Highland Copper Company Inc. (TSXV: HI; OTCQB: HDRSF)

(“

Highland” or the “

Company”) is

pleased to announce its strategy to develop the Copperwood and

White Pine North projects in Michigan, US.

Key Highlights

-

Highland will pursue a sequenced asset development

strategy. As announced on March 6, 2023, Highland intends

to prioritize speed to production and cash flow by developing the

fully permitted Copperwood project first. The development of the

White Pine North project, just 60 kilometers away, is expected to

start soon after construction completion at Copperwood with the

goal of incorporating key synergies in various cost areas.

-

With all key state permits received, Copperwood is ready to

begin early site works in 2023. Site preparation work will

begin as per the various permit obligations. Advancing towards site

readiness and starting detailed engineering work will also help

support a construction decision. A portion of these expenditures

will net against the initial capital estimate.

-

At White Pine North, permitting and an updated PEA are

advancing. Highland has engaged with the Michigan

permitting authority on developing a timeline for the completion of

the baseline studies to file for the missing permits at the White

Pine North project. The Company also expects to issue an updated

PEA by June 2023, after which, subject to the results, the Company

expects to proceed with a Feasibility Study. As Copperwood reaches

the production stage, it is the goal that the Feasibility Study

will be completed, and the permits will be received to allow for a

construction decision on White Pine North.

-

Infill drilling continues at White Pine North. The

objectives of the drilling program are the conversion of a portion

of the inferred resources into the Measured and Indicated category

while accumulating more material for the metallurgical tests needed

to support future feasibility studies and further de-risk the

project.

“After thorough review, we have concluded that

sequencing the development of Copperwood and White Pine North

represents the best path to generate short-term value creation from

our assets. This strategy will allow us to proceed quickly with the

development of the fully permitted Copperwood project, while

advancing permitting, drilling and engineering studies at White

Pine North simultaneously. We also feel it is the most sustainable

development path from both a funding and risk perspective.

The projects have the potential to provide

approximately 70,000 tonnes of much-needed domestic copper supply

in the US while also contributing significantly to the regional

economy in Upper Peninsula, Michigan.” said Denis

Miville-Deschênes, President and CEO of Highland Copper.

Asset Development Strategy

Over the past months, Highland has evaluated

development options for its two key Michigan assets, Copperwood and

White Pine North. Particularly, the Company considered a combined

scenario with a shared processing plant located at White Pine

North.

There are a range of factors indicating that a

sequenced development plan, assuming key synergies in general and

administrative costs, is the appropriate path to develop the

Company’s Michigan assets.

The following are the main reasons to

prioritize a sequenced development strategy:

-

Accelerate Timeline to Production: Highland wants

to minimize uncertainties and risks and elected to proceed in

priority with the development of the fully permitted Copperwood

project. This will accelerate the timeline to cash flow from

production and allow the Company to benefit from the prevailing

copper price strength.

-

Staged Capital: The construction of the two

projects, one immediately after the other, with their respective

facilities and infrastructure, instead of using one central

processing plant as contemplated under the combined scenario,

eliminates some of the challenges and costs while allowing for an

earlier start. The high capital cost of the required infrastructure

for the transportation of ore to a central facility and the

subsequent yearly operating costs were certainly detrimental to the

economics of the combined scenario project. The perspective of

raising less capital upfront, as required for a staged approach, is

also favourable.

-

Sustainable Development with Synergies: The

sequenced development of the projects allows Highland to take

advantage of considerable synergies particularly in technical

services, procurement, general management, and other general and

administrative cost areas. In addition, it provides a more

sustainable path to attract a labour force to support both

operations.

Highland has concluded the sequenced development

plan represents the best path to near-term production and cash flow

and potentially the fastest path to consolidated production at the

two projects.

As a result, Highland has elected to complete

the updated Copperwood Feasibility Study and is looking to move

forward with early works activities on-site. Simultaneously, work

with state authorities will continue in an effort to optimize the

permitting timeline at White Pine North. Considerable work was

completed on White Pine North as part of the effort to assess a

combined operating scenario and will be used to update a

stand-alone White Pine North Preliminary Economic Assessment,

expected to be issued by June 2023.

Combined Scale

Highland’s goal remains to operate the

two projects in unison. On a combined basis, this presents the

opportunity to produce in excess of 70,000 tonnes of copper per

year, which would be a significant contribution to the supply of US

domestic copper.

The updated Copperwood Feasibility Study, which

will be filed on SEDAR in April 2023, reflects expected annual

production of 30,000 tonnes per year and the 2019 White Pine

North PEA1 indicated the potential for 41,000 tonnes per year.

Copperwood Next Steps

The following key steps will be taken to

facilitate a construction decision at Copperwood anticipated in

early 2024:

-

Early Site Works: Certain early site work must be

completed to meet permit obligations under the Wetlands and Streams

Permit. The Project will complete permitted impacts, which include

site clearing and grubbing, during the summer of 2023.

-

Environmental Mitigation: Work will begin on

environmental mitigation commitments under the Wetland and Streams

Permit which must be completed within one year of on-site

impact.

-

Detailed Engineering: Detailed engineering will be

initiated, particularly for long-lead items and any aspects of the

project being included in early site works.

-

Construction Finance Plan: Capital markets will

continue to be assessed and Highland will develop a broad financing

plan for the construction of the Copperwood Project.

White Pine North Next Steps

White Pine North remains critical to the overall

value proposition of Highland Copper. The goal will be to sequence

development and reach the production stage as quickly as possible

after Copperwood. The following key steps will be taken to progress

White Pine North:

-

Update PEA: The Company will continue preparing an

updated White Pine North PEA, expected to be issued in June 2023.

Assuming the economic results of the PEA warrant it, the project is

expected to advance to a Feasibility Study.

-

Advance Permitting: Highland is already engaged

with the Michigan Department of Environment, Great Lakes and Energy

(EGLE), Michigan’s permitting authority, on a timeline to permit

White Pine North and believe that the company has a viable path to

permits in the relatively near-term.

-

Infill Drill Program: As announced earlier this

year, Highland has initiated an infill drilling program with the

goal of upgrading a portion of the Inferred resources into the

Measured and Indicated category. If successful, this will increase

the usable resource base and mine life in the planned Feasibility

Study.

ABOUT HIGHLAND

Highland Copper Company Inc. is a Canadian

company focused on exploring and developing copper projects in the

Upper Peninsula of Michigan, U.S.A. The Company owns the Copperwood

deposit through long-term mineral leases. The Company also owns

surface rights securing access to the deposit and providing space

for infrastructure as required. The Company has 736,363,619 common

shares issued and outstanding. Its common shares are listed on the

TSX Venture Exchange under the symbol "HI" and trade on the OTCQB

Venture Market under symbol "HDRSF".

More information about the Company is available

on the Company’s website at www.highlandcopper.com and on SEDAR at

www.sedar.com.

CAUTIONARY STATEMENT Regarding

Forward-Looking Information

This press release contains certain

“forward-looking information within the meaning of applicable

Canadian securities legislation. These forward-looking statements

are made as of the date of this news release and Highland Copper

Company Inc. does not intend, and does not assume any obligation,

to update this forward-looking information, except as required

under applicable securities legislation. Forward-looking

information relate to future events or future performance and

reflect Company management’s expectations or beliefs regarding

future events and include, but are not limited to, information with

respect to the development sequence of Copperwood and White Pine

North, 2023 site work at Copperwood, , future permitting decisions

and timelines at White Pine North, the estimation of mineral

reserves and mineral resources, the conversion of mineral resources

to mineral reserves, the expected timing for commencement of

construction of the Copperwood mine, Highland’s ability to raise

the necessary debt and equity contribution to the project, the

realization of mineral reserve estimates, the timing and amount of

estimated future production, costs of production, capital

expenditures, success of mining operations, life of mine,

environmental risks, the timing of the receipt of permits, the

timing and terms of a power purchase agreement, unanticipated

reclamation expenses, title disputes or claims and limitations on

insurance coverage. In certain cases, forward-looking information

can be identified by the use of words such as “plans”, “expects” or

“does not expect”, “is expected”, “outlook”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases

or information that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative of these terms or comparable terminology.

In this document certain forward-looking information are identified

by words including “scheduled”, “plan”, “planned”, “estimated”,

“projections”, “projected” and “expected”. Forward-looking

information is based on a number of assumptions which may prove

incorrect, including, but not limited to, the development potential

of the Copperwood Project and current and future metal prices and

exchange rates. By their very nature forward-looking information

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance, or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information. Such factors include, among others,

changes in project parameters as plans continue to be refined;

future prices of commodities; possible variations in mineral

reserves.

Cautionary Note to United States

Investors

Highland advises U.S. investors that this press

release contains the terms "inferred", "indicated" and "measured"

resources. All resource estimates have been prepared in accordance

with NI 43-101. NI 43-101 is a rule developed by the Canadian

Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Canadian standards differ

significantly from the requirements of the United States Securities

and Exchange Commission ("SEC"), and resource information contained

therein may not be comparable to similar information disclosed by

U.S. companies. In particular, and without limiting the generality

of the foregoing, the term "resource" does not equate to the term

"reserves". "Inferred resources" have a great amount of

uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all

or any part of an "inferred resource" will ever be upgraded to a

higher category. U.S. investors are cautioned not to assume that

all or part of an inferred resource exists, or is economically or

legally mineable. U.S. Investors are also cautioned not to assume

that all or any part of mineral deposits in the "measured" or

"indicated" resource categories will ever be converted into

reserves.

Effective February 2019, the SEC adopted

amendments to its disclosure rules to modernize the mineral

property disclosure requirements for issuers whose securities are

registered with the SEC under the Exchange Act and as a result, the

SEC now recognizes estimates of "measured mineral resources",

"indicated mineral resources" and "inferred mineral resources". In

addition, the SEC has amended its definitions of "proven mineral

reserves" and "probable mineral reserves" to be "substantially

similar" to the corresponding definitions under the CIM Standards,

as required under NI 43-101. However, information regarding mineral

resources or mineral reserves in Highland's disclosure may not be

comparable to similar information made public by United States

companies.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please contact: Denis

Miville-Deschênes, President & CEOEmail:

info@highlandcopper.comWebsite: www.highlandcopper.com

1 The White Pine North PEA (dated effective

September 22, 2019, and posted to SEDAR on November 7, 2019)

includes an economic analysis of mineral resources. Readers are

cautioned that mineral resources that are not mineral reserves do

not have demonstrated economic viability.

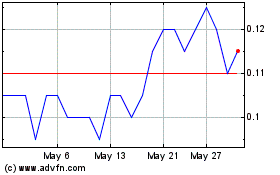

Highland Copper (TSXV:HI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Highland Copper (TSXV:HI)

Historical Stock Chart

From Nov 2023 to Nov 2024