Regulatory News:

Maurel & Prom (Paris:MAU):

- M&P’s working interest production in 2023: 28,057 boepd,

up 10% compared to 2022

- M&P’s working interest production of 15,354 bopd on the

Ezanga permit in Gabon, an increase of 5%

- M&P’s working interest production of 4,103 bopd in Angola,

up 10%

- M&P's working interest gas production of 51.6 mmcfd in

Tanzania, an increase of 19%

- Sales of $682 million in 2023, up 1% from 2022

- Average oil saleprice of $79.3/bbl in 2023, versus $97.8/bbl in

2022

- Valued production of $608 million in 2023

- Group development continues

- Resumption of activity in Venezuela: two liftings in December

and January, ongoing restart of interventions on the Urdaneta Oeste

field

- Acquisition of Wentworth Resources finalised in December 2023;

after TPDC exercised its call option in January 2024, M&P now

holds a 60% interest in the Mnazi Bay gas field

- Following the Gabonese government's announcement of its project

to preempt the acquisition of Assala, M&P has been able to

confirm that it will maintain its partnership proposals and remains

at disposal of Gabonese authorities

- Significant liquidity and substantial decrease in net

debt

- Available liquidity of $159 million as at 31 December 2023, of

which $97 million in cash

- Net debt of $120 million at end-2023, down $80 million from

end-2022 ($200 million), prior to the collection of $98 million of

receivables in January 2024

- 2P reserves for M&P’s working interest as at 31 December

2022: 182 mmboe

- Reserves up by 12% after restatement of 2023 production

Key indicators for 2023

Q1

2023

Q2

2023

Q3

2023

Q4

2023

2023

2022

Change 2023 v. 2022

M&P working interest

production

Gabon (oil)

bopd

15,839

15,719

15,574

14,300

15,354

14,646

+5%

Angola (oil)

bopd

3,424

4,097

4,341

4,534

4,103

3,732

+10%

Tanzania (gas)

mmcfd

46.7

47.6

54.5

57.3

51.6

43.2

+19%

Total

boepd

27,054

27,755

29,003

28,390

28,057

25,584

+10%

Average sale price

Oil

$/bbl

75.2

74.0

83.4

83.0

79.3

97.8

-19%

Gas

$/mmBtu

3.76

3.77

3.76

3.76

3.76

3.50

+7%

Sales1

Gabon

$mm

105

106

124

107

442

527

-16%

Angola

$mm

19

22

27

30

98

104

-7%

Tanzania

$mm

18

18

13

19

68

68

-1%

Valued production

$mm

142

147

164

156

608

700

-13%

Drilling activities

$mm

5

6

6

6

23

12

Trading of third-party oil

$mm

–

–

26

–

26

Restatement for lifting imbalances and

inventory revaluation

$mm

42

-43

-1

26

25

-35

Consolidated sales

$mm

190

109

196

187

682

676

+1%

In fiscal 2023, M&P’s working interest production stood at

28,057 boepd, a sharp increase of 10% over 2022 (25,584 boepd). The

average sale price of oil was $79.3/bbl for the period, a decrease

of 19% from 2022 ($97.8/bbl) due to the lower crude oil price

environment.

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

was $608 million for 2023, down 13% compared to the previous year.

The restatement of lifting imbalances net of inventory revaluation

resulted in a positive impact of $25 million for the fiscal year.

After incorporating income from drilling activities ($23 million)

and trading of third-party oil ($26 million), consolidated sales

for 2023 are therefore $682 million, an increase of 1% compared to

2022.

Production activities

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 15,354 bopd for the year 2023, an increase of 5%

compared to 2022.

A well stimulation campaign took place at the end of 2023 with

positive results.

M&P’s working interest gas production (48.06% up to

end-December 2023) on the Mnazi Bay permit was 51.6 mmcfd for 2023,

up 19% from 2022.

After the acquisition of Wentworth Resources was finalised in

December 2023, TPDC exercised its call option as anticipated,

allowing it to acquire an additional working interest of 20% in

Mnazi Bay. M&P's working interest in the asset is therefore

60%, with the remaining 40% belonging to TPDC.

M&P’s working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) was 4,103 bopd in 2023, an increase of 10% over

2022.

End-of-year production saw a notable increase: production in Q4

2023 (4,103 bopd for M&P’s working interest) was indeed 21%

higher than the average level for 2022 (3,732 bopd).

M&P Iberoamerica’s working interest production (40%) in the

Urdaneta Oeste field in Q4 2023 was 5,490 bopd (gross production:

13,724 bopd).

The resumption of activity in the Urdaneta Oeste field continues

with the implementation of the new organisation from the end of

November, as well as initial well interventions and equipment

orders in January. The associated increase on the production should

be felt from Q2 2024.

The first lifting took place at the end of December on behalf of

the mixed company Petroregional del Lago, making it possible to

begin financing the resumption of activity. A second cargo, this

one being entirely deducted from the amount of the debt owed to

M&P Iberoamerica and the profits from the sale of which are

shared with PdVSA, was lifted in January. New liftings should

follow in February and March.

Information on the Assala

acquisition

Following M&P's signing on 15 August 2023 of a share

purchase agreement (“SPA”) with Carlyle for the acquisition of

Assala, the Gabonese national oil company Gabon Oil Company (“GOC”)

announced its intention to exercise its right to preempt the sale

at the end of 2023.

The option to preempt falls under the sovereign rights of the

Gabonese state and its national company GOC. Since the SPA was

signed in August 2023, M&P has made proposals to the Gabonese

authorities in order to increase their participation in Assala and

to strengthen the existing partnership between M&P and the

Gabonese Republic. These propositions remain valid and M&P is

in contact with the national authorities regarding this matter.

Group reserves as at 31 December

2023

The Group’s reserves correspond to the volumes of technically

recoverable hydrocarbons on permits where production is currently

underway—proportionate to the Group’s share of interest in those

permits—plus those revealed by discovery and delineation wells that

can be operated commercially. These reserves were certified as at

31 December 2023 by DeGolyer and MacNaughton in Gabon and Angola,

and by RPS Energy in Tanzania.

The Group’s 2P reserves stood at 182.2 mmboe at 31 December

2023, of which 111.6 mmboe are proven reserves (1P).

2P reserves for M&P’s working

interest:

Oil (mmbbls)

Oil (mmbbls)

Gas (bcf)

mmboe

Gabon

Angola

Tanzania

Group total

31/12/2022

120.8

18.0

206.2

173.2

Production

-5.6

-1.5

-18.8

-10.2

Revision

+3.8

+4.2

+67.7

+19.3

31/12/2023

118.9

20.8

255.0

182.2

O/w 1P reserves

74.9

17.9

112.7

111.6

As a % of 2P

63%

86%

44%

61%

In Tanzania, the 67.7 bcf revision includes the 50.7 bcf

increase due to the change in M&P’s working interest from

48.06% to 60% following the acquisition of Wentworth Resources and

proforma the exercise of TPDC’s call option.

These figures do not take into account M&P’s 20.46% interest

in Seplat, one of Nigeria’s main operators listed on the London and

Lagos stock markets. As a reminder, Seplat’s 2P reserves were 206

mmbbls of oil and 1,343 bcf of gas at 31 December 2022, i.e. 430

mmboe (88 mmboe for M&P’s 20.46% interest).

Following the resumption of M&P activities in Venezuela at

the end of 2023, the inaugural fiscal year for the certification of

reserves in Urdaneta Oeste is now ongoing.

Financial position

Available liquidity as at 31 December 2023 was $159 million,

including $97 million in cash and an undrawn RCF tranche of $62

million.

During the 2023 fiscal year, M&P repaid a total of $120

million in gross debt, reducing its gross debt to $217 million at

31 December 2023 (from $337 million at the end of 2022), of which

$146 million was a bank loan (including an RCF tranche of $5

million fully drawn at 31 December 2022) and $71 million was a

shareholder loan.

As a result, net debt has decreased by $80 million over the year

2022 to $120 million at 31 December 2023, compared to $200 million

at 31 December 2022.

It should also be noted that, in January 2024, M&P received

a total of $98 million covering the payment of the lifting

performed in Gabon in December 2023 and TPDC's exercise of its call

option to acquire a 20% stake in Mnazi Bay.

Français

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding

the financial position, results, business and industrial strategy

of Maurel & Prom. By nature, forecasts contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

forecasts are based on assumptions we believe to be reasonable, but

which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP.PA

1 The process of closing and auditing the Group's 2023 financial

statements is underway and the financial data communicated at this

stage may be slightly modified in the final version of the

financial statements

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240124711599/en/

Maurel & Prom Press, shareholder and investor

relations Tel: +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor relations/Media

relations Louis-Victor Delouvrier/Nicolas Merigeau Tel: +33 (0)1 44

71 98 53/+33 (0)1 44 71 94 98 maureletprom@newcap.eu

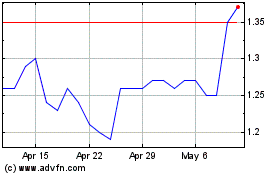

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025