Salona Global Completes Turn Around Plan with Profitable Third Quarter, Posting Record Results with 18.5% Quarterly Organic Revenue Growth and 29% Quarterly Gross Profit Growth; Generates $749,425 in Adjusted EBITDA for the Quarter

November 15 2023 - 6:30AM

Salona Global Medical Device Corporation (the

“

Company”) (TSXV:SGMD), soon to be renamed Evome

Medical Technologies Inc., today announced financial highlights for

its third quarter, ending September 30, 2023.

Financial Headlines

Revenues

- Generated $19,647,489 in revenue

for the quarter ending September 30, 2023.

- 18.5% increase from the previous

quarter.

- 78.3% increase from the same period

in the prior year.

Profits

- Generated $7,268,163 in gross

profit for the quarter ending September 30, 2023.

- 29.0% increase from the previous

quarter.

- 128.4% increase from the same

period in the prior year.

- Improved gross profit margins to

37% from 34% in the previous quarter.

- Generated $749,425 in positive

Adjusted EBITDA (defined below) for the quarter ending September

30, 2023 as compared to negative Adjusted EBTIDA of $819,394 in the

previous quarter, a difference of $1,568,819 for the quarter.

- Generated $2,998,468 in net income

for the quarter ending September 30, 2023 as compared to a net loss

of $1,115,843 in the previous quarter, a difference of $4,114,311

for the quarter.

Acquisition Debt Reduction

The Company reduced acquisition debt by

US$428,237.45 in the third quarter pursuant to the previously

announced forbearance agreement. On October 31, 2023, the Company

further reduced its acquisition debt by making a scheduled

payment.

“We have succeeded in implementing our

turnaround plan very quickly this quarter with fantastic results,”

said CEO Mike Seckler. “We had record revenue with solid organic

revenue and gross profit growth. With this sales momentum I now

want to focus on getting our gross profit figures up above 40%. I

am also optimistic our operational challenges will be overcome and

we are now assessing a pathway to eliminate our going concern

issues.”

“Most importantly, we can now look to the future

and focus on revenue growth. We have some very exciting product

launches and international partnerships that look to fuel growth in

2024. I look forward to announcing our new product tomorrow and

soon we will debut our entire next generation line of

products.”

Earnings Call

On Wednesday, November 15, 2023, at 4:00 p.m.

(Eastern Time), CEO Mike Seckler and CFO Natalia Vakhitova will

hold an earnings call (see details below) to discuss the third

quarter financial results. The call-in numbers for participants

are:

Toll Free Dial In: +1 (800)

245-3047 Direct Dial: +1 (203)

518-9765 Conference

ID: SALONA

Sign up

at http://tinyurl.com/salonaglobalnewsletter for updates on

the Company delivered directly to your inbox.

Full Financial Statements

Condensed financial statements for the third

quarter ending September 30, 2023 are attached at end of this

release. The full financial statements and related management

discussion and analysis (in the form of a quarterly report on Form

10-Q) for the three and nine months ended September 30, 2023 have

been filed with the United States Securities and Exchange

Commission and available at www.sec.gov, and with the securities

regulatory authorities in certain provinces of Canada and

available at www.sedarplus.com.

For more information please contact:

Mike SecklerChief Executive OfficerTel: 1 (800)

760-6826Email: Info@Salonaglobal.com

Non-GAAP Measures

This press release refers to “Adjusted EBITDA”

which is a non-GAAP and non-IFRS financial measure that does not

have a standardized meaning prescribed by GAAP or IFRS. The

Company’s presentation of this financial measure may not be

comparable to similarly titled measures used by other companies.

This non-GAAP financial measure assists the Company’s management

in comparing its operating performance over time because certain

items may obscure underlying business trends and make comparisons

of long-term performance difficult, as they are of a nature and/or

size that occur with inconsistent frequency or relate to discrete

acquisition plans that are fundamentally different from the

ongoing operating plans of the Company. The Company’s management

also believes that presenting this measure allows investors to

view the Company’s performance using the same measures that the

Company uses in evaluating its financial and business performance

and trends.

“Adjusted EBITDA” is defined as net loss

excluding interest expense, provision for income taxes,

depreciation of property and equipment, amortization of

right-of-use asset, amortization of intangible asset, foreign

exchange (loss) gain, other income, provision for impairment,

change in fair value of contingent consideration, transaction

costs, and stock-based compensation.

The following table provides reconciliation

between net income (loss) and Adjusted EBITDA:

| |

|

For the three months ended |

|

For the nine months ended |

|

|

|

September 30 |

|

September 30 |

|

September 30 |

|

September 30 |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

2,988,468 |

|

|

$ |

(9,801,081 |

) |

|

$ |

209,881 |

|

|

$ |

(14,045,048 |

) |

| Interest Expense |

|

|

641,466 |

|

|

|

196,788 |

|

|

|

1,373,998 |

|

|

|

432,005 |

|

| Provision for income

taxes |

|

|

9,561 |

|

|

|

(69,033 |

) |

|

|

48,105 |

|

|

|

(214,750 |

) |

| Depreciation of property and

equipment |

|

|

273,092 |

|

|

|

172,654 |

|

|

|

722,422 |

|

|

|

313,594 |

|

| Amortization of right-of-use

asset |

|

|

518,873 |

|

|

|

133,991 |

|

|

|

1,441,014 |

|

|

|

304,027 |

|

| Amortization of intangible

asset |

|

|

392,615 |

|

|

|

254,706 |

|

|

|

1,093,714 |

|

|

|

718,716 |

|

| Foreign exchange (loss)

gain |

|

|

80 |

|

|

|

62,971 |

|

|

|

(4,438 |

) |

|

|

66,904 |

|

| Other income |

|

|

(1,185,110 |

) |

|

|

(1,252 |

) |

|

|

(2,000,671 |

) |

|

|

(1,300 |

) |

| Provision for impairment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,527,913 |

|

| Change in fair value of

earnout consideration |

|

|

- |

|

|

|

- |

|

|

|

(1,165,697 |

) |

|

|

2,451,600 |

|

| Change in fair value of

contingent consideration |

|

|

(3,542,325 |

) |

|

|

8,053,337 |

|

|

|

(3,269,230 |

) |

|

|

2,659,329 |

|

| Transaction costs |

|

|

72,839 |

|

|

|

838,957 |

|

|

|

607,151 |

|

|

|

2,407,366 |

|

| Severance Expenses |

|

|

315,569 |

|

|

|

- |

|

|

|

544,318 |

|

|

|

- |

|

| Stock based compensation |

|

|

264,637 |

|

|

|

378,683 |

|

|

|

1,001,733 |

|

|

|

1,306,341 |

|

| Adjusted

EBITDA |

|

$ |

749,765 |

|

|

$ |

220,721 |

|

|

$ |

602,300 |

|

|

$ |

1,926,697 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information

Unless otherwise specified, all dollar amounts

in this press release are expressed in Canadian dollars.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Certain statements contained in this press

release constitute “forward-looking information” within the meaning

of the Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. These statements can be

identified by the use of forward-looking terminology such as

“expects” “believes”, “estimates”, “may”, “would”, “could”,

“should”, “potential”, “will”, “seek”, “intend”, “plan”, and

“anticipate”, and similar expressions as they relate to the

Company, including: the Company getting gross profit figures up

above 40%; the Company launching new products in 2024, including

announcing new products on November 16, 2023 and debuting an entire

next generation line of products soon.

All statements other than statements of

historical fact may be forward-looking information. Such

statements reflect the Company’s current views and intentions with

respect to future events, and current information available to the

Company, and are subject to certain risks, uncertainties and

assumptions, including: the Company finding additional cost

restructuring opportunities and reductions.

The Company cautions that the forward-looking

statements contained herein are qualified by important factors that

could cause actual results to differ materially from those

reflected by such statements. Such factors include but are not

limited to the general business and economic conditions in the

regions in which the Company operates; the ability of the Company

to execute on key priorities, including the successful

completion of acquisitions, business retention, and strategic

plans and to attract, develop and retain key executives;

difficulty integrating newly acquired businesses; ongoing or new

disruptions in the supply chain, the extent and scope of such

supply chain disruptions, and the timing or extent of the

resolution or improvement of such disruptions; the ability to

implement business strategies and pursue business opportunities;

disruptions in or attacks (including cyber-attacks) on the

Company’s information technology, internet, network access or other

voice or data communications systems or services; the evolution

of various types of fraud or other criminal behavior to which

the Company is exposed; the failure of third parties to comply with

their obligations to the Company or its affiliates; the impact

of new and changes to, or application of, current laws and

regulations; granting of permits and licenses in a highly

regulated business; the overall difficult litigation

environment, including in the United States; increased competition;

changes in foreign currency rates; increased funding costs

and market volatility due to market illiquidity and competition for

funding; the availability of funds and resources to pursue

operations; critical accounting estimates and changes to

accounting standards, policies, and methods used by the

Company; the occurrence of natural and unnatural catastrophic

events and claims resulting from such events; as well as

those risk factors discussed or referred to in the Company’s

disclosure documents filed with United States Securities and

Exchange Commission and available at www.sec.gov, and with the

securities regulatory authorities in certain provinces of Canada

and available at www.sedarplus.ca. Should any factor affect the

Company in an unexpected manner, or should assumptions underlying

the forward-looking information prove incorrect, the actual

results or events may differ materially from the results or

events predicted. Any such forward-looking information is

expressly qualified in its entirety by this cautionary

statement. Moreover, the Company does not assume responsibility

for the accuracy or completeness of such forward-looking

information. The forward-looking information included in this

press release is made as of the date of this press release and

the Company undertakes no obligation to publicly update or revise

any forward-looking information, other than as required by

applicable law.

| SALONA

GLOBAL MEDICAL DEVICE CORPORATION |

|

|

|

|

|

|

| Unaudited

Interim Condensed Consolidated Statements of Operations and

Comprehensive Loss |

| |

|

For the three months ended |

|

For the nine months ended |

|

|

|

September 30 |

|

September 30 |

|

September 30 |

|

September 30 |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

19,647,489 |

|

|

$ |

11,019,251 |

|

|

$ |

46,905,793 |

|

|

$ |

29,448,811 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

| Direct service personnel |

|

|

1,509,715 |

|

|

|

1,508,339 |

|

|

|

4,987,474 |

|

|

|

4,382,736 |

|

| Direct material costs |

|

|

10,546,970 |

|

|

|

6,036,325 |

|

|

|

23,937,770 |

|

|

|

14,588,950 |

|

| Other direct costs |

|

|

322,641 |

|

|

|

292,528 |

|

|

|

984,112 |

|

|

|

792,049 |

|

| Total cost of revenue |

|

|

12,379,326 |

|

|

|

7,837,192 |

|

|

|

29,909,356 |

|

|

|

19,763,735 |

|

| Gross margin |

|

|

7,268,163 |

|

|

|

3,182,059 |

|

|

|

16,996,437 |

|

|

|

9,685,076 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

|

7,098,604 |

|

|

|

3,340,021 |

|

|

|

17,940,188 |

|

|

|

9,064,720 |

|

| Depreciation of property and

equipment |

|

|

273,092 |

|

|

|

172,654 |

|

|

|

722,422 |

|

|

|

313,594 |

|

| Amortization of operating

lease right-of-use assets |

|

|

518,873 |

|

|

|

133,991 |

|

|

|

1,441,014 |

|

|

|

304,027 |

|

| Amortization of intangible

assets |

|

|

392,615 |

|

|

|

254,706 |

|

|

|

1,093,714 |

|

|

|

718,716 |

|

| Total operating expenses |

|

|

8,283,184 |

|

|

|

3,901,372 |

|

|

|

21,197,338 |

|

|

|

10,401,057 |

|

| Net operating (loss) |

|

|

(1,015,021 |

) |

|

|

(719,313 |

) |

|

|

(4,200,901 |

) |

|

|

(715,981 |

) |

| Interest expense |

|

|

(641,466 |

) |

|

|

(196,788 |

) |

|

|

(1,373,998 |

) |

|

|

(432,005 |

) |

| Foreign currency

exchange gain (loss) |

|

|

(80 |

) |

|

|

(62,971 |

) |

|

|

4,438 |

|

|

|

(66,904 |

) |

| Other income |

|

|

1,185,110 |

|

|

|

1,252 |

|

|

|

2,000,671 |

|

|

|

1,300 |

|

| Provision for impairment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,527,913 |

) |

| Change in fair value of

earnout consideration |

|

|

- |

|

|

|

- |

|

|

|

1,165,697 |

|

|

|

(2,451,600 |

) |

| Change in fair value of

contingent consideration |

|

|

3,542,325 |

|

|

|

(8,053,337 |

) |

|

|

3,269,230 |

|

|

|

(2,659,329 |

) |

| Transaction costs |

|

|

(72,839 |

) |

|

|

(838,957 |

) |

|

|

(607,151 |

) |

|

|

(2,407,366 |

) |

| Net income (loss) before

taxes |

|

|

2,998,029 |

|

|

|

(9,870,114 |

) |

|

|

257,986 |

|

|

|

(14,259,798 |

) |

| Provision for income

taxes |

|

|

(9,561 |

) |

|

|

69,033 |

|

|

|

(48,105 |

) |

|

|

214,750 |

|

| Net income (loss) |

|

$ |

2,988,468 |

|

|

$ |

(9,801,081 |

) |

|

$ |

209,881 |

|

|

$ |

(14,045,048 |

) |

| Other comprehensive

income |

|

|

|

|

|

|

|

|

| Foreign currency translation

gain |

|

|

324,132 |

|

|

|

400,253 |

|

|

|

386,682 |

|

|

|

1,068,257 |

|

| Comprehensive income

(loss) |

|

$ |

3,312,600 |

|

|

$ |

(9,400,828 |

) |

|

$ |

596,563 |

|

|

$ |

(12,976,791 |

) |

| Net loss per share |

|

|

|

|

|

|

|

|

| Basic |

|

|

0.04 |

|

|

|

(0.18 |

) |

|

|

0.00 |

|

|

|

(0.27 |

) |

| Diluted |

|

|

0.03 |

|

|

|

(0.18 |

) |

|

|

0.00 |

|

|

|

(0.27 |

) |

| Weighted average number shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

77,978,130 |

|

|

|

54,719,867 |

|

|

|

71,504,018 |

|

|

|

52,981,400 |

|

| Diluted |

|

|

88,483,489 |

|

|

|

54,719,867 |

|

|

|

82,003,843 |

|

|

|

52,981,400 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALONA GLOBAL MEDICAL

DEVICE CORPORATION |

|

|

|

|

|

|

|

| Unaudited Interim

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,052,647 |

|

|

$ |

1,928,464 |

|

|

| Accounts receivable, net |

|

|

9,986,167 |

|

|

|

6,353,275 |

|

|

| Inventories, net |

|

|

12,132,422 |

|

|

|

8,102,626 |

|

|

| Prepaid expenses and other

receivables |

|

|

2,203,034 |

|

|

|

216,489 |

|

|

| Total current

assets |

|

|

25,374,270 |

|

|

|

16,600,854 |

|

|

| Security deposit |

|

|

608,459 |

|

|

|

566,198 |

|

|

| Long-term accounts

receivable |

|

|

- |

|

|

|

189,616 |

|

|

| Long-term prepaid expenses and

other receivables |

|

|

241,024 |

|

|

|

441,025 |

|

|

| Property and equipment,

net |

|

|

3,843,493 |

|

|

|

3,399,898 |

|

|

| Operating lease right-of-use

assets, net |

|

|

11,489,568 |

|

|

|

7,781,300 |

|

|

| Intangible assets, net |

|

|

10,191,624 |

|

|

|

9,376,162 |

|

|

| Goodwill |

|

|

16,143,398 |

|

|

|

13,695,194 |

|

|

| Total

assets |

|

$ |

67,891,836 |

|

|

$ |

52,050,247 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

| Line of credit |

|

$ |

7,682,971 |

|

|

$ |

5,162,711 |

|

|

| Accounts payable and accrued

liabilities |

|

|

9,918,137 |

|

|

|

6,641,181 |

|

|

| Current portion of debt |

|

|

9,463,750 |

|

|

|

195,489 |

|

|

| Current portion of operating

lease liability |

|

|

1,514,813 |

|

|

|

847,253 |

|

|

| Other liabilities |

|

|

2,152,083 |

|

|

|

1,807,702 |

|

|

| Obligation for payment of

earn-out consideration |

|

|

9,278,389 |

|

|

|

15,506,531 |

|

|

| Total current

liabilities |

|

|

40,010,143 |

|

|

|

30,160,867 |

|

|

| Debt, net of current

portion |

|

|

764,235 |

|

|

|

574,515 |

|

|

| Operating lease liability, net

of current portion |

|

|

7,722,597 |

|

|

|

5,983,333 |

|

|

| Total

liabilities |

|

$ |

48,496,975 |

|

|

$ |

36,718,715 |

|

|

| |

|

|

|

|

| Stockholders’

equity |

|

|

|

|

| Common stock; no par value,

unlimited shares authorized; 56,791,592 shares issued and

outstanding as of September 30, 2023 (December 31, 2022:

53,707,780) |

|

|

39,680,472 |

|

|

|

38,767,442 |

|

|

| Class A shares; no par value,

unlimited shares authorized; 21,378,799 shares issued and

outstanding as of September 30, 2023 (December 31, 2022:

3,403,925) |

|

|

12,542,088 |

|

|

|

1,800,064 |

|

|

| Class A Shares to be issued:

6,261,340 Class A shares to be issued as of September 30, 2023

(December 31, 2022: 19,019,000) |

|

|

4,696,005 |

|

|

|

14,264,250 |

|

|

| Additional

paid-in-capital |

|

|

9,452,567 |

|

|

|

8,072,610 |

|

|

| Accumulated other

comprehensive income |

|

|

2,075,134 |

|

|

|

1,688,452 |

|

|

| Deficit |

|

|

(49,051,405 |

) |

|

|

(49,261,286 |

) |

|

| Total stockholders’

equity |

|

|

19,394,861 |

|

|

|

15,331,532 |

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

67,891,836 |

|

|

$ |

52,050,247 |

|

|

| |

|

|

|

|

|

|

|

|

|

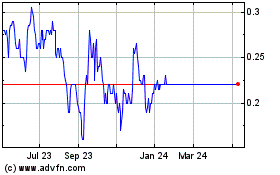

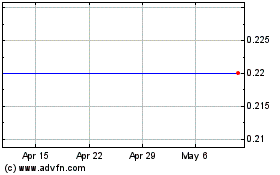

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024