WestCan Uranium Corp. Receives Letter of Comfort on Saskatchewan Coal Permits

June 10 2008 - 5:00AM

Marketwired

VANCOUVER, BRITISH COLUMBIA (OTCBB: WCURF)(FRANKFURT: IAR)

("WestCan") ("the Company") is pleased to announce that a "Letter

of Comfort" has been received from the Saskatchewan Ministry of

Energy and Resources in regard to coal permit applications

submitted on behalf of the Company.

WestCan submitted the applications for permits in the vicinity

of the Goldsource Mines Inc. discovery, north of the Town of Hudson

Bay, in East-Central Saskatchewan, on May 08th, 2008 and May 12th,

2008. Goldsource believes the coal it encountered is from the

Mannville/Swan River group of Creataceous age (Goldsource Mines

Inc. news release in Stockwatch on May 5, 2008). Coal structures of

the Creataceous age are generally stratigraphic and can encompass

several thousand square kilometres.

The "Comfort Letter" includes a list of dispositions applied

for, the dates of the submissions, land description, boundary plan,

affirmation of fee payment and first-year rent, the allocated Coal

Prospecting Permit (CPP) numbers, and if the submission has

priority over other applications. The "Comfort Letter" received by

WestCan confirms that half of permits applied for are "first in

line" and will be given priority sequence.

The final granting of the coal permits is dependent upon

government regulatory approval and time required to process the

applications, which is at the discretion of the Government of

Saskatchewan. Granting of coal permits is subject to a final review

of each application, indicating the nature of the work and money to

be expended. The "Comfort Letter" is not a guarantee that all or

any of the permits will be issued to WestCan, only whether or not

the Company is first in line for the permits.

Dr. K. Warren Geiger, Ph.D., P.Eng., P.Geo., a Qualified Person

for WestCan, as defined by NI 43-101, is currently co-ordinating

the research of the development in east-central Saskatchewan.

Subject to final permitting, the Company is preparing a

preliminary exploration program for the summer field season.

Private Placement

The Company wishes to offer a Private Placement offering of

securities for an amount of $800,000.

Flow Through

Offering: Up to 4,000,000 units at $0.10 per unit. Each unit

consists of one flow through common share in the

capital of the Company and one share purchase

warrant. Each warrant will entitle the holder to

buy one additional common share of the Company for

a period of 12 months from the date of the closing

of the Private Placement. The exercise price of

the warrant will be $0.18 for the 12 month term of

the warrants.

Non Flow Through

Offering: Up to 5,000,000 units at $0.08 per unit. Each unit

consists of one non-flow through common share in

the capital of the Company and one share purchase

warrant. Each warrant will entitle the holder to

buy one additional non-flow through common share

of the Company for a period of 12 months from the

date of the closing of the Private Placement. The

exercise price of the warrant will be $0.15 for

the 12 month term of the warrants.

Description of Offering: The Company shall rely on the "Accredited Investor

Exemption" (B.C., Alberta, Ontario) and the

"Friends and Relatives Exemption" (B.C.),

therefore will not be preparing an offering

document.

Exchange: TSX Venture Exchange.

Qualifying Jurisdiction: British Columbia, Alberta and Ontario.

Use of Proceeds: The gross proceeds of the offering will be used in

part for general working capital and the "flow

through portion" of the Private Placement will be

used for qualified Canadian Exploration

Expenditures.

Finder's Fee: The Company will pay a finder's fee in connection

with the Private Placement, of 10% cash plus 8%

Agent's Warrants where permitted by the TSX

Venture Exchange. The exercise price of the

Agent's Warrant will be $0.15 for the 12 months

term of the warrants.

On behalf of the Board of Directors

Chris England, President and CEO

WestCan Uranium Corp.

Statements about the Company's future expectations and all other

statements in this press release other than historical facts are

"forward looking statements". The Company intends that such

forward-looking statements be subject to the safe harbours created

thereby. Since these statements involve risks and uncertainties and

are subject to change at any time, the Company's actual results may

differ materially from the expected results.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: WestCan Uranium Corp. Chris England President and CEO

(604) 694-0888 Email: info@westcanuranium.com Website:

www.westcanuranium.com

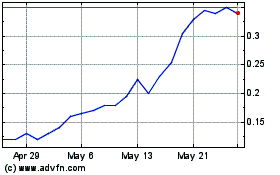

World Copper (TSXV:WCU)

Historical Stock Chart

From Feb 2025 to Mar 2025

World Copper (TSXV:WCU)

Historical Stock Chart

From Mar 2024 to Mar 2025