Harfang Exploration Inc. (“

Harfang”) (TSX.V: HAR)

and LaSalle Exploration Corp. (“

LaSalle”) (TSX-V:

LSX) are pleased to announce that they have entered into a

definitive Arrangement Agreement dated January 5, 2022 (the

“

Agreement”) pursuant to which Harfang will

acquire all of the issued and outstanding shares of LaSalle (the

“

LaSalle Shares”). The transaction will be carried

out by way of a plan of arrangement under the Business Corporations

Act (British Columbia) (the

“

Arrangement”).

Under the terms of the Arrangement, LaSalle

shareholders will receive, on a pre-consolidation basis (further

details on the proposed Harfang share consolidation below), 0.3908

of a Harfang common share (the “Harfang Shares”)

for each LaSalle Share. The exchange ratio implies a consideration

of $0.0968 per LaSalle Share based on the 30-day volume weighted

average price (“VWAP”) of the Harfang Shares

and the LaSalle Shares on the TSX Venture Exchange

(“TSX-V”) on December 22, 2021. Upon completion of

the Arrangement, it is expected that the shareholders of LaSalle

will hold approximately 35.5% of Harfang’s issued and outstanding

shares (prior to the concurrent Offering).

The LaSalle management and board, representing

5.1% of the LaSalle Shares, are supportive of the transaction and

have entered into support agreements with Harfang to vote their

LaSalle Shares in favour of the Arrangement. LaSalle’s CEO, Ian

Campbell, and VP Corporate Development, Ron Stewart will continue

their positions to lead the combined company, which will deliver

LaSalle shareholders an exceptional geological and financial team

in a much stronger exploration vehicle. See details

below.

Dan Innes, Chairman of LaSalle commented, “This

transaction represents a compelling opportunity to accelerate the

growth strategy of LaSalle in all aspects from exploration, access

to capital and additional accretive transactions. It delivers to

both LaSalle and Harfang shareholders the platform to create an

industry leader guided by an experienced management team, an

exceptionally strong board, a highly prospective portfolio of

exploration assets, the financial resources and access to capital

to advance our projects and realize their full potential.”

André Gaumond, Chairman of Harfang added, “We

are delighted to be entering into a transaction between LaSalle and

Harfang. It is an excellent strategic and cultural fit for

both companies, creating a far stronger platform that has already

been embraced by the Quebec institutional funds. The new

Harfang will be larger, more relevant and benefit from the

significant synergies unlocked by the transaction.”

Transaction Highlights

The transaction will consolidate the contiguous

gold exploration assets of Lasalle’s Radisson and Harfang’s Serpent

properties, James Bay Region, Québec, both of which will benefit

from operational efficiency, synergies and a combined exploration

strategy as the projects advance, along with an exploration

portfolio of high quality gold assets in Québec and Ontario.

The integration of the Radisson property will

add 6 km of strike of potential mineralization to the Serpent gold

bearing structures, further solidifying Harfang as the largest

mineral claim holder in the region totalling 508.4 km2. Drill-ready

targets within the consolidated project portfolio offer compelling

value creation potential to shareholders of the combined

company.

Figure 1. Location of the major gold corridor straddling the

limit between the Serpent and Radisson properties.

The transaction offers several positive direct

benefits to the shareholders of Harfang and LaSalle, including, the

following:

- Highly qualified board and

management team with a track record of success;

- Solid platform for further

consolidation and growth opportunities;

- $9.8M in treasury, excluding the

proceeds under the concurrent Offering for total maximum gross

proceeds of $5M;

- Accelerating the exploration of a

new district-scale gold corridor in the James Bay Region, QC, by

merging Serpent and Radisson properties (total surface area of

508.4 km2);

- Numerous drill ready targets and

blue-sky exploration potential;

- LaSalle and Harfang to commence a

combined minimum 6,000 metre drill program on the Serpent-Radisson

property;

- Strong portfolio of exploration

properties from which to unlock shareholder value.

Ian Campbell, President and CEO of LaSalle and

incoming President and CEO of Harfang commented, “I am very excited

about leading the team and to what this transaction represents for

all of our shareholders as we open this new chapter. Ron and I are

very much looking forward to joining forces with Francois Huot and

Yvon Robert and leveraging our broad range of skillsets, adding

value through focused exploration, unlocking value in all our

projects and the platform which opens up tremendous potential for

further consolidation and growth opportunities.”

Strong Board and Management

The Arrangement brings together a highly

experienced team of mining industry professionals with the Board to

be composed of:

- Jean-Pierre Janson as Chairman,

current Chairman of Midland Exploration

- André Gaumond, Former President of

Virginia Mines

- Daniel Innes, Founder and original

CEO, Lake Shore Gold Corp.

- Ian Campbell, President and CEO of

LaSalle Exploration Corp.

- Sylvie Prud’homme, former Manager,

Investor Relations at Osisko Mining Corporation

- Karen Rees, Former VP Exploration

and Corporate Secretary at Temex Resources Corp.

- Vincent Dubé-Bourgeois, CEO of

GoldSpot Discoveries Corp.

At the closing of the Arrangement, Ian Campbell

will be appointed as President and Chief Executive Officer, Ron

Stewart will be appointed as Vice President, Corporate Development,

François Huot will remain Vice President Exploration, and Yvon

Robert will remain as Chief Financial Officer. François Goulet has

accepted to remain as President and Chief Executive Officer of

Harfang until the closing of the Arrangement, at which time his

resignation previously announced on September 1, 2021 will become

effective.

Transaction Details

Pursuant to the terms of the Agreement, Harfang

will acquire all of the issued and outstanding LaSalle Shares on

the basis of 0.3908 Harfang Shares (on a pre-Consolidation basis)

for each share of LaSalle held (the “Exchange

Ratio”). Warrants and options of LaSalle will be adjusted

or exchanged to become warrants and options, respectively, of

Harfang based on the Exchange Ratio. It is anticipated that these

securities will be adjusted or exchanged on a post-Consolidation

basis. The transaction was negotiated at arm’s length.

Immediately prior to the closing of the

transaction, it is anticipated that Harfang will consolidate its

common shares on a 2.1554 for one basis (the

“Consolidation”), subject to the receipt of all

necessary approvals.

The Arrangement will be carried out by way of a

court-approved plan of arrangement under the Business Corporations

Act (British Columbia) and is subject to a number of conditions

being satisfied or waived by one or both of Harfang and LaSalle at

or prior to closing of the Arrangement, including approval of

LaSalle shareholders, together with any requisite minority

approvals, completion of the Consolidation, amendment of the

Harfang stock option plan to extend expiry date of stock options to

12 months following the date a person ceases to be an “eligible

person” under the plan, and receipt of all necessary regulatory and

court approvals and the satisfaction of certain other closing

conditions customary for a transaction of this nature, including

completion of the Offering (as hereinafter defined).

It is expected that the special meeting of

LaSalle shareholders to approve the proposed Arrangement will be

held on or before March 31, 2022 (the “LaSalle

Meeting”) and, if approved at such meeting and all other

conditions have been met, it is expected that the Arrangement would

close shortly thereafter.

The Agreement includes customary provisions,

including non-solicitation, right-to-match and fiduciary out

provisions, as well as certain representations, covenants and

conditions that are customary for a transaction of this nature. A

termination fee of $300,000 may be payable by either party in the

case of certain terminating events.

Further information regarding the Arrangement

will be contained in the management information circular to be

prepared by LaSalle (the “LaSalle Circular”) and

mailed to its securityholders in connection with the LaSalle

Meeting. All securityholders of LaSalle are urged to read the

information circular once available, as it will contain important

additional information concerning the Arrangement.

LaSalle is subject to Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). MI 61-101

provides that, in certain circumstances, where a “related party”

(as defined in MI 61-101) of an issuer is entitled to receive a

“collateral benefit” (as defined in MI 61-101) in connection with

an arrangement transaction such as the Arrangement, such

transaction may be considered a “business combination” for the

purposes of MI 61-101 and subject to minority shareholder approval

requirements.

LaSalle has determined that certain directors or

executive officers of LaSalle are receiving a “collateral benefit”

in connection with the Arrangement as each beneficially owns or

exercises control or direction over more than 1% of LaSalle

Securities (calculated in accordance with MI 61-101).

Consequently, the LaSalle Shares beneficially owned, directly or

indirectly, these certain directors or executive officers will be

excluded for the purposes of determining if minority approval of

the Arrangement is obtained

This announcement is for informational purposes

only and does not constitute an offer to purchase, a solicitation

of an offer to sell any shares or a solicitation of a proxy.

Concurrent Financing

Concurrently with the Arrangement, Harfang

proposes to complete, on a post-Consolidation basis, a non-brokered

private placement of subscription receipts (the

“Offering”) for minimum proceeds of $1 million and

maximum proceeds of $5 million. The Offering will be comprised of

common share subscription receipts (the “Subscription

Receipts”) at a price of $0.55 per Subscription Receipt.

Upon satisfaction of the Escrow Release Conditions (as defined

below), each Subscription Receipt shall be exchangeable for one

post-Consolidation common share of Harfang.

The Offering is anticipated to close on or

before January 31, 2022. The funds received from the Offering will

be held in escrow (the “Escrowed Funds”) by an

escrow agent pending completion of the Arrangement. Release of the

Escrowed Funds will be conditional upon satisfaction of the

following conditions (together, the “Escrow Release

Conditions”): (i) approval of the Arrangement by LaSalle

shareholders; (ii) closing of the Arrangement; (iii) completion of

the Consolidation; (iv) the closing of the Offering for minimum

proceeds of $1 million; and (v) the receipt of all required

regulatory approvals including, without limitation, the conditional

approval of the TSX-V for the Arrangement, the Consolidation and

the Offering. Harfang intends to use the net proceeds of the

Offering, once released by the escrow agent following completion of

the Escrow Release Conditions, to continue its exploration programs

on the combined Serpent / Radisson properties and for general

corporate purposes. The LaSalle Circular will contain complete

details on the intended use of proceeds.

In connection with the Offering, Harfang has

received expressions of interest from strategic investors including

Québec Institutional Funds for an amount of $1,600,000.

Furthermore, Harfang and Monarch Mining Corporation

(“Monarch”) have signed a binding term sheet

pursuant to which Monarch has agreed to participate in the Offering

for an amount of $1,500,000 (the “Monarch

Investment”). In connection with the Monarch Investment,

and as a condition precedent thereto, Harfang has also agreed,

subject to the receipt of the required regulatory approvals, to

subscribe for common shares of Monarch for a total amount of

$750,000. It is also anticipated that management will participate

in the Offering for a total of $200,000 (details of such

participation remain to be confirmed).

Board Recommendations

The board of directors of LaSalle (the

“LaSalle Board”) has formed a special committee

(the “Special Committee”) to consider and evaluate

the Arrangement. The Special Committee, following a review of the

terms and conditions of the Agreement and consideration of a number

of factors, unanimously recommended that the LaSalle Board approve

the Arrangement. After receiving the recommendation of the Special

Committee and advice, including a fairness opinion, from its

advisors, the LaSalle Board has unanimously determined that the

Arrangement is in the best interests of LaSalle and will recommend

that LaSalle shareholders vote in favour of the Arrangement. Prior

to the execution of the Agreement, Evans & Evans, Inc. provided

a fairness opinion that, based upon and subject to the assumptions,

limitations and qualifications in such opinion, the consideration

to be received by the LaSalle shareholders is fair, from a

financial point of view, to LaSalle shareholders. A summary of the

fairness opinion will be included in the LaSalle Circular.

LaSalle Delisting and SEDAR

If the Arrangement is completed, the LaSalle

Shares will be delisted from the TSX-V. A copy of the Agreement

will be available through LaSalle and Harfang’s filings with the

applicable securities regulatory authorities in Canada on SEDAR at

www.sedar.com.

Advisors and Counsel

Laurentian Bank Securities Inc. is acting as

financial advisor and Fasken Martineau DuMoulin LLP is acting as

legal counsel to Harfang.

Evans & Evans, Inc. has provided the Special

Committee with a fairness opinion in respect of the Arrangement and

Armstrong Simpson is acting as legal counsel to LaSalle.

Qualified Persons

Technical aspects of this news release have been

reviewed, verified and approved on behalf of Harfang by François

Huot, P.Geo., Vice President Exploration of Harfang, and on behalf

of LaSalle by Ron Stewart, Vice President Corporate Development,

BSc. Geology, of LaSalle, both of whom are qualified persons as

defined by National Instrument 43-101 – Standards of Disclosure for

Mineral Projects.

About Harfang Exploration

Inc.

Harfang is a mining exploration company whose

primary mission is to discover new gold districts in the province

of Québec. Harfang's development model is based on the generation

of new mining projects and on the establishment of partnerships

with major exploration and mining companies to advance its

exploration projects. Harfang trades on the TSX Venture Exchange

(“TSX-V”) under the symbol “HAR”.

About LaSalle Exploration

Corp.

LaSalle is a Canadian exploration company

focused on less explored districts of the Abitibi in Ontario and

Québec, recognized for mining investment based on mineral

potential, policy and success, LaSalle is actively exploring

Radisson in the developing Eeyou Itschee-James Bay region in Québec

as well as the Blakelock and Egan high-grade gold properties

located in northeastern Ontario. LaSalle trades on the TSX Venture

Exchange (“TSX-V”) under the symbol “LSX”.

For further information please

contact:

Harfang Exploration IncTelephone:

514 940-0670 x339Email: info@harfangexploration.com

LaSalle Exploration Corp.Telephone: (604)

647-3966Email: info@lasallecorp.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding Forward

Looking Information

All statements, trend analysis and other

information contained in this press release about anticipated

future events or results constitute forward-looking statements.

Forward-looking statements are often, but not always, identified by

the use of words such as “seek”, “anticipate”, “believe”, “plan”,

“estimate”, “expect” and “intend” and statements that an event or

result “may”, “will”, “should”, “could” or “might” occur or be

achieved and other similar expressions. All statements, other than

statements of historical fact, included herein, including, without

limitation, statements regarding anticipated benefits of the

Arrangement, the closing of the Arrangement, the Offering, the

Serpent and Radisson properties (the “Projects”), including

anticipated operational synergies between the properties, are

forward-looking statements. Although Harfang and LaSalle (the

"Companies") believe that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

the Companies can give no assurance that such expectations will

prove to be correct. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements, including the risks, uncertainties

and other factors identified in the Companies' periodic filings

with Canadian securities regulators, and assumptions made with

regard to: the Companies' ability to complete the proposed

Arrangement; the Companies' ability to secure the necessary

shareholder, securityholder, legal and regulatory approvals

required to complete the Arrangement; the ability to complete the

Offering; the estimated costs associated with the advancement of

the Projects; and the Companies' ability to achieve the synergies

expected as a result of the Arrangement. Forward-looking statements

are subject to business and economic risks and uncertainties and

other factors that could cause actual results of operations to

differ materially from those contained in the forward-looking

statements. Important factors that could cause actual results to

differ materially from the Companies’ expectations include risks

associated with the business of Harfang and LaSalle; risks related

to the satisfaction or waiver of certain conditions to the closing

of the Arrangement; non-completion of the Arrangement; risks

related to reliance on technical information provided by Harfang

and LaSalle; risks related to exploration and potential development

of the Projects; business and economic conditions in the mining

industry generally; the impact of COVID-19 on the Companies’

business; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology, continuity and grade of mineral deposits; the need

for cooperation of government agencies and indigenous groups in the

exploration and development of properties and the issuance of

required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; and other risk factors as detailed

from time to time and additional risks identified in Harfang and

LaSalle’s filings with Canadian securities regulators on SEDAR in

Canada (available at www.sedar.com). Forward-looking statements are

based on estimates and opinions of management at the date the

statements are made. Neither Harfang nor LaSalle undertakes any

obligation to update forward-looking statements except as required

by applicable securities laws. Investors should not place undue

reliance on forward-looking statements.

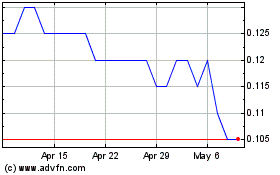

Harfang Exploration (TSXV:HAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Harfang Exploration (TSXV:HAR)

Historical Stock Chart

From Jan 2024 to Jan 2025