Table of Contents

File No. 024-12317

As filed with the Securities and Exchange Commission

on November 6, 2023

PART II - INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering

Circular dated November 6, 2023

An offering statement pursuant to Regulation A relating to these securities

has been filed with the United States Securities and Exchange Commission (the “SEC”). Information contained in this Preliminary

Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the

offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation

of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful

before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering

Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final

Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

Aqua Power Systems Inc.

16,000,000 Units

Each Unit Consisting of 3 Shares of Common Stock

and 2 Warrants to Purchase One Share Each of

Common Stock

Exercisable at $0.25 Per Warrant

By this Offering Circular, Aqua Power Systems

Inc., a Nevada corporation, is offering for sale a maximum of 16,000,000 units of its securities (the “Units”) at a fixed

price of $___.0.45-0.75. per Unit (the price to be fixed by a post-qualification supplement), with each Unit consisting of 3 shares

of common stock (the “Common Stock”) and 2 warrants (each, a “Warrant”) to purchase one share each of Common

Stock (each, a “Warrant Share”) exercisable at $0.25 per Warrant, pursuant to Tier 1 of Regulation A of the United States

Securities and Exchange Commission (the “SEC”).

A minimum purchase of $5,000 of the Units is required

in this offering; any additional purchase must be in an amount of at least $1,000. This offering is being conducted on a best-efforts

basis, which means that there is no minimum number of Units that must be sold by us for this offering to close; thus, we may receive no

or minimal proceeds from this offering. All proceeds from this offering will become immediately available to us and may be used as they

are accepted. Purchasers of the Units will not be entitled to a refund and could lose their entire investments.

Please see the “Risk Factors” section, beginning on page

4, for a discussion of the risks associated with a purchase of the Units.

We estimate that this offering will commence within two days of the

SEC’s qualification of the Offering Statement of which this Offering Circular forms a part; this offering will terminate at the

earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified

by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

| Title of |

|

Number |

|

|

|

|

|

|

| Securities Offered |

|

of Shares |

|

Price to Public |

|

Commissions(1) |

|

Proceeds to Company(2) |

| Units(3) |

|

16,000,000 |

|

$_____0.45-0.75 |

|

$-0- |

|

$_____7,200,000-20,000,000(4) |

| (1) | | We do not intend

to offer and sell the Units through registered broker-dealers or utilize finders. However, should we determine to employ a registered

broker-dealer of finder, information as to any such broker-dealer or finder shall be disclosed in an amendment to this Offering Circular. |

| (2) | | Does not account

for the payment of expenses of this offering estimated at $20,000. See “Plan of Distribution.” |

| (3) | | Each Unit consists

of 3 Shares of Common Stock and 2 Warrants to purchase one Warrant Share exercisable at $0.25 per Warrant. |

| (4) | | Does not include

up to $8,000,000 in additional proceeds from the exercise of all of the Warrants included in the Units. There is assurance that any of

the Warrants will be exercised. |

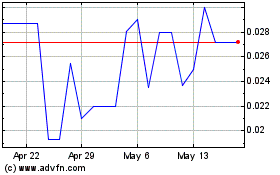

Our common stock is quoted in the over-the-counter

under the symbol “APSI” in the OTC Pink marketplace of OTC Link. On November 3, 2023, the closing price of our common

stock was $0.037675 per share.

Investing in the Units is speculative and involves substantial risks,

including the superior voting rights of our outstanding shares of Convertible Series B Preferred Stock (the “Series B Preferred

Stock”), which preclude current and future owners of our common stock, including the Units, from influencing any corporate decision.

The Series B Preferred Stock has the following voting rights: each share of Series B Preferred Stock is entitled to 1,000 votes on all

matters.

Our directors, as the owners of all outstanding shares of the Series

B Preferred Stock, will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval

by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets,

and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Units”).

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO,

ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER

SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT

MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited.

No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Units.

No sale may be made to you in this offering

if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State

Law Exemption and Offerings to Qualified Purchasers” (page 24). Before making any representation that you satisfy the established

investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing,

we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Form S-1, pursuant

to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is ______, 2023.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information contained in this Offering Circular

includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include,

but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated

development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies,

standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the

future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes,

continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this

Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot

guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to

us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also

described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions

prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not

place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking

statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws.

OFFERING CIRCULAR SUMMARY

The following summary highlights material information

contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common

stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and

the unaudited consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms we, us and our refer and

relate to Aqua Power Systems, Inc., a Nevada corporation, including its subsidiaries.

Our Company

The Company was originally incorporated in Nevada

on December 9, 2010, as NC Solar Inc. with the goal of developing solar energy collection farms on commercial and/or industrial buildings

located on distressed, blighted and/or underutilized commercial land in North Carolina and other southern states of the United States.

On June 6, 2014, management changed and, on August 12, 2014, the Company changed its name to Aqua Power Systems Inc.

On December 1, 2020, the Eighth Judicial District

Court of Nevada entered an order appointing Small Cap Compliance, LLC as custodian of the Company, authorizing and directing it to, among

other things, take any action reasonable, prudent and for the benefit of the Company, including reinstating the Company under Nevada law,

appointing officers and convening a meeting of stockholders. Small Cap Compliance, LLC was not a shareholder of the Company on the date

that it applied to serve as a custodian of the Company.

On December 7, 2020, Small Cap Compliance, LLC

filed the Certificate of Reinstatement for the Company, thereby reinstating the Company, appointed Stephen W. Carnes as the sole officer

and director of the Company, and amended the Company’s Certificate of Incorporation to authorize the issuance of up to one million

shares of Series B Preferred Stock.

On March 3, 2021, the Eighth Judicial District

Court of Nevada entered an order approving Small Cap Compliance, LLC’s actions, without prejudice to the claims of interested parties

as to dilution of their interest, terminated Small Cap Compliance, LLC’s custodianship of the Company, and discharged Small Cap

Compliance as the custodian of the Company.

On April 27, 2022, Robert Morris and the board

of directors of APSI agreed in a Unanimous Written Consent of the Board of Directors In Lieu of Special Meeting that Mr. Morris would

become a director of APSI to help with acquisitions, effective May 1, 2022.

On December 28, 2022, pursuant to the closing and

completion of the acquisition, the Company acquired Tradition Transportation Group, Inc., an Indiana corporation (“Tradition”).

Tradition was incorporated under the laws of the state of Indiana on September 16, 2015. Tradition is headquartered in Angola, Indiana,

and provides freight transportation, brokerage, truck leasing and financing, warehousing and fulfillment services throughout the United

States, and manufactures and sells bolts and fasteners, and creates custom plates, cages, and embeds.

Upon the acquisition of Tradition, the business

of Tradition became the primary business of the Company. (See “Business”).

Offering Summary

| Securities Offered |

16,000,000 Units, with each Unit consisting of 3 Shares of Common Stock and 2 Warrants to purchase one Warrant Share each at $0.25. |

| |

|

| Offering Price |

$_____0.45-0.75 per Unit. |

| |

|

|

Shares of Common Stock

Outstanding Before

This Offering |

17,204,180 shares issued and outstanding as of the date hereof. |

| |

|

|

Shares of Common Stock

Outstanding After

This Offering |

97,204,180 shares issued and outstanding, assuming (1) the sale of all of the Units hereunder and (2) the exercise of all Warrants included in the Units. |

| |

|

|

Minimum Number of Shares

to Be Sold in This Offering |

None |

| |

|

| Disparate Voting Rights |

Our outstanding shares of Series B Preferred Stock possess superior voting rights, which preclude current and future owners of our Common Stock, including the Warrant Shares, from influencing any corporate decision. The Series B Preferred Stock has the following voting rights: each share of Series B Preferred Stock is entitled to 1,000 votes on all matters. Our Directors, Robert Morris, Joseph Davis and Stephen W. Carnes, own of all of the outstanding shares of the Series B Preferred Stock and will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”). |

| |

|

| Investor Suitability Standards |

The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings. |

| |

|

| Market for our Common Stock |

Our common stock is quoted in the over-the-counter market under the symbol “APSI” in the OTC Pink marketplace of OTC Link. |

| |

|

| Termination of this Offering |

This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. |

| |

|

| Use of Proceeds |

We will apply the proceeds

of this offering for repayment of indebtedness and for working capital. (See “Use

of Proceeds”). |

| |

|

| Risk Factors |

An investment in the Units involves a high degree of risk and should

not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included

in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to

making an investment decision regarding the Units |

| |

|

| Corporate Information |

Our principal executive offices are located at 2180 Park Avenue North, Unit 200, Winter Park, Florida 32789; our telephone number is 407-674-9444; our corporate website is located at www.aquapowersystemsinc.com. No information found on our company’s website is part of this Offering Circular. |

Continuing Reporting Requirements Under Regulation A

As a Tier 1 issuer under Regulation A, we will

be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering. We will not be required

to file any other reports with the SEC following this offering.

However, during the pendency of this offering and

following this offering, we intend to file quarterly and annual financial reports and other supplemental reports with OTC Markets, which

will be available at www.otcmarkets.com.

All of our future periodic reports, whether filed

with OTC Markets or the SEC, will not be required to include the same information as analogous reports required to be filed by companies

whose securities are listed on the NYSE or NASDAQ, for example.

RISK FACTORS

An investment in the Units involves substantial risks. You should carefully

consider the following risk factors, in addition to the other information contained in this Offering Circular, before purchasing any of

the Units. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties

discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to

our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in

the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Related to Our Company

We have incurred losses in prior periods,

and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial

condition, our ability to pay our debts as they become due, and on our cash flows. We have incurred losses in prior periods. For

the six months ended June 30, 2023, we reported a net loss of $1,848,135 (unaudited) and, as of that date, we had an accumulated deficit

of $2,553,856 (unaudited). For the year ended December 31, 2022 (12/28/2022 through 12/31/2022), we incurred a net loss of $142,019 (unaudited)

and, as of that date, we had an accumulated deficit of $705,721 (unaudited). For the year ended March 31, 2022, we reported net income

of $554,911 (unaudited). Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse

effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

Our financial statements are not independently

audited, which could result in errors and/or omissions in our financial statements if proper standards are not applied. We are

not required to have our financial statements audited by a firm that is certified by the Public Company Accounting Oversight Board (“PCAOB”).

As such, we do not have a third party reviewing the accounting. We may also not be up to date with all publications and releases released

by the PCAOB regarding accounting standards and treatments. This circumstance could mean that our unaudited financials may not properly

reflect up to date standards and treatments, resulting in misstated financial statements.

There is doubt about our ability to continue

as a viable business. We have not earned a profit from our operations during recent financial periods. There is no assurance that

we will ever earn a profit from our operations in future financial periods.

We do not have a successful operating history.

Historically, we have reported net losses from operations, which makes an investment in the Units speculative in nature. Because of this

lack of operating success, it is difficult to forecast our future operating results. Our performance and business prospects will suffer

if we are unable to overcome the following challenges, among others:

| |

• | our dependence upon external sources for the financing of our operations, particularly given

that there are concerns about our ability to continue as a going concern; |

| |

• | our ability to manage our expansion, growth and operating expenses; |

| |

• | our ability to finance our business; |

| |

• | our ability to compete and succeed in a highly competitive industry; and |

| |

• | future geopolitical events and economic crisis. |

There are risks and uncertainties encountered

by under-capitalized companies. As an under-capitalized company, we are unable to offer assurance that we will be able to overcome

our lack of capital, among other challenges.

Natural disasters and other events beyond

our control could materially adversely affect us. Natural disasters or other catastrophic events may cause damage or disruption

to our operations, international commerce and the global economy, and thus could have a strong negative effect on us. Our business operations

are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond our control. Although we maintain

crisis management and disaster response plans, such events could make it difficult or impossible for us to deliver our services to our

customers and could decrease demand for our services. In the spring of 2020, large segments of the U.S. and global economies were impacted

by COVID-19, a significant portion of the U.S. population are subject to “stay at home” or similar requirements. The extent

of the impact of COVID-19 on our operational and financial performance will depend on certain developments, including the duration and

spread of the outbreak, impact on our customers and our sales cycles, impact on our customer, employee or industry events, and effect

on our vendors, all of which are uncertain and cannot be predicted. At this point, the extent to which COVID-19 may impact our financial

condition or results of operations is uncertain. To date, the COVID-19 outbreak, has significantly impacted global markets, U.S. employment

numbers, as well as the business prospects of many small businesses (our potential clients). To the extent COVID-19 continues to wreak

havoc on the markets and limits investment capital or personally impacts any of our key employees, it may have significant impact on our

results and operations.

Risks Generally Related to the Company’s and Tradition’s

Business and Industry

Shareholders will not receive disclosure

or information regarding a prospective business. Management is not required to and will not provide shareholders with disclosure

or information regarding prospective business opportunities. Moreover, a prospective business opportunity may not result in a benefit

to shareholders or prove to be more favorable to shareholders than any other investment that may be made by shareholders and investors.

We likely will complete only the acquisition

of Tradition. Given our limited financial resources, which have mainly been provided by one of our officers and directors, Stephen

W. Carnes, our competition with similar companies that are looking for potential acquisitions and have more resources than us, and other

considerations, it is likely we will only complete only the acquisition of Tradition. Accordingly, the prospects for our success may be

solely dependent upon the performance of Tradition. In this case, we will not be able to diversify our operations or benefit from the

possible diversification of risks or offsetting of losses, unlike other entities which may have the resources to complete several business

transactions or asset acquisitions in different industries or different areas of a single industry so as to diversify risks and offset

losses.

Tradition’s business is subject to

economic, business and regulatory factors affecting the truckload industry that are largely beyond its control, any of which could have

a material adverse effect on its results of operations. The truckload industry is highly cyclical, and Tradition’s business

is dependent on a number of factors that may have a negative impact on its results of operations, many of which are beyond its control.

Tradition believes that some of the most significant of these factors are economic changes that affect supply and demand in transportation

markets that could have a material adverse effect, such as:

Economic conditions that decrease shipping demand

or increase the supply of available tractors and trailers can exert downward pressure on rates and equipment utilization, thereby decreasing

asset productivity. The risks associated with these factors are heightened when the U.S. economy is weakened. Some of the principal risks

during such times are as follows:

| |

• |

Tradition may experience low overall freight levels, which may impair Tradition’s asset utilization; |

| |

• |

certain of Tradition’s customers may face credit issues and cash flow problems that may lead to payment delays, increased credit risk, bankruptcies and other financial hardships that could result in even lower freight demand and may require us to increase Tradition’s allowance for doubtful accounts; |

| |

• |

freight patterns may change as supply chains are redesigned, resulting in an imbalance between Tradition’s capacity and Tradition’s customers’ freight demand; |

| |

• |

customers may solicit bids for freight from multiple trucking companies or select competitors that offer lower rates from among existing choices in an attempt to lower their costs, and Tradition might be forced to lower its rates or lose freight; and |

| |

• |

Tradition may be forced to accept more loads from freight brokers, where freight rates are typically lower, or may be forced to incur more non-revenue miles to obtain loads. |

Tradition is also subject to cost increases outside

its control that could materially reduce its profitability if Tradition is unable to increase Tradition’s rates sufficiently. Such

cost increases include, but are not limited to, increases in fuel prices, driver and office employee wages, purchased transportation costs,

interest rates, taxes, tolls, license and registration fees, insurance, revenue equipment and related maintenance, tires and other components

and healthcare and other benefits for Tradition’s employees. Further, Tradition may not be able to appropriately adjust Tradition’s

costs to changing market demands. In order to maintain high variability in Tradition’s business model, it is necessary to adjust

staffing levels to changing market demands. In periods of rapid change, it is more difficult to match Tradition’s staffing level

to its business needs. Further, Tradition may not be able to appropriately adjust its costs to changing market demands.

In addition, events outside Tradition’s control,

such as deterioration of U.S. transportation infrastructure and reduced investment in such infrastructure, strikes or other work stoppages

at Tradition’s facilities or at customer, port, border or other shipping locations, pandemics, armed conflicts or terrorist attacks,

efforts to combat terrorism, military action against a foreign state or group located in a foreign state or heightened security requirements

could lead to wear, tear and damage to Tradition’s equipment, driver dissatisfaction, reduced economic demand and freight volumes,

reduced availability of credit, increased prices for fuel or temporary closing of the shipping locations or U.S. borders. Such events

or enhanced security measures in connection with such events could impair Tradition’s operating efficiency and productivity and

result in higher operating costs.

Regarding Tradition’s manufacturing

business, a downturn in the economy and other factors may affect customer spending, which could harm Tradition’s operating results.

In general, Tradition’s sales represent spending on discretionary items or consumption needs by its customers. This spending is

affected by many factors, including, among others:

| |

• |

general business conditions, |

| |

• |

interest rates, |

| |

• |

inflation, |

| |

• |

the availability of consumer credit, |

| |

• |

taxation, |

| |

• |

fuel prices and electrical power rates, |

| |

• |

unemployment trends, |

| |

• |

terrorist attacks and acts of war, and |

| |

• |

other matters that influence consumer confidence and spending. |

A downturn or political conflict regionally, nationally,

or internationally could negatively impact sales.

Tradition operates in the highly competitive

and fragmented truckload carrier industry, and numerous competitive factors could impair its ability to improve its profitability and

materially adversely affect its results of operations. Numerous competitive factors could impair Tradition’s ability to

improve its profitability and materially adversely affect its results of operations, including:

| |

• |

Tradition competes with many other truckload carriers of varying sizes and service offerings and, to a lesser extent, with (i) less-than-truckload carriers and (ii) other transportation and brokerage companies, several of which have access to more equipment and greater capital resources than Tradition does; |

| |

• |

maintaining or expanding Tradition’s business or Tradition may be required to reduce its freight rates in order to maintain business and keep its equipment productive; |

| |

• |

Tradition may increase the size of its fleet during periods of high freight demand during which its competitors also increase their capacity, and Tradition may experience losses in greater amounts than such competitors during subsequent cycles of softened freight demand if Tradition is required to dispose of assets at a loss to match reduced freight demand; |

| |

• |

Tradition may have difficulty recruiting and retaining drivers because upgrades of its tractor fleet to match or exceed those of its competitors may not increase its cost savings or profitability; |

| |

• |

some of Tradition’s larger customers are other transportation companies and/or also operate their own private trucking fleets, and they may decide to transport more of their own freight; |

| |

• |

some shippers have reduced or may reduce the number of carriers they use by selecting preferred carriers as approved service providers or by engaging dedicated providers, and Tradition may not be selected; |

| |

• |

consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages, and Tradition may have difficulty competing with them; |

| |

• |

Tradition’s competitors may have better safety records than Tradition or a perception of better safety records; |

| |

• |

competition from freight brokerage companies may materially adversely affect Tradition’s customer relationships and freight rates; |

| |

• |

new digital entrants with cheaper sources of capital could inhibit Tradition’s ability to compete; |

| |

• |

Tradition’s competitors may have better technology that may lead to increased operating efficiencies, reduced costs, a better ability to recruit drivers and more demand for their services; and |

| |

• |

economies of scale that procurement aggregation providers may pass on to smaller carriers may improve such carriers’ ability to compete with Tradition. |

Regarding Tradition’s manufacturing

business, Tradition may not be able to compete effectively against its competitors, which could harm its business and operating results.

The industrial, construction, and maintenance supply industry, although consolidating, still remains a large, fragmented industry that

is highly competitive. Tradition believes that sales of industrial, construction, and maintenance industry supplies will become more concentrated

over the next few years, which may make the industry even more competitive. Tradition’s current or future competitors include companies

with similar or greater market presence, name recognition, and financial, marketing, and other resources, and Tradition believes they

will continue to challenge Tradition with their product selection, financial resources, and services. Increased competition or the adoption

by competitors of aggressive pricing strategies and sale methods could cause us to lose market share or to reduce Tradition’s prices

or increase its spending, thus eroding its margins.

Tradition may not be able to effectively

manage and implement its organic growth strategies. While Tradition currently believes it can grow its profits and cash flows

organically through further penetration of existing customers and by expanding its customer base, Tradition may not be able to effectively

and successfully implement such strategies and realize its stated goals. Tradition’s goals may be negatively affected by a failure

to further penetrate its existing customer base, cross-sell its service offerings, pursue new customer opportunities, manage the operations

and expenses of new or growing service offerings or otherwise achieve growth of its service offerings. Successful execution of Tradition’s

business strategies may not result in Tradition achieving its current business goals.

Tradition has several major customers, the

loss of one or more of which could have a material adverse effect on its business. A significant portion of Tradition’s

operating revenue is generated from a number of major customers, the loss of one or more of which could have a material adverse effect

on its business. For fiscal year 2021, Tradition’s largest customer accounted for approximately 13% of its operating revenue. Economic

and capital markets conditions may adversely affect Tradition’s customers and their ability to remain solvent. Tradition’s

customers’ financial difficulties can negatively impact its business and operating results and financial condition. Generally, Tradition

does not have contractual relationships with its customers that guarantee any minimum volumes, and its customer relationships may not

continue as presently in effect. Tradition generally does not have long-term contractual relationships with its customers, including its

dedicated customers, and certain of these contracts contain clauses that permit cancellation on a short-term basis without cause, and

accordingly any of its customers may not continue to utilize its services, renew its existing contracts or continue at the same volume

levels. Despite the existence of contract arrangements with Tradition’s customers, certain of its customers may nonetheless engage

in competitive bidding processes that could negatively impact its contractual relationship. In addition, certain of Tradition’s

major customers may increasingly use their own truckload and delivery fleets, which would reduce its freight volumes. A reduction in or

termination of Tradition’s services by one or more of its major customers could have a material adverse effect on Tradition’s

business and operating results.

Tradition’s profitability may be materially

adversely impacted if its capital investments do not match customer demand for invested resources or if there is a decline in the availability

of funding sources for these investments. Tradition’s operations require significant investments. The amount and timing

of capital investments depend on various factors, including anticipated volume levels and the price and availability of assets. If anticipated

demand differs materially from actual usage, Tradition’s capital-intensive Freight Transportation segment may have too much or too

little capacity. Moreover, across Tradition’s reportable segments resource requirements vary with customer demand, which may be

subject to seasonal or general economic conditions. Tradition’s ability to properly select freight and adapt to changes in customer

transportation requirements is important to efficiently deploy resources and make capital investments in trucks, trailers, and containers

(with respect to Tradition’s Freight Transportation segment) or obtain qualified third-party capacity at a reasonable price (with

respect to Tradition’s Brokerage segment). Although Tradition’s business volume is not highly concentrated, its customers’

financial failures or loss of customer business may also affect it.

Tradition may not be able to successfully

implement its company growth strategy of diversifying its revenue base and expanding its capabilities. Tradition’s company

growth strategy entails selectively diversifying its revenue base, as Tradition has done with its service offerings, and venturing into

the manufacturing space. This strategy involves certain risks, and Tradition may not overcome these risks, in which case Tradition’s

business, financial position and operating results could be materially and adversely affected. In connection with Tradition’s company

growth strategy, Tradition has in the past made selective acquisitions, made new investments in technology and in office, service and

warehouse centers, increased sales and marketing efforts and hired new drivers and associates. Tradition expects to continue to pursue

its company growth strategy, and this exposes Tradition to certain risks, including:

| |

• |

making significant capital expenditures, which could require substantial capital and cash flow that Tradition may not have or may not be able to obtain on satisfactory terms; |

| |

• |

growth may strain Tradition’s management, capital resources, information systems and customer service; |

| |

• |

hiring new managers, drivers and other associates, including in specialty equipment services, may increase training and compliance costs and may result in temporary inefficiencies until those associates become proficient in their jobs; |

| |

• |

specialty transport of hazardous materials, which subjects Tradition to environmental, health and safety laws and regulations by governmental authorities and, in the event of an accidental release of these commodities, could result in significant loss of life and extensive property damage as well as environmental remediation obligations; and |

| |

• |

expanding Tradition’s service offerings may require it to encounter new competitive challenges in markets in which Tradition has not previously operated or with which it is unfamiliar. |

Fluctuations in the price or availability

of fuel or surcharge collection may increase Tradition’s costs of operations, which could materially adversely affect its profitability.

Fuel is one of Tradition’s largest operating expenses. Diesel fuel prices fluctuate greatly due to factors beyond Tradition’s

control, such as supply and demand, political events, terrorist activities, armed conflicts, commodity futures trading, depreciation of

the dollar against other currencies, weather events and other natural disasters, which could increase in frequency and severity due to

climate change, as well as other man-made disasters, each of which may lead to an increase in the cost of fuel. Fuel prices also are affected

by the rising demand for fuel in developing countries, including China, and could be materially adversely affected by the use of crude

oil and oil reserves for purposes other than fuel production and by diminished drilling activity. Such events may lead not only to increases

in fuel prices, but also to fuel shortages and disruptions in the fuel supply chain. Because Tradition’s operations are dependent

upon diesel fuel, significant diesel fuel cost increases, shortages, rationings, or supply disruptions would materially adversely affect

Tradition’s business, financial condition and results of operations.

Increases in fuel costs, to the extent not offset

by rate per mile increases or fuel surcharges, have a material adverse effect on Tradition’s operations and profitability. While

Tradition has fuel surcharge programs in place with a majority of Tradition’s customers, which historically have helped Tradition

offset the majority of the negative impact of rising fuel prices associated with loaded or billed miles, Tradition also incurs fuel costs

that cannot be recovered even with respect to customers with which Tradition maintains fuel surcharge programs, such as those associated

with non-revenue generating miles, the time when Tradition’s engines are idling and fuel for refrigeration units on Tradition’s

refrigerated trailers. Moreover, the terms of each customer’s fuel surcharge program vary, and certain customers have sought to

modify the terms of their fuel surcharge programs to minimize recoverability for fuel price increases. In addition, because Tradition’s

fuel surcharge recovery lags behind changes in fuel prices, Tradition’s fuel surcharge recovery may not capture the increased costs

Tradition pays for fuel, especially when prices are rising. This could lead to fluctuations in Tradition’s levels of reimbursement,

which have occurred in the past. During periods of low freight volumes, shippers can use their negotiating leverage to impose fuel surcharge

policies that provide a lower reimbursement of Tradition’s fuel costs. There is no assurance that Tradition’s fuel surcharge

program can be maintained indefinitely or will be sufficiently effective. Tradition’s results of operations would be negatively

affected to the extent Tradition cannot recover higher fuel costs or fail to improve Tradition’s fuel price protection through its

fuel surcharge program.

Regarding Tradition’s manufacturing

business, increases in energy costs and the cost of raw materials used in its products could impact its cost of goods and distribution

and occupancy expenses, which may result in lower operating margins. Costs of raw materials used in Tradition’s products

(e.g., steel) and energy costs have been rising during the last several years, which has resulted in increased production costs for Tradition’s

vendors. Those vendors typically look to pass their increased costs along to Tradition through price increases. The fuel costs of Tradition’s

distribution operation have risen as well. While Tradition typically tries to pass increased vendor prices and fuel costs through to its

customers or to modify Tradition’s activities to mitigate the impact, Tradition may not be successful. Failure to fully pass these

increased prices and costs through to Tradition’s customers or to modify its activities to mitigate the impact would have an adverse

effect on Tradition’s operating margins.

Difficulties attracting and retaining qualified

drivers, including through owner-operators, could materially adversely affect Tradition’s profitability and ability to maintain

or grow its fleet. Like many truckload carriers, from time to time Tradition may experience difficulty in attracting and retaining

sufficient numbers of qualified drivers, including through owner-operators, and driver shortages may recur in the future. Tradition’s

challenge with attracting and retaining qualified drivers stems from intense market competition and Tradition’s driver quality standards,

which subjects Tradition to increased payments for driver compensation and owner-operator contracted rates. Failure to recruit high-quality,

safe drivers that meet Tradition’s testing standards could diminish the safety of its fleet and could have a materially adverse

effect on its customer relationships and its business.

Tradition’s company drivers are generally

compensated on a per-mile basis, and the rate per-mile generally increases with the drivers’ length of service. Owner-operators

contracting with Tradition are generally compensated on a percentage of revenue basis. The compensation Tradition offers its drivers and

owner-operators is also subject to market conditions and labor supply. Tradition may in future periods increase company driver and owner-operator

compensation, which will be more likely to the extent that economic conditions improve and industry regulation exacerbates driver shortages

forcing driver compensation higher. The average trucking company will have a turnover rate of roughly 95% annually. Tradition’s

turnover rate, one-hundred and twenty-four percent (124%), in the last twelve (12) months, requires Tradition to continually recruit a

substantial number of company drivers in order to operate Tradition’s revenue-producing fleet equipment, including trucks and specialty

equipment. If Tradition is unable to continue to attract and retain a sufficient number of high-quality company drivers, and contract

with suitable owner-operators, Tradition could be required to adjust its compensation packages, or operate with fewer trucks and face

difficulty meeting shipper demands, all of which could adversely affect Tradition’s profitability and ability to maintain its size

or grow.

Tradition’s use of owner-operators

to provide a portion of its truck fleet exposes it to different risks than it faces with its owned trucks. Tradition may contract

with more owner-operators and use more owner-operator trucks than some of its competitors. Tradition is therefore more dependent on owner-operator

trucks than some of its competitors. Failure to maintain owner-operator business and relationships and increased industry competition

for owner-operators could have a materially adverse effect on Tradition’s operating results.

During times of increased economic activity, Tradition

faces heightened competition for owner-operators from other carriers. To the extent Tradition’s turnover increases, Tradition may

be required to increase owner-operator compensation or take other measures to remain an attractive option for owner-operators. If Tradition

cannot attract sufficient owner-operators, or it becomes economically difficult for owner-operators to survive, Tradition may not be able

to maintain the percentage of Tradition’s fleet provided by owner-operators or maintain Tradition’s delivery schedules.

Tradition provides financing to certain qualified

owner-operators who qualify for financing in order to lease trucks from Tradition. If Tradition is unable to provide such financing in

the future, due to liquidity constraints or other restrictions, Tradition may experience a decrease in the number of owner-operators available

to fully operate its assets. Further, if owner-operators operating the trucks Tradition finance default under or otherwise terminate the

financing arrangement and Tradition is unable to find a replacement owner-operator, Tradition may incur losses on amounts owed to Tradition

with respect to the truck in addition to any losses Tradition may incur as a result of the idling of the truck.

Tradition’s lease contracts with owner-operators

are governed by federal and other leasing regulations, which impose specific requirements on us and owner-operators. It is possible that

Tradition could face lawsuits alleging the violation of leasing obligations or failure to follow the contractual terms, which could result

in liability.

Tradition utilizes owner-operators to complete

its services. These owner-operators are subject to similar regulation requirements, such as the electronic on-board recording and driver

Hours of Service (HOS) requirements that apply to larger carriers, which may have a more significant impact on their operations, causing

them to exit the transportation industry. Aside from when these third parties may use Tradition’s trailing equipment to fulfill

loads, Tradition does not own the revenue equipment or control the drivers delivering these loads. The inability to obtain reliable third-party

owner-operators could have a material adverse effect on Tradition’s operating results and business growth.

Tradition depends on third-party service

providers, particularly in Tradition’s Brokerage segment, and service instability from these providers could increase Tradition’s

operating costs and reduce its ability to offer brokerage services, which could materially adversely affect its revenue, business, financial

condition, results of operations and customer relationships. Tradition’s Brokerage Services segment is dependent upon the

services of third-party carriers, including other truckload carriers. For this business, Tradition does not own or control the transportation

assets that deliver to Tradition’s customers’ freight and Tradition does not employ the providers directly involved in delivering

the freight. These third-party providers may seek other freight opportunities and/or require increased compensation in times of improved

freight demand or tight truckload capacity. If Tradition is unable to secure the services of these third parties or if Tradition becomes

subject to increases in the prices Tradition must pay to secure such services, its business, financial condition and results of operations

may be materially adversely affected, and Tradition may be unable to serve its customers on competitive terms. Tradition’s ability

to secure sufficient equipment or other transportation services may be affected by many risks beyond Tradition’s control, including

equipment shortages, increased equipment prices, new entrants with different business models, interruptions in service due to labor disputes,

driver shortage, changes in regulations impacting transportation and changes in transportation rates.

Difficulty in obtaining materials, equipment,

goods and services from Tradition’s vendors and suppliers could adversely affect Tradition’s Freight Transportation, Brokerage,

and Equipment Leasing segments. Tradition primarily uses Love’s Travel Stops & Country Stores, Inc.’s network

for fueling and on road repairs, and Tradition is dependent upon its suppliers for certain products and materials, including Tradition’s

tractors and trailers. If Tradition fails to maintain favorable relationships with its vendors and suppliers, or if its vendors and suppliers

are unable to provide the products and materials Tradition needs or undergo financial hardship, Tradition could experience difficulty

in obtaining needed goods and services because of production interruptions, limited material availability or other reasons, or Tradition

may not be able to obtain favorable pricing or other terms. As a result, Tradition’s business and operations could be adversely

affected.

Furthermore, a decrease in vendor output may have

a materially adverse effect on Tradition’s ability to purchase a quantity of new revenue equipment that is sufficient to sustain

Tradition’s desired growth rate and to maintain a late-model fleet. Tractor and trailer vendors may reduce their manufacturing output

in response to lower demand for their products in economic downturns or shortages of component parts. Currently, tractor and trailer manufacturers

are experiencing significant shortages of semiconductor chips and other component parts and supplies, including steel, forcing many manufacturers

to curtail or suspend their production, which has led to a lower supply of tractors and trailers, higher prices, and lengthened trade

cycles, which could have a material adverse effect on Tradition’s business, financial condition, and results of operations, particularly

Tradition’s maintenance expense and driver retention.

If Tradition is unable to recruit, develop

and retain its key associates, its business, financial condition and operating results could be adversely affected. Tradition

is highly dependent upon the services of certain key employees, including its team of executive officers and managers. The loss of any

of their services could negatively impact Tradition’s operations and future profitability. Inadequate succession planning or unexpected

departure of key executive officers could cause substantial disruption to Tradition’s business operations, deplete its institutional

knowledge base and erode its competitive advantage. Additionally, Tradition must continue to recruit, develop and retain skilled and experienced

managers if Tradition is to realize its goal of expanding its operations and continuing its growth. Failure to recruit, develop and retain

a core group of managers could have a materially adverse effect on Tradition’s business.

Developments in labor and employment law

and any unionizing efforts by employees could have a material adverse effect on Tradition’s results of operations. Tradition

faces the risk that Congress, federal agencies or one or more states could approve legislation or regulations significantly affecting

its businesses and its relationship with its employees which would have substantially liberalized the procedures for union organization.

None of Tradition’s employees are currently covered by a collective bargaining agreement, but any attempt by its employees to organize

a labor union could result in increased legal and other associated costs. Additionally, given the National Labor Relations Board’s

“speedy election” rule, Tradition’s ability to timely and effectively address any unionizing efforts would be difficult.

If Tradition entered into a collective bargaining agreement with its employees, the terms could materially adversely affect its costs,

efficiency and ability to generate acceptable returns on the affected operations.

Insurance and claims expenses could significantly

reduce Tradition’s earnings. Tradition’s future insurance and claims expense might exceed historical levels, which

could reduce its earnings. Estimating the number and severity of claims, as well as related judgment or settlement amounts is inherently

difficult.

Tradition believes its aggregate insurance limits

should be sufficient to cover reasonably expected claims, it is possible that the amount of one or more claims could exceed Tradition’s

aggregate coverage limits. If any claim were to exceed Tradition’s coverage, Tradition would bear the excess. Insurance carriers

have raised premiums for many businesses, including transportation companies. As a result, Tradition’s insurance and claims expense

could increase, or Tradition could raise its deductible when its policies are renewed or replaced. Tradition’s operating results

and financial condition could be materially and adversely affected if (i) cost per claim, premiums, or the number of claims significantly

exceeds its estimates, (ii) Tradition experiences a claim in excess of its coverage limits, (iii) Tradition’s insurance carriers

fail to pay on its insurance claims or (iv) Tradition experiences a claim for which coverage is not provided.

Tradition operates in a highly regulated

industry, and increased direct and indirect costs of compliance with, or liability for violations of, existing or future regulations could

have a material adverse effect on its business. Tradition, its drivers, and its equipment are regulated by the DOT, the EPA, the

DHS and other agencies in states in which it operates. For further discussion of the laws and regulations applicable to Tradition, its

drivers, and its equipment, please see “Regulation”. Future laws and regulations may be more stringent, require changes in

Tradition’s operating practices, influence the demand for transportation services or require Tradition to incur significant additional

costs. Higher costs incurred by Tradition, or by Tradition’s suppliers who pass the costs onto Tradition through higher supplies

and materials pricing, or liabilities Tradition may incur related to its failure to comply with existing or future regulations could adversely

affect its results of operations.

If the independent contractors Tradition

contracts with are deemed by regulators or judicial process to be employees, its business, financial condition and results of operations

could be materially adversely affected. Tax and other regulatory authorities, as well as independent contractors themselves, have

increasingly asserted that independent contractor drivers in the trucking industry are employees rather than independent contractors.

Companies that use lease-purchase independent contractor programs, such as Tradition, have been more susceptible to reclassification lawsuits.

If the independent contractors with whom Tradition contracts are determined to be employees, Tradition would incur additional exposure

under federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, including for prior

periods, as well as potential liability for employee benefits and tax withholdings, and Tradition’s business, financial condition

and results of operations could be materially adversely affected. For further discussion of legislation regarding independent contractors,

please see “Regulation”.

Safety-related evaluations and rankings under

CSA could materially adversely affect Tradition’s profitability and operations, its ability to maintain or grow its fleet and its

customer relationships. Under the CSA program, fleets are evaluated and ranked against their peers based on certain safety-related

standards. As a result, Tradition’s fleet could be ranked poorly as compared to peer carriers, which could have an adverse effect

on its business, financial condition and results of operations. The occurrence of future deficiencies could affect driver recruitment

by causing high-quality drivers to seek employment with other carriers or limit the pool of available drivers or could cause Tradition’s

customers to direct their business away from Tradition and to carriers with higher fleet safety rankings, either of which would materially

adversely affect Tradition’s business, financial condition and results of operations. In addition, future deficiencies could increase

Tradition’s insurance expenses. Further, Tradition may incur greater than expected expenses in its attempts to improve unfavorable

scores.

None of Tradition’s subsidiaries is currently

exceeding the established intervention thresholds in the seven CSA safety-related categories. If Tradition were to receive unfavorable

ratings, Tradition may be prioritized for an intervention action or roadside inspection, either of which could materially adversely affect

Tradition’s business, financial condition and results of operations. In addition, customers may be less likely to assign loads to

Tradition. For further discussion of the CSA program, please see “Regulation”.

Receipt of an unfavorable DOT safety rating

could have a material adverse effect on Tradition’s operations and profitability. Tradition currently has a satisfactory

DOT safety rating, which is the highest available rating under the current safety rating scale. If Tradition were to receive a conditional

or unsatisfactory DOT safety rating, it could materially adversely affect Tradition’s business, financial condition and results

of operations as customer contracts may require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could materially

adversely affect or restrict its operations. For further discussion of the DOT safety rating system, please see “Regulation.”

Changes in U.S. tax laws and regulations

may impact Tradition’s effective tax rate and may adversely affect its business, financial condition and operating results.

Significant reform of the U.S. tax laws, including significant changes related to federal tax rates, interest expense deductions, capital

expenditure deductions and the taxation of business entities, could adversely affect Tradition. Tradition benefits from certain tax provisions

relating to capital expenditure deductions. Reform could have a material adverse effect on Tradition’s growth opportunities, business

and results of operations.

Changes to trade regulation, quotas, duties

or tariffs, caused by the changing U.S. and geopolitical environments or otherwise, may increase Tradition’s costs and materially

adversely affect its business. The imposition of additional tariffs or quotas or changes to certain trade agreements, including

tariffs applied to goods traded between the United States and China, could harm Tradition’s Warehouse Leasing and Equipment Leasing

service segments, and among other things, increase the costs of the materials used by Tradition’s suppliers to produce new revenue

equipment or increase the price of fuel. Such cost increases for Tradition’s revenue equipment suppliers would likely be passed

on to Tradition, and to the extent fuel prices increase, Tradition may not be able to fully recover such increases through rate increases

or its fuel surcharge program, either of which could have a material adverse effect on Tradition’s business.

Tradition’s operations

are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties. Tradition

is subject to various environmental laws and regulations dealing with the hauling and handling of hazardous materials, waste and other

oil, fuel storage tanks, air emissions from Tradition’s vehicles and facilities, engine idling and discharge and retention of storm

water. Tradition’s truck terminals often are located in industrial areas where groundwater or other forms of environmental contamination

could occur. Tradition’s operations involve the risks of fuel spillage or seepage, environmental damage and hazardous waste disposal,

among others. Certain of Tradition’s facilities have waste oil or fuel storage tanks and fueling islands. If Tradition is involved

in a spill or other accident involving hazardous substances, if there are releases of hazardous substances Tradition transports, if soil

or groundwater contamination is found at Tradition’s facilities or results from its operations, or if Tradition is found to be

in violation of applicable environmental laws or regulations, Tradition could owe cleanup costs and incur related liabilities, including

substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on Tradition’s

business and operating results.

EPA regulations limiting exhaust emissions became

more restrictive in 2010. In 2010, an executive memorandum was signed directing the NHTSA and the EPA to develop new, stricter fuel efficiency

standards for heavy trucks. In 2011, the NHTSA and the EPA adopted final rules that established the first-ever fuel economy and greenhouse

gas standards for medium-and heavy-duty vehicles. These standards apply to model years 2014 to 2018, which are required to achieve an

approximate 20 percent reduction in fuel consumption by model year 2018, and equates to approximately four gallons of fuel for every 100

miles traveled. In June 2015, the EPA and NHTSA jointly proposed new stricter standards that would apply to trailers beginning with model

year 2018 and tractors beginning with model year 2021.

In October 2016, the EPA and NHTSA formally published

the Final Rule for Phase 2 of the GHG emissions and fuel efficiency standards for medium and heavy-duty engines and vehicles. On August

5, 2021, U.S. EPA announced an update to the Cleaner Trucks Initiative called the Clean Trucks Plan. The Clean Trucks Plan plans to reduce

GHG and other harmful air pollutants from heavy-duty trucks through a series of rulemakings over the next three years. Further, the EPA

is targeting 2027 for these new standards to take effect and is also working on enacting more stringent greenhouse gas emission standards

(beginning with model year 2030 vehicles) by the end of 2024. For further discussion of the laws and regulations applicable to Tradition,

its drivers, and its equipment, please see “Regulation”.

Tradition is subject to various claims and

lawsuits in the ordinary course of business, and increases in the amount or severity of these claims and lawsuits could adversely affect

us. Tradition is exposed to various claims and litigation related to commercial disputes, personal injury, property damage, environmental

liability and other matters. Developments in regulatory, legislative or judicial standards, material changes to litigation trends, or

a catastrophic accident or series of accidents, involving any or all of property damage, personal injury, and environmental liability

could have a material adverse effect on Tradition’s operating results, financial condition and liquidity.

Tradition has significant ongoing capital

requirements that could affect its profitability if Tradition is unable to generate sufficient cash from operations or obtain financing

on favorable terms. The truckload industry generally, and Tradition’s Equipment Leasing and Warehouse Leasing services segments,

are capital intensive and asset heavy. Tradition expects to pay for projected capital expenditures with cash flows from operations, proceeds

from equity sales or financing available under its existing debt instruments. Tradition’s total capital expenditures in its fiscal

year ended December 31, 2021 were $21,950,374. If Tradition were unable to generate sufficient cash from operations, Tradition would need

to seek alternative sources of capital, including financing, to meet its capital requirements. In the event that Tradition is unable to

generate sufficient cash from operations or obtain financing on favorable terms in the future, Tradition may have to limit its fleet size,

enter into less favorable financing arrangements or operate its revenue equipment for longer periods, any of which could have a materially

adverse effect on its profitability.

The seasonal pattern generally experienced

in the trucking industry may affect Tradition’s periodic results during traditionally slower shipping periods and winter months.

In the trucking industry, revenue generally follows a seasonal pattern which may affect Tradition’s operating results. Tradition

typically experiences a seasonal surge in sales during the fourth quarter of Tradition’s fiscal year as a result of holiday sales.

After the December holiday season and during the remaining winter months, Tradition’s freight volumes are typically lower because

some customers reduce shipment levels. Tradition’s operating expenses have historically been higher in the winter months because

of cold temperatures and other adverse winter weather conditions which result in decreased fuel efficiency, increased cold weather-related

maintenance costs of revenue equipment and increased insurance and claims costs. Revenue can also be affected by adverse weather conditions,

holidays and the number of business days during a given period because revenue is directly related to the available working days of shippers.

From time to time, Tradition may also suffer short-term impacts from severe weather and similar events, such as tornadoes, hurricanes,

blizzards, ice storms, floods, fires, earthquakes, and explosions that could harm Tradition’s results of operations or make its

results of operations more volatile.

Tradition is increasingly dependent on data

networks and systems, including tracking and communications systems, and significant systems disruptions, including those caused by cybersecurity

breaches, could adversely affect Tradition’s business. Tradition’s policy of increasingly using technology to improve

productivity and reduce costs means that its business is reliant on the efficient, stable and uninterrupted operation of its data networks

and systems, including tracking and communications systems. Tradition’s computer systems are used in various aspects of its business,

including load planning and receiving, dispatch of drivers and third-party capacity providers, freight and container tracking, customer

billing and account monitoring, automation of tasks, producing financial and other reports and other general functions and purposes. Tradition

is currently dependent on two vendors, Transport Pro, for fleet and transportation management software, and Camelot Software, for warehouse

management systems. Tradition is in the process of converting its transportation management software from Transport Pro to TMW by Trimble

Transportation Enterprise Solutions, Inc. (“Trimble”) and will be dependent on Trimble, once the conversion process is complete.

If the stability or capability of such vendors is compromised, it could adversely affect Tradition’s revenue, customer service,

driver turnover rates and data preservation. Additionally, if any of Tradition’s critical information or communications systems

fail or become unavailable, Tradition could have to perform certain functions manually, which could temporarily affect the efficiency

and effectiveness of its operations.

Tradition’s operations and those of its technology

and communications service providers are vulnerable to interruption by fire, earthquake, power loss, telecommunications failure, terrorist

attacks, internet failures, computer viruses, malware, hacking and other events beyond Tradition’s control. More sophisticated and

frequent cyber-attacks within the United States in recent years have also increased security risks associated with information technology

systems. In the event of a cyber-attack, breach or other such event, Tradition’s business and operations could be adversely affected

in the event of a system failure, disruption or security breach that causes a delay, or interruption or impairment of Tradition’s

services and operations.

Tradition may not make acquisitions in the

future, which could impede growth, or if it does, Tradition may not be successful in integrating any acquired businesses, either of which

could have a material adverse effect on Tradition’s business. Historically, a key component of Tradition’s growth

strategy has been to pursue acquisitions of complementary businesses and/or assets. As discussed in “Karr Transportation Asset Purchase”

and “EDSCO Purchase and Sale,” in “BUSINESS”. Tradition acquired assets in two separate deals in 2022. The EDSCO

Purchase and Sale is complimentary, but different to Tradition’s core business, and Tradition cannot assure that it will be successful

in integrating all of or portions of the aforementioned acquisitions. Further, Tradition may not be successful in identifying, negotiating

or consummating any future acquisitions. If Tradition succeeded in consummating future acquisitions, any acquisitions Tradition undertakes

could involve numerous risks that could have a materially adverse effect on Tradition’s business and operating results, including:

| |

• |

difficulties in integrating the acquired company’s operations and in realizing anticipated economic, operational and other benefits in a timely manner that could result in substantial costs and delays or other operational, technical or financial problems; |

| |

• |

challenges in achieving anticipated revenue, earnings or cash flows; |

| |

• |

assumption of liabilities that may exceed Tradition’s estimates or what was disclosed to Tradition; |

| |

• |

the diversion of Tradition’s management’s attention from other business concerns; |

| |

• |

the potential loss of customers, key associates and drivers of the acquired company; |

| |

• |

difficulties operating in markets in which Tradition has had no or only limited direct experience; |

| |

• |

the incurrence of additional indebtedness; and |

| |

• |

the issuance of additional shares of APSI’s common stock, which would dilute your ownership in APSI. |

Tradition’s existing and future indebtedness

could limit its flexibility in operating its business or adversely affect its business and our liquidity position. As of June

30, 2023, Tradition had the following indebtedness:

| Notes payable to new primary bank bearing interest ranging from 4% to 5,75%: payable in various monthly installments through April 2032, secured by guarantees of certain shareholders and related entities, and secured by substantially all business assets. | |

$ | 13,160,552 | |

| | |

| | |

| Installment notes payable to various financial institutions bearing interest

ranging from 3.75% to 6.99%; payable in various monthly installments through October 2029, secured by guarantees of certain

shareholders and related entities, and collateralized by related equipment with a net book value of $10,031,281 at June 30,

2023. | |

| 12,185,327 | |

| | |

| | |

| Installment notes for acquisition of stock in Traditions; payable in 16 quarterly installments aggregating $1,603,786 including interest at 3%; secured by assignment and pledge of stock in Tradition Transportation Group. | |

| 24,092,038 | |

| | |

| | |

| Installment note for acquisition of Traditions; payable in full upon repayment of installment notes above for acquisition of Traditions; noninterest bearing and unsecured. | |

| 1,731,421 | |

| | |

| | |

| Installment notes payable to shareholder, bearing interest at 10%, principal and interest due June 2023. | |

| 244,940 | |

| | |

| | |

| Installment note for redemption of Tradition stock; payable in monthly installments of $34,167 beginning February 2023 through January 2028 unsecured. | |

| 2,050,000 | |

| | |

| 53,464,278 | |

| Less unamortized debt issuance costs | |

| (286,220 | ) |

| Current maturities of long-term debt | |

| (9,105,783 | ) |

| | |

$ | 44,072,275 | |

Tradition’s indebtedness may increase

from time to time in the future for various reasons, including fluctuations in operating results, capital expenditures and potential acquisitions.

Any indebtedness Tradition incurs and restrictive covenants contained in the agreements related thereto could:

| |

• |

make it difficult for Tradition to satisfy its obligations, including making interest payments on its debt obligations; |

| |

• |

limit its ability to obtain additional financing to operate its business; |

| |

• |

require it to dedicate a substantial portion of its cash flow to payments on its debt, reducing its ability to use its cash flow to fund capital expenditures and working capital and other general operational requirements; |

| |

• |

limit its flexibility to plan for and react to changes in its business; |

| |

• |

place it at a competitive disadvantage relative to some of Tradition’s competitors that have less, or less restrictive, debt than Tradition; |

| |

• |

limit its ability to pursue acquisitions; and |

| |

• |

increase its vulnerability to general adverse economic and industry conditions, including changes in interest rates or a downturn in Tradition’s business or the economy. |

The occurrence of any one of these events could

have a material adverse effect on Tradition’s business, financial condition and operating results or cause a significant decrease

in Tradition’s liquidity and impair Tradition’s ability to pay amounts due on Tradition’s indebtedness. Significant

repayment penalties may limit its flexibility.

Tradition and/or APSI may need to obtain

additional financing which may not be available or, if it is available, may result in a reduction in the percentage ownership of APSI’s

then-existing shareholders. Tradition and/or APSI may need to raise additional funds in order to:

| |

• |

finance unanticipated working capital requirements or refinance existing indebtedness; |

| |

• |

develop or enhance Tradition’s technological infrastructure and our existing products and services; |

| |

• |

fund strategic relationships; |

| |

• |

respond to competitive pressures; and |

| |

• |

acquire complementary businesses, technologies, products or services. |