North American Construction Group Ltd. (“NACG”) (TSX:NOA/NYSE:NOA)

today announced results for the second quarter ended June 30,

2020.

Financial Highlights of the Second

Quarter Ended June 30, 2020

- Revenue for the quarter was $70.8 million, compared to $176.9

million for the same period in the prior year, a decrease of $106.2

million (or 60%).

- Year to date revenue was $269.6 million, compared to $363.3

million for the same period in the prior year, a decrease of $93.8

million (or 26%).

- Adjusted EBITDA for the quarter was $31.9 million, compared to

$37.1 million for the same period in the prior year, a decrease of

$5.2 million (or 14%).

- Year to date Adjusted EBITDA was $92.1 million, compared

to $89.2 million for the same period in the prior year, an

increase of $2.9 million (or 3%).

- Adjusted EPS for the quarter was $0.45, compared to $0.43 for

same period in the prior year, an increase of $0.02 (or 5%).

- Year to date Adjusted EPS was $1.14, compared to $0.93 for the

same period in the prior year, an increase of $0.21 (or 23%).

- Free cash flow for the quarter was $10.6 million, compared to

$1.7 million for the same period in the prior year, an increase of

$8.9 million.

- Year to date free cash flow was $20.1 million, compared to

$(3.6) million for the same period in the prior year, an increase

of $23.6 million.

- Total liquidity at quarter-end was of $135.4 million, compared

to $114.6 million at December 31, 2019, a increase of $20.8

million.

NACG Chairman and CEO, Martin Ferron, commented: “As one of very

few companies that provided any sort of outlook for the second

quarter, we were determined to both minimize the impact of the

COVID-19 pandemic on the health and safety of our workforce; and

mitigate its effect on our business performance. Therefore, we are

pleased to report that good headway was made on both objectives, as

we also helped our customers manage the virus risk on their

worksites.

“A close stewardship of costs rewarded us with a nicely

profitable quarter, despite a greater than 60% sequential fall in

our revenues, in the toughest operating environment we have ever

experienced. We also hit our free cash flow target and reduced our

net debt by around 10%, with that cash flow and the call of a

convertible debenture.”

Mr. Ferron added, “Looking ahead, we anticipate that our core

business activity will gradually improve as the year progresses,

such that we now expect our full year adjusted EBITDA to be in the

range of $140-$170 million.”

Other Highlights of the Quarter Ended June 30,

2020

- On April 6, 2020, our 5.50% convertible debentures due March

31, 2024 were redeemed in accordance with their original terms. The

redemption was satisfied through issuance of 4,583,655 voting

common shares and all accrued and unpaid interest was paid in

cash.

- On June 21, 2020, formal handover of the management services

agreement was completed for the operation of a coal mine operation

in Texas, USA.

COVID-19 - Impact and

Response

- Diligent attention was paid to improve personal hygiene and

physical distancing, primarily at mine sites but also our

maintenance and administrative facilities with objective of

limiting the spread of COVID-19. This resulted in numerous

enhancements and practical adjustments to existing health and

safety procedures.

- Cleaning and disinfection practices were increased in frequency

and rigor and daily questionnaires were implemented to monitor

health of employees.

- Technical accommodations were made for staff to work from

home.

Declaration of Quarterly

Dividend

On July 28th, 2020, the NACG Board of Directors declared a

regular quarterly dividend (the “Dividend”) of four Canadian cents

($0.04) per common share, payable to common shareholders of record

at the close of business on August 31, 2020. The Dividend will be

paid on October 2, 2020 and is an eligible dividend for Canadian

income tax purposes.

Consolidated Financial Highlights

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

|

(dollars in thousands, except per share amounts) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Revenue |

$ |

70,771 |

|

|

$ |

176,935 |

|

|

$ |

269,588 |

|

|

$ |

363,343 |

|

| Project costs |

12,331 |

|

|

73,938 |

|

|

72,448 |

|

|

144,429 |

|

| Equipment costs |

25,792 |

|

|

57,432 |

|

|

97,533 |

|

|

114,485 |

|

| Depreciation |

11,551 |

|

|

22,099 |

|

|

43,859 |

|

|

51,380 |

|

|

Gross profit(i) |

$ |

21,097 |

|

|

$ |

23,466 |

|

|

$ |

55,748 |

|

|

$ |

53,049 |

|

| Gross profit margin(i) |

29.8 |

% |

|

13.3 |

% |

|

20.7 |

% |

|

14.6 |

% |

| General and administrative

expenses (excluding stock-based compensation) |

3,467 |

|

|

5,992 |

|

|

12,137 |

|

|

14,812 |

|

| Stock-based compensation

expense (benefit) |

2,213 |

|

|

(872 |

) |

|

(4,650 |

) |

|

5,106 |

|

| Interest expense, net |

4,274 |

|

|

5,123 |

|

|

9,802 |

|

|

10,584 |

|

| Net income and comprehensive

income available to shareholders |

13,299 |

|

|

13,894 |

|

|

32,334 |

|

|

21,075 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA(i)(ii) |

31,941 |

|

|

37,122 |

|

|

92,073 |

|

|

89,192 |

|

| Adjusted EBITDA

margin(i)(ii) |

45.1 |

% |

|

21.0 |

% |

|

34.2 |

% |

|

24.5 |

% |

| |

|

|

|

|

|

|

|

| Per share information |

|

|

|

|

|

|

|

| Basic net income per

share |

$ |

0.46 |

|

|

$ |

0.55 |

|

|

$ |

1.19 |

|

|

$ |

0.84 |

|

| Diluted net income per

share |

$ |

0.42 |

|

|

$ |

0.45 |

|

|

$ |

1.07 |

|

|

$ |

0.70 |

|

|

Adjusted EPS(i) |

$ |

0.45 |

|

|

$ |

0.43 |

|

|

$ |

1.14 |

|

|

$ |

0.93 |

|

(i)See "Non-GAAP Financial Measures".(ii)In the three months

ended December 31, 2019 we changed the calculation of adjusted

EBITDA. This change has not been reflected in results prior to the

three months ended December 31, 2019. Applying this change to

previously reported periods would result in no change for the three

months ended June 30, 2019 and an increase of $0.2 million in

adjusted EBITDA for the six months ended June 30, 2019.

Results for the Three and Six Months

Ended June 30, 2020

For the three months ended June 30, 2020,

revenue was $70.8 million, down from $176.9 million in the same

period last year. The decrease in revenue is primarily due to

reduced activity at our mine sites as several customers suspended

all services in late Q1 and throughout the majority of Q2 as part

of their risk mitigation measures against the COVID-19 pandemic.

Additionally, contributing to the slower quarter was unfavorable

weather conditions which resulted in shift cancellations and

continuous delays for overburden removal work due to haul road

repairs. The completion of the Highland Valley Copper Mine contract

and the heavy civil construction work at the Fort Hills Mine in Q4

2019 also contributed to the year over year decrease.

For the six months ended June 30, 2020, revenue

was $269.6 million, down from $363.3 million in the same period

last year. This decrease of 25.8% reflects the Q2 challenges

mentioned above, combined with the effect of the change in

consolidation method for Nuna whereby revenues are now included

within equity earnings. These decreases were partially offset by

the completion of the new civil construction services work at the

Mildred Lake Mine and the increased volume on the winter works

program at the Aurora Mine.

For the three months ended June 30, 2020, gross profit was $21.1

million, and a 29.8% gross profit margin, down from a $23.5 million

gross profit but up from a 13.3% gross profit margin in the same

period last year. The gross profit margin achieved was the result

of an effectively operated fleet, albeit smaller in number than

originally anticipated, and the disciplined cost constraints in

place during the customer imposed reductions at the various mine

sites. Furthermore, the mix of work that was executed in the

quarter were higher margin scopes than the prior year.

For the six months ended June 30, 2020, gross profit was $55.7

million, and a 20.7% gross profit margin, up from $53.0 million,

and a 14.6% gross profit margin in the same period last year. The

improvement in current year gross profit and margin was impacted by

the Q2 factors discussed above, and the strong margins achieved in

Q1 from the favorable operating conditions at our mine sites

particularly in January and February.

For the three months ended June 30, 2020, depreciation was $11.6

million, or 16.3% of revenue, down from $22.1 million, or 12.5% of

revenue, in the same period last year. For the six months ended

June 30, 2020, depreciation was $43.9 million, or 16.3% of revenue,

down from $51.4 million, or 14.6% of revenue, in the same period

last year. The significant drop in depreciation is the result of a

significant reduction in revenue and utilization of the heavy

equipment fleet in the months of April and May as a result of the

impacts of COVID-19. Depreciation as a percentage of revenue

increased significantly as a result of lower revenue and lower

depreciation of the heavy equipment fleet, relative to assets under

straight-line depreciation when compared to the same period in

2019.

For the three months ended June 30, 2020, we recorded operating

income of $14.7 million, a decrease of $3.9 million from the $18.6

million for the same period last year. General and administrative

expense, excluding stock-based compensation expense, was $3.5

million (or 4.9% of revenue) for the quarter, lower than the $6.0

million (or 3.4% of revenue) in the prior year. Stock-based

compensation expense increased $3.1 million compared to the prior

year, primarily from the effect of a fluctuating share price on the

carrying value of our liability classified award plans.

For the six months ended June 30, 2020, we recorded operating

income of $47.1 million, an increase of $14.0 million from the

$33.1 million for the same period last year. General and

administrative expense, excluding stock-based compensation expense

was $12.1 million (or 4.5% of revenue) compared to the $14.8

million (or 4.1% of revenue) for the six months ended June 30,

2019. Stock-based compensation expense decreased by $9.8 million

for the same period in the prior year.

For the three months ended June 30, 2020, we recorded $13.3

million of net income and comprehensive income available to

shareholders (basic income per share of $0.46 and diluted income

per share of $0.42), compared to $13.9 million net income and

comprehensive income available to shareholders (basic income per

share of $0.55 and diluted income per share of $0.45) recorded for

the same period last year. The net income and comprehensive income

available to shareholders in the current year was affected by an

increase of income tax expense of $1.1 million in the current

period.

For the six months ended June 30, 2020, we recorded $32.3

million net income and comprehensive income available to

shareholders (basic income per share of $1.19 and diluted income

per share of $1.07), compared to $21.1 million net income and

comprehensive income available to shareholders (basic income per

share of $0.84 and diluted income per share of $0.70) for the same

period last year.

Cash provided by operating activities prior to change in working

capital for the three months ended June 30, 2020 was $24.6 million,

compared to cash provided by operating activities prior to change

in working capital of $29.9 million for the three months ended June

30, 2019. Cash provided by operating activities prior to change in

working capital for the six months ended June 30, 2020 was $79.0

million, compared to cash provided by operating activities prior to

change in working capital of $74.6 million for the six months ended

June 30, 2019. The year to date increase in cash flow is largely a

result of the improved gross profit in the year.

We have prepared our consolidated financial statements in

conformity with accounting principles generally accepted in the

United States ("US GAAP"). Unless otherwise specified, all dollar

amounts discussed are in Canadian dollars. Please see the

Management’s Discussion and Analysis (“MD&A”) for the quarter

ended June 30, 2020 for further detail on the matters

discussed in this release. In addition to the MD&A, please

reference the dedicated Q2 2020 Results Presentation for more

information on our results and projections which can be found on

our website under Investors - Presentations.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

our financial results for the quarter ended June 30, 2020

tomorrow, Thursday, July 30, 2020 at 9:00 am Eastern Time (7:00 am

Mountain Time).

The call can be accessed by dialing:

Toll free:

1-800-838-7301International: 1-206-596-9924

A replay will be available through August 30, 2020, by

dialing:

Toll Free:

1-855-859-2056International: 1-404-537-3406Conference ID:

6885852

A slide deck for the webcast will be available for download on

the company’s website at www.nacg.ca/presentations/

The live presentation and webcast can be accessed at:

www.nacg.ca/conference-calls/

For those unable to listen live, a replay will be available

using the link provided above until August 30, 2020.

Non-GAAP Financial Measures

A non-GAAP financial measure is generally defined by the

securities regulatory authorities as one that purports to measure

historical or future financial performance, financial position or

cash flows, but excludes or includes amounts that would not be

adjusted in the most comparable GAAP measures. We use non-GAAP

financial measures such as "gross profit", "adjusted net earnings",

"adjusted EBIT", "equity investment EBIT", "adjusted EBITDA",

"equity investment depreciation and amortization", "adjusted EPS",

"margin", "cash provided by operating activities prior to change in

working capital" and "free cash flow". We provide tables in this

document that reconcile non-GAAP measures used to amounts reported

on the face of the consolidated financial statements.

"Gross profit" is defined as revenue less: project costs;

equipment costs; and depreciation. We believe that gross profit is

a meaningful measure of our business as it portrays results before

general and administrative overheads costs, amortization of

intangible assets and the gain or loss on disposal of property,

plant and equipment. Management reviews gross profit to determine

the profitability of operating activities, including equipment

ownership charges and to determine whether resources, property,

plant and equipment are being allocated effectively.

"Adjusted net earnings" is defined as net income and

comprehensive income available to shareholders excluding the

effects of unrealized foreign exchange gain or loss, realized and

unrealized gain or loss on derivative financial instruments, cash

and non-cash (liability and equity classified) stock-based

compensation expense, gain or loss on disposal of property, plant

and equipment and certain other non-cash items included in the

calculation of net income.

"Adjusted EBIT" is defined as adjusted net earnings before the

effects of interest expense, income taxes and equity earnings in

affiliates and joint ventures, but including the equity investment

EBIT from our affiliates and joint ventures accounted for using the

equity method.

“Equity investment EBIT” is defined as our proportionate share

(based on ownership interest) of equity earnings in affiliates and

joint ventures before the effects of gain or loss on disposal of

property, plant and equipment, interest expense and income

taxes.

“Adjusted EBITDA” is defined as adjusted EBIT before the effects

of depreciation, amortization and equity investment depreciation

and amortization.

“Equity investment depreciation and amortization” is defined as

our proportionate share (based on ownership interest) of

depreciation and amortization in other affiliates and joint

ventures accounted for using the equity method.

We believe that adjusted EBIT and adjusted EBITDA are meaningful

measures of business performance because they exclude items that

are not directly related to the operating performance of our

business. Management reviews these measures to determine whether

property, plant and equipment are being allocated efficiently.

"Adjusted EPS" is defined as adjusted net earnings, divided by

the weighted-average number of common shares.

As adjusted EBIT, adjusted EBITDA, adjusted net earnings and

adjusted EPS are non-GAAP financial measures, our computations may

vary from others in our industry. These measures should not be

considered as alternatives to operating income or net income as

measures of operating performance or cash flows and they have

important limitations as analytical tools and should not be

considered in isolation or as substitutes for analysis of our

results as reported under US GAAP. For example adjusted EBITDA does

not:

- reflect our cash expenditures or requirements for capital

expenditures or capital commitments or proceeds from capital

disposals;

- reflect changes in our cash requirements for our working

capital needs;

- reflect the interest expense or the cash requirements necessary

to service interest or principal payments on our debt;

- include tax payments or recoveries that represent a reduction

or increase in cash available to us; or

- reflect any cash requirements for assets being depreciated and

amortized that may have to be replaced in the future.

"Margin" is defined as the financial number as a percent of

total reported revenue. Examples where we use this reference and

related calculation are in relation to "gross profit margin",

"operating income margin", "net income margin", or "adjusted EBITDA

margin". We will often identify a relevant financial metric as a

percentage of revenue and refer to this as a margin for that

financial metric.

We believe that presenting relevant financial metrics as a

percentage of revenue is a meaningful measure of our business as it

provides the performance of the financial metric in the context of

the performance of revenue. Management reviews margins as part of

its financial metrics to assess the relative performance of its

results.

"Cash provided by operating activities prior to change in

working capital" is defined as cash used in or provided by

operating activities excluding net changes in non-cash working

capital.

"Free cash flow" is defined as cash from operations less cash

used in investing activities (including finance lease additions but

excluding cash used for growth capital expenditures, cash used for

/ provided by acquisitions and proceeds from equipment sale and

leaseback). We believe that free cash flow is a relevant measure of

cash available to service our total debt repayment commitments, pay

dividends, fund share purchases and fund both growth capital

expenditures and potential strategic initiatives.

A reconciliation of net income and comprehensive income

available to shareholders to adjusted net earnings, adjusted EBIT

and adjusted EBITDA is as follows:

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

|

(dollars in thousands) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Net income and comprehensive income available to shareholders |

$ |

13,299 |

|

|

$ |

13,894 |

|

|

$ |

32,334 |

|

|

$ |

21,075 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Loss (gain) on disposal of property, plant and equipment |

672 |

|

|

(519 |

) |

|

829 |

|

|

(475 |

) |

|

Stock-based compensation expense (benefit) |

2,213 |

|

|

(872 |

) |

|

(4,650 |

) |

|

5,106 |

|

|

Unrealized gain on derivative financial instrument |

(2,496 |

) |

|

— |

|

|

(286 |

) |

|

— |

|

|

Restructuring costs |

— |

|

|

— |

|

|

— |

|

|

1,442 |

|

|

Write-down on assets held for sale |

— |

|

|

— |

|

|

1,800 |

|

|

— |

|

|

Pre-2019 inventory correction |

— |

|

|

(2,775 |

) |

|

— |

|

|

(2,775 |

) |

|

Tax effect of the above items |

(721 |

) |

|

1,104 |

|

|

956 |

|

|

(874 |

) |

|

Adjusted net earnings(i) |

12,967 |

|

|

10,832 |

|

|

30,983 |

|

|

23,499 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Tax effect of the above items |

721 |

|

|

(1,104 |

) |

|

(956 |

) |

|

874 |

|

|

Interest expense, net |

4,274 |

|

|

5,123 |

|

|

9,802 |

|

|

10,584 |

|

|

Income tax expense (benefit) |

992 |

|

|

(121 |

) |

|

6,986 |

|

|

2,354 |

|

|

Equity earnings in affiliates and joint ventures(ii) |

(1,474 |

) |

|

— |

|

|

(1,934 |

) |

|

— |

|

|

Equity investment EBIT(i)(ii) |

1,990 |

|

|

— |

|

|

2,550 |

|

|

— |

|

|

Adjusted EBIT(i)(ii) |

19,470 |

|

|

14,730 |

|

|

47,431 |

|

|

37,311 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation |

11,551 |

|

|

22,099 |

|

|

43,859 |

|

|

51,380 |

|

|

Write-down on assets held for sale |

— |

|

|

— |

|

|

(1,800 |

) |

|

— |

|

|

Amortization of intangible assets |

88 |

|

|

293 |

|

|

729 |

|

|

501 |

|

|

Equity investment depreciation and amortization(i)(ii) |

832 |

|

|

— |

|

|

1,854 |

|

|

— |

|

|

Adjusted EBITDA(i)(ii) |

$ |

31,941 |

|

|

$ |

37,122 |

|

|

$ |

92,073 |

|

|

$ |

89,192 |

|

(i)See "Non-GAAP Financial Measures". (ii)In the three months

ended December 31, 2019 we changed the calculation of adjusted

EBITDA. This change has not been reflected in results prior to the

three months ended December 31, 2019. Applying this change to

previously reported periods would result in increases to adjusted

EBIT of $0.2 million for the three months ended June 30, 2019 and

$0.4 million for the six months ended June 30, 2019, and no change

in adjusted EBITDA for the three months ended June 30, 2019 and an

increase of $0.2 million in adjusted EBITDA for the six months

ended June 30, 2019.

We have included equity investment EBITDA in the calculation of

adjusted EBITDA beginning in the fourth quarter of 2019. Below is a

reconciliation of the amount included in adjusted EBITDA for the

three and six months ended June 30, 2020.

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

|

(dollars in thousands) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Equity earnings in affiliates and joint ventures |

$ |

1,474 |

|

$ |

— |

|

$ |

1,934 |

|

$ |

— |

| Adjustments: |

|

|

|

|

|

|

|

|

Interest expense, net |

127 |

|

— |

|

179 |

|

— |

|

Income tax expense |

9 |

|

— |

|

57 |

|

— |

|

Loss on disposal of property, plant and equipment |

380 |

|

— |

|

380 |

|

— |

|

Equity investment EBIT(i) |

$ |

1,990 |

|

$ |

— |

|

$ |

2,550 |

|

$ |

— |

|

Depreciation |

$ |

799 |

|

$ |

— |

|

$ |

1,788 |

|

$ |

— |

|

Amortization of intangible assets |

33 |

|

— |

|

66 |

|

— |

|

Equity investment depreciation and

amortization(i) |

$ |

832 |

|

$ |

— |

|

$ |

1,854 |

|

$ |

— |

(i)See "Non-GAAP Financial Measures".

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

“anticipate”, “believe”, “expect”, “should” or similar

expressions.

The material factors or assumptions used to develop the above

forward-looking statements include, and the risks and uncertainties

to which such forward-looking statements are subject, are

highlighted in the MD&A for the three and six months ended June

30, 2020. Actual results could differ materially from those

contemplated by such forward-looking statements because of any

number of factors and uncertainties, many of which are beyond

NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

About the Company

North American Construction Group Ltd. (www.nacg.ca) is one of

Canada’s largest providers of heavy civil construction and mining

contractors. For more than 65 years, NACG has provided services to

large oil, natural gas and resource companies.

For further information contact:

Jason Veenstra, CPA, CAChief Financial OfficerNorth American

Construction Group Ltd.(780)

948-2009jveenstra@nacg.cawww.nacg.ca

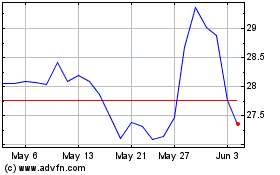

North American Construct... (TSX:NOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

North American Construct... (TSX:NOA)

Historical Stock Chart

From Dec 2023 to Dec 2024