,231,119 |

|

6,195,760 |

|

| Ore milled per calendar

day – tonnes |

|

14,776 |

|

16,975 |

|

| Grade

% – copper |

|

0.229 |

|

0.207 |

|

| Grade

g/t – gold |

|

0.283 |

|

0.277 |

|

| Recovery

% – copper |

|

34.0 |

|

52.89 |

|

| Recovery

% – gold |

|

52.3 |

|

67.25 |

|

| Copper – 000’s pounds |

|

3,825 |

|

14,974 |

|

| Gold – ounces |

|

10,619 |

|

37,120 |

|

| Silver

– ounces |

|

11,119 |

|

33,458 |

|

(1) production stated for period January 1

to May 26, 2019

During 2019, the mine’s contact water (water

that comes in contact with the mine site) was discharged via a

water treatment plant through a pipeline at depth into Quesnel

Lake. Dredging operations continued in the Springer Pit into

November. Through Summer 2019, the mine completed installation of 5

kilometres of rainbow trout habitat in Hazeltine Creek. The trout

were allowed back into Hazeltine Creek in May 2018, where they have

successfully spawned for the last two years. The BC Ministry of

Environment (“ENV”) had issued Pollution Abatement Order (“PAO”)

107461 under Section 83 of the BC Environmental Management Act on

August 5, 2014. The PAO directed MPMC to implement measures and

submit documentation describing its response, and to communicate to

the ENV regarding response progress. The PAO was cancelled on

September 12, 2019 when ENV deemed that all PAO requirements had

been complied with, including ENV’s acceptance of the final

remediation plan.

During late Fall 2019, a Mobile Metal Ion soil

sampling program and a 3D Induced Polarization geophysical survey

were conducted to explore new regions at Mount Polley. The program

was completed over an area north-northwest of the mine. The soil

sampling program consisted of 948 samples collected over 51 km of

soil lines. The IP survey was completed over a total of 81.6 km of

survey lines by SJ Geophysics. The data is under review for drill

target prioritizing.

For the year ended December 31, 2019, the Mount

Polley mine incurred idle mine costs comprised of $7.8 million in

operating costs and $3.1 million in depreciation expense.

Exploration, development, and capital

expenditures were $5.4 million in 2019 compared to $13.3 million in

2018.

Huckleberry Mine

Huckleberry remains on care and maintenance

status since operations shut-down in August 2016. During this

period of mine care and maintenance, activities at the mine site

have been focused on water management, snow removal in the winter

to maintain access, and maintenance to the site infrastructure and

equipment. All environmental sampling and reporting is coordinated

from the mine site as well.

A preliminary plan to restart the mine has been

developed, for such time when the economics of mining improve. In

the interim, the Company will develop exploration programs designed

to expand the resource.

In 2019, a Mobile Metal Ion soil sampling

program was conducted at Whiting Creek, consisting of 449 soil

samples collected over portions of the Creek Zone, the Rusty Zone,

and the Ridge Zone. The data is under review.

For the year ended December 31, 2019, the

Huckleberry mine incurred idle mine costs comprised of $4.9 million

in operating costs and $0.8 million in depreciation expense.

Ruddock Creek Joint Venture

The Ruddock Creek lead-zinc project is operated

by way of a Joint Venture with Imperial, Mitsui Mining and Smelting

Co. Ltd., Itochu Corporation, and Japan Oil, Gas and Metals

National Corporation (JOGMEC). Imperial operates the project

through its wholly owned subsidiary Ruddock Creek Mining

Corporation.

JOGMEC funded the 2019 drill program and now has

earned the assignable right to be vested in an approximate 7.96%

Participating Interest in the joint venture. Imperial’s interest

has been reduced to approximately 45.29%, Mitsui’s interest to

28.05% and Itochu’s interest to 18.70%.

The 2019 diamond drill program consisted of 17

drill holes totaling 8,802.1 metres targeting the V Zone (11 drill

holes; 6,955.5 metres) and the Q Zone (6 drill holes; 1,846.6

metres). Highlights include drill hole RD-19-V54 which intersected

40.9 metres (true thickness 36.8 metres) grading 16.83% zinc, 3.46%

lead and 4.74 g/t silver, including 20.1 metres grading 18.93%

zinc, 4.15% lead and 6.11 g/t silver. Drill hole RD-19-V54 was

drilled targeting the deep V Zone (where 2018 drill hole RD-18-V41

intersected 21.7 metres (true thickness 21.5 metres) grading 16.99%

zinc, 3.44% lead and 2.41 g/t silver, including 10.4 metres grading

25.70% zinc, 5.41% lead and 3.44 g/t silver located 52.0 metres

below hole RD-19-54).

The V Zone drilling was designed to expand and

increase the confidence in the resource in the deep portions of the

zone. The V Zone has a steeper dip than all the other known zones

at Ruddock Creek. The steeper dip should facilitate lower mining

costs than the shallower dipping zones, and thus a larger resource

of steeply dipping mineralization in the V Zone would improve the

economics of the project. The wide high-grade intercept in

RD-V19-54 will add to the resource, along with the other V Zone

mineralized intercepts obtained this year.

Jim Miller-Tait, P.Geo., VP Exploration, is the

designated Qualified Person as defined by National Instrument

43-101 for the exploration program. Ruddock Creek samples for the

2019 drilling reported were analysed at Bureau Veritas Mineral

Laboratories in Vancouver. A full QA/QC program using blanks,

standards and duplicates was completed for all diamond drilling

samples submitted to the lab.

A comprehensive review will be completed in 2020

using the geophysical and geological information from the last two

years of field work to recommend future exploration at Ruddock

Creek. Plans for further exploration in the vicinity of the

excellent results obtained in a portion of the V zone are being

developed, and will be discussed with our joint venture

partners.

FOURTH QUARTER RESULTS FROM CONTINUING

OPERATIONS

Revenue in the fourth quarter of 2019 was $29.4

million compared to $27.8 million in 2018. Sales revenue is

recorded when title for concentrate is transferred on ship loading.

Variations in revenue are impacted by the timing and quantity of

concentrate shipments, metal prices and exchange rates, and period

end revaluations of revenue attributed to concentrate shipments

where copper and gold prices will settle at a future date along

with finalization of contained metals as a result of final

assays.

The Company recorded a net loss of $12.3 million

($0.10 per share) in the fourth quarter of 2019 compared to net

loss of $43.3 million ($0.36 per share) in the prior year

quarter.

Expenditures for exploration and ongoing capital

projects at Mount Polley, Red Chris and Huckleberry totaled $10.5

million during the three months ended December 31, 2019 compared to

the expenditures for exploration and ongoing capital projects at

Mount Polley and Huckleberry which totaled $0.8 million in the 2018

comparative quarter. Red Chris expenditures from August 15, 2019

onwards represented Imperial’s 30% proportionate share compared to

the prior year quarter where these expenditures were classified as

discontinued operations.

OUTLOOK

Corporate and Operations

At December 31, 2019 the Company had not hedged

any copper, gold or US$/CDN$ exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the US$/CDN$

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

Newcrest provided metals production guidance

(100%) for Red Chris mine, for the period August 15, 2019 to June

30, 2020 (to conform to their annual year end of June 30, 2020), in

the range of 63-79 million pounds copper and 36,000-50,000 ounces

gold.

Exploration

At Red Chris, over 17,500 metres were drilled in

2019. Newcrest’s initial exploration program includes over 50,000

metres total. This initial program, which is ongoing, includes

planned drilling in the Gully/Far West area, the East zone, the

Main zone, and the Saddle area between the Main and East zones. The

goals are to search for additional zones of higher grade

mineralization within the Red Chris porphyry corridor, and to drill

in the East zone to obtain geological, geotechnical and

metallurgical data to support future studies for underground block

cave mining.

At Mount Polley, an option to earn a 100%

interest in seven mineral claims (3,331 ha), adjacent to the Mount

Polley mine was entered into. Three target settings occur within

the optioned claims and adjacent Mount Polley claims, including a

potential northern projection of the high-grade Quarry zone beneath

a post-mineral conglomerate unit, a partially tested glacial till

covered area where regional magnetics suggests a faulted offset of

the Mount Polley Intrusive complex, which hosts the Mount Polley

orebodies, is present and a till covered prospective area

immediately east of the Southeast zone. A deep looking IP survey,

along with a soil sampling program, was completed over the first

two target areas described above. Once the information IP survey

and soil sampling has been compiled, a drill program to test the

targets will be designed. Also, a drill program designed to expand

the copper and gold resource in Springer and WX zones to depth, has

been laid out.

The Huckleberry East zone pit has historically

provided the highest grade mill feed, and the majority drilling in

the zone was only to a depth of 300 metres, and often ended in

above cut-off grade copper mineralization. A drill program to test

the East zone at depth has been designed to test below the historic

drilling.

At Ruddock Creek, a total of 17 holes were

drilled in the V and Q zones located on the western edge of the

Ruddock Creek massive sulphide horizon. Plans for further

exploration in the vicinity of the excellent result obtained in

hole RC-19-V54 (40.9 metres grading 16.83% zinc and 3.46% lead) are

being developed and will be discussed with our joint venture

partners.

Exploration planned for 2020 will depend on

funding. Priority will be directed to Red Chris, then Mount Polley

and Huckleberry and Ruddock Creek, and potentially some of the 23

exploration projects held by Imperial.

DEVELOPMENT

At Red Chris, following completion of the

initial exploration drilling in the East zone, Newcrest plans to

update the Red Chris resource model. However, prior to completion

of drilling in the East zone, Newcrest have initiated a concept

study investigating the potential for commercial production from a

block cave. The block cave concept study includes studying

potential decline portal locations and underground development

layouts to maximize the value of the existing plant and

infrastructure. The indications are that production from a block

cave could start in about five years from the commencement of a

decline to access the deep East zone. Newcrest hopes to begin a

decline to access the deep east zone by the end of calendar year

2020.

For 2020, plans are being made to conduct

exploration drilling at Mount Polley and Huckleberry. The restart

of operations at the site, will be dependent on metal prices,

however if the planned exploration proves successful, metal prices

required for restart may be reduced.

However, the Company’s plans for 2020 could be

impacted, by the novel coronavirus (2019-nCoV) global pandemic, in

a number of ways including but limited to, causing a temporary

closure the Red Chris mine, or suspension exploration work planned,

causing an economic slowdown resulting in a decrease in the demand

and have a negative impact on for copper and gold prices, and

impacting the Company’s ability to transport or market the

Company’s concentrate or cause disruptions in the Company’s supply

chains.

For detailed information, refer to Imperial’s

2019 Annual Report available on imperialmetals.com and

sedar.com

About Imperial

Imperial is a Vancouver exploration, mine

development and operating company. The Company, through its

subsidiaries, owns a 30% interest in the Red Chris mine, and a 100%

interest in both the Mount Polley and Huckleberry copper mines in

British Columbia. Imperial also holds a 45.3% interest in the

Ruddock Creek lead/zinc property.

Company Contacts

Brian Kynoch | President |

604.669.8959Andre Deepwell | Chief Financial

Officer | 604.488.2666Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding the Company’s

expectations with respect to metal production guidance and

estimates, expectations regarding the care, maintenance and

rehabilitation activities at Mount Polley and Huckleberry,

expectations and timing regarding current and future exploration

and drilling programs including plans to search for additional

zones of higher grade mineralization, drilling in the East zone to

obtain data to support future studies for underground block cave

mining, plans to develop exploration programs at the Mount Polley

and Huckleberry mines and plans for further exploration in the V

zone at the Ruddock Creek Project, expectations regarding the

construction and timing of a new Red Chris resource model for

drilling data, adequacy of funds for projects and liabilities,

expectations regarding exploration results and metal prices

required to restart the Mount Polley and Huckleberry mines, and

expectations about the potential impact of the novel coronavirus on

the Company’s plans for 2020.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

release, the Company has applied certain factors and assumptions

that are based on information currently available to the Company as

well as the Company’s current beliefs and assumptions. These

factors and assumptions and beliefs and assumptions include, the

risk factors detailed from time to time in the Company’s interim

and annual financial statements and management’s discussion and

analysis of those statements, all of which are filed and available

for review on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended, many of which are beyond the Company’s

ability to control or predict. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

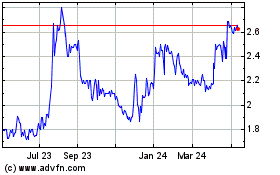

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

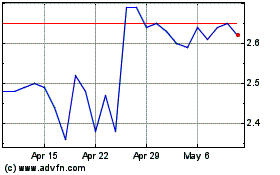

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025