Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB: AQSZF) (“Aequus” or

the “Company”), a specialty pharmaceutical company with a focus on

developing, advancing and promoting differentiated products, today

reported financial results for the year ended December 31, 2020

(“Fiscal 2020”) and associated Company developments. Unless

otherwise noted, all figures are in Canadian currency.

“We had a very strong end to our fiscal year and

set new records for both the fourth quarter and annual revenue,”

said Doug Janzen, Chairman and CEO of Aequus. “2020 gross revenues

were $2,592,613 for the year, a 59% increase over Fiscal 2019

revenues of $1,632,524 and Q4 revenues were $851,187 a 59% increase

over Q4 2019. Our fourth quarter is traditionally our strongest

quarter, and we will work to carry this momentum forward into 2020.

We significantly improved on our bottom line as well; the net loss

for Fiscal 2020 was $1,045,360, a 66% reduction compared to a net

loss of $3,106,104 in Fiscal 2019 and the net loss for Q4 2020

dropped to $165,376 compared to $1,037,354 for the same period in

2019.

I am very pleased with our performance in 2020.

We have dramatically narrowed our operating losses and continue to

close in on our goal of reaching operational break-even. With the

recent launch of the EvolveTM and ReviveTM products our focus

remains on commercial execution while expanding our existing

partnerships to include the acquisition of new products for our

growing pipeline. In the next few weeks, we will be submitting the

first tranche of information to Health Canada to support the

approval of Zimed-PF, a preservative free prescription product for

open angle Glaucoma. We are very excited about introducing this

product to the Canadian market. We are also encouraged by the pace

of negotiations we are having with potential new partners and B2B

relationships, despite the challenges associated with the impact of

COVID-19 on our partners and customers.”

Key 2020 Financial Highlights

- Highest annual revenue to date,

with Fiscal 2020 total revenue of $2.6 million, resulted in an

increase of 59% over the $1.6 million in revenue during the year

ended December 31, 2019 (“Fiscal 2019”).

- The three months ended December 31,

2020 (“Fourth Quarter 2020”) had revenues of $851,187, is a 59%

increase over the three months ended December 31, 2019 (“Fourth

Quarter 2019”).

- Fiscal 2020 net loss of $1.0

million, a reduction of 66% from the $3.1 million loss in Fiscal

2019, mainly due to higher sales and a temporary reduction in sales

expenses during the mandated shutdowns last year.

- Fourth Quarter 2020 operating loss

of $164,750, before other expenses, was 70% less compared to the

same quarter in 2019. The Fourth Quarter 2020 net loss of $165,376

was a $871,978 decrease when compared to $1,037,354 net loss in the

Fourth Quarter 2019. The change was primarily due to higher sales

in 2020 and a $478,940 expense in Q4 2019 related to the impairment

of an intangible asset when there was no such expense in Q4

2020.

Key 2020 Operational Highlights

Commercial Activities

- On January 10, 2020, the Company

advanced the filings for provincial reimbursement in both Quebec

and British Columbia for its lead product, PRVistitanTM

(Bimatoprost 0.03%). If successful, this additional coverage would

advance sales in the second and third largest markets in Canada and

would trigger an increase in the percentage of total revenue that

Aequus receives from its partner Sandoz.

- On October 16, 2020, the Company

agreed to a contract extension under modified terms for its

promotional service agreement with Sandoz Canada Inc. (“Sandoz”)

for Tacrolimus IR to December 31, 2021.

- On October 29, 2020, the Company,

together with its partner, Medicom Healthcare Ltd. (“Medicom”), was

issued a new Medical Device License for two of three product

submissions made for the EvolveTM preservative free dry eye product

line, including Daily Intensive Drops and Daily Intensive Gel.

Corporate Activities

- On August 6, 2020, the Company

issued 31,250,000 units at a price of $0.08 per unit for aggregate

proceeds of $2,500,000. Each unit is comprised of one common share

and one-half of one warrant of the Company (each whole common share

purchase warrant, a "Warrant"). Each Warrant entitles the holder to

purchase one common share at an exercise price of $0.12 for 36

months. The Warrants include an acceleration provision, exercisable

at the Company's option, if the Company's daily volume weighted

average share price is greater than $0.20 for ten consecutive

trading days.

2021 Highlights - Subsequent to December 31,

2020

- In February 2021, the Company

closed a private placement of 6,666,666 units at a price of $0.15

per unit, for proceeds of $1,000,000 to Marc Lustig, a director of

the Company. Each unit shall consist of one common share and

one-half warrant. Each warrant shall entitle the holder to purchase

one common share at an exercise price of $0.25 for 24 months.

- In March 2021, the Company elected

to exercise its right to trigger an accelerated expiry under the

terms of the warrant indenture which governed the Warrants issued

under the August 2020 financing, and subsequently issued 12,343,750

shares at $0.12 per share, pursuant to the exercise of certain

other common share purchase warrants for net proceeds of

$1,481,250. The Company also issued 317,000 shares at $0.22 per

share pursuant to the exercise of warrants for net proceeds of

$69,740.

- In March 2021, Aequus launched the

newly approved EvolveTM Daily intensive drops and Daily Intensive

Gel. Products are sold direct to professionals via a newly created

e-commerce platform, www.aequuseyecare.ca.

Commercial Update

“Despite Covid-19 and significant reductions in

rep selling time, -41% in field vs full time deployment, Aequus

combined revenues were $2.6 Million, +59% increase compared to

Fiscal 2019. Vistitan revenue at +15% and Tacrolimus at +49% showed

strong consistent growth as we increased clinic and transplant

center penetration respectively. Fourth Quarter 2020 revenues from

operations were $851,187, the first time in our Company’s history

that we exceeded $750,000 in sales for a single quarter. We’ve

successfully executed sales force deployment strategies into key

professional areas of Ophthalmology and Transplant across Canada.

We’ve used Covid as an opportunity to improve our remote selling

capabilities and scale out our technology with video conferencing

and professional CRM implementation,” says Grant Larsen, Chief

Commercial Officer with Aequus. “Our accelerated ability to adapt

to market conditions, and implement digital technology with a

scalable platform of assets, is expected to attract international

partners looking for rapid access to the Canadian marketplace.”

With the addition of business development,

medical science liaison and commercial analysis resources in late

2020, our focus is on expanding our product offerings in key

strategic areas as well as expanding our established partnerships

with Sandoz and Medicom. With a new drug establishment license in

Canada, and the demonstrated ability to deliver on promotional

partnerships, in-license agreements, we have a flexible business

model capable of adapting to many portfolio opportunities.

Operating Expenses

The Company reported an operating loss before

other income of $1,064,989 for Fiscal 2020, an improvement of 60%

from the loss before other income of $2,636,560 in Fiscal 2019. The

lower loss was primarily due to higher sales and a decrease in

research and development expenses. The Fiscal 2020 improvement in

loss was offset by higher sales and marketing expenses and a higher

interest and accretion expenses recognized in general

administration expenses which related to the debenture issued

during Fiscal 2019.

Sales and marketing costs in Fiscal 2020 were

$1,547,773 when compared to $1,857,478 in Fiscal 2019, a reduction

of 17% or $309,705. The majority of the reduction related to a

decrease in sales activities and reduced work hours due to the

COVID-19 pandemic response restrictions which resulted in temporary

layoffs, limited travel to customers and reduced in-person

meetings. Non-cash expenses for depreciation, amortization and

share-based payments in Fiscal 2020 were $91,209 and $150,433

respectively, compared to $189,309 and $82,241 respectively in

Fiscal 2019.

Research and development project maintenance

expenses in Fiscal 2020 were $54,608 when compared to $210,827 in

Fiscal 2019, a decrease of 74% or $156,219. The majority of the

decrease was attributable to a reduction in consulting and

compensation related expenses as we are now focused on revenue

generating third-party commercial products as opposed to internal

product development programs.

General and administration expenses in Fiscal

2020 were $2,055,221 when compared to $2,200,779 in Fiscal 2019, a

decrease of 7% or $145,558. The Company’s interest and accretion

expenses relating to the convertible debenture issued in May 2019

were $246,753 and $232,433 respectively for Fiscal 2020, compared

to $147,478 and $223,428 respectively for Fiscal 2019. The Company

recognized cost reductions in Management, wages and related, and

travel, and legal and professional fees in Fiscal 2020 which were

offset by the increased expenses related to the convertible

debenture and interest expenses.

ABOUT AEQUUS PHARMACEUTICALS INC.

Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB:

AQSZF) is a growing specialty pharmaceutical company focused on

developing and commercializing high quality, differentiated

products. Aequus has grown its sales and marketing efforts to

include several commercial products in ophthalmology and

transplant. Aequus plans to build on its Canadian commercial

platform through the launch of additional products that are either

created internally or brought in through an acquisition or license;

remaining focused on highly specialized therapeutic areas. For

further information, please visit www.aequuspharma.ca.

FORWARD-LOOKING STATEMENT DISCLAIMER

This release may contain forward-looking

statements or forward-looking information under applicable Canadian

securities legislation that may not be based on historical fact,

including, without limitation, statements containing the words

“believe”, “may”, “plan”, “will”, “estimate”, “continue”,

“anticipate”, “intend”, “expect”, “potential” and similar

expressions. Forward- looking statements are necessarily based on

estimates and assumptions made by us in light of our experience and

perception of historical trends, current conditions and expected

future developments, as well as the factors we believe are

appropriate. Forward-looking statements include but are not limited

to statements relating to: the implementation of our business model

and strategic plans; revenue growth trends into the future;

expected timing for product launches; the Company’s expected

revenues; the regulatory approval of its products; ongoing

discussions with current and future partners’ ability to further

grow our product portfolio. Such statements reflect our current

views with respect to future events and are subject to risks and

uncertainties and are necessarily based upon a number of estimates

and assumptions that, while considered reasonable by Aequus, are

inherently subject to significant business, economic, competitive,

political and social uncertainties and contingencies. Many factors

could cause our actual results, performance or achievements to be

materially different from any future results, performance, or

achievements that may be expressed or implied by such

forward-looking statements. In making the forward looking

statements included in this release, the Company has made various

material assumptions, including, but not limited to: obtaining

regulatory approvals; general business and economic conditions; the

Company’s ability to successfully out license or sell its current

products and in-license and develop new products; the assumption

that the Company’s current good relationships with third parties

will be maintained; the availability of financing on reasonable

terms; the Company’s ability to attract and retain skilled staff;

market competition; the products and technology offered by the

Company’s competitors; the impact of the coronavirus (COVID-19) on

the Company’s operations; and the Company’s ability to protect

patents and proprietary rights. In evaluating forward looking

statements, current and prospective shareholders should

specifically consider various factors set out herein and under the

heading “Risk Factors” in the Company’s Annual Information Form

dated April 28, 2020, a copy of which is available on Aequus’

profile on the SEDAR website at www.sedar.com, and as otherwise

disclosed from time to time on Aequus’ SEDAR profile. Should one or

more of these risks or uncertainties, or a risk that is not

currently known to us materialize, or should assumptions underlying

those forward-looking statements prove incorrect, actual results

may vary materially from those described herein. These

forward-looking statements are made as of the date of this release

and we do not intend, and do not assume any obligation, to update

these forward-looking statements, except as required by applicable

securities laws. Investors are cautioned that forward-looking

statements are not guarantees of future performance and are

inherently uncertain. Accordingly, investors are cautioned not to

put undue reliance on forward looking statements.

VistitanTM: Trademark owned or used under

license by Sandoz Canada Inc.

CONTACT INFORMATION Aequus Investor Relations

Email: investors@aequuspharma.ca Phone: 604-336-7906

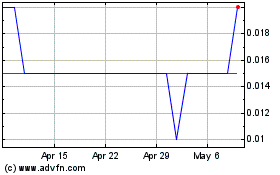

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

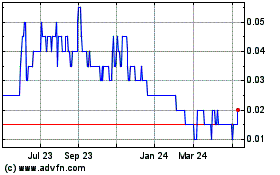

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

From Feb 2024 to Feb 2025