FRNT Financial Inc. (TSXV: FRNT) (OTCQB: FRFLF) (FSE: XZ3) (“FRNT”

or the “Company”) is pleased to announce its partnership with

BitGo, a leading qualified custodian in the digital assets space,

and the launch of its new institutional-only lending platform,

aiding the origination and maintenance of BTC and ETH-backed loans.

The platform offers significant advantages to both lenders and

borrowers over existing industry structures.

FRNT's new lending interface leverages a tri-party structure to

mitigate counterparty risk by using a bankruptcy remote third-party

custodian, BitGo, ensuring that the collateral is securely held in

cold storage and cannot be rehypothecated. FRNT’s solution

minimizes the lender’s required engagement while maintaining the

benefits and safety of a tri-party structure. Unlike traditional

tri-party lending arrangements that demand a high degree of

involvement from the lender, FRNT’s platform requires the lender

only to provide the balance sheet, with FRNT’s technology handling

all loan monitoring. This streamlined approach offers significant

advantages, providing lenders with peace of mind and returns, while

borrowers can access liquidity without selling their BTC or ETH,

maintaining potential upside in their investments.

“Our platform is designed to provide a seamless and secure

lending experience for institutional clients,” said Giles Colwell,

Head of NA Capital Markets at FRNT. “With 24/7 monitoring,

automated margin calls, and a robust liquidation management

process, lenders can confidently lend against BTC and ETH without

the need to handle the physical assets.”

Key features of the new platform include:

Overcollateralization: Loans are typically

structured with a starting Loan-to-Value (LTV) ratio of

50%-70%.No Rehypothecation: Collateral is held

with BitGo, a qualified custodian, and remains in bankruptcy-remote

cold storage, providing an additional layer of

security.Automated Management: The platform offers

24/7/365 trading capabilities, deep liquidity, and real-time

monitoring of collateral health, margin levels, and liquidation

points.Auditability: Utilizing the public BTC and

ETH blockchains ensures all transactions are transparent and can be

audited in real-time, enhancing trust and security.

The platform aims to address the growing demand for digital

asset-backed lending solutions. As the market for BTC and ETH

continues to mature, the availability of a secure and efficient

lending platform presents a significant opportunity for both

lenders seeking yield and borrowers looking to leverage their

digital assets without selling them.

“We are excited to partner with FRNT and leverage our extensive

collateral management capabilities to assist them in growing their

lending platform,” said Adam Sporn, BitGo’s Head of Prime Brokerage

and U.S. Institutional Sales.

“Crypto-backed loans are a key component in institutional

integration into the digital asset ecosystem,” added FRNT CEO and

co-founder Stéphane Ouellette. “For lenders, FRNT’s platform

provides a unique opportunity to diversify lending book exposure to

a less correlated asset class. For borrowers, FRNT’s platform

offers a secure and transparent means to access dollar liquidity

while maintaining long exposure to the collateralized asset. We’re

further extremely excited to be announcing this launch with BitGo,

one of the longest serving and trusted names in digital asset

custody.”

About FRNTFRNT is an institutional capital

markets and advisory platform focused on digital assets. FRNT,

through a technology-forward and compliant operation, aims to

bridge the worlds of traditional and web-based finance. Partnering

with both financial institutions and crypto native firms, FRNT

operates 5 synergistic business lines including deliverable trading

services, institutional structured derivative products, merchant

banking, advisory and consulting, and principal investments &

trading. Co-founded in 2018 by CEO Stéphane Ouellette, FRNT is a

global firm headquartered in Toronto, Canada.

About BitGoBitGo is the leading infrastructure

provider of digital asset solutions for businesses, offering

custody, wallets, staking, trading, financing and settlement.

Founded in 2013, BitGo is the first digital asset company to focus

exclusively on serving institutional clients. In 2018, it launched

BitGo Trust Company, the first qualified custodian purpose-built

for storing digital assets and established BitGo New York Trust in

2021. In 2022, BitGo launched institutional-grade DeFi, NFT and

web3 services. BitGo also supports over 800 digital assets on its

platform and provides the security and operational backbone for

more than 1500 institutional clients in 50 countries, including

many of the world’s top cryptocurrency exchanges and platforms. For

more information, please visit www.bitgo.com.

FRNT Financial Inc. Chief

Executive OfficerStéphane Ouelletteinvestors@frnt.io833

222-3768https://frnt.io

Neither the TSXV nor its regulation

services provider (as that term is defined in policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this press

release.

FORWARD-LOOKING STATEMENTSThis press release

contains “forward-looking statements” and “forward-looking

information” within the meaning of applicable law which may

include, without limitation, statements relating to financial and

business prospects of the Company, its assets and other matters.

Generally, forward-looking statements and forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, “believes”, or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. All forward-looking

statements and forward-looking information are based on reasonable

assumptions that have been made by the Company as at the date of

such information. Forward-looking statements and forward-looking

information are subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking statements and forward-looking information,

including but not limited to: the general risks associated with the

speculative nature of the Company’s business, current global

financial conditions, uncertainty of additional capital, price

volatility, no history of earnings, government regulation in the

industries in which the Company operates, political and economic

risk, absence of public trading market, arbitrary offering price,

dilution to the Company’s common shares, dependence on key

personnel, currency fluctuations, insurance and uninsured risks,

competition, legal proceedings, conflicts of interest and lack of

dividends. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements and forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements or information. Accordingly, readers should not

place undue reliance on forward-looking statements or

forward-looking information. The Company does not undertake to

update any forward-looking statement or forward-looking information

that is included herein, except in accordance with applicable

securities laws.

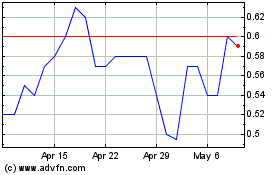

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

From Jan 2025 to Feb 2025

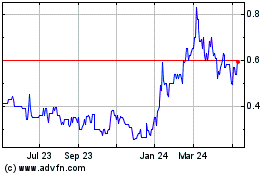

FRNT Financial (TSXV:FRNT)

Historical Stock Chart

From Feb 2024 to Feb 2025