Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG) is

pleased to report year-end 2022 Mineral Reserves and Resources for

the Morelos Complex, which includes the producing El Limón Guajes

(“ELG”) Mine Complex (consisting of the ELG Open Pits and ELG

Underground), development stage Media Luna deposit, EPO deposit,

and surface stockpiles.

Table 1: Year-over-year comparison of

Mineral Reserves & Mineral Resources for the Morelos

Complex

|

|

December 31, 2022 |

December 31, 2021 |

Variance |

|

|

Tonnes |

AuEq |

AuEq1 |

Tonnes |

AuEq |

AuEq1 |

Tonnes |

AuEq |

AuEq1 |

|

|

(kt) |

(gpt) |

(koz) |

(kt) |

(gpt) |

(koz) |

(kt) |

(gpt) |

(koz) |

|

Proven & Probable Reserves |

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

23,017 |

4.54 |

3,360 |

23,017 |

4.54 |

3,360 |

- |

- |

- |

|

ELG Open Pit |

8,403 |

3.27 |

885 |

10,371 |

3.15 |

1,051 |

(19%) |

4% |

(16%) |

|

ELG Underground |

2,563 |

6.17 |

508 |

2,675 |

5.81 |

500 |

(4%) |

6% |

2% |

|

Surface Stockpiles |

4,655 |

1.30 |

195 |

4,808 |

1.38 |

213 |

(3%) |

(6%) |

(9%) |

|

Total Morelos Complex |

38,638 |

3.98 |

4,947 |

40,871 |

3.90 |

5,123 |

(5%) |

2% |

(3%) |

|

Measured & Indicated

Resources2 |

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

27,390 |

5.30 |

4,669 |

25,380 |

5.38 |

4,394 |

8% |

(2%) |

6% |

|

ELG Open Pit |

11,304 |

3.08 |

1,119 |

16,754 |

2.93 |

1,580 |

(33%) |

5% |

(29%) |

|

ELG Underground |

5,016 |

6.26 |

1,009 |

4,551 |

6.34 |

927 |

10% |

(1%) |

9% |

|

EPO Underground |

4,050 |

5.16 |

671 |

- |

- |

- |

na |

na |

na |

|

Total Morelos Complex |

47,760 |

4.86 |

7,468 |

46,685 |

4.60 |

6,901 |

2% |

6% |

8% |

|

Inferred Resources |

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

7,322 |

4.27 |

1,006 |

5,991 |

4.05 |

780 |

22% |

6% |

29% |

|

ELG Open Pit |

1,385 |

1.95 |

87 |

812 |

1.83 |

48 |

71% |

7% |

82% |

|

ELG Underground |

1,480 |

6.05 |

288 |

1,380 |

4.95 |

220 |

7% |

22% |

31% |

|

EPO Underground |

5,634 |

4.04 |

732 |

8,019 |

3.97 |

1,024 |

(30%) |

2% |

(29%) |

|

Total Morelos Complex |

15,821 |

4.15 |

2,112 |

16,202 |

3.98 |

2,071 |

(2%) |

4% |

2% |

Notes to Table:

- Gold equivalent (AuEq) Mineral Reserves and Resources take into

account respective metal prices and metallurgical recoveries for

gold, silver, and copper (see Table 3 and Table 5).

- Mineral Resources are reported inclusive of Mineral

Reserves.

- The reader is cautioned not to

misconstrue this tabulation as a Mineral Reserve or a Mineral

Resource statement. Tonnes, grades, and contained metal are shown

for comparison purposes only.

- Year-end Mineral Reserves and

Resources as well as year-over-year variance subject to

rounding.

Gold equivalent (“AuEq”) Mineral Reserves and

Mineral Resources take into account respective metal prices and

metallurgical recoveries for gold (“Au”), silver (“Ag”) and copper

(“Cu”) by deposit. Metals prices used to estimate Mineral Reserves

and Mineral Resources remain unchanged.

Jody Kuzenko, President & CEO of Torex,

stated:

“We are pleased with the results of the year-end

2022 Mineral Reserve & Resource estimate which further

highlights the geological excellence of our Morelos Property. On a

total asset AuEq basis, net of depletion, Measured & Indicated

Resources increased 567 koz (+8%) and Inferred Resources increased

41 koz (+2%). Prior to mine depletion of 511 koz AuEq, Measured

& Indicated Resources increased 1,078 koz (+16%).

“At Media Luna, an inaugural Measured Resource

of 473 koz AuEq at an average grade of 8.06 grams per tonne (“gpt”)

AuEq was declared. The Measured Resource is contained within three

separate zones of the deposit. Additionally, drilling was

successful in expanding Inferred Resources along the northern and

southern boundaries of the Media Luna deposit while inclusion of

outstanding results from the 2021 infill drilling program resulted

in additional Indicated Resources.

“The success at Media Luna was equally matched

by the success at EPO, with infill drilling delivering an inaugural

Indicated Resource of 671 koz AuEq at an average grade of 5.16 gpt

AuEq. Step-out drilling to the south and west of EPO was successful

in partially offsetting resources upgraded to the Inferred

category. Based on the updated resource estimate and potential for

additional resource growth, we are growing increasingly confident

about the prospect of EPO becoming an additional future source of

mill feed at the Morelos Complex, thereby even further unlocking

the economics of the Media Luna project.

“At the ELG Mine Complex, conversion of

resources to reserves, drilling success and model updates resulted

in more than 60% of Proven & Probable gold reserves processed

in 2022 being replaced. On an AuEq basis, additional laybacks in

the El Limón open pit added approximately 190 koz to Mineral

Reserves while expansion of the El Limón Sur open pit added

approximately 50 koz. Reserve gains in the producing Sub-Sill and

ELD deposits as well as initial reserves within the Sub-Sill South

and El Limón Sur Deep deposits offset a majority of ore mined from

the ELG Underground in 2022.”

Detailed breakdowns of Mineral Reserve and

Mineral Resource estimates can be found in Table 7 and Table 8 of

this press release. The detailed breakdowns include tonnes, grade

and contained metal estimates by metal as well as notes

accompanying the applicable Mineral Reserve and Resource

estimates.

PROVEN & PROBABLE MINERAL

RESERVES

Total Proven and Probable Mineral Reserves are

estimated at 4,947 koz AuEq at an average grade of 3.98 gpt AuEq,

representing a 3% decrease relative to year-end 2021 reserves of

5,123 koz AuEq at 3.90 gpt AuEq. Of the Proven & Probable

Reserves, 73% of the AuEq estimate is attributable to Au, 23% to

Cu, and 4% to Ag.

Table 2: Year-over-year change in Proven

& Probable Mineral Reserves

|

|

December 31, 2022 |

Variance (2022 / 2021) |

|

|

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

|

|

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

|

Proven & Probable Reserves |

|

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

23,017 |

2,077 |

18,944 |

444 |

3,360 |

- |

- |

- |

- |

- |

|

ELG Open Pit |

8,403 |

863 |

1,195 |

27 |

885 |

(1,968) |

(173) |

(308) |

(2) |

(166) |

|

ELG Underground |

2,563 |

480 |

598 |

14 |

508 |

(112) |

(14) |

87 |

0 |

8 |

|

Surface Stockpiles |

4,655 |

188 |

470 |

7 |

195 |

(152) |

(21) |

(14) |

0 |

(18) |

|

Total Morelos Complex |

38,638 |

3,609 |

21,206 |

493 |

4,947 |

(2,233) |

(208) |

(236) |

(2) |

(176) |

|

Change - Net (%) |

|

|

|

|

|

(5%) |

(5%) |

(1%) |

(0%) |

(3%) |

|

Change in Reserves Prior to Depletion |

|

|

|

|

|

|

|

|

|

|

|

Ore Processed2 |

|

|

|

|

|

(4,599) |

(538) |

(568) |

(15) |

(545) |

|

Reserves - Added / Lost |

|

|

|

|

|

2,366 |

330 |

332 |

13 |

369 |

|

Change - Prior to Depletion (%) |

|

|

|

|

|

6% |

9% |

2% |

3% |

7% |

Notes to Table:

- Gold equivalent Mineral Reserves

take into account respective metal prices and metallurgical

recoveries for gold, silver, and copper (see Table 3).

- Ore processed (depletion) in 2022

on a AuEq basis assumes respective based on prices and recoveries

used at year-end 2021.

- Year-end Mineral Reserves and

year-over-year variance (2022 versus 2021) subject to

rounding.

Drilling and model updates were successful in

replacing 68% of AuEq Proven & Probable Reserves processed in

2022. In the ELG Open Pit operation, additional laybacks in the El

Limón pit added approximately 190 koz to reserves while drilling

success in the El Limón Sur pit added approximately 50 koz. In the

ELG Underground, reserves were once again added at the Sub-Sill and

ELD deposits while initial Mineral Reserves were declared at

Sub-Sill South and El Limón Sur Deep.

Table 3: Metal price and metallurgical

recoveries assumptions used in the estimation of Mineral

Reserves

|

Mineral Reserves |

December 31, 2022 |

December 31, 2021 |

Variance |

|

|

Au |

Ag |

Cu |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

|

Metal Prices |

($/oz) |

($/oz) |

($/lb) |

($/oz) |

($/oz) |

($/lb) |

($/oz) |

($/oz) |

($/lb) |

|

Media Luna Underground |

$1,400 |

$17.00 |

$3.25 |

$1,400 |

$17.00 |

$3.25 |

- |

- |

- |

|

ELG Open Pit |

$1,400 |

$17.00 |

$3.25 |

$1,400 |

$17.00 |

$3.25 |

- |

- |

- |

|

ELG Underground |

$1,400 |

$17.00 |

$3.25 |

$1,400 |

$17.00 |

$3.25 |

- |

- |

- |

|

Surface Stockpiles |

$1,400 |

$17.00 |

$3.25 |

$1,400 |

$17.00 |

$3.25 |

- |

- |

- |

|

Metallurgical Recoveries |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

|

Media Luna Underground |

85% |

79% |

91% |

85% |

79% |

91% |

- |

- |

- |

|

ELG Open Pit |

89% |

30% |

23% |

89% |

30% |

10% |

- |

- |

13% |

|

ELG Underground |

90% |

62% |

63% |

89% |

30% |

10% |

1% |

32% |

53% |

|

Surface Stockpiles |

89% |

30% |

23% |

89% |

30% |

10% |

- |

- |

13% |

Metal prices used in the estimation of Mineral

Reserves are unchanged. Metallurgical recoveries for the ELG

Underground have been updated to reflect anticipated Au, Ag, and Cu

recoveries once the copper and iron sulphide flotation circuits are

commissioned in late-2024 as part of the Media Luna Project.

Proven & Probable Reserves in the ELG

Underground are now based on an AuEq cut-off grade. Mineral

Reserves at Media Luna are unchanged.

MEASURED & INDICATED MINERAL

RESOURCES

Total Measured & Indicated Mineral Resources

are estimated at 7,468 koz at an average grade of 4.86 gpt AuEq,

representing an 8% increase relative to 6,901 koz AuEq at 4.60 gpt

AuEq at year-end 2021. Of the Measured & Indicated Resource,

68% of the AuEq estimate is attributable to Au, 26% to Cu, and 5%

to Ag.

Table 4: Year-over-year change in

Measured & Indicated Mineral Resources

|

|

December 31, 2022 |

Variance (2022 / 2021) |

|

|

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

|

|

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

|

Measured & Indicated

Resources2 |

|

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

27,390 |

2,796 |

27,168 |

645 |

4,669 |

2,011 |

154 |

1,462 |

43 |

275 |

|

ELG Open Pit |

11,304 |

1,090 |

1,650 |

37 |

1,119 |

(5,450) |

(468) |

(929) |

(7) |

(461) |

|

ELG Underground |

5,016 |

916 |

1,304 |

33 |

1,009 |

464 |

1 |

216 |

3 |

82 |

|

EPO Underground |

4,050 |

308 |

4,528 |

132 |

671 |

4,050 |

308 |

4,528 |

132 |

671 |

|

Total Morelos Complex |

47,760 |

5,110 |

34,650 |

847 |

7,468 |

1,075 |

(4) |

5,277 |

170 |

567 |

|

Change - Net (%) |

|

|

|

|

|

2% |

(0%) |

18% |

25% |

8% |

|

Change in Resources Prior to Depletion |

|

|

|

|

|

|

|

|

|

|

|

Ore Mined (depletion)3 |

|

|

|

|

|

(4,447) |

(504) |

(686) |

(16) |

(511) |

|

Resources - Added / Lost |

|

|

|

|

|

5,522 |

499 |

5,963 |

186 |

1,078 |

|

Change - Prior to Depletion (%) |

|

|

|

|

|

12% |

10% |

20% |

28% |

16% |

Notes to Table:

- Gold equivalent Mineral Resources

take into account respective metal prices and metallurgical

recoveries for gold, silver, and copper (see Table 5).

- Measured & Indicated Resources inclusive of Mineral

Reserves.

- Ore mined (depletion) in 2022 on a

AuEq basis assumes respective based on prices and recoveries used

at year-end 2021.

- Year-end Mineral Resources and

year-over-year variance (2022 versus 2021) subject to

rounding.

The decline in Measured & Indicated

Resources within the ELG Open Pit primarily reflects depletion. At

the ELG Underground, infill drilling was successful in more than

offsetting 110 koz AuEq of mine depletion.

Measured & Indicated Resources specific to

Media Luna increased 275 koz AuEq, driven by the benefit of

incorporating outstanding assay results from the 2021 infill

drilling program, results which were received post the cut-off date

for the year-end 2021 resource estimate. Additionally, infill

drilling targeting three separate zones within the Media Luna

deposit resulted in an inaugural Measured Resource of 473 koz AuEq

at an average grade of 8.06 gpt AuEq.

Infill drilling at EPO was successful in

establishing an inaugural Indicated Resource of 671 koz AuEq at an

average grade of 5.16 gpt AuEq. The higher-grade nature of the

Indicated Resource relative to the previous Inferred Resource at

EPO is due to higher grades encountered through the 2022 infill

drilling program, which in the area targeted led to a conversion

rate of 108% based on AuEq contained metal and 83% based on

tonnes.

Table 5: Metal price and metallurgical

recoveries assumptions used in the estimation of Mineral

Resources

|

Mineral Resources |

December 31, 2022 |

December 31, 2021 |

Variance |

|

|

Au |

Ag |

Cu |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

|

Metal Prices |

($/oz) |

($/oz) |

($/lb) |

($/oz) |

($/oz) |

($/lb) |

($/oz) |

($/oz) |

($/lb) |

|

Media Luna Underground |

$1,550 |

$20.00 |

$3.50 |

$1,550 |

$20.00 |

$3.50 |

- |

- |

- |

|

ELG Open Pit |

$1,550 |

$20.00 |

$3.50 |

$1,550 |

$20.00 |

$3.50 |

- |

- |

- |

|

ELG Underground |

$1,550 |

$20.00 |

$3.50 |

$1,550 |

$20.00 |

$3.50 |

- |

- |

- |

|

EPO Underground |

$1,550 |

$20.00 |

$3.50 |

$1,550 |

$20.00 |

$3.50 |

- |

- |

- |

|

Metallurgical Recoveries |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

|

Media Luna Underground |

85% |

79% |

91% |

85% |

79% |

91% |

- |

- |

- |

|

ELG Open Pit |

89% |

30% |

23% |

89% |

30% |

10% |

- |

- |

13% |

|

ELG Underground |

90% |

86% |

93% |

89% |

30% |

10% |

1% |

56% |

83% |

|

EPO Underground |

85% |

75% |

89% |

85% |

75% |

89% |

- |

- |

- |

Metal prices used in the estimation of Mineral

Resources are unchanged. Metallurgical recoveries for the ELG

Underground have been updated to reflect anticipated Au, Ag, and Cu

recoveries once the copper and iron sulphide flotation circuits are

commissioned in late-2024 as part of the Media Luna Project.

INFERRED MINERAL RESOURCES

Total Inferred Resources are estimated at 2,112

koz AuEq at an average grade of 4.15 gpt AuEq, representing a 2%

increase relative to 2,071 koz AuEq at 3.98 gpt AuEq at year-end

2021. Of the Inferred Mineral Resource at year-end 2022, 60% of the

AuEq estimate is attributable to Au, 34% to Cu, and 6% Ag.

Table 6: Year-over-year change in

Inferred Mineral Resources

|

|

December 31, 2022 |

Variance (2022 / 2021) |

|

|

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

Tonnes |

Au |

Ag |

Cu |

AuEq1 |

|

|

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(kt) |

(koz) |

(koz) |

(Mlb) |

(koz) |

|

Inferred Resources |

|

|

|

|

|

|

|

|

|

|

|

Media Luna Underground |

7,322 |

598 |

5,422 |

143 |

1,006 |

1,331 |

122 |

1,425 |

36 |

226 |

|

ELG Open Pit |

1,385 |

85 |

100 |

2 |

87 |

573 |

38 |

10 |

0 |

39 |

|

ELG Underground |

1,480 |

259 |

485 |

10 |

288 |

100 |

43 |

210 |

2 |

68 |

|

EPO Underground |

5,634 |

324 |

5,668 |

145 |

732 |

(2,385) |

(68) |

(3,240) |

(79) |

(292) |

|

Total Morelos Complex |

15,821 |

1,267 |

11,675 |

299 |

2,112 |

(381) |

135 |

(1,596) |

(41) |

41 |

|

Change - Net (%) |

|

|

|

|

|

(2%) |

12% |

(12%) |

(12%) |

2% |

Notes to Table:

- Gold equivalent Mineral Resources

take into account respective metal prices and metallurgical

recoveries for gold, silver and copper (see Table 5).

- Year-end Mineral Resources and

year-over-year variance (2022 versus 2021) subject to

rounding.

At Media Luna, drilling targeting spatial gaps

in prior drilling was successful at adding Inferred Resources along

the northern and southern boundaries of the deposit. The success of

this program partially offset resources upgraded to the Indicated

category.

Drilling at the El Limón Sur open pit was

successful in expanding Inferred Mineral Resources within the upper

areas of the deposit while drilling within the ELG Underground

added to Inferred Resources. The additional Inferred Resources

helped offset a portion of resources upgraded to the Indicated

category during 2022.

Step-out drilling to the south and west of EPO

offset a portion of the Inferred Resources upgraded to the

Indicated category (671 koz AuEq). The EPO deposit remains open to

the north, south and west.

QUALITY ASSURANCE/QUALITY

CONTROL

Torex maintains an industry-standard analytical

quality assurance/quality control (QA/QC) and data verification

program to monitor laboratory performance and to ensure high

quality assay results. Results from this program confirm

reliability of the assay results. All sampling is conducted by

Torex Gold with analytical work for exploration programs at El

Limón Guajes performed by SGS de Mexico S.A. de C.V. (“SGS”) in

Durango, and by SGS in Nuevo Balsas, Mexico (each lab is

independent of the Company). Gold analyses comprise fire assays

with atomic absorption or gravimetric finish. External check assays

for QA/QC purposes are performed by ALS Chemex de Mexico S.A. de

C.V. (independent of the Company). The analytical QA/QC program at

El Limón Guajes is currently overseen by Carlo Nasi, Chief Mine

Geologist for Minera Media Luna, S.A. de C.V.

Torex has a sampling and analytical QA/QC

program in place that has been approved by Bureau Veritas

(“BV”) and is overseen by Nicolas Landon, Chief Exploration

Geologist for Minera Media Luna, S.A. de C.V. The program includes

5% each of Certified Reference Materials and Blanks; blind

duplicates are not included, but Torex evaluates the results of

internal BV laboratory duplicates. Torex uses an independent

laboratory to check selected assay samples and reference materials

and has retained a consultant to audit the QA/QC data for every

drill campaign at Media Luna.

QUALIFIED PERSONS

Carolina Milla, P.Eng., is the qualified person under NI 43-101

and she has reviewed and approved the scientific and technical

information pertaining to Mineral Resources in this news release.

Ms. Milla is a member of the Association of Professional Engineers

and Geoscientists of Alberta (Member ID #168350), has experience

relevant to the style of mineralization under consideration, is a

qualified person under NI 43-101, and is an employee of Torex. Ms.

Milla has verified the data disclosed, including sampling,

analytical, and test data underlying the drill results;

verification included visually reviewing the drillholes in three

dimensions, comparing the assay results to the original assay

certificates, reviewing the drilling database, and reviewing core

photography consistent with standard practice.

The scientific and technical data contained in

this news release pertaining to Mineral Reserves have been reviewed

and approved by Johannes (Gertjan) Bekkers P.Eng., the

Vice-President, Mines Technical Services for Torex Gold, who is a

qualified person as defined by NI 43-101. Mr. Bekkers is a

registered member of the Professional Engineers of Ontario, has

worked the majority of his career in open pit and underground hard

rock mining in Canada and overseas in progressively senior

engineering roles with relevant experience in mine design and

planning, mining economic viability assessments, and mining

studies.

Additional information on the Morelos Complex

including but not limited to, sampling and analyses, analytical

labs, and methods used for data verification is available in the

Company’s most recent annual information form and the technical

report entitled “Morelos Property, NI 43-101 Technical Report, ELG

Mine Complex Life of Mine Plan and Media Luna Feasibility Study,

Guerrero State, Mexico”, dated effective March 16, 2022 filed on

March 31, 2022 (the “Technical Report”) on SEDAR at www.sedar.com

and the Company’s website at www.torexgold.com.

ABOUT TOREX GOLD RESOURCES

INC.

Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant, and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016, and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

|

TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan Rollins |

| President and CEO |

Senior Vice President, Corporate

Development & Investor Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTSThis press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements about:

the potential for additional resource growth; the Company growing

increasingly confident about the prospect of EPO becoming an

additional future source of mill feed at the Morelos Complex,

thereby even further unlocking the economics of the Media Luna

project; the EPO deposit remains open to the north, south and west;

and the Company’s key strategic objectives to extend and optimize

production from the ELG Mining Complex, de-risk and advance Media

Luna to commercial production, build on ESG excellence, and to grow

through ongoing exploration across the entire Morelos Property.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “strategy”, “focus”,

“potential” or variations of such words and phrases or statements

that certain actions, events or results “will”, or “is expected to"

occur. Forward-looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward-looking information, including, without limitation,

risks and uncertainties associated with: the ability to add mineral

resources, the ability to upgrade mineral resources categories of

mineral resources with greater confidence levels or to mineral

reserves; risks associated with mineral reserve and mineral

resource estimation; uncertainty involving skarn deposits; and

those risk factors identified in the Technical Report and the

Company’s annual information form and management’s discussion and

analysis or other unknown but potentially significant impacts.

Forward-looking information is based on the assumptions discussed

in the Technical Report and such other reasonable assumptions,

estimates, analysis and opinions of management made in light of its

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances at the date such

statements are made. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information,

there may be other factors that cause results not to be as

anticipated. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information. The Company does not undertake to

update any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws.

Table 7: Mineral Reserve Estimate –

Morelos Complex (December 31, 2022)

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(gpt) |

(gpt) |

(%) |

(koz) |

(koz) |

(Mlb) |

(gpt) |

(koz) |

|

Media Luna Underground |

|

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

Proven & Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

ELG Open Pit |

|

|

|

|

|

|

|

|

|

|

Proven |

2,821 |

4.65 |

5.5 |

0.15 |

421 |

495 |

9 |

4.73 |

429 |

|

Probable |

5,582 |

2.46 |

3.9 |

0.15 |

442 |

699 |

18 |

2.54 |

456 |

|

Proven & Probable |

8,403 |

3.20 |

4.4 |

0.15 |

863 |

1,195 |

27 |

3.27 |

885 |

|

ELG Underground |

|

|

|

|

|

|

|

|

|

|

Proven |

829 |

6.22 |

7.7 |

0.28 |

166 |

204 |

5 |

6.60 |

176 |

|

Probable |

1,734 |

5.64 |

7.1 |

0.24 |

314 |

393 |

9 |

5.96 |

332 |

|

Proven & Probable |

2,563 |

5.83 |

7.3 |

0.25 |

480 |

598 |

14 |

6.17 |

508 |

|

Surface Stockpiles |

|

|

|

|

|

|

|

|

|

|

Proven |

4,655 |

1.26 |

3.1 |

0.07 |

188 |

470 |

7 |

1.30 |

195 |

|

Probable |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Proven & Probable |

4,655 |

1.26 |

3.1 |

0.07 |

188 |

470 |

7 |

1.30 |

195 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Proven |

8,306 |

2.90 |

4.4 |

0.12 |

776 |

1,170 |

22 |

2.99 |

800 |

|

Probable |

30,332 |

2.91 |

20.5 |

0.70 |

2,833 |

20,037 |

471 |

4.25 |

4,148 |

|

Proven & Probable |

38,638 |

2.91 |

17.1 |

0.58 |

3,609 |

21,206 |

493 |

3.98 |

4,947 |

Notes to accompany Mineral Reserve table:1.

Mineral Reserves were developed in accordance with CIM (2014)

guidelines.2. Rounding may result in apparent summation differences

between tonnes, grade, and contained metal content. Surface

Stockpile Mineral Reserves are estimated using production and

survey data and apply the same gold equivalent (“AuEq”) formula as

ELG Open Pits.3. AuEq of Total Reserves is established from

combined contributions of the various deposits.4. The qualified

person for the Mineral Reserve estimate is Johannes (Gertjan)

Bekkers, P. Eng., VP of Mines Technical Services.5. The qualified

person is not aware of mining, metallurgical, infrastructure,

permitting, or other factors that materially affect the Mineral

Reserve estimates.Notes to accompany the Media Luna Underground

Mineral Reserves:6. Mineral Reserves are based on Media Luna

Indicated Mineral Resources with an effective date of October 31,

2021.7. Media Luna Underground Mineral Reserves are reported above

a diluted ore cut-off grade of 2.2 g/t AuEq.8. Media Luna

Underground cut-off grades and mining shapes are considered

appropriate for a metal price of $1,400/oz gold (“Au”), $17/oz

silver (“Ag”) and $3.25/lb copper (“Cu”) and metal recoveries of

85% Au, 79% Ag, and 91% Cu.9. Mineral Reserves within designed mine

shapes assume long-hole open stoping, supplemented with mechanized

cut-and-fill mining and includes estimates for dilution and mining

losses.10. Media Luna Underground AuEq = Au (g/t) + Ag (g/t) *

(0.0112) + Cu (%) * (1.6946), accounting for metal prices and

metallurgical recoveries.Notes to accompany the ELG Open Pit

Mineral Reserves:11. Mineral Reserves are founded on Measured and

Indicated Mineral Resources, with an effective date of December 31,

2022, for ELG Open Pits (including El Limón, El Limón Sur and

Guajes deposits).12. ELG Open Pit Mineral Reserves are reported

above an in-situ cut-off grade of 1.2 g/t Au.13. ELG Low Grade

Mineral Reserves are reported above an in-situ cut-off grade of

0.88 g/t Au.14. It is planned that ELG Low Grade Mineral Reserves

within the designed pits will be stockpiled during pit operation

and processed during pit closure.15. Mineral Reserves within the

designed pits include assumed estimates for dilution and ore

losses.16. Cut-off grades and designed pits are considered

appropriate for a metal price of $1,400/oz Au and metal recovery of

89% Au.17. Mineral Reserves are reported using a Au price of

US$1,400/oz, Ag price of US$17/oz, and Cu price of US$3.25/lb.18.

Average metallurgical recoveries of 89% for Au, 30% for Ag, and 23%

for Cu.19. ELG Open Pit (including surface stockpiles) AuEq = Au

(g/t) + Ag (g/t) * (0.0041) + Cu (%) * (0.4114), accounting for

metal prices and metallurgical recoveries.Notes to accompany the

ELG Underground Mineral Reserves:20. Mineral Reserves are founded

on Measured and Indicated Mineral Resources, with an effective date

of December 31, 2022, for ELG Underground (including Sub-Sill, ELD,

Sub-Sill South and El Limón Sur Deep deposits).21. Mineral Reserves

were developed in accordance with CIM guidelines.22. El Limón

Underground Mineral Reserves are reported above an in-situ ore

cut-off grade of 3.2 g/t AuEq and an in-situ incremental cut-off

grade of 1.05 g/t Au.23. Cut-off grades and mining shapes are

considered appropriate for a metal price of $1,400/oz Au and metal

recovery of 90% Au.24. Mineral Reserves within designed mine shapes

assume mechanized cut and fill mining method and include estimates

for dilution and mining losses.25. Mineral Reserves are reported

using a Au price of US$1,400/oz, Ag price of US$17/oz, and Cu price

of US$3.25/lb.26. Average metallurgical recoveries of 90% for Au,

62% for Ag, and 63% for Cu, accounting for the planned copper

concentrator.27. ELG Underground AuEq = Au (g/t) + Ag (g/t) *

(0.0083) + Cu (%) * (1.1202), accounting for metal prices and

metallurgical recoveries.

Table 8: Mineral Resource Estimate –

Morelos Complex (December 31, 2022)

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(gpt) |

(gpt) |

(%) |

(koz) |

(koz) |

(Mlb) |

(gpt) |

(koz) |

|

Media Luna Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

1,823 |

5.29 |

42.0 |

1.38 |

310 |

2,460 |

55 |

8.06 |

473 |

|

Indicated |

25,567 |

3.02 |

30.1 |

1.05 |

2,486 |

24,708 |

589 |

5.11 |

4,196 |

|

Measured & Indicated |

27,390 |

3.17 |

30.9 |

1.07 |

2,796 |

27,168 |

645 |

5.30 |

4,669 |

|

Inferred |

7,322 |

2.54 |

23.0 |

0.88 |

598 |

5,422 |

143 |

4.27 |

1,006 |

|

ELG Open Pit |

|

|

|

|

|

|

|

|

|

|

Measured |

3,161 |

4.67 |

5.7 |

0.16 |

475 |

576 |

11 |

4.76 |

484 |

|

Indicated |

8,143 |

2.35 |

4.1 |

0.15 |

615 |

1,073 |

26 |

2.42 |

635 |

|

Measured & Indicated |

11,304 |

3.00 |

4.5 |

0.15 |

1,090 |

1,650 |

37 |

3.08 |

1,119 |

|

Inferred |

1,385 |

1.92 |

2.2 |

0.06 |

85 |

100 |

2 |

1.95 |

87 |

|

ELG Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

1,741 |

5.94 |

8.0 |

0.34 |

332 |

450 |

13 |

6.58 |

369 |

|

Indicated |

3,274 |

5.54 |

8.1 |

0.28 |

583 |

854 |

20 |

6.08 |

640 |

|

Measured & Indicated |

5,016 |

5.68 |

8.1 |

0.30 |

916 |

1,304 |

33 |

6.26 |

1,009 |

|

Inferred |

1,480 |

5.45 |

10.2 |

0.30 |

259 |

485 |

10 |

6.05 |

288 |

|

EPO Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

4,050 |

2.37 |

34.8 |

1.48 |

308 |

4,528 |

132 |

5.16 |

671 |

|

Measured & Indicated |

4,050 |

2.37 |

34.8 |

1.48 |

308 |

4,528 |

132 |

5.16 |

671 |

|

Inferred |

5,634 |

1.79 |

31.3 |

1.17 |

324 |

5,668 |

145 |

4.04 |

732 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Measured |

6,725 |

5.17 |

16.1 |

0.54 |

1,117 |

3,486 |

80 |

6.13 |

1,325 |

|

Indicated |

41,035 |

3.03 |

23.6 |

0.85 |

3,992 |

31,164 |

767 |

4.66 |

6,143 |

|

Measured & Indicated |

47,760 |

3.33 |

22.6 |

0.80 |

5,110 |

34,650 |

847 |

4.86 |

7,468 |

|

Inferred |

15,821 |

2.49 |

23.0 |

0.86 |

1,267 |

11,675 |

299 |

4.15 |

2,112 |

Notes to accompany the Mineral Resource Table:1.

CIM (2014) definitions were followed for Mineral Resources.2.

Mineral Resources are depleted above a mining surface or to the

as-mined solids as of December 31, 2022.3. Mineral Resources are

reported using a gold (“Au”) price of US$1,550/oz, silver (“Ag”)

price of US$20/oz, and copper (“Cu”) price of US$3.50/lb.4. Gold

equivalent (“AuEq”) of Total Mineral Resources is established from

combined contributions of the various deposits.5. Mineral Resources

are inclusive of Mineral Reserves.6. Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.7.

Numbers may not add due to rounding.8. The estimate was prepared by

Ms. Carolina Milla, P.Eng. (Alberta), Principal, Mineral Resources

Notes to accompany Media Luna Underground Mineral Resources:9. The

effective date of the estimate is December 31, 2022.10. Mineral

Resources are reported above a 2.0 g/t AuEq cut-off grade.11.

Metallurgical recoveries at Media Luna average 85% for Au, 79% for

Ag, and 91% for Cu.12. Media Luna Underground AuEq = Au (g/t) + (Ag

(g/t) * 0.0119) + (Cu (%) * 1.6483). AuEq calculations consider

both metal prices and metallurgical recoveries.13. The assumed

mining method is from underground methods, using a combination of

long hole stoping and cut and fill.Notes to accompany the ELG Open

Pit Mineral Resources:14. The effective date of the estimate is

December 31, 2022.15. Average metallurgical recoveries are 89% for

Au, 30% for Ag and 23% for Cu.16. ELG Open Pit AuEq = Au (g/t) +

(Ag (g/t) * 0.0043) + (Cu (%) * 0.4001). AuEq calculations consider

both metal prices and metallurgical recoveries.17. Mineral

Resources are reported above an in-situ cut-off grade of 0.78 g/t

Au.18. Mineral Resources are reported inside an optimized pit

shell. Underground Mineral Reserves at ELD within the El Limón

shell have been excluded from the open pit Mineral Resources.Notes

to accompany ELG Underground Mineral Resources:19. The effective

date of the estimate is December 31, 2022.20. Average metallurgical

recoveries are 90% for Au, 86% for Ag and 93% for Cu, accounting

for the planned copper concentrator.21. ELG Underground AuEq = Au

(g/t) + (Ag (g/t) * 0.0123) + (Cu (%) * 1.600). AuEq calculations

consider both metal prices and metallurgical recoveries.22. Mineral

Resources are reported above a cut-off grade of 3.0 g/t AuEq.23.

The assumed mining method is underground cut and fill.Notes to

accompany EPO Underground Mineral Resources:24. The effective date

of the estimate is December 31, 2022.25. Mineral Resources are

reported above a 2.0 g/t AuEq cut-off grade.26. Metallurgical

recoveries at EPO average 85% for Au, 75% for Ag, and 89% for

Cu.27. EPO Underground AuEq = Au (g/t) + Ag (g/t) * (0.0114) + Cu %

* (1.6212). AuEq calculations consider both metal prices and

metallurgical recoveries.28. The assumed mining method is from

underground methods using a long hole stoping.

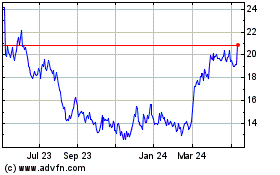

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

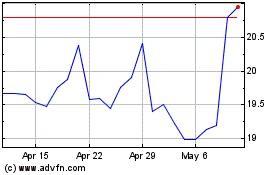

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024