Doré Copper Mining Corp. (the "

Corporation" or

"

Doré Copper") (TSXV: DCMC; OTCQX: DRCMF; FRA:

DCM) is pleased to announce its plans to drill several high

priority copper-gold targets in the Central Chibougamau mining

camp, located in proximity to its existing Copper Rand mill, near

Chibougamau, Québec (Figure 1). The drilling program is scheduled

to start at the end of June.

High Priority Drilling

Targets:

Jaculet (Figure 2)

The Jaculet mine, located 2.5 kilometers by road

from the Copper Rand mill, was in operation from 1960 to 1971 and

produced a total of 1,091,000 tonnes at 1.84% Cu, 1.44 g/t Au and

6.85 g/t Ag (20,074 tonnes of Cu and 1.57 tonnes Au)1. Jaculet was

mined to a depth of 366 meters (1,200 feet) and the shaft was

deepened to 500 meters (1,650 feet) in 1972. The Jaculet

mineralized system consists of two distinct shear zones, known as

Zone 1 and Zone 2, which both remain open at depth with very little

development below 366 meters.

Two surface holes completed in 1956 by

Chibougamau Jaculet Mines Ltd. intersected Zone 1 at a vertical

depth of approximately 400 meters. Hole V17 and V17A (wedge from

V17, located approximately 50 meters to the east) intersected

4.55% Cu and 0.86 g/t Au over 6.7 meters and 4.25% Cu and

0.59 g/t Au over 6.4 meters, respectively.

Doré Copper plans to drill two holes for a total

of 1,300 meters. The first hole will test the potential down plunge

extension of holes V17 and V17A in Zone 1. The second hole will

test another potential ore shoot located approximately 400 meters

to the west.

The Jaculet deposit is defined by two distinct

subparallel shear zones, known as Zone 1 and Zone 2, separated by

approximately 200 meters, where the veins within both zones

typically range from 91 to 137 meters in strike length. Zone 1

extends for approximately 500 meters and has an average strike of

290° with a northerly dip ranging from 55° to near vertical.

Mineralization in Zone 1 consists of chalcopyrite and minor pyrite

within the sheared and altered gabbroic anorthosite. Zone 2 extends

for approximately 670 meters in length and is oriented at 80° north

dipping 80-85° to the south. Mineralization consists of stringers

of pyrite with erratic lenses of chalcopyrite associated with

siderite, sericite and chloritoid.

Cedar Bay Southwest Zone

Extension (Figure 3)

The Southwest Zone, located 300 meters southwest

of the Cedar Bay Main Zone, was partially developed by Campbell

Chibougamau Mines Limited up to the 200-meter (650-feet) level,

right at the property limit with Patino Mining. The potential

extension of the Cedar Bay Southwest Zone along strike to the

southeast was never tested by Patino Mining and subsequent

companies that controlled that ground. In total, approximately 800

meters of strike length have not been tested up to the Lac Doré

Fault.

Doré Copper plans to drill two holes from the

same pad for a total of 1,500 meters to test the potential

southeast extension of the Cedar Bay Southwest Zone.

The Cedar Bay mine operated from 1958 to 1990

and produced 3.9 million tonnes grading 1.56% Cu and 3.22 g/t Au1.

The ore from the mine was processed at the Copper Rand mill located

5 kilometers by road. The deposit was mined to a depth of 670.5

meters and the existing shaft extends to a depth of 1,036 meters.

Doré Copper, while private, completed four holes (including wedges)

totaling 4,842 meters in 2018 and reported an Indicated resource of

130,000 tonnes at 9.44 g/t Au and 1.55% Cu, and an Inferred

resource of 230,000 tonnes at 8.32 g/t Au and 2.13% Cu (effective

date of December 31, 2018)2. During 2020, the Corporation completed

9,025 meters of drilling and successfully extended a number of

mineralized lenses (the 10-20A and 10-20B).

Figure 1. Plan View of Copper Rand

Property Showing the Jaculet and Cedar Bay SW Targets

Figure 2. Plan View and Long Section

Showing the Jaculet Target

Figure 3. Plan View and Long Section

Showing the Cedar Bay Southwest Zone Extension

Qualified Person

Sylvain Lépine, M.Sc, P.Geo, MBA, Vice President

Exploration of the Corporation and a "Qualified Person" within the

meaning of National Instrument 43-101, has reviewed and approved

the technical information contained in this news release.

About Doré Copper Mining

Corp.

Doré Copper Mining Corp. aims to be the next

copper producer in Québec with an initial production target of +50

million pounds of copper equivalent annually by implementing a

hub-and spoke operation model with multiple high-grade copper-gold

assets feeding its centralized Copper Rand mill2. The Corporation

has delivered its PEA in May 2022 and is proceeding with a

feasibility study.

The Corporation has consolidated a large land

package in the prolific Lac Doré/Chibougamau and Joe Mann mining

camps that has historically produced 1.6 billion pounds of copper

and 4.4 million ounces of gold3. The land package includes 13

former producing mines, deposits and resource target areas within a

60-kilometer radius of the Corporation's Copper Rand Mill.

For further information, please contact:

|

Ernest Mast |

Laurie Gaborit |

|

President and Chief Executive Officer |

Vice President, Investor Relations |

|

Phone: (416) 792-2229 |

Phone: (416) 219-2049 |

|

Email: ernest.mast@dorecopper.com |

Email: laurie.gaborit@dorecopper.com |

Visit: www.dorecopper.com Facebook: Doré Copper MiningLinkedIn:

Doré Copper Mining Corp.Twitter: @DoreCopperInstagram:

@DoreCopperMining

- Sources for historic production

figures: Lacroix, S., Doyon, M., Perreault, S., Nantel, S.,

Gaudreau, R., Dussault, C.,and Morin, R., 1997, Rapport des

géologues résidents sur l’activité minière régionale en 1996:

Ministère des Ressources naturelles du Québec Report DV97-01, 102

p.

- Technical report titled

"Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke

Complex, Québec, Canada" dated June 15, 2022, in accordance with

National Instrument 43-101 Standards of Disclosure for Mineral

Projects (“NI 43-101”). The Technical Report was prepared by

BBA Inc. with several consulting firms contributing to sections of

the study, including SLR Consulting (Canada) Ltd., SRK Consulting

(Canada) Inc. and WSP Inc.

- Sources for historic production

figures: Economic Geology, v. 107, pp. 963–989 - Structural and

Stratigraphic Controls on Magmatic, Volcanogenic, and Shear

Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp,

Northeastern Abitibi, Canada by François Leclerc et al. (Lac

Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the

Joe Mann Property dated January 11, 2016 by Geologica

Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann

mine).

Cautionary Note Regarding

Forward-Looking Statements This news release includes

certain "forward-looking statements" under applicable Canadian

securities legislation. Forward-looking statements include

predictions, projections and forecasts and are often, but not

always, identified by the use of words such as "seek",

"anticipate", "believe", "plan", "estimate", "forecast", "expect",

"potential", "project", "target", "schedule", "budget" and "intend"

and statements that an event or result "may", "will", "should",

"could" or "might" occur or be achieved and other similar

expressions and includes the negatives thereof. Specific

forward-looking statements in this press release include, but are

not limited to aiming to be the next copper producer in Québec with

an initial production target of +50 Mlbs of copper equivalent

annually, implementing a hub-and spoke operation model; and

completing a feasibility study.

All statements other than statements of

historical fact included in this release, including, without

limitation, statements regarding the timing and ability of the

Corporation to receive necessary regulatory approvals, and the

plans, operations and prospects of the Corporation and its

properties are forward-looking statements. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable, are subject to known

and unknown risks, uncertainties and other factors which may cause

actual results and future events to differ materially from those

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, actual exploration

results, changes in project parameters as plans continue to be

refined, future metal prices, availability of capital and financing

on acceptable terms, general economic, market or business

conditions, uninsured risks, regulatory changes, delays or

inability to receive required regulatory approvals, health

emergencies, pandemics and other exploration or other risks

detailed herein and from time to time in the filings made by the

Corporation with securities regulators. Although the Corporation

has attempted to identify important factors that could cause actual

actions, events or results to differ from those described in

forward-looking statements, there may be other factors that cause

such actions, events or results to differ materially from those

anticipated. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements. The Corporation disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9358c202-3eb0-4d0c-9351-222a3450b5f3

https://www.globenewswire.com/NewsRoom/AttachmentNg/d12dbd00-4e61-43c8-9ecc-1e40028e2df5

https://www.globenewswire.com/NewsRoom/AttachmentNg/de5907f8-3989-4267-959a-87c5dc6745ee

https://www.globenewswire.com/NewsRoom/AttachmentNg/4962850a-50ff-4b79-aed6-6a62ac775527

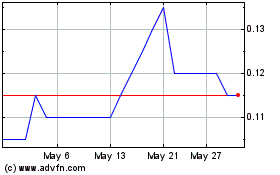

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Dec 2023 to Dec 2024