By Patricia Kowsmann and Margot Patrick

The coronavirus pandemic has brought a sense of urgency to

Europe's ailing banks to scale up or risk dying.

Around the region's capitals, banks are exploring mergers after

a decade of weak returns. They are drawing plans on how they can

face a prolonged era of low interest rates, a gloomy economic

outlook and souring loans that are expected to rise as borrowers

struggle to keep their jobs and businesses. Mergers are a way to

combine balance sheets while taking out a large chunk of costs,

including by closing duplicate branches and laying off staff.

In Switzerland, UBS Group AG has studied how it could absorb

smaller rival Credit Suisse Group AG. In Spain, which has been

severely hit by the pandemic, CaixaBank SA is buying Bankia SA to

form Spain's largest domestic bank. Another lender, Banco de

Sabadell SA, is also exploring its options, including a domestic

merger, a person familiar with the situation said.

A Sabadell spokesman said the bank has a plan to remain

independent but will study options that increase shareholder

value.

Christian Sewing, chief executive of Deutsche Bank AG, which

last year held merger talks with rival Commerzbank AG that failed,

recently said his bank wants to be part of consolidation once it

improves its profitability. Commerzbank itself -- also struggling

to make money -- might still need to find a suitor.

Many of the conversations are happening internally and have yet

to translate into deal talks or takeover offers. And most

discussions at this stage are around domestic rather than

cross-border deals, which offer less cost synergies and would

require deeper government involvement to push through to

completion.

Chatter about a wave of consolidation in Europe has been going

on for a decade because many countries have a fragmented banking

system with too many banks and returns on equity have been slim or

nonexistent. Action was constrained by issues ranging from

regulatory hurdles to fights over which management team would run a

combined entity. Now, the feeling that something needs to be done

and done soon has never been so strong, according to bank

executives and outside advisers.

European banks' return on equity, a key metric of profitability,

sank to 1.3% at the end of the first quarter from 5.7% at the end

of 2019. Some European banks are struggling to even cover costs. In

the U.S., banks thrived in a stronger economy for years, allowing

them to spend on technology and build up capital without having to

go to shareholders.

"We are in a moment of disruption," said Bankia Chairman José

Ignacio Goirigolzarri. "And when there's disruption, we have to

react to it."

Bankia and CaixaBank, which agreed on a deal two weeks after

saying they were exploring a merger, said it was being driven by

the pandemic and low profitability from persistently low interest

rates.

Bankia nearly collapsed and had to be rescued in 2012 by the

Spanish government, which retained a majority stake. Mr.

Goirigolzarri said the combined entity would have roughly 25% of

Spain's loans and deposits and shave some $900 million from annual

costs. Spain has more bank branches per capita than almost any

major economy, with around 55 per 100,000 people, according to

World Bank data, almost double the figure in the U.S.

Other banks have also stepped up internal conversations, trying

to figure out if they, too, should seek a combination, according to

bank executives and outside advisers. Even the stronger banks with

little appetite for mergers are expecting to get dragged into

takeovers by governments eager to find a savior for their weaker

banks. Others are considering how to position themselves if large

cross-border mergers eventually begin.

"Mergers, right now, are a survival move," said an official at a

Spanish bank. "You need to gain scale to face all the uncertainty

that Covid has brought."

Switzerland's two dominant banks, UBS and Credit Suisse, have

weathered the pandemic better than other large European lenders

because of their focus on global wealth management and a relatively

strong home economy. But the possibility of the two merging, the

subject of perennial speculation, was studied again recently by UBS

as a way to cut costs and stay competitive against U.S. and

European rivals, according to people familiar with the bank.

Multiple hurdles would have to be cleared, and no talks between

the banks are currently under way, the people said. Any deal would

likely have to involve selling business units since Switzerland

makes banks hold more capital if they get too big.

So far this year, European banks have posted relatively stable

results, giving the impression they are weathering the severe

economic contraction well. But that is mainly because governments

are sustaining the economies by paying companies to keep people in

their jobs and getting banks to give borrowers payment breaks on

their loans. Once those programs are lifted, analysts expect a wave

of defaults that could push weaker banks to the brink of

collapse.

That is particularly true for countries more severely hit by the

pandemic, including Spain and Italy, or whose governments don't

have the money to support the economy, such as Greece. In turn,

banks' depressed share prices make it hard for them to raise more

capital from investors. The Stoxx Europe 600 Banks index is down

close to 40% this year. European banks are trading at a fraction of

their net worth, a sign investors doubt their ability to survive or

achieve sufficient profitability. In contrast, U.S. banks are

expected to bounce back more quickly from the pandemic.

"We expect the pain for European banks to really begin next

year," said João Soares, a partner with Bain & Co.'s

financial-services practice. "Until then, banks need to prepare for

the storm."

The European Central Bank, which supervises the largest banks in

the euro area, has recently issued a draft guide on how it plans to

treat some of the common issues in mergers, in an attempt to boost

banks' appetite for deals.

"Before the Covid crisis, the need to adjust costs, eliminate

excess capacity, and restructure the banking sector was very

important," Luis de Guindos, the ECB's vice president, told

reporters recently. He said the pandemic stepped up those needs and

called for banks to consolidate "quickly and urgently."

--Ben Dummett contributed to this article.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and

Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

September 20, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

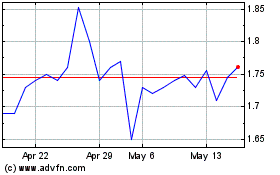

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Nov 2023 to Nov 2024