In-Person Interactions During the Mortgage Process Drive Trust and Customer Satisfaction in a Digitally Dependent World

October 18 2021 - 7:30AM

Business Wire

Solidifi Releases

Results from its 2021 Consumer Mortgage Experience Survey(1)

The third annual Consumer Mortgage Experience Survey(1)

commissioned by Solidifi U.S. Inc. (“Solidifi”) revealed that 81%

of borrowers prefer an in-person closing as it instills a greater

level of trust and because buying a home is one of the single

largest investments in their life. In a digitally dependent

society, homeowners continue to want in-person interactions when

purchasing and refinancing their home.

Yet, the preference for using digital tools in the real estate

transaction continues to increase, especially for reviewing

documents prior to or during the residential real estate closing

process. More than half of the borrowers surveyed wanted to review

documents digitally prior to their closing.

“As the consumer mortgage experience becomes more digital and we

continue to see generational shifts, investments in technology

coupled with customer service-oriented, in-person touch points like

the appraisal and closing will play a crucial role in transforming

the real estate experience and ultimately determining customer

satisfaction with a lender,” said Solidifi President Loren Cooke.

“In fact, borrowers who had an exceptional experience with their

lender are more than twice as likely to recommend their lender, and

94% are likely to use the lender again.”

The Solidifi 2021 Consumer Mortgage Experience Survey surveyed

1,000+ residential borrowers 18 years of age or older in the United

States who have refinanced or purchased a home within the last two

years, to assess the two most critical touchpoints in the mortgage

transaction, the appraisal and the closing experience. The survey

took an expansive look inside the borrower’s experience during the

valuation and closing processes, uncovering insights about what

ultimately drives consumer preferences and expectations. This

year’s results reaffirmed findings of the past two years and

uncovered interesting, new generational differences that will shift

how our industry can better serve consumers in the future.

Homeownership continues to represent the American dream,

according to survey respondents. Regardless of age, borrowers

believe owning a home represents an investment in their future,

stability, a place for children to grow and thrive, and it

represents the most significant financial transaction in their

life. Interestingly, Millennials are more likely to see home

ownership as fulfilling needs related to family and community,

while Boomers see it as a significant financial transaction and

providing stability.

“With our on-demand economy, the “convenience factor” continues

to morph consumer preferences in real estate as with so many other

retail services,” said Cooke. “Our survey revealed that convenience

drives consumer preferences when it comes to closings, and the

majority of borrowers prefer to close in an office or at their home

versus online. This year, 62% of borrowers indicated that they

would like mobile notaries to facilitate their closing, including

71% of Millennials, who were the largest age cohort to prefer a

mobile notary.”

Borrowers also revealed that appraisals are very valuable to

them. They continue to value interactions with appraisers and

confirmed that those who interacted with appraisers had a better

overall experience. In fact, 2 in 3 borrowers indicated that having

a full interior evaluation increased their trust in their

lender.

“Our survey reiterated that the caliber of the appraiser and

closing agent continues to be a key determinant of customer

satisfaction – and that Solidifi outperforms competitors on

customer satisfaction,” concluded Cooke. “Appraiser and closing

agent professionalism, meaningful interactions and communication

make or break the consumer experience – that’s why we focus on

creating an extraordinary customer experience and delivering proven

performance that our customers can depend on, every time.”

[1] Market Street Research surveyed 1,000+ residential borrowers

18 years of age or older in the United States who have refinanced

or purchased a home within the last two years, including an equal

mix of those who have purchased a home or refinanced a mortgage in

the last year and a mix of those who closed between one or two

years ago. The survey was fielded using Snap Surveys, and the panel

was sourced from Dynata. Fielding was executed in July 2021.

About Solidifi

Solidifi is a leading network management services provider for

the residential lending industry. Our platform combines proprietary

technology and network management capabilities with tens of

thousands of independent qualified professionals to create an

efficient marketplace for the provision of mortgage lending

services. We are a leading independent provider of residential real

estate appraisals, title and settlement services. Our clients

include the majority of the top 100 mortgage lenders in the U.S.

Solidifi is a wholly owned subsidiary of Real Matters (TSX: REAL).

Visit www.Solidifi.com for more information and stay connected with

our latest news on LinkedIn.

Solidifi and the Solidifi logo are trademarks of Real Matters

and/or its subsidiaries. All other trademarks are the property of

their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211018005223/en/

Jennie Craig Vice President, Marketing jlcraig@solidifi.com

832.236.3392

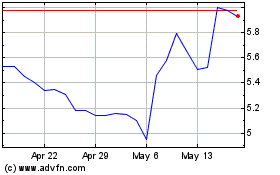

Real Matters (TSX:REAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

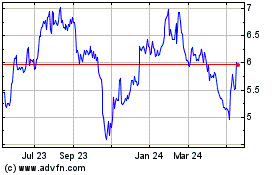

Real Matters (TSX:REAL)

Historical Stock Chart

From Dec 2023 to Dec 2024