Brompton Split Banc Corp. Completes Preferred Share Private Placement

December 14 2021 - 9:15AM

(TSX: SBC, SBC.PR.A) Brompton Split Banc

Corp. (the “Company”) is pleased to announce that it has completed

the previously announced private placement of preferred shares for

aggregate gross proceeds of approximately $32 million (the “Private

Placement”). Pursuant to the Private Placement, 3,164,203 preferred

shares were offered to investors at a price of $10.10 per preferred

share.

The Company’s previously announced split of its

class A shares (the “Share Split”) will be effected after the close

of business today. Following the Share Split there will be an equal

number of class A and preferred shares outstanding. DBRS has

confirmed that the rating of the preferred shares will continue to

be Pfd-3 (high) following the completion of the Share Split.

Over the last ten years to November 30, 2021,

the preferred shares have delivered a 4.9% per annum total return

based on NAV, outperforming the total return of the S&P/TSX

Preferred Share Index by 1.7% per annum with lower

volatility.(1)

Brompton Split Banc Corp. invests in a

portfolio, on an approximately equal weight basis, in common shares

of 6 Canadian Banks: Bank of Montreal, Canadian Imperial Bank of

Commerce, National Bank of Canada, Royal Bank of Canada, The Bank

of Nova Scotia and The Toronto-Dominion Bank.

About Brompton Funds

Founded in 2000, Brompton Funds Limited

(“Brompton”) is an experienced investment fund manager with

income focused investment solutions including TSX listed

closed-end funds and exchange-traded funds. For further

information, please contact your investment advisor, call

Brompton’s investor relations line at 416-642-6000 (toll-free at

1-866-642-6001), email us at info@bromptongroup.com or

visit our website at www.bromptongroup.com.

(1) See Standard Performance Data

table below.

|

Brompton Split Banc Corp.Compound Annual NAV

returns to November 30, 2021 |

1 Yr |

3 Yr |

5 Yr |

10 Yr |

S.I. |

|

Class A Shares (TSX:SBC) |

62.5 |

% |

19.3 |

% |

15.4 |

% |

17.9 |

% |

12.3 |

% |

|

S&P/TSX Capped Financials Index |

31.0 |

% |

13.8 |

% |

11.0 |

% |

12.9 |

% |

9.0 |

% |

|

S&P/TSX Composite Index |

23.5 |

% |

14.2 |

% |

9.7 |

% |

8.6 |

% |

7.3 |

% |

|

|

|

|

|

|

|

|

Preferred Shares (TSX:SBC.PR.A) |

5.1 |

% |

5.1 |

% |

5.0 |

% |

4.9 |

% |

5.1 |

% |

|

S&P/TSX Preferred Share Index |

20.6 |

% |

8.4 |

% |

7.0 |

% |

3.2 |

% |

3.0 |

% |

Returns are for the periods ended November 30,

2021 and are unaudited. Inception date November 15, 2005. The table

shows the Company’s compound return on a class A share and

preferred share for each period indicated, compared with the

S&P/TSX Capped Financials Index (“Financials Index”), the

S&P/TSX Composite Index (“Composite Index”), and the

S&P/TSX Preferred Share Index (“Preferred Share Index”)

(together the “Indices”). The Financials Index is derived from the

Composite Index based on the financials sector of the Global

Industry Classification Standard. The Composite Index tracks the

performance, on a market weight basis, of a broad index of

large-capitalization issuers listed on the TSX. The Preferred Share

Index tracks the performance, on a market weight basis, of

preferred shares listed on the TSX that meet criteria relating to

minimum size, liquidity, issuer rating, and exchange listing. The

class A shares and preferred shares are not expected to mirror the

performance of the Indices which have more diversified portfolios.

The Indices are calculated without the deduction of management

fees, fund expenses and trading commissions, whereas the

performance of the Company is calculated after deducting such fees

and expenses. Further, the performance of the Company’s class A

shares is impacted by the leverage provided by the Company’s

preferred shares.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the investment funds on

the TSX or other alternative Canadian trading system (an

“exchange”). If the shares are purchased or sold on an exchange,

investors may pay more than the current net asset value when buying

shares of the investment fund and may receive less than the current

net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the Company in

the public filings available at www.sedar.com. The indicated rates

of return are the historical annual compounded total returns

including changes in share value and reinvestment of all

distributions and do not take into account certain fees such as

redemption costs or income taxes payable by any securityholder that

would have reduced returns. Investment funds are not guaranteed,

their values change frequently and past performance may not be

repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the fund, to the future outlook of

the fund and anticipated events or results and may include

statements regarding the future financial performance of the fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or any

applicable exemption from the registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities nor will there be any sale of such

securities in any state in which such offer, solicitation or sale

would be unlawful.

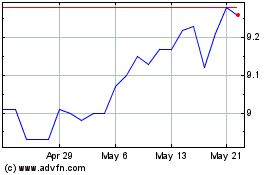

Brompton Split Banc (TSX:SBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

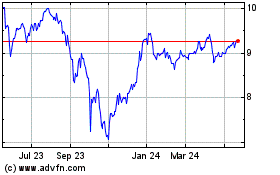

Brompton Split Banc (TSX:SBC)

Historical Stock Chart

From Dec 2023 to Dec 2024