true

Update Exhibits

0001304409

0001304409

2024-01-17

2024-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A-1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 17, 2024

ATHENA GOLD

CORPORATION

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

000-51808 |

90-0158978 |

(State or other jurisdiction

of incorporation) |

(Commission File

Number) |

(I.R.S. Employer Identification

number) |

2010

A Harbison Drive # 312, Vacaville,

CA 95687

(Address of principal executive offices) (Zip Code)

(Registrant's telephone number, including area

code) (707)

291-6198

______________________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| ITEM 3.02 | UNREGISTERED SALE OF EQUITY SECURITIES |

The following sets forth the information required

by Item 701 of Regulation S-K with respect to the unregistered sales of equity securities by Athena Gold Corporation (the “Company”

or “Athena”):

1a. Effective

January 17, 2024, the Company completed the sale of an aggregate of CDN$200,000 of its Units at a purchase price of CDN$.04 per Unit for

a total of 5,000,000 Units. Each Unit consisted of one (1) share of Common Stock and one (1) common stock purchase warrant (“Warrant”)

exercisable for two years to purchase one additional share of Common Stock at a price of CDN $0.05 per share. The transaction was part

of the Company’s unregistered private offering of up to CDN $200,000 in Units at a price of $0.04 per Unit.

Effective January 2, 2024,

the Company issued 685,564 shares of its common stock to one of its creditors as full discharge and complete satisfaction of a CDN$34,278.02

debt (the “Debt Shares”). The shares were deemed to have a per share price of CDN$0.05. A copy of the Debt Settlement Agreement

is filed herewith as Exhibit 10.1.

b. The

Units sold under 1(a) above were issued pursuant to concurrent offerings under Regulation D and Regulation S under the Securities Act

of 1933, as amended. In connection with the Regulation D offering, the Company sold securities to two (2) US Persons, each of whom qualifies

as an "accredited investor" within the meaning of Rule 501(a) of Regulation D under the Securities Act of 1933. The Units, including

the shares of Common Stock and Warrants issued are “restricted securities” under the Securities Act of 1933, as amended and

the certificate evidencing same bears the Company’s customary restrictive legend.

The Debt shares issued

under 1(a) above were issued to one creditor under Regulation S under the Securities Act of 1933, as amended. The Debt Shares issued are

“restricted securities” under the Securities Act of 1933, as amended and the certificate/book entry statement evidencing shall

bear the Company’s customary restrictive legend.

c. Not

applicable.

d. The

securities issued under 1(a) above were issued without registration under the Securities Act in reliance upon an exemption from the registration

requirements of the Securities Act set forth in Regulation D or Regulation S.

e. Each

Warrant sold as part of the Units is exercisable for two (2) years to purchase one additional share of Common Stock at an exercise price

of CDN $0.05 per share.

f. Proceeds

of the Offering will be used for working capital and other general corporate purposes.

| ITEM 7.01 | REGULATION FD DISCLOSURE |

On January 10 and January

17, 2024 respectively, Athena Gold Corporation, a Delaware corporation (the “Company”) issued a press release announcing the

full subscription and completion of a non-brokered private offering of securities described in Item 3.02 above. The press releases were

filed with the original 8-K dated January 26, 2024 and filed with the Securities and Exchange Commission on January 30, 2024.

The information in this

Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report

on Form 8-K and furnishing this information pursuant to Item 7.01, the Company makes no admission as to the materiality of any information

in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

Exhibits

| Item |

Title |

| 10.1 |

Debt Settlement Agreement |

| 104 |

Cover Page Interactive Data File (formatted in iXBRL, and included in exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Athena Gold Corporation |

| |

|

|

| |

|

|

| Date: March 11, 2024 |

By: |

/s/ John C. Power |

| |

|

John C. Power, President |

Exhibit 10.1

DEBT SETTLEMENT

AGREEMENT

THIS AGREEMENT dated for reference

the 2nd day of January 2024.

BETWEEN:

ATHENA

GOLD CORPORATION, a corporation existing under the laws of THE State of Delaware, with a head office at Suite 312 – 2010A Harbison

Drive, Vacaville, California, United States, 95687,

(hereinafter referred to as the

"Corporation")

OF THE FIRST

PART

AND:

CASTLEWOOD

CAPITAL CORPORATION, of Suite 3680, 130 King St. W., Toronto, Ontario., Canada, M5X 1B1,

(hereinafter

referred to as the "Creditor")

OF THE SECOND

PART

WHEREAS:

A.The

Corporation is indebted to the Creditor in the amount of CDN $34,278.20 (the "Debt"); and

B.The

Corporation wishes to settle the Debt by allotting and issuing 685,564 common shares in the capital of the Corporation (the "Shares")

to the Creditor in full discharge and complete satisfaction of the Debt, and the Creditor has agreed to accept such Shares in full satisfaction

of the Debt and to grant the Corporation a release as hereinafter described; and

C.The

Corporation has agreed to use its best efforts to obtain the approval of the Canadian Securities Exchange (the "CSE") to the

issuance of the Shares.

NOW THEREFORE

THIS AGREEMENT WITNESSETH THAT in consideration of the mutual covenants and agreements herein contained, the receipt and sufficiency of

which is hereby acknowledged, the parties hereto covenant and agree as follows:

1.ACKNOWLEDGMENT OF DEBT

1.1The

Corporation acknowledges and agrees that it is indebted to the Creditor in the amount of the Debt, and the Creditor and the Corporation

agree to settle the Debt as described in Section 2 herein.

2.ALLOTMENT AND ISSUANCE OF SHARES

2.1The

Corporation agrees to allot and issue the Shares to the Creditor at a deemed price of CDN S0.05 per Share as full and final payment of

the Debt, and the Creditor hereby agrees to accept the Shares as full and final payment of the Debt.

2.2The Creditor

hereby understands and agrees to any transfer restrictions applicable to the Shares and any hold period legends to be placed on the certificates

representing the Shares as may be required by applicable securities laws or the rules and policies of the CSE.

3.REGULATORY APPROVALS

AND RESTRICTIONS ON DISPOSTION

3.1The

rights and obligations of the Corporation and the Creditor are subject to and conditional upon receipt of the acceptance for filing of

this Agreement by the CSE. The Creditor consents to the collection, use and disclosure of personal information by the CSE or any securities

commission for the purposes described in Appendix A and B attached hereto or as otherwise identified by the CSE or any securities commission

from time to time.

3.2The Corporation shall use its commercial best efforts to obtain the acceptance for filing of this Agreement by the CSE.

3.3The Creditor represents and warrants to the Corporation that it will seek its own independent legal advice as to any restrictions

imposed by applicable securities laws respecting disposition of the Shares.

4.REPRESENTATIONS

AND WARRANTIES

4.1The Corporation represents

and warrants to the Creditor that:

| (a) | it is a valid and subsisting

corporation duly incorporated and in good standing under the laws of the jurisdiction in which it is incorporated, continued or amalgamated; |

| | | |

| (b) | the Corporation has complied,

or will comply, with all applicable corporate and securities laws and regulations in connection with the issuance of the Shares; |

| | | |

| (c) | it has the necessary power,

capacity, right and authority to enter into and deliver this Agreement and to perform its obligations hereunder; and |

| | | |

| (d) | the Shares, when issued,

will be duly and validly created and authorized and will be issued and delivered as fully paid and non assessable. |

4.2The Creditor represents

and warrants to the Corporation that:

| (a) | upon delivery of the Shares

by the Corporation in accordance with the provisions of this Agreement, the Debt will be fully satisfied and extinguished, and it will

remise, release and forever discharge the Corporation and its directors, officers and employees from any and all obligations relating

to the Debt; |

| | | |

| (b) | it releases the Corporation from any and all covenants and obligations relating

to the Debt; |

| | | |

| (c) | it has not previously assigned,

encumbered, parted with possession of or otherwise granted any interest in the Debt or any of his rights relating thereto; and |

| | | |

| (e) | the Shares are not being

acquired as a result of any material information that has not been generally disclosed to the public. |

5.GENERAL PROVISIONS

5.1 Time shall he of the essence of this Agreement.

5.2The

Corporation and the Creditor shall execute any and all such further deeds, documents and assurances and shall do any and all such further

and other things as may be necessary to implement and carry out the intent of this Agreement.

5.3The

provisions herein contained constitute the entire Agreement between the parties and supersede all previous understandings, communications,

representations and agreements, whether, written or verbal, between the parties with respect to the subject matter of this Agreement.

5.4This

Agreement shall be governed by and construed in accordance with the laws of Canada and the Province of British Columbia.

5.5All

dollar amounts referred to in this Agreement have been expressed in Canadian currency, unless otherwise indicated.

5.6This

Agreement shall enure to the benefit of and be binding upon each of the parties and their respective heirs, executors, administrators,

successors and permitted assigns, as the case may be.

5.7This

Agreement may be executed in several counterparts, each of which will be deemed to be an original and all of which will together constitute

one and the same instrument.

IN WITNESS

WHEREOF the parties hereto have executed these presents on the day and year first above written.

ATHENA GOLD

CORPORATION

Per:

Name:

Title:

CASTLEWOOD CAPITAL CORPORATION

Per:

Name:

Title:

APPENDIX "A"

PERSONAL INFORMATION COLLECTION

POLICY REGARDING FORM 9

The Canadian Securities Exchange and

its subsidiaries, affiliates, regulators and agents (collectively, "CSE or the "Exchange") collect and use the information

(which may include personal or other information) which has been provided in Form 9 for the following purposes:

| · | To determine whether an individual is suitable to be associated with a Listed Issuer; |

| · | To determine whether an issuer is suitable for listing; |

| · | To determine whether allowing an issuer to be listed or allowing an individual

to be associated with a Listed Issuer could give rise to investor protection concerns or could bring the Exchange into disrepute; |

| · | To conduct enforcement proceedings; |

| · | To ensure compliance with Exchange Requirements and applicable securities legislation; and |

| · | To fulfil the Exchange's obligation to regulate its marketplace. |

The CSE also collects information, including

personal information, from other sources, including but not limited to securities regulatory authorities, law enforcement and self-regulatory

authorities, regulation service providers and their subsidiaries, affiliates, regulators and agents. The Exchange may disclose personal

information to these entities or otherwise as provided by law and they may use it for their own investigations.

The Exchange may use third parties

to process information or provide other administrative services. Any third party will be obliged to adhere to the security and confidentiality

provisions set out in this policy.

All personal information provided to

or collected by or on behalf of The Exchange and that is retained by The Exchange is kept in a secure environment. Only those employees

who need to know the information for the purposes listed above are permitted access to the information or any summary thereof. Employees

are instructed to keep the information confidential at all times.

Information about you that is retained

by the Exchange and that you have identified as inaccurate or obsolete will be corrected or removed.

If you wish to consult your file or have any questions

about this policy or our practices, please write the Chief Privacy Officer, Canadian Securities Exchange, 220 Bay Street – 9th Floor,

Toronto, ON, M5J 2W4.

SCHEDULE "B"

COLLECTION OF PERSONAL INFORMATION

|

British Columbia Securities Commission

P.O. Box 10142, Pacific Centre 701 West Georgia

Street

Vancouver, British Columbia V7Y 1L2

Inquiries: (604) 899-6854

Toll free in Canada: 1 (800) 373-6393

Facsimile: (604) 899-6581 Email: FOI-privacy@bcsc.bc.ca

Public official contact regarding indirect collection of

information: FOI Inquiries |

Alberta Securities Commission Suite 600, 250 - 5th

Street SW Calgary, Alberta T2P 0R4

Telephone: (403) 297-6454

Toll free in Canada: 1 (877) 355-0585

Facsimile: (403) 297-2082

Public official contact regarding indirect collection of

information: FOIP Coordinator |

|

Ontario Securities Commission 20 Queen Street West,

22nd Floor Toronto, Ontario M5H 3S8

Telephone: (416) 593-8314

Toll free in Canada: 1 (877) 785-1555

Facsimile: (416) 593-8122

Email: exemptmarketfilings@osc.gov.on.ca

Public official contact regarding indirect collection of

information: Inquiries Officer |

Autorité des marchés financiers

800, Square Victoria, 22e étage

C.P. 246, Tour de la Bourse Montréal, Québec

H4Z 1G3

Telephone: (514) 395-0337 or 1 (877) 525-0337

Facsimile: (514) 873-6155 (for filing purposes only) Facsimile:

(514) 864-6381 (for privacy requests only) Email: financementdessocietes@lautorite.qc.ca (for corporate finance issuers); fonds_dinvestissement@lautorite.qc.ca

(for investment fund issuers)

Public official contact regarding indirect collection of

information: Secrétaire Générale |

v3.24.0.1

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

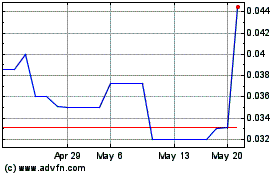

Athena Gold (QB) (USOTC:AHNR)

Historical Stock Chart

From Apr 2024 to May 2024

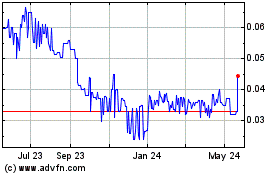

Athena Gold (QB) (USOTC:AHNR)

Historical Stock Chart

From May 2023 to May 2024