- M&P working interest production in first-half 2024:

37,113 boepd, up 29% compared to the second half of 2023 (10%

excluding Venezuela)

- M&P working interest production of 15,526 bopd in Gabon, an

increase of 4% compared to the second half of 2023; Ezoe discovery

in June, already in production

- M&P working interest production of 4,628 bopd in Angola, an

increase of 4% compared to the second half of 2023

- M&P working interest gas production of 69.3 mmcfd in

Tanzania, an increase of 24% compared to the second half of

2023

- M&P group working interest oil production of 5,412 bopd in

Venezuela, newly included and unchanged since Q4 2023

- Valued production of $310 million and sales of $412

million

- Average sale price of oil was $84.0/bbl over the period,

unchanged from the second half of 2023 ($83.2/bbl)

- Service activities contributed $20 million to sales, with

trading of third-party oil contributing $77 million

- Positive net cash position and return of value created to

shareholders

- Positive net cash position of $27 million as at 30 June 2024,

an increase of $147 million over the six months ($120 million in

net debt as at 31 December 2023)

- Dividend of €0.30 per share ($65 million in total) paid at the

start of July

Regulatory News:

Maurel & Prom (Paris:MAU):

Key indicators for the first half of

2024

Q1

2024

Q2

2024

H1

2024

H1

2023

H2

2023

Change H1 2024 vs.

H1

2023

H2

2023

M&P working interest

production

Gabon (oil)

bopd

15,499

15,553

15,526

15,779

14,937

-2%

+4%

Angola (oil)

bopd

4,634

4,621

4,628

3,763

4,437

+23%

+4%

Tanzania (gas)

mmcfd

76.9

61.7

69.3

47.2

55.9

+47%

+24%

Total interests in consolidated

entities

boepd

32,953

30,450

31,701

27,406

28,697

+16%

+10%

Venezuela (oil)

bopd

5,353

5,472

5,412

N/A

N/A

N/A

N/A

Total production

boepd

38,305

35,922

37,113

27,406

28,697

+35%

+29%

Average sale price

Oil

$/bbl

84.3

83.6

84.0

74.8

83.2

+12%

+1%

Gas

$/mmBtu

3.91

3.89

3.90

3.77

3.76

+4%

+4%

Sales

Gabon

$mm

109

115

224

211

231

+6%

-3%

Angola

$mm

30

30

60

41

56

+46%

+7%

Tanzania

$mm

14

12

26

36

32

-29%

-19%

Valued production

$mm

153

157

310

289

319

+7%

-3%

Service activities

$mm

9

10

20

11

12

Trading of third-party oil

$mm

39

38

77

0

26

Restatement for lifting imbalances &

inventory revaluation

$mm

11

-6

5

-1

26

Consolidated sales

212

200

412

299

383

+37%

+8%

M&P working interest production in the first half of 2024

was 37,701 boepd. The average sale price of oil was $84.0/bbl for

the period, essentially unchanged from H2 2023 ($83.2/bbl).

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

was $310 million in the first six months of 2024.

The restatement of lifting imbalances net of inventory

revaluation resulted in a positive impact of $5 million for the

half year. In addition, the Group posted $77 million in sales

relating to the trading of third-party oil.

After incorporating the $20 million in income relating to

service activities (drilling activities in Gabon and support for

the operations of the mixed company PRDL in Venezuela),

consolidated sales for the half stood at $412 million.

Production activities

Gabon

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 15,526 bopd for the first half of 2024, an increase

of 4% compared to the second half of 2023.

The drilling of the Ezoe exploration well in June led to a new

discovery, with gross reserves estimated by M&P to be

approximately 1.5 mmbbls. Production started immediately, with a

second well also being drilled. The gross production potential on

the Ezanga permit currently stands at approximately 22,000 bopd,

with M&P’s working interest being 17,600 bopd (80%).

Tanzania

M&P’s working interest gas production (60%) on the Mnazi Bay

permit was 69.3 mmcfd for the first half of 2024, up 24% from the

second half of 2023.

Angola

M&P’s working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) in the first half of 2024 was 4,628 bopd, an increase

of 4% on the second half of 2023.

Venezuela

M&P group’s working interest oil production (40%) in the

Urdaneta Oeste field came to 5,412 bopd in the first half of 2024,

unchanged from Q4 2023. The revision and refurbishment of the

compression should be completed over the summer. Well operations

are in the beginning stages, as the snubbing unit was mobilised on

the site in early July.

Three new cargoes were sold by M&P on behalf of the mixed

company during Q2 2024, bringing the total to five cargoes in the

first half of 2024.

Financial position

The Group posted a positive net cash position of $27 million as

at 30 June 2024, in contrast with a net debt position of $120

million as at 31 December 2023.

The cash position at the end of June 2024 was $213 million.

Available liquidity as at 30 June 2024 was $280 million, including

an undrawn RCF tranche of $67 million.

Gross debt amounted to $186 million at 30 June 2024, including

$122 million in bank loans (excluding the $67 million undrawn

revolving portion) and $64 million in shareholder loans. M&P

repaid a total of $31 million in gross debt in the first half ($24

million in bank loans and $7 million in shareholder loans).

It should be noted that this cash position precedes M&P’s

payment in early July of the dividend of €0.30 per share in respect

of the 2023 financial year (for a total of $65 million).

Glossary

Français

Anglais

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

b

bbl

Barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per

day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil

equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By nature, forecasts contain risks and uncertainties to the

extent that they are based on events or circumstances that may or

may not happen in the future. These forecasts are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris SBF 120 – CAC Mid 60 – CAC Mid & Small – CAC

All-Tradable – Eligible PEA-PME and SRD Isin FR0000051070 /

Bloomberg MAU.FP / Reuters MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717036964/en/

Maurel & Prom Investor relations Tel.: +33 (0)1 53 83

16 45 ir@maureletprom.fr

NewCap Investor and media relations Tel.: +33 (0)1 44 71

98 53 maureletprom@newcap.eu

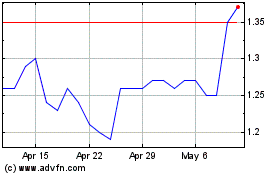

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2023 to Dec 2024