Leonovus Closes $1,578,457 Private Placement

January 04 2021 - 6:06AM

Leonovus Inc. ("

Leonovus" or the

“

Company”)

(TSXV:

LTV) announces today the closing

of a private placement for CDN $1,578,457, by way of issuance of

5,133,193 Units at a price of CDN $0.3075 per Unit. Each Unit

includes one common share in the capital of the Company (a

"

Common Share") and one Common Share purchase

warrant (a "

Warrant"). Each Warrant entitles the

holder to buy one (1) Common Share for a period expiring on the day

that is twelve (12) months after the issuance of the Units for CAD

0.60 per Common Share. The Warrant will expire at 5:00 p.m. (Ottawa

time) on December 31, 2021. Notwithstanding the foregoing, if at

any time after 4 months and 1 day following the Closing Date the

15-day volume weighted average price of the Common Shares on the

TSX Venture Exchange (the “

Exchange”) is equal to

or exceeds $1.00, the Company has the right to notify the holders

of Warrants of its intention to force the exercise of the Warrants.

Upon the delivery of such notice, the Warrants' holders shall have

60 days to exercise the Warrants, failing which the Warrants will

automatically expire.

In connection with the Offering, the Company paid a finder’s fee

of $65,018.24 for finders having raised $928,832 and the Company

directly raised $649,625. The securities issued in this Offering

are subject to a four (4) month and one (1) day hold period from

December 31, 2020. The Company intends on using the proceeds of the

Offering for working capital, marketing, and debt repayment.

The two insiders of the Company subscribed for 800,000 Units

combined, which was an aggregate amount of $246,000. Participation

of insiders of the Company in the Offering constitutes a "related

party transaction" as defined under Multilateral Instrument

61-101 - Protection of Minority Security Holders in Special

Transactions (“MI 61- 101”). The Offering is

exempt from the formal valuation and minority shareholder approval

requirements of MI 61-101. Neither the fair market value of

securities issued to insiders nor the consideration paid by

insiders will exceed 25% of the Company's market capitalization.

The Company did not file a material change report 21 days before

closing the Offering because insider participation details had not

been confirmed at that time. The Offering is subject to final

acceptance by the Exchange.

About Leonovus

Leonovus builds data lakes and smart data management solutions

for companies that need data-centric security (FIPS-120

Certified), data discovery, data collation and

transport solutions. The system includes an automated policy-based

content discovery and categorization and consolidation engine, a

unified, centrally controlled data repository that feeds AI,

Machine Learning and Analytics engines. Leonovus supplies full data

lifecycle management including, automated, policy-based transparent

data migration and long-term multi-cloud data control and

archiving. It is a distributed solution formed of several key

components, including Leonovus Smart Filer, the multi-cloud data

controller Vault.

In additions, the advanced geo-distributed architecture

minimizes latency, perfects geo-availability, reduces remote backup

costs, and meets data sovereignty requirements. With its software

and hardware agnostic design, Vault supplies petabyte scalability.

It allows the enterprise to use its existing idle storage

resources, extend the useable lifespan of depreciated resources,

and improve its overall ROI. To learn more, please

visit www.leonovus.com.

This press release may have forward-looking statements and

information, which may involve risks and uncertainties. The

results or events predicted in these statements may differ

materially from actual results or events. Factors that might cause

a difference include, but are not limited to, competitive

developments, risks associated with Leonovus’ growth, the state of

the financial markets, regulatory risks and other factors. There

can be no assurance or guarantees that any statements of

forward-looking information contained in this release will prove to

be accurate. Actual results and future events could differ

materially from those anticipated in such statements. These

and all subsequent written and oral statements containing

forward-looking information are based on the estimates and opinions

of management on the dates they are made and expressly qualified in

their entirety by this notice. Unless otherwise required by

applicable securities laws, Leonovus disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise. Readers should not place undue reliance on any

statements of forward-looking information that speak only as of the

date of this release. Further information on Leonovus’

public filings, including its most recent audited consolidated

financial statements, are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

For More Information, please contact:George

PretliChief Financial Officergpretli@leonovus.com

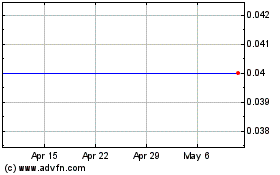

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

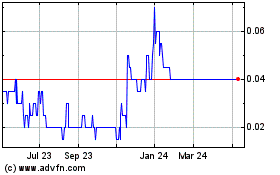

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Jan 2024 to Jan 2025