Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE

American) (“Platinum Group” “PTM” or the “Company”) reports that

Hosken Consolidated Investments Limited ("HCI") announced on

February 4, 2019 it had acquired, on a private placement basis

through its subsidiary Deepkloof Limited, 2,141,942 common shares

of Platinum Group Metals Ltd. ("PTM") at a price of US$1.33 per

share for total consideration of US$2,848,783.

Immediately before the acquisition, HCI held

4,383,447 common shares of PTM, representing 14.77% of PTM's issued

and outstanding common shares, and 3,999,999 common share purchase

warrants. This acquisition brings HCI's total holdings in the

common shares of PTM to 6,525,389, or 19.89%.

R. Michael Jones, CEO of Platinum Group said,

“HCI’s investment has been important in advancing the Waterberg

palladium project. We are working closely with our joint venture

partners Implats, JOGMEC, Hanwa and Mnombo on the completion of the

Waterberg Definitive Feasibility Study later this year.”

HCI is a South African black empowerment

investment holding company with a US$750 million market

capitalization, listed on the JSE Securities Exchange. It is

incorporated under the laws of South Africa and its head office is

located in Cape Town. HCI’s major shareholder is the South African

Clothing and Textile Workers Union. The group is involved in a

diverse group of investments including hotel and leisure,

interactive gaming, media and broadcasting, transport, mining and

properties.

The PTM securities were purchased and are

presently being held by HCI for investment purposes. In the future,

HCI or its affiliates may acquire additional securities of PTM or

dispose of such securities subject to a number of factors,

including general market and economic conditions and other

investment and business opportunities available.

About Platinum Group Metals

Ltd.

Platinum Group is focused on, and is the

operator of, the Waterberg Project, a bulk mineable underground

palladium deposit in northern South Africa. Waterberg was

discovered by the Company. Waterberg has potential to be a

low cost dominantly palladium mine and Implats, a smelter and

refiner of platinum group metals, recently made a strategic

investment in the Waterberg Project.

On behalf of the Board of

Platinum Group Metals Ltd.

“R. Michael Jones” President and CEO

For further information

contact: R. Michael Jones,

President or Kris Begic, VP, Corporate

Development Platinum Group Metals Ltd.,

Vancouver Tel: (604) 899-5450 / Toll Free: (866)

899-5450 www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American

have not reviewed and do not accept responsibility for the accuracy

or adequacy of this news release, which has been prepared by

management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking statements”). Forward-looking

statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, plans, postulate and similar

expressions, or are those, which, by their nature, refer to future

events. All statements that are not statements of historical fact

are forward-looking statements. Forward-looking statements in

this press release include, without limitation, statements

regarding the size, participation in, receipt of regulatory

approvals for, and the completion and amount and use of proceeds of

the Private Placement. Although the Company believes the

forward-looking statements in this press release are reasonable, it

can give no assurance that the expectations and assumptions in such

statements will prove to be correct. The Company cautions investors

that any forward-looking statements by the Company are not

guarantees of future results or performance and that actual results

may differ materially from those in forward-looking statements as a

result of various factors, including the Company’s inability to

obtain subscriptions for and complete the Private Placement on the

terms disclosed above, or at all, to obtain required regulatory

approvals for the Private Placement, and to maintain and extend the

waivers of Liberty Metals & Mining Holdings, LLC (“LMM”), a

subsidiary of Liberty Mutual Insurance, under the Company’s credit

facility (the “LMM Facility”) necessary to permit the use of

proceeds contemplated above; additional financing requirements; the

LMM Facility with LMM is, and any new indebtedness may be, secured

and the Company has pledged its shares of Platinum Group Metals

(RSA) Proprietary Limited (“PTM RSA”), and PTM RSA has pledged its

shares of Waterberg JV Resources (Pty) Limited (“Waterberg JV Co.”)

to LMM, under the LMM Facility, which potentially could result in

the loss of the Company’s interest in PTM RSA and the Waterberg

Project in the event of a default under the LMM Facility or any new

secured indebtedness; the Company’s history of losses and negative

cash flow; the Company’s ability to continue as a going concern;

the Company’s properties may not be brought into a state of

commercial production; uncertainty of estimated production,

development plans and cost estimates for the Waterberg Project;

discrepancies between actual and estimated mineral reserves and

mineral resources, between actual and estimated development and

operating costs, between actual and estimated metallurgical

recoveries and between estimated and actual production;

fluctuations in the relative values of the U.S. Dollar, the Rand

and the Canadian Dollar; volatility in metals prices; the failure

of the Company or the other shareholders to fund their pro

rata share of funding obligations for the Waterberg Project; any

disputes or disagreements with the other shareholders of Waterberg

JV Co., Mnombo Wethu Consultants (Pty) Ltd. or Maseve; completion

of a DFS for the Waterberg Project is subject to economic analysis

requirements; the ability of the Company to retain its key

management employees and skilled and experienced personnel;

conflicts of interest; litigation or other administrative

proceedings brought against the Company; actual or alleged breaches

of governance processes or instances of fraud, bribery or

corruption; the Company may become subject to the U.S. Investment

Company Act; exploration, development and mining risks and the

inherently dangerous nature of the mining industry, and the risk of

inadequate insurance or inability to obtain insurance to cover

these risks and other risks and uncertainties; property and mineral

title risks including defective title to mineral claims or

property; changes in national and local government legislation,

taxation, controls, regulations and political or economic

developments in Canada and South Africa; equipment shortages and

the ability of the Company to acquire necessary access rights and

infrastructure for its mineral properties; environmental

regulations and the ability to obtain and maintain necessary

permits, including environmental authorizations and water use

licences; extreme competition in the mineral exploration industry;

delays in obtaining, or a failure to obtain, permits necessary for

current or future operations or failures to comply with the terms

of such permits; risks of doing business in South Africa, including

but not limited to, labour, economic and political instability and

potential changes to and failures to comply with legislation; the

Company’s common shares may be delisted from the NYSE American or

the TSX if it cannot maintain or regain compliance with the

applicable listing requirements; and other risk factors described

in the Company’s most recent Form 20-F annual report, Annual

Information Form and other filings with the SEC and Canadian

securities regulators, which may be viewed at www.sec.gov and

www.sedar.com, respectively. Proposed changes in the mineral

law in South Africa if implemented as proposed would have a

material adverse effect on the Company’s business and potential

interest in projects. Any forward-looking statement speaks only as

of the date on which it is made and, except as may be required by

applicable securities laws, the Company disclaims any intent or

obligation to update any forward- looking statement, whether as a

result of new information, future events or results or

otherwise.

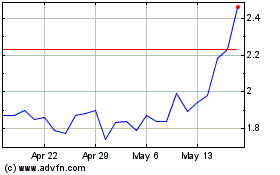

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Jan 2025 to Feb 2025

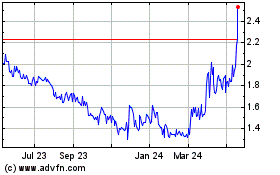

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Feb 2024 to Feb 2025