Falcon Oil & Gas

Ltd.(“Falcon”, “Group”)

Operational Update on the Stimulation

Campaign

13 February 2025 – Falcon Oil & Gas Ltd.

(TSXV: FO, AIM: FOG) provides the following update on the

stimulation campaign for the Shenandoah S2-2H ST1 (“SS-2H

ST1”) and Shenandoah South 4H (“SS-4H”)

wells in the Beetaloo Sub-basin, Northern Territory, Australia with

Falcon Oil & Gas Australia Limited’s (“Falcon

Australia”) joint venture partner, Tamboran (B2) Pty

Limited (“Operator”).

SS-2H ST1

- As previously announced stimulation

operations were successfully completed over 35 stages across the

1,671-metre (5,483-feet) horizontal section of the Amungee Member

B-shale with Liberty Energy (NYSE: LBRT) stimulation

equipment.

- The SS-2H ST1 well is being

prepared for the commencement of initial flow back and extended

production testing.

- Targeting announcement of 30 day

initial production (“IP30”) flow rates in April

2025.

SS-4H

- Commenced stimulation operations in

January 2025.

- The Operator took proactive and

precautionary steps to pause completion operations due to the

detection of stress in a casing connection.

- Reinforcement activities are

planned to be conducted in Q1 2025, aiming for stimulation

activities to recommence in Q2 2025, as soon as the IP30 flow test

is completed at SS-2H ST1.

- The deferred stimulation program

should provide an opportunity to incorporate lessons from the SS-2H

ST1 campaign.

- Targeting announcement of IP30 flow

rates in mid-2025.

Working Capital

- Falcon Australia has received a

A$4.7 million (~US$3 million) research and development tax offset

in cash.

- The Group’s current cash balance is

US$8.2 million.

Philip O’Quigley, CEO of Falcon

commented: “We continue to be extremely encouraged about

the potential of the current stimulation program based on strong

gas shows and other data observed whilst drilling, together with

the completion of a successful stimulation program on SS-2H ST1

well. We look forward to updating the market on the IP30 flow test

results from both wells as soon as they become available.”

Ends.CONTACT

DETAILS:

|

Falcon Oil & Gas Ltd.

|

+353 1 676 8702 |

|

Philip O’Quigley, CEO |

+353 87 814 7042 |

|

Anne Flynn, CFO |

+353 1 676 9162 |

|

|

|

Cavendish Capital Markets Limited (NOMAD

& Broker) |

|

Neil McDonald / Adam Rae |

+44 131 220 9771 |

This announcement has been reviewed by Dr. Gábor

Bada, Falcon Oil & Gas Ltd’s Technical Advisor. Dr. Bada

obtained his geology degree at the Eötvös L. University in

Budapest, Hungary and his PhD at the Vrije Universiteit Amsterdam,

the Netherlands. He is a member of AAPG.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil

& gas company engaged in the exploration and development of

unconventional oil and gas assets, with the current portfolio

focused in Australia. Falcon Oil & Gas Ltd is incorporated in

British Columbia, Canada and headquartered in Dublin, Ireland.

Falcon Oil & Gas Australia Limited is a c.

98% subsidiary of Falcon Oil & Gas Ltd.

For further information on Falcon Oil & Gas Ltd. Please

visit www.falconoilandgas.com

About Beetaloo Joint Venture (EP 76, 98

and 117)

|

Company |

Interest |

|

Falcon Oil & Gas Australia Limited (Falcon Australia) |

22.5% |

|

Tamboran (B2) Pty Limited |

77.5% |

|

Total |

100.0% |

Shenandoah South Pilot Project -2

Drilling Space Units – 46,080 acres1

|

Company |

Interest |

|

Falcon Oil & Gas Australia Limited (Falcon Australia) |

5.0% |

|

Tamboran (B2) Pty Limited |

95.0% |

|

Total |

100.0% |

1Subject to the completion of the SS2H ST1 and SS4H wells on the

Shenandoah South pad 2.

About Tamboran (B2) Pty

LimitedTamboran (B1) Pty Limited (“Tamboran B1”) is the

100% holder of Tamboran (B2) Pty Limited, with Tamboran B1 being a

50:50 joint venture between Tamboran Resources Corporation and Daly

Waters Energy, LP.

Tamboran Resources Corporation, is a natural gas

company listed on the NYSE (TBN) and ASX (TBN). Tamboran is focused

on playing a constructive role in the global energy transition

towards a lower carbon future, by developing the significant low

CO2 gas resource within the Beetaloo Basin through cutting-edge

drilling and completion design technology as well as management’s

experience in successfully commercialising unconventional shale in

North America.

Bryan Sheffield of Daly Waters Energy, LP is a

highly successful investor and has made significant returns in the

US unconventional energy sector in the past. He was Founder of

Parsley Energy Inc. (“PE”), an independent

unconventional oil and gas producer in the Permian Basin, Texas and

previously served as its Chairman and CEO. PE was acquired for over

US$7 billion by Pioneer Natural Resources Company.

Advisory regarding forward-looking

statementsCertain information in this press release may

constitute forward-looking information. Any statements that are

contained in this news release that are not statements of

historical fact may be deemed to be forward-looking information.

Forward-looking information typically contains statements with

words such as “may”, “will”, “should”, “expect”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “projects”, “dependent”,

“consider” “potential”, “scheduled”, “forecast”, “outlook”,

“budget”, “hope”, “suggest”, “support” “planned”, “approximately”,

“potential” or the negative of those terms or similar words

suggesting future outcomes. In particular, forward-looking

information in this press release includes, details on the

completion of the stimulation, preparation for initial flow back

and targeting an IP30 flow rate of April 2025 for SS-2H ST1; steps

taken to pause operations, planned reinforcement activities in Q1

2025, aiming for recommencement of activities in Q2 2025,

opportunity to incorporate lessons from the SS-2H ST1 campaign and

targeting IP30 flow rates in mid-2025 for SS-4H.

This information is based on current

expectations that are subject to significant risks and

uncertainties that are difficult to predict. The risks, assumptions

and other factors that could influence actual results include risks

associated with fluctuations in market prices for shale gas; risks

related to the exploration, development and production of shale gas

reserves; general economic, market and business conditions;

substantial capital requirements; uncertainties inherent in

estimating quantities of reserves and resources; extent of, and

cost of compliance with, government laws and regulations and the

effect of changes in such laws and regulations; the need to obtain

regulatory approvals before development commences; environmental

risks and hazards and the cost of compliance with environmental

regulations; aboriginal claims; inherent risks and hazards with

operations such as mechanical or pipe failure, cratering and other

dangerous conditions; potential cost overruns, drilling wells is

speculative, often involving significant costs that may be more

than estimated and may not result in any discoveries; variations in

foreign exchange rates; competition for capital, equipment, new

leases, pipeline capacity and skilled personnel; the failure of the

holder of licenses, leases and permits to meet requirements of

such; changes in royalty regimes; failure to accurately estimate

abandonment and reclamation costs; inaccurate estimates and

assumptions by management and their joint venture partners;

effectiveness of internal controls; the potential lack of available

drilling equipment; failure to obtain or keep key personnel; title

deficiencies; geo-political risks; and risk of litigation.

Readers are cautioned that the foregoing list of

important factors is not exhaustive and that these factors and

risks are difficult to predict. Actual results might differ

materially from results suggested in any forward-looking

statements. Falcon assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those reflected in the forward-looking

statements unless and until required by securities laws applicable

to Falcon. Additional information identifying risks and

uncertainties is contained in Falcon’s filings with the Canadian

securities regulators, which filings are available at

www.sedarplus.com, including under "Risk Factors" in the Annual

Information Form.

Any references in this news release to initial

production rates are useful in confirming the presence of

hydrocarbons; however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter and are not necessarily indicative of long-term

performance or ultimate recovery. While encouraging, readers are

cautioned not to place reliance on such rates in calculating the

aggregate production for Falcon. Such rates are based on field

estimates and may be based on limited data available at this

time.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

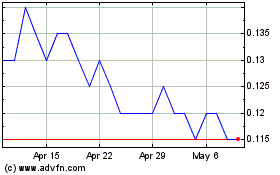

Falcon Oil and Gas (TSXV:FO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Falcon Oil and Gas (TSXV:FO)

Historical Stock Chart

From Feb 2024 to Feb 2025