CloudMD Software & Services Inc. (TSXV: DOC, Frankfurt: 6PH)

(the “

Company” or “

CloudMD”), is

pleased to announce the notice of special meeting (the

“

Meeting”) of the holders

(“

Shareholders”) of common shares of CloudMD

(“

Shares”) and of the holders (the

“

Optionholders”, and collectively with the

Shareholders, the “

Securityholders”) of stock

options of the Company and management information circular (the

“

Circular”) are now available on CloudMD’s website

at

https://investors.cloudmd.ca/events--presentations/special-meeting/,

as well as under CloudMD’s profile on SEDAR+ (www.sedarplus.ca).

The mailing of the Circular and other materials related to the

Meeting has also commenced.

The Arrangement and Meeting

Details

At the Meeting, Securityholders will be asked,

among other things, to consider and, if deemed advisable, pass a

special resolution (the “Arrangement Resolution”)

approving the Arrangement (as defined below). On May 14, 2024, the

Company entered into an arrangement agreement (the

“Arrangement Agreement”) with 1480775 B.C.

Ltd., an affiliate of CPS Capital LP (a private equity investment

firm) (the “Purchaser”), in respect of a proposed

plan of arrangement (the “Arrangement”) under the

Business Corporations Act (British Columbia). The purpose of the

Arrangement is to, among other things, permit the acquisition by

the Purchaser of all of the issued and outstanding Shares. If the

Arrangement becomes effective, each Shareholder will receive cash

consideration of $0.04 for each Share held (the

“Consideration”).

CloudMD will hold the Meeting on June 27, 2024,

at 10:00 a.m. (Toronto time) via audio webcast (at

https://web.lumiconnect.com/416813823) with the ability to

participate in the virtual meeting as explained further in the

Circular.

Reasons for the Arrangement

-

Process – The Arrangement with the Purchaser is

the culmination of a lengthy process that included a strategic

review that was initiated in August 2022 and overseen by a special

committee and the strategic and liquidity review that the special

committee (the “Special Committee”) of the board

of directors of the Company (the “Board”) has been

engaged in since July 2023, with the assistance of INFOR Financial

Inc. (“INFOR”). During that time, the Company,

through its advisors, canvassed a significant number of other

potential parties, none of which were prepared to make an

executable binding offer to acquire the Company or provide capital

to support the Company’s path to positive cash flow. The

Arrangement provides the capital to support the Company’s business

with specific consideration to all of the Company’s stakeholders

and was the best alternative available to ensure the ongoing

viability of the Company. Failure to complete the Arrangement could

materially and negatively impact the trading price of the Shares

and if the Arrangement is not completed, the Company does not

expect that there will be an alternative that would provide any

value to the Securityholders.

-

Business and Industry Risks – The Board and the

Special Committee concluded that the Consideration provides

certainty of value to Securityholders, which Securityholders may

consider as more favourable than continuing with the Company’s

current business plan, in light of the risks and uncertainties

affecting the Company and its business. These risks and

uncertainties include: the current business, operations, assets,

financial performance and condition, operating results and

prospects of the Company, the outstanding indebtedness under the

Company’s credit facilities and their near-term maturity, its

limited cash resources, the current industry and economic

conditions and trends.

-

Fairness Opinion – The fairness opinion from INFOR

(the “Fairness Opinion”) that, subject to and

based on the considerations, qualifications, assumptions and

limitations described therein, the Consideration is fair, from a

financial point of view, to the Shareholders.

- Form of

Consideration – The form of consideration payable to

Securityholders, being cash, provides certainty of value and

immediate liquidity.

-

Credibility of the Guarantors – The obligations of

the Purchaser, including its obligation to pay the Consideration

and the outstanding indebtedness under the Company’s credit

facilities, are guaranteed by affiliates of CPS Capital (the

“Guarantors”). Given the Guarantors’ commitment,

credit worthiness and record of completing transactions, the

Guarantors are expected to be better able to withstand costs,

payments, fees and other expenses, in part as a result of their

financial position and access to capital.

Board Recommendation

The Board, based in part on the unanimous

recommendation of the Special Committee and the Fairness Opinion,

has unanimously determined that the Arrangement is fair to

Securityholders and is in the best interests of the Company, and

unanimously recommends that the Securityholders vote FOR

the Arrangement Resolution. The determination of the

Special Committee and the Board is based on various factors as

described above and more fully in the Circular.

Securityholders are encouraged to read the

Circular and vote your securities as soon as possible. The proxy

voting deadline is Tuesday, June 25, 2024 at 10:00 a.m. (Toronto

time).

Securityholder Questions

Securityholders who have any questions or

require assistance with voting may contact Laurel Hill Advisory

Group, CloudMD’s proxy solicitation agent and shareholder

communications advisor:

Laurel Hill Advisory GroupToll

Free: 1.877.452.7184 (for securityholders in North

America)International: +1.416.304.0211 (for securityholders outside

Canada and the US)By Email: assistance@laurelhill.com

About CloudMD

CloudMD is an innovative North American

healthcare service provider focused on empowering healthier living

by combining leading edge technology with an exceptional national

network of healthcare professionals. Every day, our employees and

health care providers live our values of delivering excellence,

collaboration, connected communication and accountability to solve

complex health problems. CloudMD’s industry leading workplace

health and wellbeing solution, Kii, supports members and their

families with a personalized and connected healthcare experience

across mental, physical and occupation health. Kii delivers

superior clinical health outcomes, consistent high engagement, and

measurable ROI for payers such as employers, educational

institutions, associations, government, and insurers. CloudMD is

also a market leader in workplace absence management through

data-driven prevention, intervention and return to work

programs.

In addition, the Company sells health and

productivity tools to hospitals, clinics, and other healthcare

service providers to empower them to deliver better care. Visit

www.cloudmd.ca to learn more about the Company’s comprehensive

healthcare offerings.

“Karen Adams”Chief Executive Officer

FOR ADDITIONAL INFORMATION,

CONTACT:

Investor

RelationsInvestors@cloudmd.ca1-647-484-1405

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains “forward-looking

statements” and “forward-looking information” within the meaning of

Canadian securities laws, including statements relating to the

Arrangement, including in respect of the impact of the Arrangement,

the anticipated Meeting date and completion of mailing of the

Circular, timing for completion of the Arrangement and receiving

the required regulatory and court approvals, CloudMD’s expectations

regarding liquidity and continuity of the Company’s business and

operations, and the availability of the bridge loan and line of

credit and continued forbearance through the period until closing

of the Arrangement. All information that is not clearly historical

in nature may constitute forward‐looking statements. In some cases,

forward‐looking statements may be identified by the use of terms

such as “forecast”, “projected”, “assumption” and other similar

expressions or future or conditional terms such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “project”, “will”, “would”, and “should”.

Forward-looking statements contained in this news release are based

on certain factors and assumptions made by management of CloudMD

based on their current expectations, estimates, projections,

assumptions and beliefs regarding their business and CloudMD does

not provide any assurance that actual results will meet

management’s expectations. While management considers these

assumptions to be reasonable based on information currently

available to them, they may prove to be incorrect. Such

forward‐looking statements are not guarantees of future events or

performance and by their nature involve known and unknown risks,

uncertainties and other factors, including those risks described in

the Company’s MD&A (which is filed under the Company’s issuer

profile on SEDAR+ and can be accessed at www.sedarplus.ca), that

may cause the actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by such forward‐looking

statements. Although CloudMD has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward‐looking

statements, other factors may cause actions, events or results to

be different than anticipated, estimated or intended. There can be

no assurance that such statements will prove to be accurate as

actual results and future events could vary or differ materially

from those anticipated in such forward‐looking statements.

Accordingly, readers should not place undue reliance on

forward‐looking information. CloudMD does not undertake to update

any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws.

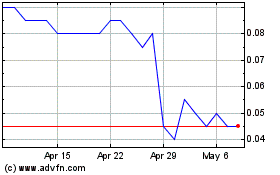

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Nov 2024 to Dec 2024

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Dec 2023 to Dec 2024