Sienna Senior Living Inc. (“

Sienna” or the

“

Company”) (TSX: SIA) today announced its

financial results for the three and twelve months ended December

31, 2024. The Consolidated Financial Statements and accompanying

Management’s Discussion and Analysis (“

MD&A”)

are available on the Company’s website at

www.siennaliving.ca and on SEDAR+ at www.sedarplus.ca.

Sienna's fourth quarter results highlight the

Company's two-year growth trajectory, marking its eighth

consecutive quarter of year-over-year adjusted same property net

operating income (“NOI”) growth since the beginning of 2023.

“2024 has been a year of tremendous progress and

demonstrates the strength and potential of our Company,” said Nitin

Jain, President and Chief Executive Officer. “We continued our

growth momentum for a second year in a row, further strengthened

our balance sheet, advanced our development pipeline with two

projects nearing completion, and secured a highly attractive

portfolio acquisition in Alberta. But this was just the

beginning—with the rapid growth of Canada’s senior population

driving unprecedented demand, we believe there is exceptional

growth potential for Sienna for years to come.”

Operating Highlights

- Adjusted

same property NOI increased by 22.6% to $45.5 million,

compared to Q4 2023, including

- a 15.3%

year-over-year increase in the Retirement segment, and

- a 29.0%

year-over-year increase in the long-term care (“LTC”) segment

-

Continued progress towards 95% same property retirement

occupancy – average same property occupancy increased by

300 basis points (“bps”) to 92.9% in Q4 2024 compared to Q4 2023;

average monthly occupancy further improved to 93.1% in January

2025;

-

Significant year-over-year increase in LTC NOI highlights

strength of LTC platform – a stable operating environment,

fully occupied homes, improvements to government funding and

Sienna’s successful cost management strategy all supported the

29.0% year-over-year increase in the Company’s LTC segment in Q4

2024;

-

Improved team member retention contributes to reduction in

agency staffing costs – agency staffing costs decreased to

$3.4 million, down $2.4 million year-over-year in Q4 2024,

supported by Sienna’s proactive staffing initiatives and a 30%

decrease in team member turnover year-over-year in 2024;

-

Comprehensive asset optimization initiatives – as

part of the Company’s asset optimization initiatives, Sienna has

identified five retirement residences for near-term repositioning

in order to enhance their market fit and unlock their full growth

potential.In connection with these initiatives, the identified

repositioning assets have been reclassified from the Company’s Same

Property portfolio to its Growth and Optimization portfolio.

Comparative figures for prior periods have been adjusted for

consistency with the current year’s presentation.

Sienna continues to grow with $81

million of high quality acquisitions in Ontario

Sienna is pleased to continue its growth

momentum with two high quality acquisitions in Ottawa and the

Greater Toronto Area (“GTA”), including a 165-suite retirement

residence in the Ottawa suburb of Stittsville, and a 192-bed Class

A long-term care home located in the City of Mississauga, a large

suburb within the GTA. With a combined purchase price of $81

million, these two assets will further enhance Sienna’s diversified

asset base in two key markets in Ontario.

"We are excited to further expand our operations

with two high quality acquisitions in Ontario, generating immediate

synergies with our existing portfolio and enhancing the size and

quality of our diversified asset base," said David Hung, Chief

Financial Officer and Executive Vice President, Investments at

Sienna. "The acquisitions will be completed at a significant

discount to replacement cost and are expected to be immediately

accretive to Sienna’s AFFO per share."

-

$48.0 million contemporary retirement residence in

Ottawa – On February 10, 2025, the Company entered into a

purchase agreement to acquire Wildpine Residence, a 165-suite

retirement residence consisting of 119 independent living (IL) and

46 assisted living (AL) units in Stittsville, a suburb located in

Ottawa’s west end. Opened in 2019, the four-storey property offers

attractive amenities, including luxury suites with balconies and

patios, multiple dining rooms, a pub and lounge, as well as

excellent health & fitness facilities. The property’s occupancy

is stabilized and is expected to benefit from synergies with nearby

properties owned by the Company in addition to the rapidly

improving supply-demand fundamentals in the Ottawa market.The gross

purchase price for the acquisition is $48.0 million, subject to

certain customary adjustments, and will be financed through the

assumption of approximately $25.0 million of CMHC insured debt and

the remainder through use of general corporate funds. Sienna is

acquiring this property at a capitalization rate of 6.25%.The

transaction is subject to regulatory approvals and customary

closing conditions, and is expected to close by mid-2025.

-

$32.6 million Class A long-term care community in the

Greater Toronto Area – On February 14, 2025, the Company

entered into a purchase agreement to acquire Cawthra Gardens, a

192-bed Class A long-term care home in Mississauga, Ontario. Built

in 2003 and located near two other Sienna LTC communities in the

highly attractive Mississauga market, Cawthra Gardens will benefit

from Sienna’s well-established operating platform to achieve

synergies with nearby properties owned by the Company. In addition,

the high wait list for long-term care homes and constrained supply,

make this three-storey home comprising 120 private beds and 72

basic beds a very attractive investment opportunity.The purchase

price for the acquisition of $32.6 million is subject to certain

customary adjustments and includes a $2.0 million capital allowance

which the Company plans to use within the first twelve months after

closing. The acquisition will be financed through use of general

corporate funds. Sienna is acquiring this property at a

capitalization rate of 6.75%.The transaction is subject to

regulatory approvals and customary closing conditions, and is

expected to close in early 2026.

Financial performance - Q4

2024

- Total

Adjusted Revenue increased by 12.5% in Q4 2024, to $246.3

million, compared to Q4 2023. In the Retirement segment, the

increase was mainly driven by occupancy increases, annual rental

rate increases, and care and ancillary revenue. In the LTC segment,

the increase was primarily due to increased flow-through funding

for direct care, significant government funding increases

offsetting cost pressures in recent years, and retroactive funding

from British Columbia health authorities of $2.5 million, including

$1.8 million relating to the prior year.

- Total

Adjusted NOI increased by 22.1%, to $46.7 million,

compared to Q4 2023. Adjusted NOI in the Retirement segment

increased by $2.7 million mainly due to occupancy increases, annual

rental rate increases, and higher care and ancillary revenue,

offset partially by higher labour and food costs, and increased

maintenance expenses. NOI in the LTC segment increased by $5.8

million largely due to a significant annual government funding

increase to support cost increases in recent years and retroactive

funding of $2.5 million from British Columbia health authorities,

of which $1.8 million relates to the prior year, offset by direct

care wages and inflationary increases in expenses.

-

Adjusted Same Property NOI increased by 22.6% to

$45.5 million, compared to Q4 2023, including a $19.1 million

contribution from the Retirement segment, and a $25.8 million

contribution from the LTC segment.

-

OFFO per share

increased by 17.5% in Q4 2024, or $0.053, to $0.356. The increase

was primarily attributable to higher Adjusted NOI, including $1.8

million of retroactive funding ($2.5 million net of $0.7 million

taxes), of which $1.4 million ($1.8 million net of $0.4 million

taxes) relates to the prior year, and lower interest, partially

offset by higher income tax.

-

AFFO per share increased by 25.1%

in Q4 2024 to $0.304. The increase was primarily related to the

increase in OFFO.

- AFFO payout ratio

was 77.1% in Q4 2024, compared to 96.2% in Q4 2023.

Financial performance - Year ended

December 31, 2024

- Total

Adjusted Revenue increased by 13.9%, or $113.3 million, to

$929.9 million, compared to the year ended December 31, 2023.

In the Retirement segment, the increase is mainly driven by

occupancy growth, annual rental rate increases in line with market

conditions, and higher care and ancillary revenue. In the LTC

segment, the increase is mainly driven by one-time and retroactive

funding of $29.5 million, including $25.5 million related to prior

years, a one-time Workplace Safety and Insurance Board (“WSIB”)

refund of $3.0 million related to prior years that was recorded in

Q2 2024, higher annual inflationary funding increases, and higher

preferred accommodation revenue.

- Total

Adjusted NOI increased by 32.0% to $199.6 million,

compared to the year ended December 31, 2023. Retirement

segment total adjusted NOI increased by $6.5 million primarily

attributed to annual rental rate and occupancy increases, and

higher care and ancillary revenue offset partially by higher

labour, food costs and operating expenses. LTC segment total

adjusted NOI increased by $41.8 million mainly due to one-time and

retroactive funding of $29.5 million, including $25.5 million

related to the prior years, and higher annual inflationary funding

increases, and a one-time WSIB refund of $3.0 million related to

prior years, offset by increase in direct care labour and other

operating expenses.

-

Adjusted Same Property NOI increased by 34.0% to

$195.8 million, compared to the year ended December 31, 2023,

including a 53.3% increase to $120.3 million in the LTC segment,

and a 12.6% increase to $73.4 million in the Retirement

segment.

-

OFFO per share increased by

35.3%, or $0.397, to $1.522, compared to the year ended

December 31, 2023. The increase was primarily attributable to

higher Adjusted NOI, including, $18.7 million of one-time &

retroactive funding relating to prior years and a one-time WSIB

refund of $2.5 million related to prior years in Q2 2024, partially

offset by higher current income tax.

-

AFFO per share increased by

31.4%, or $0.323, to $1.353, compared to the year ended

December 31, 2023. The increase was primarily related to the

increase in OFFO, offset by a decrease in construction funding

income and increase in maintenance capital expenditure.

- AFFO

payout ratio was 69.8%, a 21.1% improvement compared to

90.9% for the year ended December 31, 2023.

Financial position

The Company maintained a strong financial

position during Q4 2024:

- Increased

liquidity to $435.0 million as at December 31, 2024, compared

to $307.3 million as at December 31, 2023, mainly as a result

of Sienna’s equity raise in August 2024;

- Improved

Interest Coverage Ratio to 3.9 for the twelve months ended

December 31, 2024, compared to 3.4 for the twelve months ended

December 31, 2023;

- Improved Debt

Service Coverage Ratio to 2.3 for the twelve months ended

December 31, 2024, compared to 1.9 for the twelve months ended

December 31, 2023;

- Extended

Weighted Average Term to Maturity of its debt to 6.7 years as at

December 31, 2024, from 5.9 years as at December 31,

2023;

- Improved Debt

to Adjusted EBITDA for the trailing 12 months to 6.4 as at

December 31, 2024, from 8.4 as at December 31, 2023;

- Decreased Debt

to Adjusted Gross Book Value by 350 bps to 41.1% as at

December 31, 2024 from 44.6% as at December 31,

2023.

Financial and Operating

Results

The following table represents the Key

Performance Indicators for the periods ended December 31:

|

|

Three months ended December 31, |

Year ended December 31, |

|

$000s except occupancy, per share and ratio data |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

OCCUPANCY |

|

Retirement - Average same property (1) |

92.9 |

% |

89.9 |

% |

91.3 |

% |

88.7 |

% |

|

Retirement - Average Growth and Optimization (2) |

71.4 |

% |

77.1 |

% |

67.5 |

% |

78.5 |

% |

|

Retirement - Optimization(2) |

76.4 |

% |

77.1 |

% |

74.6 |

% |

78.5 |

% |

|

Retirement - Growth(2) |

49.8 |

% |

— |

% |

34.2 |

% |

— |

% |

|

Retirement - Average total occupancy |

89.8 |

% |

88.4 |

% |

87.9 |

% |

87.5 |

% |

|

LTC - Average private occupancy |

97.7 |

% |

93.3 |

% |

97.1 |

% |

92.0 |

% |

|

LTC - Average total occupancy (3) |

98.4 |

% |

97.5 |

% |

98.2 |

% |

97.5 |

% |

|

FINANCIAL |

|

Total Adjusted Revenue (4) |

246,265 |

|

218,863 |

|

929,911 |

|

816,657 |

|

|

Total Adjusted Same property NOI |

45,489 |

|

37,089 |

|

195,764 |

|

146,049 |

|

|

Total Adjusted NOI |

46,658 |

|

38,204 |

|

199,606 |

|

151,255 |

|

|

OFFO per share |

0.356 |

|

0.303 |

|

1.522 |

|

1.125 |

|

|

AFFO per share |

0.304 |

|

0.243 |

|

1.353 |

|

1.030 |

|

|

AFFO Payout ratio |

77.1 |

% |

96.2 |

% |

69.8 |

% |

90.9 |

% |

|

FINANCIAL RATIOS |

|

Debt to Adjusted Gross Book Value as at period end |

41.1 |

% |

44.6 |

% |

41.1 |

% |

44.6 |

% |

|

Weighted Average Cost of Debt as at period end |

3.8 |

% |

3.7 |

% |

3.8 |

% |

3.7 |

% |

|

Debt to Adjusted EBITDA as at period end |

6.4 |

|

8.4 |

|

6.4 |

|

8.4 |

|

|

Interest Coverage Ratio |

3.4 |

|

3.4 |

|

3.9 |

|

3.4 |

|

|

Debt Service Coverage Ratio |

2.0 |

|

1.8 |

|

2.3 |

|

1.9 |

|

|

Weighted Average Term to Maturity as at period end |

6.7 |

|

5.9 |

|

6.7 |

|

5.9 |

|

|

CHANGE IN TOTAL ADJUSTED SAME PROPERTY NOI |

|

Retirement |

|

15.3 |

% |

|

11.7 |

% |

|

LTC |

|

29.0 |

% |

|

53.3 |

% |

|

Total |

|

22.6 |

% |

|

34.0 |

% |

|

|

|

|

|

|

|

|

|

Notes:1. Effective January 1, 2024, the results of Woods Park,

which was acquired in January 2023, were reclassified from "Growth

and Optimization" to "Same Property".2. Effective as of Q4 2024,

"Growth and Optimization" portfolio, previously referred to as

"Acquisitions, Development and Others" includes five retirement

residences that are undergoing repositioning under asset

optimization initiative, which are grouped as part of "Retirement -

Optimization", and one retirement residence in Niagara Falls

included in "Retirement - Growth", which opened on January 24, 2024

and is currently in lease up effective January 24, 2024. Refer to

our Q4 2024 MD&A for impact of Same Property definition

changes.3. Excludes the 3rd and 4th beds in multi-bed rooms in

Ontario that will not be reopened.4. Effective January 1, 2024, the

Company began classifying all active funding that started during

the pandemic as revenue ("pandemic funding"), with the

corresponding expenses are presented as part of operating expenses.

In 2023, the Company presented them on a net basis as net pandemic

and incremental agency expenses. |

The following tables represents the Key Performance Indicators

adjusted for one-time items for the three and twelve month periods

ended December 31:

|

|

Three months ended December 31, |

|

$000s except occupancy, per share and ratio data |

2024, including one-time items |

Less: one-time items (1) |

2024, excluding one-time items |

2023 |

|

Change (2) |

|

FINANCIAL |

|

Total Adjusted Revenue |

246,265 |

|

(2,464 |

) |

243,801 |

|

218,863 |

|

24,938 |

|

|

Total Adjusted Same Property NOI |

45,489 |

|

(2,464 |

) |

43,025 |

|

37,089 |

|

5,936 |

|

|

Total Adjusted NOI |

46,658 |

|

(2,464 |

) |

44,194 |

|

38,204 |

|

5,990 |

|

|

Adjusted EBITDA |

38,575 |

|

(2,464 |

) |

36,111 |

|

31,272 |

|

4,839 |

|

|

OFFO |

29,432 |

|

(1,809 |

) |

27,623 |

|

22,112 |

|

5,511 |

|

|

AFFO |

25,084 |

|

(1,809 |

) |

23,275 |

|

17,756 |

|

5,519 |

|

|

AFFO Payout ratio |

77.1 |

% |

6.0 |

% |

83.1 |

% |

96.2 |

% |

(13.1)% |

|

PER SHARE INFORMATION |

|

OFFO per share |

0.356 |

|

(0.022 |

) |

0.334 |

|

0.303 |

|

0.031 |

|

|

AFFO per share |

0.304 |

|

(0.022 |

) |

0.282 |

|

0.243 |

|

0.039 |

|

|

FINANCIAL RATIOS |

|

Debt to Adjusted EBITDA as at period end |

6.4 |

|

1.4 |

|

7.8 |

|

8.4 |

|

(0.6 |

) |

|

Interest Coverage Ratio |

3.4 |

|

(0.2 |

) |

3.2 |

|

3.4 |

|

(0.2 |

) |

|

Debt Service Coverage Ratio |

2.0 |

|

(0.2 |

) |

1.8 |

|

1.8 |

|

— |

|

|

CHANGE IN TOTAL ADJUSTED SAME PROPERTY NOI |

|

Retirement |

|

|

|

|

15.3 |

% |

|

LTC |

|

|

|

|

16.6 |

% |

|

Total |

|

|

|

|

16.0 |

% |

|

|

|

|

|

|

|

|

|

Notes:1. In Q4 2024, the Company received retroactive funding of

$1.8 million ($2.5 million net of $0.7 million taxes) from British

Columbia health authorities, including $1,357 ($1,848 net of $491

taxes) relating to the prior year.2. Change between 2024, excluding

one-time items, and 2023. |

|

|

Year ended December 31, |

|

$000s except occupancy, per share and ratio data |

2024, including one-time items |

Less: one-time items (1) |

2024, excluding one-time items |

2023 |

|

Change (3) |

|

FINANCIAL |

|

Total Adjusted Revenue |

929,911 |

|

(29,525 |

) |

900,386 |

|

816,657 |

|

83,729 |

|

|

Total Adjusted Same Property NOI |

195,764 |

|

(29,525 |

) |

166,239 |

|

146,049 |

|

20,190 |

|

|

Total Adjusted NOI |

199,606 |

|

(29,525 |

) |

170,081 |

|

151,255 |

|

18,826 |

|

|

Adjusted EBITDA |

168,086 |

|

(29,525 |

) |

138,561 |

|

126,976 |

|

11,585 |

|

|

OFFO |

116,119 |

|

(21,674 |

) |

94,445 |

|

82,071 |

|

12,374 |

|

|

AFFO |

103,221 |

|

(21,674 |

) |

81,547 |

|

75,137 |

|

6,410 |

|

|

AFFO Payout ratio |

69.8 |

% |

18.6 |

% |

88.4 |

% |

90.9 |

% |

(2.5)% |

|

PER SHARE INFORMATION |

|

OFFO per share |

1.522 |

|

(0.284 |

) |

1.238 |

|

1.125 |

|

0.397 |

|

|

AFFO per share |

1.353 |

|

(0.284 |

) |

1.069 |

|

1.030 |

|

0.323 |

|

|

FINANCIAL RATIOS |

|

Debt to Adjusted EBITDA as at period end |

6.4 |

|

1.4 |

|

7.8 |

|

8.4 |

|

(0.6 |

) |

|

Interest Coverage Ratio |

3.9 |

|

(0.6 |

) |

3.3 |

|

3.4 |

|

(0.1 |

) |

|

Debt Service Coverage Ratio |

2.3 |

|

(0.4 |

) |

1.9 |

|

1.9 |

|

— |

|

|

CHANGE IN TOTAL ADJUSTED SAME PROPERTY NOI |

|

Retirement |

|

|

|

|

11.0 |

% |

|

LTC |

|

|

|

|

16.2 |

% |

|

Total |

|

|

|

|

13.8 |

% |

|

|

|

|

|

|

|

|

|

Notes: 1. The following table summarizes One-time items

recognized in 2024, including items relating to prior years: |

|

Thousands of Canadian dollars, except, share data |

Amount |

Taxes |

Amount net of Taxes |

|

Q1 - Ontario One-time Funding |

10,064 |

2,676 |

7,388 |

| Q1 -

British Columbia Retroactive Funding |

13,591 |

3,614 |

9,977 |

| Q2 -

WSIB refund (2) |

3,406 |

906 |

2,500 |

|

Q4 - British Columbia Retroactive Funding |

2,464 |

655 |

1,809 |

|

Total One-Time Items Relating to Prior Years |

29,525 |

7,851 |

21,674 |

|

|

|

|

|

|

2. WSIB refund of $3.4 million related to prior years of which $3.0

million as recognized by the Company's LTC segment and $0.4 million

by the Company's RET segment.3. Change between 2024, excluding

one-time items, and 2023. |

Outlook

Long-term fundamentals in Canadian senior living

are exceptionally strong, fueled by the rising needs of seniors,

who make up the fastest-growing demographic in Canada, and limited

new supply of senior living accommodations.

Looking ahead, we will continue to leverage

these outstanding sector dynamics as we grow through portfolio

optimization, achieve retirement occupancy improvements towards our

95% target and drive retirement NOI and margin growth. In addition,

our redevelopment initiatives in Ontario, with two projects

expected to be completed and operational in the second half of

2025, along with nearly $300 million of accretive acquisitions

under contract, all give us confidence with respect to Sienna's

growth outlook for 2025 and beyond.

Retirement Operations – Average

occupancy in the Company's Same Property portfolio was 92.9% in Q4

2024, a 300 bps increase year-over-year and a 110 bps increase

since Q3 2024. Our sales platform and intensified focus on

generating interest in our residences, as well as continued

improvements to our operations and exceptional supply/demand

fundamentals supported this occupancy improvement and put us on our

path to achieving stabilized occupancy of 95% in the next 12

months. Occupancy improved further to 93.1% in January 2025, and

lead indicators, including qualified leads and tours, remain

strong.

Going forward, we will continue to focus on

expanding the Company's Adjusted NOI with our concentrated

marketing and sales initiatives, as well as our asset optimization

efforts. We are targeting year-over-year adjusted Same Property NOI

growth in our retirement portfolio to be approximately 10% in 2025

as a result of occupancy growth and rate increases. We are further

targeting margin growth in our Same Property portfolio of

approximately 100 - 150 bps in 2025 compared to 2024.

Asset Optimization Initiatives

– Sienna believes that there is a significant opportunity to create

value through its asset optimization initiatives at certain

properties. These initiatives target a better market fit and

include renovations, the changes in suite mix, additional services

or the alternative use of a property to reflect the evolving needs

of residents. By optimizing our existing portfolio, we expect to

unlock substantial NOI growth while modernizing Sienna’s asset base

and ensuring the most efficient use of our capital.

We have identified five retirement residences

that are well suited for repositioning in the near term. With a

current average occupancy rate of approximately 76%, these assets

are expected to make a significant contribution to Sienna’s overall

NOI growth, once repositioned

Long-Term Care Operations – The

Government of Ontario's increase to Other Accommodations funding to

offset inflation in recent years, which covers the costs of

resident accommodation, comfort and safety, became effective as of

Q2 2024 and has helped to support the significant year-over-year

increase in Sienna's LTC NOI. Further contributing to our strong

results were high occupancy levels and higher preferred

accommodation revenues.

In 2025, we expect to continue to benefit from a

stable operating environment, fully occupied homes and our

successful cost management strategy. As a result, we expect our

2025 LTC NOI for the full year, excluding one-time and retroactive

funding of $26.1 million and a WSIB refund of $3.0 million

recognized in 2024, to increase in the low single digits, in line

with inflation.

Developments – Sienna currently

has three projects in North Bay, Brantford and Keswick under

development, which are expected to exceed $300 million.

The following table summarizes development

projects that were in progress in Q4 2024:

|

Projects |

Property Type |

Expected Completion |

Number of Beds / Suites |

Estimated Development Costs |

Development Grant |

Annual Construction Subsidy

(1) |

Expected Development Yield |

|

Brantford |

LTC / Retirement |

Q4 2025 |

160 / 147 |

$140M |

$4.0M |

$3.3M |

8.5 |

% |

| North Bay |

LTC |

Q4 2025 |

160 |

$80M |

$4.0M |

$3.3M |

8.0 |

% |

|

Keswick |

LTC |

Q1 2027 |

160 |

$87M |

$8.2M |

$3.5M |

8.5 |

% |

|

Total |

|

|

480 / 147 |

$307M |

$16.2M |

$10.1M |

|

Notes:1. Total amount receivable each year over a period of 25

years.

The Government of Ontario's commitment in its

2024 budget to significant new investments in the long-term care

sector affirmed our strategy to enhance and expand our long-term

care platform and maintain a diversified portfolio of long-term

care communities and retirement residences.

Once completed and fully operational, our three

development projects are expected to have a significant impact on

our operating results and improve our net incremental AFFO/share on

average by approximately 3%.

Significant Potential for Growth in

Adjusted NOI - We see significant growth potential in our

business over the next several years and are actively working on a

number of initiatives which may contribute to the Company’s

Adjusted NOI expansion including:

-

Occupancy growth in the Company’s retirement

segment, including incremental Adjusted NOI as we move

towards our target for stabilized average occupancy of 95.0%. In

our same-property portfolio, this would represent a 210 bps

increase from our average occupancy of 92.9% in Q4 2024, supporting

rental rate growth in line with market rents and targeted margin

growth of 100 - 150 bps points within the next 12 months.

-

Contributions from acquisitions, asset optimization and new

developments, including incremental Adjusted NOI from:

- The Elgin Falls

Retirement Residence, completed in late 2023 for $38.5 million with

respect to the Company's 70% joint venture interest, which has an

expected development yield of approximately 7.5%; in addition, the

Company has the ability to acquire the remaining 30% ownership

interest, once the property is fully stabilized;

- The Company's

five assets identified to be repositioned as part of its asset

optimization initiatives;

- The Company’s

acquisition of its remaining interest in Nicola Lodge, expected to

generate an investment yield of 6.75%;

- The Company's

development projects in North Bay, Brantford, and Keswick, once

completed and operational;

- The

contributions from the Company's Acquisition in Alberta, expected

to generate an approximate 6.5% investment yield once stabilized

following the closing of the transaction at the end of Q1 2025,

with potential additional upside; and

- The contributions from the

Company’s acquisition of a retirement residence in Ottawa and a

long-term care community in the GTA, expected to generate

approximate investment yields of 6.25% and 6.75%,

respectively.

These initiatives, individually and

collectively, could have a significant positive impact on the value

of Sienna’s business, enhancing its financial performance with

growth in Adjusted NOI and OFFO, and supporting the Company’s AFFO

payout ratio.

Conference Call

Sienna will host a conference call on February

20, 2025 at 10:00 a.m. (ET). The toll-free dial-in number for

participants is 1-800-715-9871, conference ID: 4902109. A webcast

of the call will be accessible via Sienna's website at

www.siennaliving.ca/investors/events-presentations. It will be

available for replay until February 20, 2026 and archived on

Sienna’s website.

About Sienna Senior Living

Sienna Senior Living Inc. (TSX:SIA) offers a

full range of seniors' living options, including independent

living, assisted living and memory care under its Aspira retirement

brand, long-term care, and specialized programs and services.

Sienna's approximately 13,500 employees are passionate about

cultivating happiness in daily life. For more information, please

visit www.siennaliving.ca.

Risk Factors

Refer to the risk factors disclosed in the

Company’s MD&A for the year ended December 31, 2024, and its

most recent Annual Information Form for more information.

Forward-Looking Statements

Certain of the statements contained in this news

release are forward-looking statements and are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future. Readers are

cautioned that such statements may not be appropriate for other

purposes. These statements generally use forward-looking words,

such as “anticipate,” “continue,” “could,” “expect,” “may,” “will,”

“estimate,” “believe,” “goals” or other similar words and are based

on the Company’s expectations, estimates, forecasts and

projections. These statements are subject to significant known and

unknown risks and uncertainties that may cause actual results or

events to differ materially from those expressed or implied by such

statements and, accordingly, should not be read as guarantees of

future performance or results and will not necessarily be accurate

indications of whether or not such results will be achieved. The

forward-looking statements in this news release are based on

information currently available and what management currently

believes are reasonable assumptions. The Company does not undertake

any obligation to publicly update or revise any forward-looking

statements except as may be required by applicable law.

FOR FURTHER INFORMATION, PLEASE CONTACT:

David HungChief Financial Officer and Executive Vice President,

Investments (905) 489-0258david.hung@siennaliving.ca

Nancy WebbExecutive Vice President, Corporate Affairs and

Marketing(905) 489-0788nancy.webb@siennaliving.ca

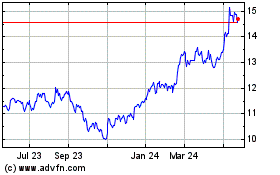

Sienna Senior Living (TSX:SIA)

Historical Stock Chart

From Jan 2025 to Feb 2025

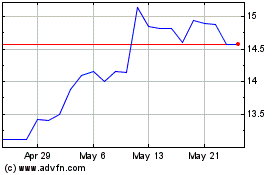

Sienna Senior Living (TSX:SIA)

Historical Stock Chart

From Feb 2024 to Feb 2025