GFG Resources Inc. (TSXV: GFG) (OTCQB: GFGSF)

(“

GFG” or the “

Company”)

announces the signing of a binding letter of intent (the

“

LOI”) for the sale of its 100% owned Rattlesnake

Hills Gold Project (the “

Project”) to Patriot

Gold Vault Ltd., (“

Patriot”). Under the terms

of the LOI, which will be formalized by a definitive agreement

between the parties within forty-five (45) days (the

“Transaction”), Patriot will pay GFG an aggregate

consideration of approximately C$3.3 million.

“We are excited to announce our agreement with

Patriot for the sale of our Rattlesnake Hills Gold Project,” stated

Brian Skanderbeg, President and CEO of GFG. “The Patriot team's

impressive track record gives us great confidence in their ability

to drive the Project forward from both an exploration and

development perspective. This deal enhances shareholder value

through staged cash payments that strengthen our treasury while

minimizing future dilution, as well as equity participation in

Patriot that provides exposure to future successes. We will

now advance with an undivided focus on our three large scale

projects in the prolific Timmins Gold District.”

“Patriot Gold Vault is proud to announce the

agreement for the purchase of the Rattlesnake Hills Gold Project as

our launch asset. Patriot was created to offer leverage to the next

gold cycle by creating a liquid, public gold aggregator. Patriot

will focus on acquiring resource-ready projects in Tier 1

jurisdictions and drilling them aggressively with the lens of a new

gold price paradigm. Much like the Detour and Malartic gold mines,

we believe that past producers and historical resources are often

constrained by capital and lack of drilling not geology. Despite a

robust gold price backdrop, pre-production gold inventories are

trading at cycle low multiples, and this is our opportunity,”

stated Mario Vetro, Co-Founder of Patriot. “We thank the GFG team

for their work on this transaction and diligent stewardship of the

Project. We look forward to shortly updating the market with

further acquisitions.”

Transaction TermsPatriot will

acquire a 100% interest in the Project on the following terms:

- Cash payment of

C$250,000 to GFG on signing of the binding LOI;

- Cash payment of

C$250,000 to GFG upon the execution and delivery of a definitive

agreement;

- On closing of

the Transaction, Patriot will:

- Make a cash

payment of C$1,200,000 to GFG; and

- Issue to GFG the

greater of 3,000,000 common shares of Patriot (the

“Consideration Shares”) or $600,000 in value of

Consideration Shares based on the volume weighted average trading

price of the Consideration Shares for the 20 trading days

immediately preceding the Closing Date, or in the event that

Patriot is not listed, the value of the Consideration Shares shall

be determined by the last financing price of the Patriot shares

sold to arm’s length investors to Patriot; and

- On the date that

is 12 months following the Closing Date, Patriot will pay to GFG a

cash payment of C$1,000,000.

Additional Terms

- On closing of

the Transaction, Patriot will replace the US$219,000 reclamation

bond for the Project, which in turn GFG will recoup.

- If a National

Instrument 43-101 resource estimate in the Project reveal a mineral

resource of greater than 3,000,000 ounces of gold in a Measured and

Indicated or Inferred category, Patriot will pay to GFG a further

C$1 per total mineral resource ounce in cash or common shares of

Patriot, at the election of Patriot.

- Patriot shall

reimburse GFG and cover all costs and expenses relating to the

Project incurred from the date this LOI to the Closing Date, up to

a maximum of US$228,000.

The closing of the Transaction is expected to

occur on or about 120 days following the date of signing of the

Definitive Agreement.

About The Rattlesnake Hills Gold

ProjectThe Rattlesnake Hills Gold Project is a

district-scale gold exploration project located in central Wyoming,

approximately 100 kilometres southwest of Casper. Geologically, the

Project is centrally located within a roughly 1,500-kilometre-long

belt of alkalic intrusive complexes that occur along the eastern

side of the Rocky Mountains from Montana to New Mexico, several of

which are associated with multiple gold deposits.

The Project has approximately 100,000 metres

(“m”) of historic drilling which has outlined three significant

zones of alteration and precious metal mineralization that are

associated with Eocene age alkalic intrusions at North Stock,

Antelope Basin and Blackjack. The majority of the drilling has

focused on near-surface, open pit mineralization in the North Stock

and Antelope Basin deposits with highlights that include

intercepts(1) of 1.85 grams of gold per tonne (g/t Au) over 236.2 m

hole length; 4.20 g/t Au over 77.7 m hole length; 2.08 g/t Au over

150.9 m hole length and 0.82 g/t Au over 99.1 m hole length. In

addition to the outlined zones of mineralization, the Company

believes that the district is highly prospective and has outlined

several kilometre-scale greenfield targets that have never been

drill tested. These greenfield targets were generated from the

Company’s geophysical and geochemical programs and host strong

similarities to the North Stock and Antelope Basin systems.

(1) Gold intervals reported are based on a 0.20

g/t or 0.50 g/t Au cutoff. Weighted averaging has been used to

calculate all reported intervals. True widths are estimated at

60-100% of drilled thicknesses.

About Patriot Gold Vault

Ltd.Patriot Gold Vault is a gold mineral resource

aggregator whose principal activity is to acquire high quality

resource-ready gold assets in Tier 1 jurisdictions. Led by a team

of proven technical and financial mining executives, Patriot will

focus on increasing asset resources via drilling in Phase 1 and

profitably divesting of its assets in Phase 2.

About GFG Resources Inc. GFG is

a North American precious metals exploration company focused on

district scale gold projects in tier one mining jurisdictions,

Ontario and Wyoming. In Ontario, the Company operates three gold

projects, each large and highly prospective gold properties within

the prolific gold district of Timmins, Ontario, Canada. The

projects have similar geological settings that host most of the

gold deposits found in the Timmins Gold Camp which have produced

over 70 million ounces of gold. The Company also owns 100% of the

Rattlesnake Hills Gold Project, a district scale gold exploration

project located approximately 100 km southwest of Casper, Wyoming,

U.S.

For further information, please contact: Brian

Skanderbeg, President & CEOor Marc Lepage, Vice President,

Business Development Phone: (306) 931-0930 Email:

info@gfgresources.comWebsite: www.gfgresources.com

Stay Connected with UsTwitter:

@gfgresourcesLinkedIn:

https://www.linkedin.com/company/gfgresources/Facebook:

https://www.facebook.com/GFGResourcesInc/

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING

INFORMATIONAll statements, other than statements of

historical fact, contained in this news release constitute

“forward-looking information” within the meaning of applicable

Canadian securities laws and “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 (referred to herein as “forward-looking

statements”). Forward-looking statements include, but are not

limited to, disclosure regarding possible events, the Agreement and

proposed activities thereunder (the “Transaction”), exploration

plans for the Project and expected results, conditions or financial

performance that is based on assumptions about future economic

conditions and courses of action; planned use of proceeds,

expenditures and budgets and the execution thereof. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate” or

“believes”, or the negative connotation thereof or variations of

such words and phrases or state that certain actions, events or

results, “may”, “could”, “would”, “will”, “might” or “will be

taken”, “occur” or “be achieved” or the negative connotation

thereof.

All forward-looking statements are based on

various assumptions, including, without limitation, the

expectations and beliefs of management, the assumed long-term price

of gold, that the current exploration and other objectives

concerning its mineral projects can be achieved and that its other

corporate activities will proceed as expected; that the current

price and demand for gold will be sustained or will improve; the

continuity of the price of gold and other metals, economic and

political conditions and operations; that all conditions precedent

to the Transaction, including requisite regulatory approval will be

fulfilled in a timely manner and on acceptable terms; and that

general business and economic conditions will not change in a

materially adverse manner.

Forward-looking statements are subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of GFG to be materially different from those expressed or implied

by such forward-looking statements, including but not limited to:

risks and uncertainties related to the Transaction not being

completed in the event that any of the conditions precedent thereto

are not satisfied; actual results of current exploration

activities; environmental risks; future prices of gold; operating

risks; accidents, labour issues and other risks of the mining

industry; delays in obtaining government approvals or financing;

and other risks and uncertainties. These risks and uncertainties

are not, and should not be construed as being, exhaustive.

Although GFG has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. In addition,

forward-looking statements are provided solely for the purpose of

providing information about management’s current expectations and

plans and allowing investors and others to get a better

understanding of our operating environment. Accordingly, readers

should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release

are made as of the date hereof and GFG assume no obligation to

update any forward-looking statements, except as required by

applicable laws.

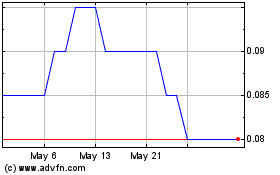

GFG Resources (TSXV:GFG)

Historical Stock Chart

From Feb 2025 to Mar 2025

GFG Resources (TSXV:GFG)

Historical Stock Chart

From Mar 2024 to Mar 2025