Prime Restaurants Inc. ("PRI" or the "Company") (TSX:EAT) today reported its

results for the 13 and 52 weeks ended January 2, 2011. Effective April 5, 2010

Prime Restaurants Royalty Income Fund (the "Fund") was reorganized (the

"Reorganization") into a public corporation named Prime Restaurants Inc. The new

corporate structure includes the combination of the businesses of Prime

Restaurants of Canada Inc. ("PRC"), the Fund and PRC Trademarks Inc.

("TradeMarkCo"). The Fund was dissolved and unitholders and limited voting

unitholders of the Fund received, for each unit ("Unit") and limited voting unit

of the Fund, one class A limited voting share ("Class A Limited Voting Shares")

of PRI. Additionally, in connection with the Reorganization, Prime Restaurant

Holdings Inc. ("PRH"), the former parent of PRC, received class B limited voting

shares ("Class B Limited Voting Shares") and class C non-voting shares ("Class C

Non-Voting Shares"), which shares are convertible into Class A Limited Voting

Shares of PRI if certain financial targets are met by PRI. Details regarding the

conversion rights are set out in the share conversion agreement between PRI and

PRH dated April 5, 2010 (the "Conversion Agreement").

The 13 and 52-week periods ended January 2, 2011 of PRI are compared below to

the three and twelve-month periods ended December 31, 2009 of the Fund. As PRI's

operations are substantially different from the operations of the Fund, some of

the information in this press release is not directly comparable.

2010 HIGHLIGHTS:

-- Strong Same Store Sales Growth ("SSSG") of 4.1% for the year, up 4.3% in

fourth quarter

-- Solid growth across all brands and geographic regions

-- Solid performance at East Side Mario's with strong 4.9% SSSG, up 5.4% in

fourth quarter

-- Casey's and Pubs post SSSG of 2.1% and 5.0% respectively in 2010

-- New menus, price increases and increased advertising programs to benefit

future growth.

PRI generated a solid increase in SSSG in the fourth quarter and fiscal year

ended January 2, 2011, as the Company's proven sales and marketing programs

successfully capitalized on the slowly improving Canadian economy and resurgence

in consumer sentiment. Same store sales for the 13 weeks ended January 2, 2011

increased by 4.3% compared to negative same store sales of (4.4%) for the same

period last year. For the 52 weeks ended January 2, 2011 same store sales were

up 4.1% compared to a decline of (6.5%) last year.

All of the Company's brands posted positive SSSG in the quarter, with East Side

Mario's leading the way with strong SSSG of 5.4%, while Prime Pubs posted SSSG

of 4.0% and Casey's at 1.4% SSSG. For the 52 weeks ended January 2, 2011, East

Side Mario's posted SSSG of 4.9%, while Casey's and the pubs posted SSSG of 2.1%

and 5.0% respectively. All of PRI's geographic regions in Canada posted positive

SSSG, with Ontario up 4.5%, Quebec rising 3.4%, Atlantic Canada up 5.1% and

Western Canada posting SSSG of 2.6% for the 13 weeks ended January 2, 2011. For

the 52 weeks ended January 2, 2011, Ontario generated SSSG of 4.1%, Quebec was

up 5.0%, Atlantic Canada 5.7% and Western Canada rose 2.0%. There were 154

restaurant and pub locations as at January 2, 2011.

"We are very pleased with the solid growth and strong operational performance

generated in 2010, a testament to the effectiveness of our value enhancing

programs and our multi-brand approach covering all aspects of the Canadian

casual dining and pub business," commented John Rothschild, Chief Executive

Officer of PRI.

In 2011 East Side Mario's will focus on utilizing larger format restaurants to

maximize revenues, supported by a four-fold increase in television advertising

compared to 2010. A new and updated menu was introduced at East Side Mario's in

January. Casey's launched new marketing programs early in 2011, including e-mail

blast and direct mail campaigns, as well as the testing of a Loyalty Rewards

program at eight locations for potential national roll-out in the fourth

quarter. PRI's pub locations introduced a new core food and beverage menu in the

first quarter of 2011 that features an innovative quick reference code directing

guests to a mobile web site suggesting recommended beer and food pairings.

"Looking ahead, we believe our ongoing renovation programs, new location

openings, menu innovations and other sales initiatives, combined with our

rigorous focus on customer service, will continue to attract new and repeat

guests and contribute to our growth over the long term," Mr. Rothschild

concluded.

Operational Review

During the 13 weeks ended January 2, 2011, PRI opened one pub in Ontario and one

East Side Mario's restaurant in Calgary. During the quarter one Casey's and two

East Side Mario's locations were closed. For the year ended January 2, 2011

three East Side Mario's restaurants and two pubs were opened, and nine

restaurants were closed, including seven East Side Mario's, three in Ontario and

four in Alberta, and two Casey's locations in Ontario.

During the year ended January 2, 2011 three Casey's and one East Side Mario's

restaurants were renovated. Sales at these locations have cumulatively risen

12.2% and 14.3% for the 13 and 52 weeks ended January 2, 2011, respectively,

compared with their pre-renovation sales levels.

FINANCIAL HIGHLIGHTS:

($000's) 13 weeks Three 52 weeks 12 months

ended months ended ended

ended

January December

2, December January 2, 31,

2011 31, 2009 2011 2009

Entity PRI Fund PRI & Fund Fund

Gross revenue - reported by

PRI restaurants 82,490 - 257,209 -

----------------------------------------------------------------------------

Total revenue 10,638 1,294 35,295 6,860

Operating costs &

administrative expenses 9,096 169 28,699 263

----------------------------------------------

Earnings before the undernoted 1,542 1,125 6,596 6,597

Interest and amortization

expenses 90 - 230 -

Share of loss from

significantly influenced

company - - 19 -

Write-down of investments 123 16,754 123 16,754

Reorganization adjustments - 11,905

Reorganization transaction

costs - - 2,436 -

Stock-based compensation

expense 116 - 273 -

----------------------------------------------

Income/(Loss) before taxes 1,213 (15,629) (8,390) (10,157)

Income tax recovery (4,200) - (2,416) -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Income/(Loss) for the period 5,413 (15,629) (5,974) (10,157)

Income/(loss) attributed to

non-controlling interest 6 - 17 -

Income/(loss) attributed to

shareholders equity 5,407 (15,629) (5,991) (10,157)

----------------------------------------------------------------------------

Total assets 51,973 42,579 51,973 42,579

Total liabilities 10,849 514 10,849 514

Shareholder's Equity 41,094 42,065 41,094 42,065

Non-controlling interest 30 - 30 -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenue reported by PRI for the 13 and 52 weeks ended January 2, 2011 includes

royalties and franchise-related income, sales from corporate-owned restaurants,

and income from PRI's 50% ownership interest in The Ricmar Limited Partnership

which owns one Casey's restaurant. Prior to the Reorganization, the Fund's

revenues included interest income on a promissory note issued by TradeMarkCo,

common share dividend and amortization of deferred financing fees.

Operating and administrative costs for the 13 and 52 weeks ended January 2, 2011

include costs incurred by company-owned restaurants such as marketing and

advertising expenses, cost of sales, operating expenses, as well as general and

administrative expenses associated with managing the activities of PRI and

providing services to the corporate and franchised restaurants. Prior to the

Reorganization, operating and administrative costs reflected only the operating

and administrative expenses of the Fund.

Interest expense for the 13 and 52 weeks ended January 2, 2011 includes interest

arising from a loan agreement that was assumed by PRI as part of the

Reorganization. The proceeds from the loan were used by PRC to finance the

construction and opening of a second Bier Markt location in downtown Toronto.

The loan bears interest at the banker's acceptance rate plus 3.25% per annum and

will mature in September 2015. Prior to the Reorganization, the Fund did not

have any outstanding loans.

Amortization expense is comprised of amortization on property, plant and

equipment. Prior to the Reorganization, the Fund did not have any depreciable

assets.

At the time of the Reorganization, PRI acquired, through its acquisition of

Prime Restaurants of America Inc., 50% of the partnership of Prime Pubs of

America LLC. During the quarter ended January 2, 2011, the remaining 50%

ownership was purchased by PRI and the investment was written off, resulting in

a net charge of $123,000.

As previously disclosed, PRI is the successor reporting issuer to the Fund, and

is accounted for as a continuity of the interest and business operations of the

Fund. In order to facilitate the Reorganization, the Fund recorded a one-time

adjustment of $11.9 million comprised of an $11.95 million write-down of its

investment in TradeMarkCo to the market value of the outstanding Units as of

April 4, 2010, $302,000 write-off of inter-company payables and a $258,000

write-off of interest receivable from TradeMarkCo that it would have used to pay

a distribution on April 15, 2010, to Unitholders of record on March 31, 2010,

had the Reorganization not been approved. Instead, the distribution payable to

Unitholders of record on March 31, 2010 was paid as a dividend by PRI on April

15, 2010 to holders of Class A Limited Voting Shares of record on April 8, 2010.

Reorganization costs for the 13 and 52 weeks ended January 2, 2011 were one-time

and include costs such as legal, audit, TSX listing, transfer agent, third-party

valuation and consulting fees.

Stock-based compensation expense relates to a restricted share plan that

provides for the grant of restricted share units ("RSUs") to officers, employees

and directors of PRI and its affiliates, and to certain consultants engaged by

PRI or its affiliates. PRI recorded stock based compensation expenses of

$116,000 and $273,000 respectively, related to the RSUs for the 13 and 52 weeks

ended January 2, 2011. The current year expense is comprised of the value of

RSUs that have vested and the straight-line amortization of the unvested RSUs

over their respective vesting periods. The total value of the RSUs granted was

based on the market price of the Class A Limited Voting Shares on the grant

date. There were no similar stock- based compensation plans existing in the

prior year.

PRI's financial statements and management discussion and analysis (the "MD&A")

for the 13 and 52 weeks ended January 2, 2011 as well as historical financial

statements and MD&As of PRC and the Fund are available at

www.primerestaurants.com and www.sedar.com.

Amendment to Conversion Agreement

PRI also reported today certain amendments to the Conversion Agreement. The

amendments involve changes to the "Adjusted Earnings Targets" set out in the

Conversion Agreement as a result of changes in the accounting treatment of

certain deferred revenue and deferred rent following the completion of the

Reorganization. The changes were made with the approval of the independent

directors of PRI and the consent of PRH pursuant to the terms of the Conversion

Agreement and were consented to by the Toronto Stock Exchange. The amendment to

the Conversion Agreement will be filed under PRI's profile on SEDAR at

www.sedar.com.

Conversion of Class B Limited Voting Shares and Class C Non-Voting Shares

Additionally, PRI reported today that as PRI had achieved the "Adjusted Earnings

Target" for 2010 as set out in the Conversion Agreement, PRH converted 628,457

Class B Limited Voting Shares and 203,667 Class C Non-Voting Shares into an

aggregate of 832,124 Class A Limited Voting Shares.

About Prime Restaurants Inc.

PRI franchises, owns and operates one of Canada's leading networks of casual

dining restaurants and pubs. With such well- respected brands as East Side

Mario's, Casey's, Fionn MacCool's, D'Arcy McGee's, Paddy Flaherty's, Tir nan Og,

and Bier Markt, Prime has been delivering quality, value and a superior guest

experience for more than thirty years. Prime's Class A Limited Voting Shares are

listed on the Toronto Stock Exchange under the symbol "EAT".

Forward-Looking Statements

The public communications of PRI often include written or oral forward-looking

statements. Statements of this type are included in this news release, and may

be included in filings with Canadian securities regulators, or in other

communications. Forward-looking statements may involve, but are not limited to,

comments with respect to our objectives for 2011 and beyond, our strategies or

planned future actions, and our targets or expectations for our financial

performance and condition. All statements, other than statements of historical

fact, contained in this news release are forward-looking statements, including,

without limitation, statements regarding the future financial position and

operations, business strategy, plans and objectives of or involving PRI. Readers

can identify many of these statements by looking for words such as "believe",

"expects", "will", "intends", "projects", "anticipates", "estimates",

"continues" and similar words or the negative thereof. Although management

believes that the expectations represented in such forward-looking statements

are reasonable, there can be no assurance that such expectations will prove to

be correct.

By their nature, forward-looking statements require us to make assumptions and

are subject to inherent risks and uncertainties including those discussed in the

MD&A and the Annual Information Form (the "AIF") under "Narrative Description of

the Business - Risk Factors" which are available at www.sedar.com. There is

significant risk that predictions and other forward-looking statements will not

prove to be accurate. We caution readers of this news release not to place undue

reliance on our forward-looking statements because a number of factors could

cause actual future results, conditions, actions or events to differ materially

from the targets, expectations, estimates or intentions expressed in the

forward- looking statements.

The information set forth in the MD&A and AIF identifies factors that could

affect operating results and performance. We caution that the list of factors

discussed in the MD&A and the AIF is not exhaustive, and that, when relying on

forward-looking statements to make decisions with respect to PRI, investors and

others should carefully consider the factors discussed, as well as other

uncertainties and potential events, and the inherent risks and uncertainties of

forward-looking statements.

The forward-looking statements contained herein are expressly qualified in their

entirety by this cautionary statement. The forward-looking statements included

in this news release are made as of the date of this news release. Except as

required by applicable securities laws, PRI does not undertake to update any

forward-looking statement, whether written or oral, that may make or that may be

made, from time to time.

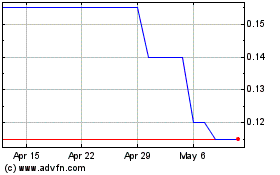

Pearl River (TSXV:PRH)

Historical Stock Chart

From Apr 2024 to May 2024

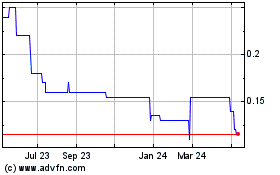

Pearl River (TSXV:PRH)

Historical Stock Chart

From May 2023 to May 2024