CloudMD Software & Services Inc. (TSXV: DOC, Frankfurt: 6PH)

(the “

Company” or “

CloudMD”), an

innovative health services company transforming the delivery of

care, and CPS Capital (“

CPS Capital”), an

entrepreneurial investment firm partnering with businesses and

teams to realize their growth goals, are pleased to announce that

they have entered into an arrangement agreement (the

“

Arrangement Agreement”) pursuant to which CPS

Capital (through an affiliate) (the “

Purchaser”)

has agreed to acquire all of the outstanding common shares (the

“

Shares”) of CloudMD for cash consideration of

C$0.04 per Share (the “

Transaction”).

The Transaction is the culmination of a

strategic and liquidity review that the Special Committee (as

defined below) has been engaged in since July 2023, with the

assistance of INFOR Financial Inc. Such review was necessary to

address the Company’s liquidity issues, which were largely the

result of the number of acquisitions that the Company completed

over the last four years. Although management of the Company was

able to deliver on organic growth targets and strengthen the

balance sheet (through cost reductions resulting in over C$20

million in cost savings) while creating an ecosystem of care, the

Company’s forecasted liquidity issues impacted the Company’s

ability to remain a going concern. This is the result of the

Company being unable to generate positive cashflow to support the

business while making scheduled debt repayments, along with limited

refinancing opportunities on commercially reasonable terms without

onerous covenants, restricted business operations and forecasted

growth initiatives.

The Transaction provides the capital to support

the Company’s business with specific consideration to all of the

Company’s stakeholders and was the best alternative available to

ensure the ongoing viability of the Company. If the Transaction is

not completed, the Company does not expect that there will be an

alternative that would provide any value to the holders of

CloudMD’s equity securities.

Karen Adams, Chief Executive Officer of CloudMD,

stated:

“We are happy to receive the support of CPS

Capital, which will provide us with the ability to execute on our

long-term plan, accelerate growth, and move forward on a strong

financial footing. The Transaction will provide the Company with

much-needed capital to execute on future initiatives to sustain and

grow the business. The healthcare sector has large demand for

outcome-based service providers who have the ecosystem of

services.”

Mike Arblaster, Partner at CPS Capital,

stated:

“We are excited to invest in CloudMD given its

large and diverse customer base combined with its industry leading

service offerings. The Transaction is especially exciting for CPS

Capital given our experience in the employer healthcare space. We

are confident that the Transaction will provide the required

liquidity and support to enable CloudMD to achieve its strategic

vision of advancing the role of healthcare navigation in managing

health and wellbeing, creating value for its customers,

individuals, employees, healthcare providers and partners. We look

forward to partnering with the CloudMD team to build on the

strength of their capabilities and create new opportunities for the

Company and its employees to thrive and grow.”

CPS Capital is funding the Transaction through a

combination of equity from its new flagship fund CPS Partners Fund

V and its previous flagship fund CPS Partners Fund IV.

Transaction Summary

The Transaction will be completed pursuant to a

court-approved plan of arrangement under the Business Corporations

Act (British Columbia). The Transaction will be subject to the

approval of at least: (i) 66⅔% of the votes cast by shareholders;

(ii) 66⅔% of the votes cast by shareholders and optionholders

voting as a single class; and (iii) 50% of the votes cast by

disinterested shareholders at a special meeting of CloudMD

securityholders expected to be held before the end of June 2024. In

addition to securityholder approval, the Transaction is also

subject to the receipt of certain regulatory, court and stock

exchange approvals and other closing conditions customary in

transactions of this nature.

The Arrangement Agreement includes, among other

things, non-solicitation covenants on the part of the Company

(subject to customary fiduciary out provisions) and a right for the

Purchaser to match any competing offer that constitutes a superior

proposal. Under certain circumstances, the Purchaser is entitled to

a $3 million termination fee or an expense reimbursement to a

maximum of $1.5 million, and CloudMD is entitled to a $1.75 million

reverse termination fee.

The directors and executive officers of CloudMD,

who collectively hold approximately 0.16% of the outstanding Shares

and approximately 0.60% of the outstanding Shares and stock options

collectively, entered into voting support agreements with the

Purchaser to support the Transaction.

Following completion of the Transaction, the

Shares will be delisted from the TSX Venture Exchange (the

“TSXV”), and the Company will apply to cease to be

a reporting issuer in applicable provinces in Canada.

CloudMD Board

Recommendation

The Transaction has been unanimously approved by

the Board of Directors of the Company following the unanimous

recommendation of a special committee of independent directors of

the Company (the “Special Committee”). INFOR

Financial has provided an opinion to the Special Committee that,

based upon and subject to the assumptions, limitations and

qualifications set forth therein, the consideration offered to the

CloudMD shareholders pursuant to the Transaction is fair, from a

financial point of view, to the CloudMD shareholders.

Interim Financing

To support the Company’s liquidity needs during

the period prior to closing the Transaction, CPS Capital (through

an affiliate) has agreed to provide a $1 million secured bridge

loan to the Company, and the Company’s secured lender under the

Company’s existing credit facilities (the “Credit

Facilities”) has agreed to extend an additional line of

credit to the Company in the amount of $2 million, in addition to

forbearance of the Credit Facilities during the period prior to

closing of the Transaction.

Timing

Full details of the Transaction will be included

in the Company’s management information circular, which is expected

to be mailed to securityholders in June 2024 in connection with the

securityholders meeting expected to be held before the end of June

2024. Securityholders are urged to read the information circular

once available, as it will contain additional important information

concerning the Transaction. The Arrangement Agreement will also be

filed on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Advisors

INFOR Financial is acting as the exclusive

strategic and financial advisor to CloudMD and Cassels Brock &

Blackwell LLP is acting as legal counsel to CloudMD in connection

with the Transaction.

Owens Wright LLP is acting as legal counsel to

CPS Capital in connection with the Transaction.

2023 Annual Financial

Results

The Company will file its audited consolidated

financial statements and accompanying management’s discussion and

analysis for the fourth quarter and year end December 31, 2023 (the

“Annual Financial Filings”) on May 15, 2024. There

will not be a conference call to discuss the Company’s Q4 2024

results. The failure-to-file cease trade order that was issued by

the Ontario Securities Commission on May 7, 2024, is expected to be

revoked shortly following the filing of the Annual Financial

Filings, with trading of the Shares on the TSXV expected to resume

thereafter.

About CloudMD

CloudMD is an innovative North American

healthcare service provider focused on empowering healthier living

by combining leading edge technology with an exceptional national

network of healthcare professionals. Every day, our employees and

health care providers live our values of delivering excellence,

collaboration, connected communication and accountability to solve

complex health problems. CloudMD’s industry leading workplace

health and wellbeing solution, Kii, supports members and their

families with a personalized and connected healthcare experience

across mental, physical and occupation health. Kii delivers

superior clinical health outcomes, consistent high engagement, and

measurable ROI for payers such as employers, educational

institutions, associations, government, and insurers. CloudMD is

also a market leader in workplace absence management through

data-driven prevention, intervention and return to work

programs.

In addition, the Company sells health and

productivity tools to hospitals, clinics, and other healthcare

service providers to empower them to deliver better care. Visit

www.cloudmd.ca to learn more about the Company’s comprehensive

healthcare offerings.

“Karen Adams”Chief Executive Officer

FOR ADDITIONAL INFORMATION,

CONTACT:

Investor

RelationsInvestors@cloudmd.ca1-647-484-1405

About CPS Capital

CPS Capital is a middle market private equity

firm, based in Toronto, founded by owner-operators who look to

partner with business owners to realize their growth and transition

goals. CPS Capital is focused on North American opportunities to

invest in exceptional businesses in growing industries with

attractive characteristics. CPS Capital brings significant

capability, expertise, and capital to provide business owners with

an attractive option compared to traditional financial or strategic

buyers.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains “forward-looking

statements” and “forward-looking information” within the meaning of

Canadian securities laws, including statements relating to the

Transaction, including in respect of the impact of the Transaction,

the anticipated meeting date and mailing of the information

circular in respect of the meeting, timing for completion of the

Transaction and receiving the required regulatory and court

approvals, CloudMD’s expectations regarding liquidity and

continuity of the Company’s business and operations, the

availability of the bridge loan and line of credit and continued

forbearance through the period until closing of the Transaction,

the timing of the filing of the Annual Financial Filings, and the

timing of the revocation of the failure-to-file cease trade order

and resumption of trading on the TSXV. All information that is not

clearly historical in nature may constitute forward‐looking

statements. In some cases, forward‐looking statements may be

identified by the use of terms such as “forecast”, “projected”,

“assumption” and other similar expressions or future or conditional

terms such as “anticipate”, “believe”, “could”, “estimate”,

“expect”, “intend”, “may”, “plan”, “predict”, “project”, “will”,

“would”, and “should”. Forward-looking statements contained in this

news release are based on certain factors and assumptions made by

management of CloudMD based on their current expectations,

estimates, projections, assumptions and beliefs regarding their

business and CloudMD does not provide any assurance that actual

results will meet management’s expectations. While management

considers these assumptions to be reasonable based on information

currently available to them, they may prove to be incorrect. Such

forward‐looking statements are not guarantees of future events or

performance and by their nature involve known and unknown risks,

uncertainties and other factors, including those risks described in

the Company’s MD&A (which is filed under the Company’s issuer

profile on SEDAR+ and can be accessed at www.sedarplus.ca), that

may cause the actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by such forward‐looking

statements. Although CloudMD has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward‐looking

statements, other factors may cause actions, events or results to

be different than anticipated, estimated or intended. There can be

no assurance that such statements will prove to be accurate as

actual results and future events could vary or differ materially

from those anticipated in such forward‐looking statements.

Accordingly, readers should not place undue reliance on

forward‐looking information. CloudMD does not undertake to update

any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws.

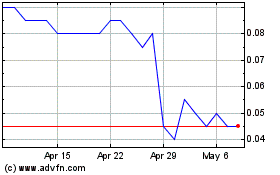

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Oct 2024 to Nov 2024

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Nov 2023 to Nov 2024