Treasury Metals Inc. (

TSX: TML; OTCQX:

TSRMF) (“

Treasury Metals” or the

“

Company”) announces that it has filed its notice

of annual and special meeting of shareholders, management

information circular (the “

Circular”) and related

materials (together, the “

Meeting Materials”) with

securities regulators. The Circular contains information regarding

the annual and special meeting (the “

Meeting”) of

the holders of common shares in the capital of the Company (the

“

Shareholders”), to be held on Wednesday June 26,

2024 at 1:00 p.m. (Eastern time) at the offices of Cassels Brock

& Blackwell LLP, located at Suite 3200, Bay Adelaide Centre –

North Tower, 40 Temperance Street, Toronto, Ontario, Canada.

On May 1, 2024, the Company entered into a

definitive agreement with Blackwolf Copper and Gold Ltd.

(“Blackwolf”) pursuant to which the Company will

acquire all of the common shares of Blackwolf (“Blackwolf

Shares”) pursuant to a statutory plan of arrangement (the

“Arrangement”) under the Business Corporations Act

(British Columbia). Each Blackwolf shareholder will be entitled to

receive 0.607 of a common share (the “Arrangement

Shares”) in the capital of the Company for each Blackwolf

Share held. The Arrangement will combine the two companies to

advance the Company’s Goliath Gold Complex Project in Ontario

towards production with a strengthened leadership, balance sheet

and capital markets team.

At the Meeting, Shareholders will be asked to

consider and vote on, among other things: (1) the issuance of the

Arrangement Shares, (2) the issuance of common shares pursuant to a

concurrent non-brokered flow-through financing, (3) the continuance

of the Company into British Columbia; (4) the election of

non-Arrangement and post-Arrangement boards of directors; and (5)

non-Arrangement and Arrangement omnibus equity incentive plans of

the Company, all as set forth in greater detail in the Circular

(collectively, the “Shareholder Resolutions”).

Board Recommendation

The board of directors of the Company (the

“Board”), based in part on the fairness opinion

that the special committee of directors of the Board (the

“Special Committee”) received from RwE Growth

Partners, Inc., and the unanimous recommendation of the Special

Committee, unanimously determined that the Arrangement is fair to

the Shareholders and is in the best interest of the Company, and

unanimously recommends that Shareholders vote FOR the

Shareholder Resolutions. The determination of the Special

Committee and the Board is based on various factors described more

fully in the Circular.

Shareholders who hold shares as of the record

date of May 21, 2024 will be eligible to vote. Voting instructions

are included in the Circular, and eligible Shareholders are

encouraged to vote well in advance of the proxy voting deadline on

June 24, 2024 at 1:00 p.m. (Eastern time). The Meeting Materials

can be found online at

https://treasurymetals.com/investors/annual-meeting-of-shareholders/

and under the Company’s issuer profile on SEDAR+ at

www.sedarplus.ca. Shareholders may also request a paper copy of

these documents as indicated in the Circular, which has been mailed

to Shareholders.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold-focused company

with assets in Canada. Treasury’s Goliath Gold Complex (which

includes the Goliath, Goldlund and Miller deposits) is located in

Northwestern Ontario. For information on the Goliath Gold Complex,

refer to the technical report, prepared in accordance with

NI 43-101, entitled “Goliath Gold Complex – NI 43-101

Technical Report and Prefeasibility Study” and dated March 27, 2023

with an effective date of February 22, 2023, led by independent

consultants Ausenco Engineering Canada Inc. The technical report is

available on SEDAR+ at www.sedarplus.ca, on the OTCQX at

www.otcmarkets.com and on the Company website at

www.treasurymetals.com.

Contact:

|

Jeremy WyethPresident & CEO |

Orin BaranowskyCFO |

|

|

|

|

Treasury Metals Inc.T: +1 416-214-4654; Toll-free:

+1-855-664-4654Email: ir@treasurymetals.com |

|

|

|

Cautionary Note Regarding

Forward-Looking Information This news release includes

certain “forward-looking information” and “forward-looking

statements” (collectively, “forward-looking statements”) within the

meaning of Canadian and United States securities legislation that

is based on expectations, estimates, projections and

interpretations as at the date of this news release. Any statement

that involves predictions, expectations, interpretations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often, but not always, using phrases such as

“expects”, or “does not expect”, “is expected”, “interpreted”,

“management’s view”, “anticipates” or “does not anticipate”,

“plans”, “budget”, “scheduled”, “forecasts”, “estimates”,

“potential”, “feasibility”, “believes” or “intends” or variations

of such words and phrases or stating that certain actions, events

or results “may” or “could”, “would”, “might” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking information and are intended to identify

forward-looking information.

Since forward-looking information address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Actual results could differ materially

from those currently anticipated due to a number of factors and

risks. These include, but are not limited to, expected timing and

completion of the Arrangement; the strengths, characteristics and

expected benefits and synergies of the Arrangement; receipt of

court approval; approval of the Arrangement by Blackwolf

securityholders and Treasury Metals shareholders; obtaining TSX and

TSXV acceptance to complete the Arrangement; the expected delisting

of Blackwolf shares from the TSXV; the composition of the

post-Arrangement board and management team of the combined company;

completion of the proposed consolidation; expectations regarding

the potential benefits and synergies of the Arrangement and the

ability of the combined company to successfully achieve business

objectives, including integrating the companies or the effects of

unexpected costs, liabilities or delays; expectations relating to

future exploration, development and production activities;

expectations relating to costs; expectations regarding financial

strength, free cash flow generation, trading liquidity, and capital

markets profile; expectations regarding future exploration and

development, growth potential for Treasury Metals’ and Blackwolf’s

operations; availability of the exemption under Section 3(a)(10) of

the United States Securities Act of 1933 to the securities issuable

in the Arrangement; the companies’ assessments of, and expectations

for, future business activities and operating performance;

expectations regarding the completion of the concurrent financing

on substantially the same terms announced or at all; exploration

and production for precious metals; delays or changes in plans with

respect to exploration or development projects or capital

expenditures; the uncertainty of mineral resource, production and

cost estimates; health, safety and environmental risks; worldwide

demand for gold and base metals; gold price and other commodity

price and exchange rate fluctuations; environmental risks;

competition; incorrect assessment of the value of acquisitions;

ability to access sufficient capital from internal and external

sources; and changes in legislation, including but not limited to

tax laws, royalties and environmental regulations. Actual results,

performance or achievement could differ materially from those

expressed in, or implied by, the forward-looking information and,

accordingly, no assurance can be given that any of the events

anticipated by the forward-looking information will transpire or

occur, or if any of them do so, what benefits may be derived

therefrom and accordingly, readers are cautioned not to place undue

reliance on the forward-looking information.

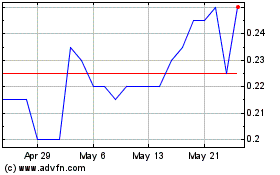

Treasury Metals (TSX:TML)

Historical Stock Chart

From Nov 2024 to Dec 2024

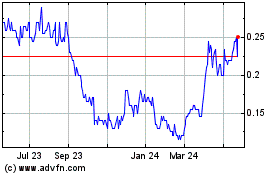

Treasury Metals (TSX:TML)

Historical Stock Chart

From Dec 2023 to Dec 2024