0001300524

false

0001300524

2023-07-17

2023-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July

17, 2023

AMERICAN

INTERNATIONAL HOLDINGS CORP.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

000-50912 |

|

90-1898207 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 205S Bailey Street Electra Texas |

|

76360 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (940) 495-2155

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act: None.

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On July 13, 2023, we entered into an Equity Financing

Agreement (the “Financing Agreement”) with Pacific Lion LLC, a Florida limited liability company (“Pacific Lion Stockholder”),

providing for an equity financing facility (the “Equity Line”). The Financing Agreement provides that, upon the terms and

subject to the conditions in the Financing Agreement, Pacific Lion is committed to invest up to twenty million dollars ($20,000,000.00)

(the “Commitment Amount”), over the course of the period beginning on the 15th day of June, 2023 and ending

on September 30, 2024 (the “Contract Period”) to purchase the Company’s common stock, par value $0.00001 per

share (the “Common Stock”).

Pursuant to the Equity Financing Agreement,

Pacific Lion has agreed to purchase up to $20,000,000 of AMIH common stock following the receipt of put notices from AMIH and subject

to certain conditions. Pursuant to the Registration Rights Agreement entered into in connection with the Equity Financing Agreement, AMIH

agreed to file a registration statement to register the common stock issuable under the Equity Financing Agreement. Following the effectiveness

of the registration statement, if AMIH elects to cause Pacific Lion to purchase shares, the shares will be purchased at a 15% discount

to the lowest closing trade price of AMIH’s common stock in the prior 10 trading days. The Equity Financing Agreement with Pacific

Lion replaces the Equity Financing Agreement previously entered into with GHS Investments LLC, which has been terminated.

Pacific Lion also agreed to fund AMIH

up to $400,000 under a Convertible Promissory Note to bridge AMIH through to the effectiveness of the registration of the shares to be

sold under the Financing Agreement.

Pursuant to the Convertible Promissory

Note issued to Pacific Lion by AMIH, Pacific Lion has the right to fund up to $400,000. The note bears interest at 6% and is due on May

10, 2024. Following an uplisting to a senior stock exchange, the note will automatically convert at 80% of the uplisting offering price.

In addition to the note, the Company also issued a Warrant to Purchase Shares of Common Stock to Pacific Lion. The warrant is exercisable

for 500,000 shares for a period of five years at $0.10 per share. In the event that an uplisting to a senior stock exchange does not occur

within nine months of the issuance date, the warrant will automatically be canceled. The note is designed to provide a mechanism for Pacific

Lion to make regular fundings to cover AMIH’s working capital needs during the pendency of the registration statement. Pacific Lion

funded the first tranche of $100,000 upon the issuance of the note.

Under the terms of the Financing Agreement, Pacific

Lion will not be obligated to purchase shares of common Stock unless and until certain conditions are met, including but not limited to

a Registration Statement (the “Registration Statement”) on Form S-1 becoming effective which registers Pacific Lion’s

resale of any shares purchased by it under the Equity Line. From time to time and before the expiry of the Financing Agreement, commencing

on the trading day immediately following the date on which the Registration Statement becomes effective, we may, in our sole discretion,

provide Pacific Lion with a put notice (each, a “Put Notice”), to purchase a specified number of shares of Common Stock (each,

a “Put Amount Requested”), subject to the limitations discussed below. After ten (10) consecutive Trading Days preceding the

relevant Put Notice Date (the “Pricing Period”) Purchase Price shall be established and number of Shares equaling one hundred

percent (100%) of the Put Amount (the “Put Shares”) shall be delivered to the Investor’s broker for a particular

Put. The timing and amounts of each Put shall be at the discretion of the Company. The maximum dollar amount of each Put will not exceed

one hundred and twenty-five percent (125%) of the average daily trading dollar volume for the Common Stock during the ten (10) consecutive

Trading Days preceding the Put Notice Date. No Put will be made in an amount equaling less than twenty-five thousand ($25,000) dollars

or greater than five hundred thousand ($500,000) (unless such cap is waived by the Investor).

The Closing of a Put shall occur upon the first Trading

Day following the confirmation of receipt and approval for trading by Investor’s broker of the Put Shares, whereby the Company shall

have caused the Transfer Agent to electronically transmit, prior to the applicable Closing Date, the applicable Put Shares by crediting

the account of the Investor’s broker with DTC through its Deposit Withdrawal Agent Commission (“DWAC”) system.

The Investor shall deliver the Purchase Amount specified in the Put Notice (less deposit and clearing fees) by wire transfer of immediately

available funds to an account designated by the Company if the aforementioned receipt and approval are confirmed before 9:30 AM ET or

on the following Trading Day if receipt and approval by the Investor’s broker is made after 9:30 AM ET (“Closing Date”

or “Closing”). In addition, on or prior to such Closing Date, each of the Company and Investor shall deliver to each

other all documents, instruments and writings required to be delivered or reasonably requested by either of them pursuant to this Agreement

in order to implement and effect the transactions contemplated herein.

The Financing Agreement contains customary representations,

warranties, and covenants by, among, and for the benefit of the parties. Unless earlier terminated, the Financing Agreement will terminate

automatically on the earlier to occur of: (i) When the Investor has purchased an aggregate of Twenty Million Dollars ($20,000,000) of

the Common Stock of the Company pursuant to this Agreement, or (ii) September 30, 2024 (the “Open Period”).

If during the Open Period the Company becomes listed

on an exchange which limits the number of shares of Common Stock that may be issued without shareholder approval, then the number of Shares

issuable by the Company and purchasable by the Investor, shall not exceed that number of the shares of Common Stock that may be issuable

without shareholder approval (the “Maximum Common Stock Issuance”). If such issuance of shares of Common Stock could

cause a delisting on the stock exchange, then the Maximum Common Stock Issuance shall first be approved by the Company’s shareholders

in accordance with applicable law and the By-laws and the Certificate of Incorporation of the Company. Further, the Company’s failure

to seek or obtain such shareholder approval shall in no way adversely affect the validity and due authorization of the issuance and sale

of Securities or the Investor’s obligation in accordance with the terms and conditions hereof to purchase a number of Shares in

the aggregate up to the Maximum Common Stock Issuance, and that such approval pertains only to the applicability of the Maximum Common

Stock Issuance limitation provided herein.

In no event shall the Investor be entitled to purchase

that number of Shares, which when added to the sum of the number of shares of Common Stock beneficially owned (as such term is defined

under Section 13(d) and Rule 13d-3 of the 1934 Act), by the Investor, would exceed 4.99% of the number of shares of Common Stock outstanding

on the Closing Date (the “Maximum Percentage”), as determined in accordance with Rule 13d-1(j) of the 1934 Act. By

written notice to the Company, the Investor may increase the Maximum Percentage to 9.99%, but any such waiver will not be effective until

the 61st day after delivery thereof. The foregoing 61-day notice requirement is enforceable, unconditional, and non-waivable and shall

apply to all affiliates and assigns of the Investor.

In connection with the Equity Line, we also entered

into a Registration Rights Agreement, dated July 13, 2023, with Pacific Lion (the “Registration Rights Agreement”), pursuant

to which we agreed to register for resale all of the shares issuable in accordance with the Financing Agreement in a registration statement

to be filed with the Securities and Exchange Commission (the “SEC”). We have not yet filed a Form S-1 registration statement

with the SEC. The effectiveness of a registration statement is a condition precedent to our ability to sell shares of Common Stock to

Pacific Lion under the Financing Agreement.

In making sales of our Common Stock to Pacific Lion

under the Financing Agreement, we are relying on an exemption from the registration requirements of Section 4(a)(2) of the Securities

Act of 1933, as amended, and Rule 506 of Regulation D promulgated thereunder. Copies of the Financing Agreement and the Registration Rights

Agreement are attached as Exhibits 10.1 and 10.2 hereto. The description of certain terms of the Financing Agreement and the Registration

Rights Agreement set forth herein do not purport to be complete and are qualified in their entirety by the provisions of such agreements.

The shares to be issued by us to Pacific Lion under the Financing Agreement will be issued in private placements in reliance upon the

exemption from the registration requirements set forth in Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506 of Regulation

D promulgated thereunder. The information disclosed under Item 1.01 is incorporated into Item 1.01 in its entirety.

* * * * *

Item 9.01. Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

AMERICAN INTERNATIONAL HOLDINGS CORP. |

| |

|

|

| Dated: July 21, 2023 |

By: |

/s/ Michael McLaren |

| |

Name: |

Michael McLaren |

| |

|

Chief Executive Officer |

Exhibit 10.1

Exhibit 10.2

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

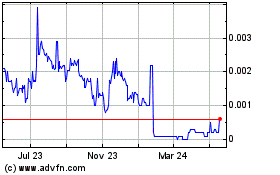

American (CE) (USOTC:AMIH)

Historical Stock Chart

From Feb 2025 to Mar 2025

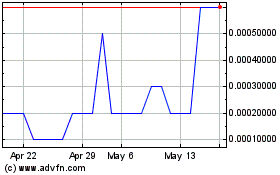

American (CE) (USOTC:AMIH)

Historical Stock Chart

From Mar 2024 to Mar 2025