FOBI AI Inc. (FOBI:TSXV) (FOBIF:OTCQB) (“

Fobi” or the

“

Company”) announces that it has applied to its principal

regulator, the British Columbia Securities Commission

(“

BCSC”), for a variation order (“

Variation Order”)

to the partial revocation order granted by the BCSC on December 30,

2024 (the “

Original Order”), of the ongoing failure-to-file

cease trade order (“

FFCTO”) ordered by the BCSC on

November 1, 2024, in order to change the structure of and

lower the proceeds to be received from its non-brokered private

placement offering previously announced on December 24, 2024.

The Original Order contemplated the sale of

56,114,400 units of the Company (each, a “Unit”) to a single

subscriber (the “Subscriber”) at a price per Unit of US$0.04

for aggregate gross proceeds of US$2,244,576 on a prospectus exempt

basis. Each Unit is comprised of one common share in the capital of

the Company (a “Common Share”) and one Common Share purchase

warrant (a “Unit Warrant”) exercisable to purchase 1

additional Common Share of the Company at an exercise price of

US$0.06 for 2 years. The terms of the offering have now been

revised to an offering of up to 1,495 unsecured convertible

debentures (each, a “Debenture”) of the Company to the

Subscriber, each with a principal amount of C$1,000, for aggregate

proceeds of up to C$1,495,000 (the “Revised Offering”).

Each Debenture will bear interest of 10.0% per

annum, calculated and payable semi-annually. All interest owed

under the Debentures will be paid in cash. The maturity date of the

Debentures will be the date that is 2 years from the closing date

of the Revised Offering. Subject to the policies of the TSX Venture

Exchange, or any other public exchange on which the Common Shares

of the Company may trade (the “Exchange”), the debenture

holder may convert the principal balance of any outstanding

Debentures purchased under the Revised Offering into Units at a

conversion price of C$0.06 per Unit (the “Conversion

Price”). Each Unit Warrant will entitle the holder thereof to

purchase one Common Share for 2 years following the closing of the

offering at a price of C$0.06 per Common Share. If the closing

price of the Common Shares on the Exchange is C$0.12 or higher for

10 consecutive trading days at any time, the Company may, at its

sole discretion, pay the principal amount of any outstanding

Debentures by issuing Units at the Conversion Price.

The proceeds from the Revised Offering will be

used to file the outstanding continuous disclosure documents of the

Company, cover essential expenses, and subsequently apply for a

full revocation of the FFCTO within a reasonable time, among other

things. The Company intends to use the proceeds of the Revised

Offering as described in the table below.

|

Description |

Costs (C$) |

|

Accounting, audit and legal fees (amounts past due) |

$321,755 |

|

Regulatory and late filing fees (amounts past due) |

$74,101 |

|

Payroll -Amounts past due of $569,947(1) -Accruals and 3 month

working needs of $120,000 |

$689,947 |

|

Payroll CRA source deductions (accrual and 3 months working

need) |

$100,000 |

|

US Internal Revenue Service payments (accruals) |

$50,000 |

|

BC employer tax (amounts past due) |

$50,000 |

|

Essential operating expenses (amounts past due |

$91,514 |

|

Unallocated working capital and general and administrative

expenses |

$117,683 |

|

Total |

$1,495,000 |

Notes:(1)Includes certain amounts payable in U.S. dollars

converted to CAD using Bank of Canada exchange rate of 1 USD to

1.4298 CAD on February 12, 2025.

On closing of the Revised Offering, assuming the

conversion of 1,495 Debentures, the Subscriber is anticipated to

hold 9.99% of the issued and outstanding Common Shares of the

Company. The exercise by the Subscriber of Unit Warrants will be

prohibited if it would result in their control of 10.0% or more of

the outstanding voting securities of the Company unless a personal

information form is filed with the Exchange, or 20.0% or more of

the outstanding voting securities of the Company unless approval of

the shareholders of the Company is obtained.

Completion of the Revised Offering remains

conditional on the grant of the Variation Order by the BCSC and the

execution of a subscription agreement by the Subscriber, among

other things.

Based on management’s current reasonable

estimation, the Company believes the proceeds from the Revised

Offering will be sufficient to enable the Company to file its

outstanding continuous disclosure documents and pay all related

outstanding fees. The Company anticipates filing (i) audited annual

financial statements, management’s discussion and analysis, and

related certifications for the year ended June 30, 2024 (“Annual

Filings”), within 60 days of the closing of the Revised

Offering and (ii) interim financial statements, management’s

discussion and analysis, and related certifications for the three

months ended September 30, 2024, including certifications thereto

(“Interim Filings”), within 15 days of the filing of the

Annual Filings, at which time the Company intends to apply for a

full revocation of the FFCTO.

About Fobi

Founded in 2017 in Vancouver, Canada, Fobi is a

leading AI and data intelligence company that provides businesses

with real-time applications to digitally transform and future-proof

their organizations. Fobi enables businesses to action, leverage,

and monetize their customer data by powering personalized and

data-driven customer experiences, and drives digital sustainability

by eliminating the need for paper and reducing unnecessary plastic

waste at scale.

Fobi works with some of the largest global

organizations across retail & CPG, insurance, sports &

entertainment, casino gaming, and more. Fobi is a recognized

technology and data intelligence leader across North America and

Europe, and is the largest data aggregator in Canada's hospitality

& tourism industry.

For more information, please contact:

|

Fobi AI Inc. |

|

Fobi Website: www.fobi.ai |

|

Rob Anson, CEO |

|

Facebook: @ Fobiinc |

|

T : +1 877-754-5336 Ext. 3 |

|

Twitter: @ Fobi_inc |

|

E: ir@fobi.ai |

|

LinkedIn: @ Fobiinc |

Forward Looking

Statements/Information:

This news release contains certain statements

which constitute forward-looking statements or information,

including statements regarding the terms of the Revised Offering,

the Variation Order, the intended use of the proceeds of the

Revised Offering, the time to complete the Annual Filings and

Interim Filings, and other statements characterized by words such

as “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,”

“expects,” “projects,” “targets,” “intends,” “likely,” “will,”

“should,” “to be”, “potential” and other similar words, or

statements that certain events or conditions “may”, “should” or

“will” occur. Such forward-looking statements are subject to

numerous risks and uncertainties, some of which are beyond the

Company’s control, including, without limitation, market

competition, the impact of general economic and industry

conditions, competition, stock market volatility, BCSC and Exchange

approval conditions, and the ability to access sufficient capital

from internal and external sources. Although the Company believes

that the expectations in its forward-looking statements are

reasonable, they are based on factors and assumptions concerning

future events which may prove to be inaccurate. Those factors and

assumptions are based upon currently available information. Such

forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that could influence actual results

or events and cause actual results or events to differ materially

from those stated, anticipated or implied in the forward-looking

statements. Among the key factors that could cause actual results

to differ materially from those projected in the forward-looking

information are the following: Fobi not receiving approval of the

Exchange with respect to any future issuances of securities as

required; and changes to volatile exchange rates, market

conditions, market competition and other economic and market

factors. This forward-looking information may be affected by risks

and uncertainties in the business of the Company and market

conditions. As such, readers are cautioned not to place undue

reliance on the forward-looking statements, as no assurance can be

provided as to future plans, operations, and results, levels of

activity or achievements.

The forward-looking statements contained in this

news release are made as of the date of this news release and,

except as required by applicable law, the Company does not

undertake any obligation to publicly update or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise. The forward-looking

statements contained in this document are expressly qualified by

this cautionary statement. Trading in the securities of the Company

should be considered highly speculative. There can be no assurance

that the Company will be able to achieve all or any of its proposed

objectives.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

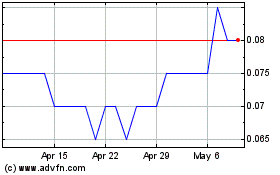

Fobi AI (TSXV:FOBI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fobi AI (TSXV:FOBI)

Historical Stock Chart

From Feb 2024 to Feb 2025