false

0000793306

0000793306

2024-10-30

2024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 30, 2024

Blue Dolphin Energy Company

(Exact name of registrant as specified in its charter)

|

Delaware

(State or Other Jurisdiction

of Incorporation)

|

0-15905

(Commission File Number)

|

73-1268729

(IRS Employer Identification No.)

|

801 Travis Street, Suite 2100

Houston, TX 77002

(Address of principal executive office and zip code)

(713) 568-4725

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol (s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

BDCO

|

|

OTCQX

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

Blue Dolphin Services Co. (“BDSC”), a wholly owned subsidiary of Blue Dolphin Energy Company (“Blue Dolphin”), maintains an office lease in Houston, Texas. On August 31, 2024, the fifth amendment to the office lease between BDSC and TR 801 Travis LLC expired. On October 30, 2024, BDSC signed a new 24-month lease extension, the sixth amendment, with the lessor named therein (the “Lessor”). The sixth amendment has an effective date of September 1, 2024.

Under the sixth amendment, months 1 (September 2024) and 2 (October 2024) cover the holdover period wherein management negotiated the lease with Lessor. During the holdover period, BDSC was not subject to a holdover rate but paid the expiring rate under the fifth amendment to the office lease of $30.00 per square foot. During months 3 through 12, which began on November 1, 2024, Lessor reduced the annual base rent to $29.00 per square foot. During months 13 through 24 the annual base rent will increase to $30.00 per square foot. As additional rent, BDSC will pay a proportionate share of basic building costs (e.g., utilities) up to a maximum of $1,500 per month. BDSC will also receive an improvement allowance of $1.50 per square foot. However, the improvement allowance will expire six months from the lease signing date. The total rental area under the sixth amendment is 9,961 square feet, an increase of 2,268 square feet to accommodate additional personnel.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

10.1

|

Sixth Amendment to Lease dated October 30, 2024 and effective September 1, 2024 by and between Blue Dolphin Services Co. and Lessor.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 5, 2024

| |

Blue Dolphin Energy Company

|

| |

|

| |

|

| |

/s/ JONATHAN P. CARROLL

|

| |

Jonathan P. Carroll

Chief Executive Officer, President,

Secretary and Assistant Treasurer

(Principal Executive Officer)

|

Exhibit Index

|

10.1

|

Sixth Amendment to Lease dated October 30, 2024 and effective September 1, 2024 by and between Blue Dolphin Services Co. and Lessor.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Exhibit 10.1

SIXTH AMENDMENT TO LEASE

This SIXTH AMENDMENT TO LEASE (this "Amendment"), dated as of October 30, 2024, to be effective for all purposes as of September 1, 2024 ("Effective Date") by and between Stuart Walker of Implex Advisors, LLC, as court appointed Receiver of 801 Travis LLC ("Lessor"), and BLUE DOLPHIN SERVICES CO., a Texas corporation ("Lessee").

WHEREAS, Lessor, as a successor-in-interest to CRCPF 801 Travis, L.P., a California limited partnership, and Lessee are parties to that certain Lease Agreement dated November 30, 2006 (the "Original Lease"), as amended by that certain First Amendment to Lease Agreement dated as of May 9, 2014 (the "First Amendment"), as amended by that certain Second Amendment to Lease (mislabeled the First Amendment to Lease) dated September 19, 2014 (the "Second Amendment"), as amended by that certain Third Amendment to Lease dated January 1, 2018 (the "Third Amendment"), as amended by that certain Fourth Amendment to Lease (the "Fourth Amendment") dated May 27, 2021, and as further amended by that certain Fifth Amendment to Lease dated May 31, 2023 (the "Fifth Amendment", and collectively with the Original Lease, the First Amendment, the Second Amendment, the Third Amendment, the Fourth Amendment, and the Fifth Amendment, the "Lease"); and

WHEREAS, pursuant to the Lease, Lessor has leased to Lessee certain premises consisting of approximately 7,675 rentable square feet on the twenty-first (21st) floor of the Building, being Suite 2100, as described in the Lease (the "Current Premises") in the building located at 801 Travis, Harris County, Houston, Texas 77002 (the "Building"), as more particularly set forth in the Lease; and

WHEREAS, Lessee desires to lease additional space containing approximately 2,286 rentable square feet of space in the Building known as Suite 2125 and as shown on Exhibit A attached hereto (the "Expansion Space");

WHEREAS, the Term is currently scheduled to expire on August 31, 2024, and Lessee desires to extend the Term to expire on August 31, 2026; and

WHEREAS, subject to the terms and conditions hereof, Lessor has agreed to lease the Expansion Space to Lessee and extend the Term as described herein; and

WHEREAS, Lessor and Lessee desire to amend the Lease to reflect their agreements as to the terms and conditions governing Lessee's lease of the Expansion Space and extension of the Term.

NOW, THEREFORE, in consideration of the mutual agreements herein set forth, the mutual agreements set forth in the Lease, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Lessor and Lessee have agreed, and hereby agree that the Lease is amended as follows:

1. Recitals Incorporated. The Recitals set forth above are hereby incorporated by this reference and shall be deemed terms and provisions hereof with the same force and effect as if fully set forth in this Section 1.

2. Defined Terms. Capitalized terms which are not otherwise defined herein shall be deemed to have the same meanings herein as are ascribed to such terms in the Lease. All references herein to "Lease" shall be deemed to be references to the Lease, as amended hereby.

3. Extension of Term. The Term currently expires on August 31, 2024. Effective on the Effective Date, the Term is hereby extended to expire on August 31, 2026 (the "Extended Term").

4. Premises. Effective as of November 1, 2024 (the "Expansion Date"), Lessor shall lease the Expansion Space to Lessee and Lessee shall lease the Expansion Space from Lessor, and the "Premises" as defined in the Lease shall mean, collectively, the Current Premises and the Expansion Space. Accordingly, effective as of the Expansion Date, the rentable square footage of the Premises shall be amended to mean 9,961 rentable square feet of space. The Expansion Space shall be subject to all the terms and conditions of the Lease except as expressly modified herein and except that Lessee shall not be entitled to receive any allowances, abatements or other financial concessions that were granted with respect to the Current Premises unless such concessions are expressly provided for herein with respect to the Expansion Space. Lessee shall be permitted to take possession of the Expansion Space upon the full execution and delivery of this Amendment. Any possession of the Expansion Space prior to the Expansion Date shall be subject to the terms and conditions of the Lease, as amended hereby, except that Lessee shall not be required to pay Base Rental or Additional Rent for the Expansion Space for the period prior to the Expansion Date.

5. Base Rental for the Premises. From the Effective Date and continuing through the date immediately preceding the Expansion Date, Lessee shall continue to pay Base Rental for the Current Premises in the monthly amount of $19,187.50. Commencing on the Expansion Date, Lessee shall pay Base Rental for the Premises (i.e., the Current Premises and the Expansion Space) in the amounts set forth in the schedule below, which shall be payable in accordance with the provisions of the Lease:

|

Period

|

Annual Rent Per Square Foot

|

Annual Base Rent

|

Monthly Base Rental

|

|

11/1/24 – 8/31/25

|

$29.00

|

$288,869.04

|

$24,072.42

|

|

9/1/25 – 8/31/26

|

$30.00

|

$298,830.00

|

$24,902.50

|

6. Additional Rent. Lessee shall continue to pay, as additional rent, Lessee's Proportionate Share of Basic Cost, together with all other amounts and charges payable by Lessee to Lessor under the Lease. Notwithstanding the foregoing, effective as of the Expansion Date, Lessee's Proportionate Share shall be adjusted in accordance with the terms of the Lease and, notwithstanding anything in the Lease to the contrary, Lessee's payment of Lessee's Proportionate Share of Basic Costs shall not exceed $1,500.00 per month during the period from the Expansion Date through August 31, 2026.

7. Condition of Premises. Lessee is in possession of the Current Premises and has inspected the Expansion Space and accepts the same in "as is" condition without any representations or warranties of any kind. No agreement of Lessor to alter, remodel, decorate, repair or improve the Premises or the Building (or to provide Lessee with any credit or allowance for the same), and no representation regarding the condition of the Premises or the Building, have been made by or on behalf of Lessor or relied upon by Lessee except as expressly set forth below.

8. Improvement Allowance. Lessor shall provide an allowance of up to $14,941.50 (the "Improvement Allowance") toward the cost of Lessor-approved leasehold improvements, including, but not limited to, alterations to connect the Expansion Space to the Current Premises, and related permitting and architectural fees incurred by Lessee in connection with improvements to be performed by Lessee in the Premises (i.e., the Current Premises and the Expansion Space). Lessor shall reimburse Lessee for such costs (up to the amount of the Improvement Allowance) within thirty (30) days after Lessor's receipt of receipted bills covering all labor and materials expended and used in the leasehold improvements and full and final waivers of lien from all contractors and subcontractors performing any work in connection therewith. Any portion of the Improvement Allowance for which Lessee has not requested reimbursement prior to the date that is six (6) months after the date of this Amendment shall be the sole property of Lessor and Lessee shall not be entitled to any credit, payment or abatement on account thereof. Any construction, alterations or improvements to the Premises (i.e., the Current Premises and Expansion Space) shall be performed by Lessee at its sole cost and expense (subject to reimbursement through the Improvement Allowance as described above) and shall be governed in all respects by the terms of the Lease. Notwithstanding anything herein to the contrary, Lessor shall not be obligated to disburse any portion of the Improvement Allowance during the continuance of an uncured default under the Lease, as amended hereby, and Lessor's obligation to disburse shall only resume when and if such default is cured. Lessee shall pay Lessor, within ten (10) days after Lessor's written demand, a construction fee equal to 5% of the hard cost of such work to compensate for its construction management services in connection with such work. Lessor reserves the right to deduct such fee from the Improvement Allowance.

9. Miscellaneous. Each party hereby represents and warrants to the other that, as of the Execution Date, such party, to the best of its actual knowledge, is not aware of any default or breach by the other party of any of the provisions of the Lease.

10. No Broker. Lessee represents and warrants that it has not dealt with any real estate broker, salesperson or finder in connection with this Amendment, and no such person initiated or participated in the negotiation of this Amendment or is entitled to any fee or commission in connection herewith by, through or under Lessee. Lessee agrees to indemnify and hold Lessor, its agents and employees harmless from and against any and all damages, liabilities, claims, actions, costs and expenses (including attorneys' fees) arising from any claims or demands of any broker, salesperson or finder retained by or through Lessee for any fee or commission alleged to be due to any broker, salesperson or finder.

11. Counterparts. Lessor and Lessee agree that this Amendment may be executed in counterparts, including via facsimile, email transmission, or in portable document (pdf) format, each of which will be deemed to be an original and all of which together will be deemed to be one and the same document, and that such agreement shall be legal and binding upon the parties hereto; provided, however, that any party providing its signature in any electronic manner shall promptly forward to the other party an original signed copy of this Amendment, if requested by the other party. By affixing their respective electronic signatures hereto by means of DocuSign's electronic signature system, the signatories below acknowledge and agree that they intend to bind the respective parties on behalf of whom they are signing. The affixing of an electronic signature hereto shall constitute a valid signature by the signatory and shall be construed as the signatory having signed the document as an original manuscript. Each party warrants that the person signing this Amendment on behalf of that party has the requisite authority to bind that party and that they consent to electronic signature by means of DocuSign's electronic signature system.

12. Time is of the Essence. Time is of the essence for this Amendment and the Lease and each provision hereof and thereof.

13. Submission of Amendment. Submission of this instrument for examination shall not bind Lessor and no duty or obligation on Lessor shall arise under this instrument until this instrument is signed and delivered by Lessor and Lessee.

14. Entire Agreement. This Amendment and the Lease contain the entire agreement between Lessor and Lessee with respect to Lessee's leasing of the Premises. Except for the Lease and this Amendment, no prior agreements or understandings with respect to the Premises shall be valid or of any force or effect.

15. Severability. If any provision of this Amendment or the application thereof to any person or circumstance is or shall be deemed illegal, invalid or unenforceable, the remaining provisions hereof shall remain in full force and effect and this Amendment shall be interpreted as if such illegal, invalid or unenforceable provision did not exist herein.

16. Lease In Full Force and Effect. Except as modified by this Amendment, all of the terms, conditions, agreements, covenants, representations, warranties and indemnities contained in the Lease remain in full force and effect. In the event of any conflict between the terms and conditions of this Amendment and the terms and conditions of the Lease, the terms and conditions of this Amendment shall prevail.

17. Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of the parties hereto and their respective heirs, legal representatives, successors and assigns.

18. Integration of the Amendment and the Lease. This Amendment and the Lease shall be deemed to be, for all purposes, one instrument. In the event of any conflict between the terms and provisions of this Amendment and the terms and provisions of the Lease, the terms and provisions of this Amendment shall, in all instances, control and prevail.

19. Confidentiality. It is agreed and understood that Lessee may acknowledge only the existence of an agreement between Lessor and Lessee pertaining to the Lease, as amended, and that Lessee may not disclose any of the terms and provisions contained in this Amendment to any lessee or other occupant in the Building or to any agent, employee, subtenant or assignee of such lessee or occupant. Lessee acknowledges that any breach by Lessee of this Section shall cause Lessor irreparable harm. The terms and provisions of this Section shall survive the termination of the Lease (whether by lapse of time or otherwise).

20. Exculpation. It is understood and agreed expressly by and between the parties hereto, anything herein to the contrary notwithstanding, that each and all of the representations, warranties, covenants, undertakings and agreements made herein or in the Lease on the part of Lessor, while in form purporting to be the representations, warranties, covenants, undertakings and agreements of Lessor, are nevertheless each and every one of them made and intended, not as personal representations, warranties, covenants, undertakings and agreements by Lessor or for the purpose or with the intention of binding Lessor personally, but are made and intended for the purpose only of subjecting Lessor's interest in the Building and the Premises to the terms of this Amendment and the Lease and for no other purpose whatsoever, and in case of default hereunder by Lessor, Lessee shall look solely to the interests of Lessor in the Building; that Lessor shall have no personal liability whatsoever to pay any indebtedness accruing hereunder or to perform any covenant, either express or implied, contained herein; and that no personal liability or personal responsibility of any sort is assumed by, nor shall at any time be asserted or enforceable against, said Lessor, individually or personally, on account of any representation, warranty, covenant, undertaking or agreement of Lessor in this Amendment or the Lease contained, either express or implied, all such personal liability, if any, being expressly waived and released by Lessee and by all persons claiming by, through or under Lessee.

21. Reaffirmation of Guaranty. The undersigned Guarantor hereby consents to this Amendment and hereby reaffirms all of the obligations of Guarantor under that certain Lease Guaranty Agreement dated as of November 30, 2006 (the "Guaranty"). Guarantor acknowledges and agrees that the Guaranty shall continue in full force and effect and that the Guarantor, as of the Execution Date, has no defenses, offsets or counterclaims to or against the enforcement of the Guaranty in accordance with its terms.

[EXECUTION PAGE FOLLOWS]

IN WITNESS WHEREOF, Lessor and Lessee have executed this Amendment as of the Effective Date set forth above.

LESSOR:

By: /s/ STUART WALKER

Stuart Walker of Implex Advisors, LLC, solely in his capacity as court appointed Receiver for all real and personal property of Lessor and on behalf of the Receivership

LESSEE:

BLUE DOLPHIN SERVICES CO., a Texas corporation

By: /s/ JONATHAN P. CARROLL

Name: Jonathan P. Carroll

Its: President

GUARANTOR:

BLUE DOLPHIN ENERGY COMPANY, a Delaware corporation

By: /s/ JONATHAN P. CARROLL

Name: Jonathan P. Carroll

Its: President

EXHIBIT A

EXPANSION SPACE

v3.24.3

Document And Entity Information

|

Oct. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Blue Dolphin Energy Company

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 30, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-15905

|

| Entity, Tax Identification Number |

73-1268729

|

| Entity, Address, Address Line One |

801 Travis Street, Suite 2100

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

568-4725

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BDCO

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000793306

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

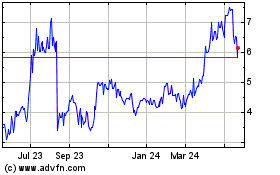

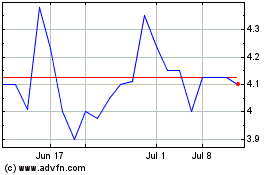

Blue Dolphin Energy (QX) (USOTC:BDCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Blue Dolphin Energy (QX) (USOTC:BDCO)

Historical Stock Chart

From Jan 2024 to Jan 2025